This put up was initially publihed onn TKer.co

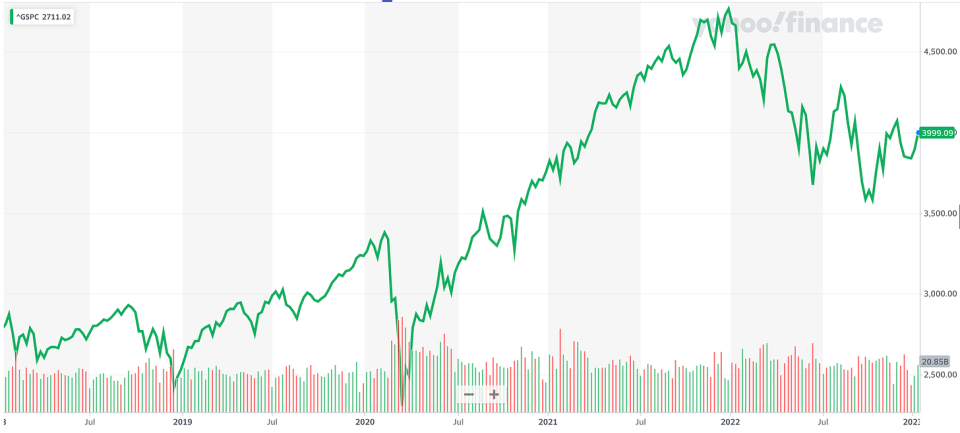

Shares rallied once more, with the S&P 500 climbing 2.7% final week. The index is now up 11.8% from its October 12 closing low of three,577.03 and down 16.6% from its January 3, 2022 closing excessive of 4,796.56.

The previous two weeks have include a great deal of new knowledge, and numerous analysts getting back from break revealed tons of contemporary analysis.

Listed below are just a few charts in regards to the market that stood out:

Monetary obligations have been manageable

“So far, greater rates of interest haven’t negatively impacted margins,” Jonathan Golub, chief U.S. fairness strategist at Credit score Suisse, wrote in a January 4 notice to shoppers.

For example this, Golub share this chart of S&P 500 curiosity bills as proportion of income.

For extra on the implications of upper rates of interest, learn “There’s extra to the story than ‘excessive rates of interest are unhealthy for shares’ 🤨,“ “Enterprise funds look nice 💰,“ and “Why repaying $500 might be more durable than repaying $1,000 🤔“

Corporations are investing of their enterprise

“Regardless of macro uncertainty, capex spending has remained sturdy, accelerating to +24% YoY in 3Q, pushed by Vitality and Communication Companies,“ Savita Subramanian, head of U.S. fairness technique at BofA, noticed on Friday.

BofA expects the U.S. economic system to enter recession this 12 months.

“Though capex is usually pro-cyclical, we see a number of causes that capex might be extra resilient throughout this recession than up to now, together with persistent provide challenges, the necessity to spend on automation amid wage inflation/tight labor market, reshoring, underinvestment by corporates for many years, and the vitality transition.“

For extra on capex spending, learn “9 causes to be optimistic in regards to the economic system and markets 💪“ and “Three huge financial tailwinds I am unable to cease fascinated with 📈📈📈.“

