Proper now, Apple (NASDAQ: AAPL) is the world’s largest firm by market cap. Nevertheless, traders want to pay attention to some issues beneath the hood.

As a substitute of Apple, I feel there are a lot better buys proper now, together with Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Meta Platforms (NASDAQ: META). These three present vital long-term upside that ought to permit them to outperform Apple.

What is going on on with Apple?

Apple reached the highest of the rankings of the world’s largest firms with shockingly low income progress. Gross sales of iPhones have not elevated meaningfully because the pandemic started, and traders put a variety of hope into the iPhone 16 being the era that turns it round, primarily due to its Apple Intelligence integration. However the newest studies say that its gross sales are under expectations, which might spell catastrophe for the inventory.

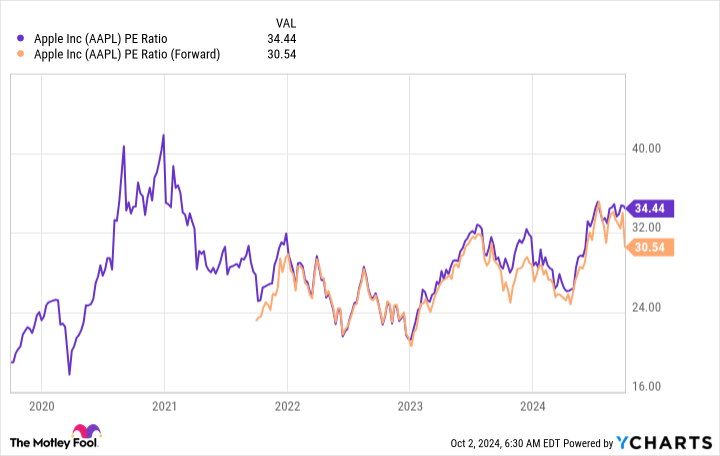

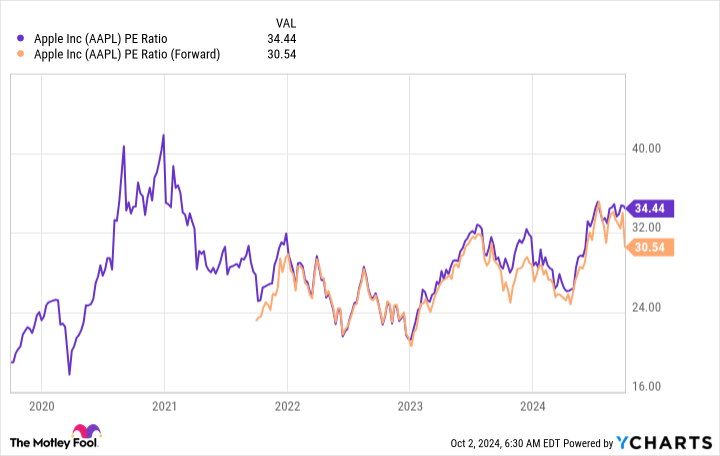

It trades at 34 instances trailing earnings and 31 instances ahead earnings. That is a premium traders would anticipate to pay for a corporation that is rising quickly.

In Apple’s newest quarter, nonetheless, gross sales solely grew by 4.9% and earnings per share (EPS) by 10.2%. These aren’t figures that help the inventory’s lofty valuation.

The instant future seems to be barely higher, however not sufficient to justify as we speak’s worth. In fiscal 2025, ending Sept. 30, 2025, Wall Road expects 8% greater income and 17% EPS progress. In comparison with the next three choices, Apple inventory would not look engaging.

These tech shares look to outperform Apple over the following few years

As a substitute, I might urge you to contemplate Nvidia, Alphabet, and Meta Platforms (and lots of different firms as effectively).

Let’s begin with Nvidia. Its graphics processing models (GPUs) are powering synthetic intelligence (AI), and demand would not appear to be slowing down any time quickly.

Alphabet is Google’s guardian firm, and its market dominance amongst search engines like google allowed it to capitalize on promoting in one of the profitable areas on the web.

Meta Platforms is the guardian of social media websites like Fb and Instagram, and it additionally generates a variety of its cash from adverts on its platforms.

