The inventory of SoFi Applied sciences (NASDAQ: SOFI) has been crushed this 12 months after doubling final 12 months. It is down 20% 12 months so far regardless of what looks as if fairly strong efficiency.

Nonetheless, the tide may flip, and shortly. Let’s examine why SoFi inventory may soar over the following 5 years.

Expanded enterprise, decrease rates of interest

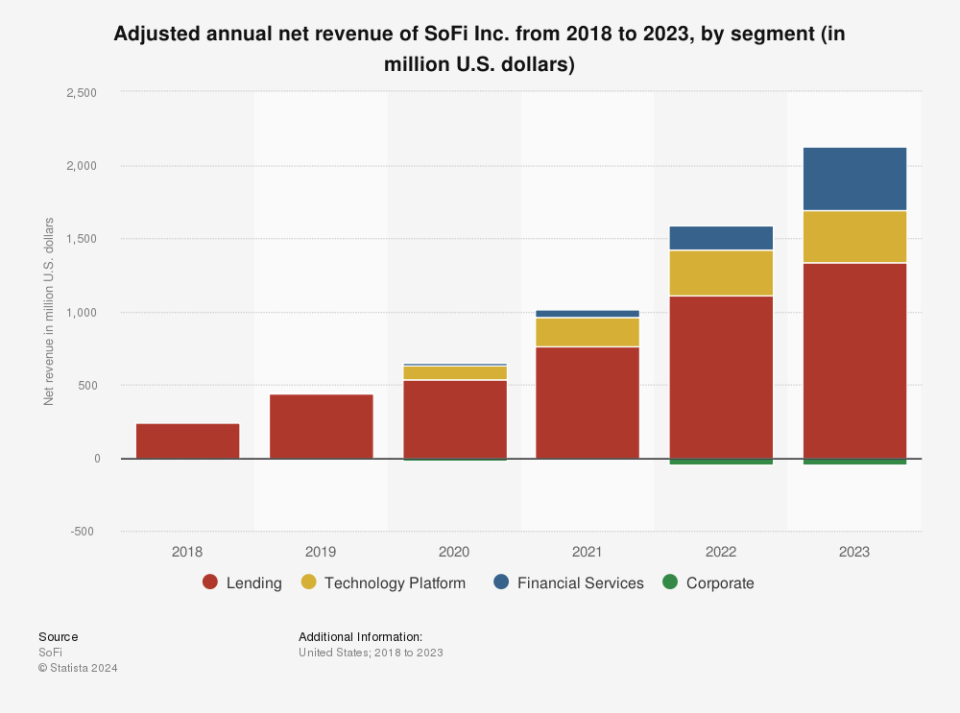

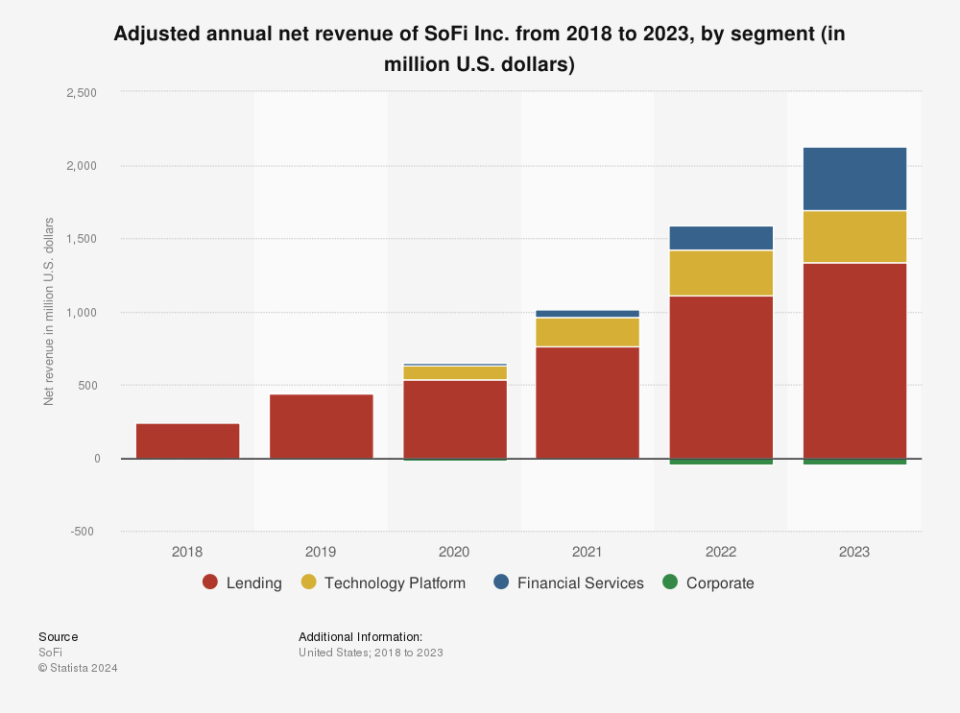

SoFi’s predominant enterprise is lending, but it surely has expanded into a big array of monetary companies like financial institution accounts and investments. Providing different companies gives a number of advantages for SoFi.

It offers it new income sources, it creates better cross-platform engagement amongst present members, it could entice new members, and — what stands out now — is that it shields the enterprise from the altering results of rates of interest.

Lending is usually a profitable enterprise, but it surely’s extremely delicate to rates of interest, and SoFi’s lending section has been underneath stress as charges stay excessive.

Now that rates of interest seem like they’ll begin coming down, the stress ought to start to ease. In the meantime, the opposite segments are nonetheless in progress mode, they usually proceed to account for the next share of the corporate’s general enterprise.

The lending section continues to develop, however the non-lending segments are rising a lot quicker. They accounted for 45% of the enterprise within the 2024 second quarter, up from 38% a 12 months in the past. As the opposite segments outpace lending progress, SoFi will change into a extra steady enterprise, with decrease publicity to rate of interest motion.

If the lending section picks up with decrease charges, which is how the section works, traders’ present considerations concerning the enterprise will fall away. Once you mix that with the power within the firm’s enlargement mannequin, SoFi inventory may explode over the following 5 years, and now might be a good time to purchase in.

Do you have to make investments $1,000 in SoFi Applied sciences proper now?

Before you purchase inventory in SoFi Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and SoFi Applied sciences wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 23, 2024

Jennifer Saibil has positions in SoFi Applied sciences. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

Prediction: SoFi Inventory Will Soar Over the Subsequent 5 Years. Here is 1 Purpose Why. was initially printed by The Motley Idiot