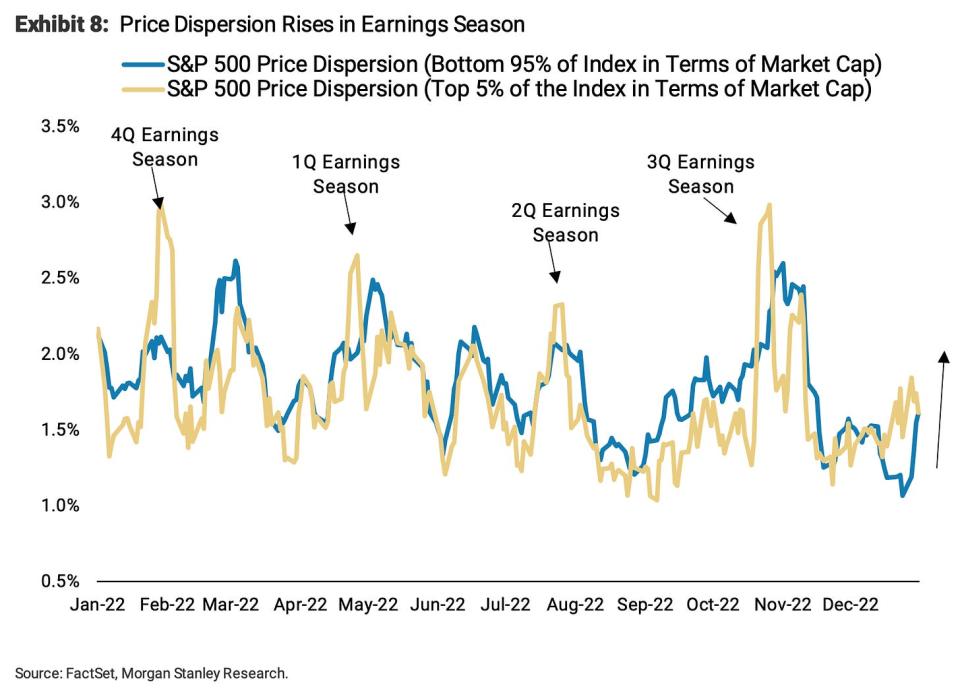

Look ahead to shares to decouple throughout earnings season

“We search for value dispersion to rise over the subsequent ~6 weeks because it has performed all through prior earnings seasons,” Mike Wilson, chief U.S. fairness strategist at Morgan Stanley, wrote on Monday.

Dispersion displays the diploma to which particular person shares transfer collectively.

Whereas Subramanian believes capex spending will maintain up, Wilson argues that corporations chopping again might be see their inventory costs outperform.

“In our view, a key driver of this decide up in dispersion would be the widening relative efficiency hole between these corporations which can be operationally environment friendly on this difficult macro setting and people that aren’t,” he mentioned. “On this sense, we expect corporations that decrease capex, stock and labor funding and maximize money stream might be rewarded on a relative foundation.”

Subscribed

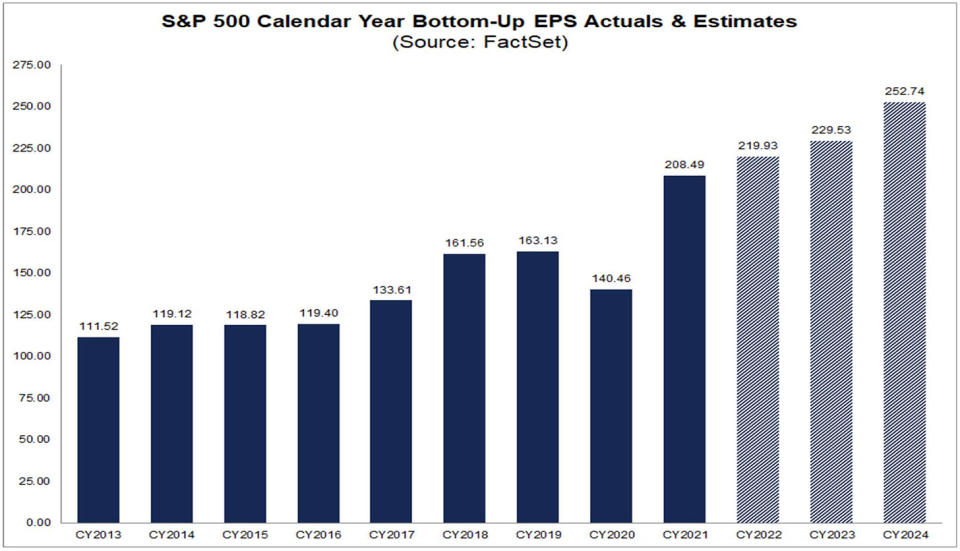

Analysts count on earnings progress in 2023 and 2024

In accordance with FactSet, analysts expect S&P 500 earnings per share (EPS) to rise to $229.53 in 2023 and $252.74 in 2024.