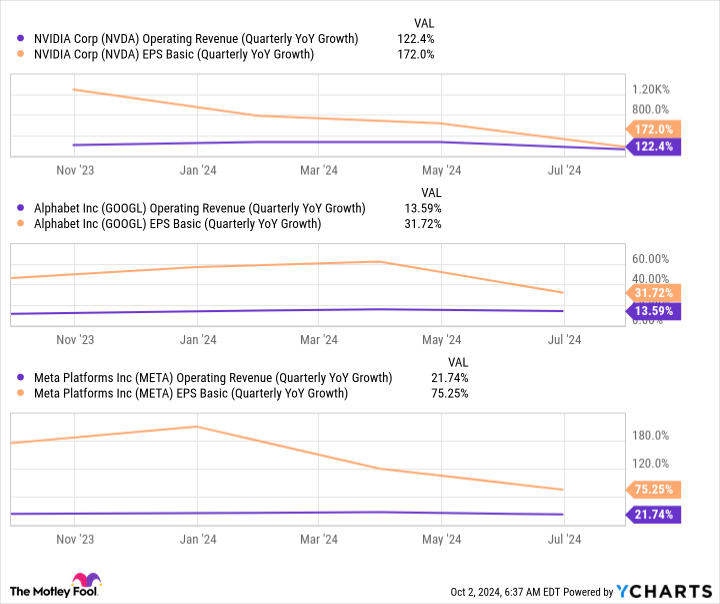

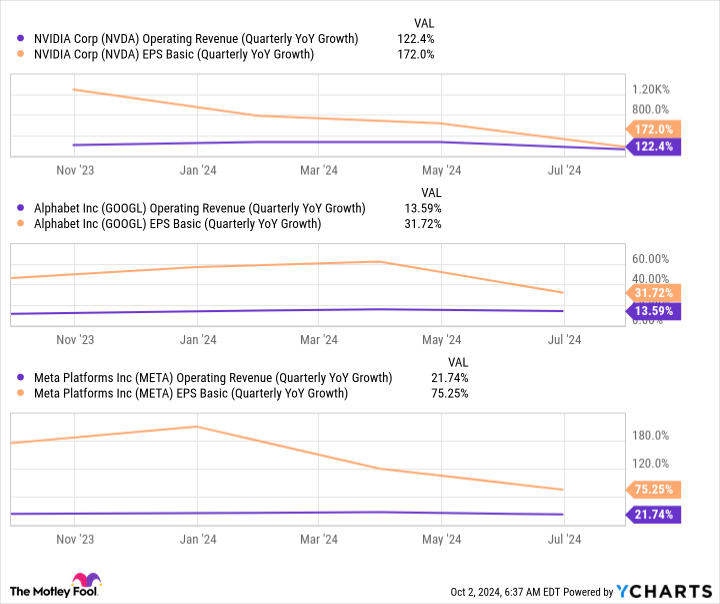

All three of those firms are far outperforming Apple in income and EPS progress.

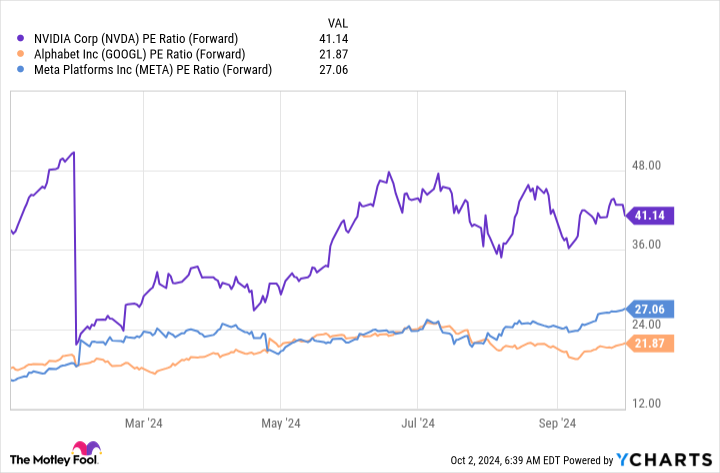

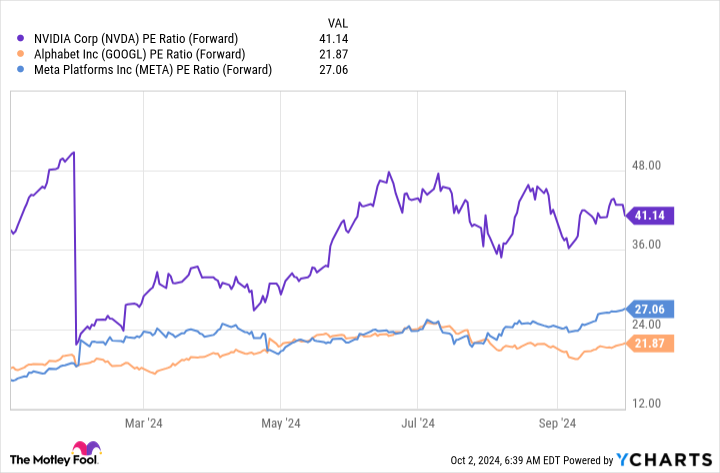

Regardless of doing considerably higher than Apple, two of them do not maintain a premium compared to it, whereas Nvidia is not that rather more costly.

As an investor, I am on the lookout for firms with sustainable enterprise fashions, sooner progress, and decrease inventory valuations. In comparison with Apple, each Meta and Alphabet obtain that, so shopping for these two as an alternative makes a variety of sense.

Nvidia is not cheaper now, however its prospects are way more profitable. Whereas its days of accelerating income at a triple-digit tempo are over, if it retains up its present fee, it is going to nonetheless publish spectacular progress.

In its 2025 second quarter (ending July 28), Nvidia grew income 15% sequentially, and its third-quarter projections point out gross sales will rise one other 8.3% over the earlier interval. Apple cannot muster this type of improve 12 months over 12 months, but Nvidia is doing it one quarter after one other.

If the inventory worth would not transfer, this may quickly drive down Nvidia’s valuation. Nevertheless, with AI being such a scorching funding matter, the inventory will proceed to be robust and can doubtless keep its premium over different tech shares.

Consequently, its inventory efficiency will likely be carefully tied to its income and EPS progress, which is able to simply permit it to outperform the iPhone maker.

Apple is a good firm, however it is not the juggernaut it was. Buyers ought to begin on the lookout for different funding alternatives.

The place to take a position $1,000 proper now

When our analyst staff has a inventory tip, it may possibly pay to pay attention. In any case, Inventory Advisor’s whole common return is 768% — a market-crushing outperformance in comparison with 167% for the S&P 500.*

They simply revealed what they imagine are the 10 finest shares for traders to purchase proper now… and Apple made the checklist — however there are 9 different shares you might be overlooking.

See the ten shares »

*Inventory Advisor returns as of September 30, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Alphabet and Meta Platforms. The Motley Idiot has positions in and recommends Alphabet, Apple, Meta Platforms, and Nvidia. The Motley Idiot has a disclosure coverage.

Ought to You Neglect Apple and Purchase These 3 Tech Shares As a substitute? was initially printed by The Motley Idiot