For extra bullish metrics, learn “9 causes to be optimistic in regards to the economic system and markets 💪.“

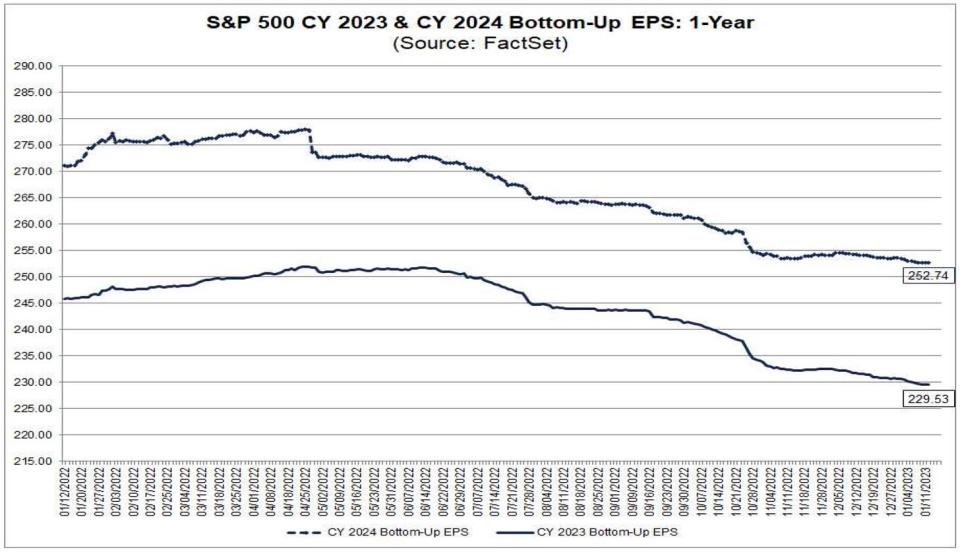

Nevertheless, these expectations have been coming down

From FactSet:

There’s no scarcity of strategists anticipating these numbers to be revised decrease. For extra, learn “One of the crucial incessantly cited dangers to shares in 2023 is ‘overstated’ 😑.“

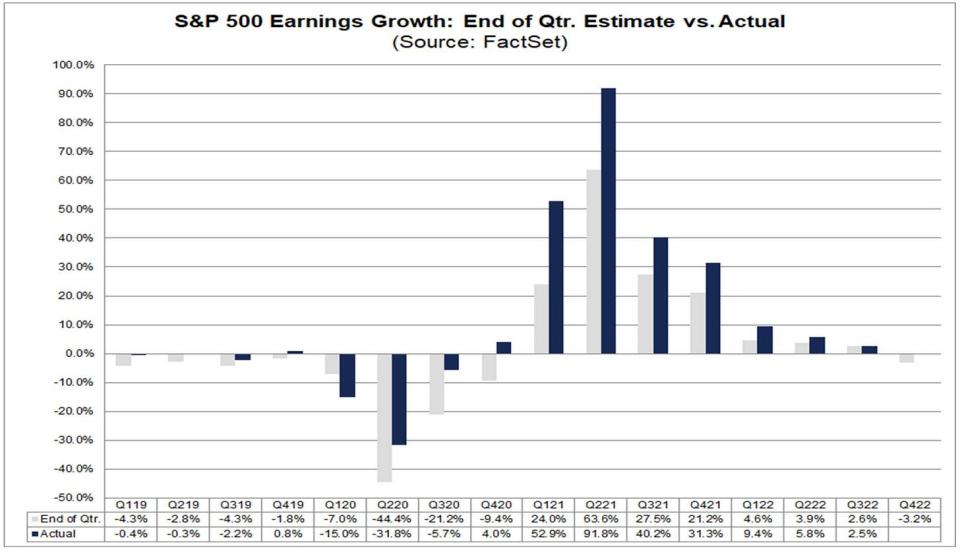

Earnings progress normally beats estimates

From FactSet: “…the precise earnings progress fee has exceeded the estimated earnings progress fee on the finish of the quarter in 38 of the previous 40 quarters for the S&P 500. The one exceptions had been Q1 2020 and final quarter (Q3 2022).”

For extra on this, learn “‘Higher-than-expected’ has misplaced its that means 🤷🏻♂️“ and “The reality about analysts’ deteriorating expectations 📉.“

Share

Valuations backside earlier than anticipated earnings

“In prior bear markets, equities have troughed ~1m earlier than the ISM bottoms, however 1-2 months after monetary circumstances peak,” Keith Parker, head of U.S. fairness technique at UBS, wrote in a January 4 notice. “The market backside coincides with the P/E backside in nearly all situations, with an increase within the P/E usually following a fall in company bond yields.“

The chart under exhibits the P/E backside additionally precedes the underside in ahead earnings estimates.

For extra on P/E ratios, learn “Use valuation metrics just like the P/E ratio with warning ⚠️.“ For extra on shares bottoming, learn “Shares normally backside at the start else.“

In the long term, earnings go up

Deutsche Financial institution’s Binky Chadha expects This fall earnings of $53.80 per share for the S&P 500. This is able to carry EPS nearer to its long-run development, which is up and to the suitable.

For extra on long-term earnings, learn “Expectations for S&P 500 earnings are slipping 📉“ and “Legendary inventory picker Peter Lynch made a remarkably prescient market statement in 1994 🎯.“

Nice years observe horrible years

“Previously 90 years, the S&P 500 has solely posted a extra extreme loss than its 19.4% annual decline in 2022 on 4 events – 1937, 1974, 2002, and 2008,” Brian Belski, chief funding strategist at BMO Capital Markets, noticed on Thursday. “Within the subsequent calendar years, the index logged >20% beneficial properties every time with a mean value return of 26.5% as highlighted in Exhibit 8.“

For extra on short-term patterns within the inventory market, learn “2022 was an uncommon 12 months for the inventory market 📉“ and “Do not count on common returns within the inventory market this 12 months 📊“

Subscribed

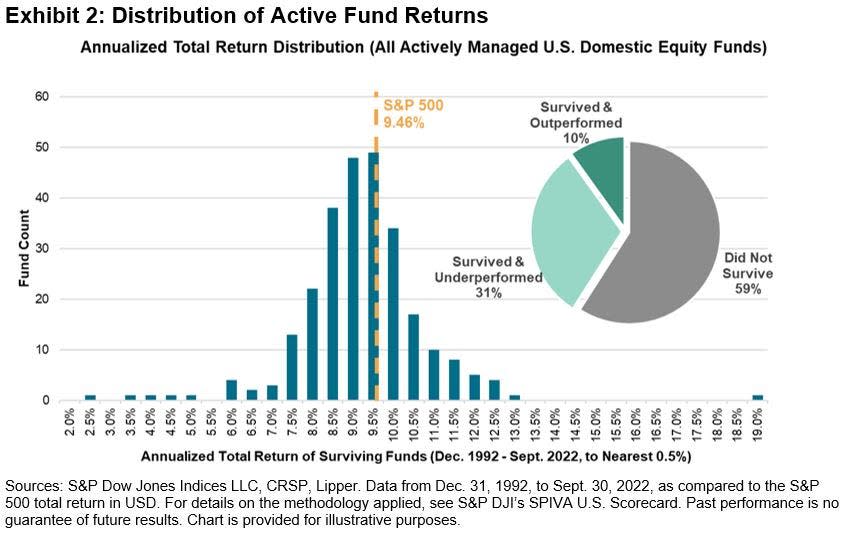

Not many ETFs beat the S&P 500

From S&P Dow Jones Indices: “On Jan. 29, 2023, the world’s longest-surviving exchange-traded fund — initially often called the Customary & Poor’s Depository Receipt or by the acronym SPDR (the “Spider”) — will have a good time 30 years because it started buying and selling… Investing in an index tracker was seen (by some) as an admission of defeat again in early 1993. At greatest, an index fund was “settling for common.” However, because it seems, a portfolio roughly replicating the S&P 500’s return would have been emphatically above common since then.”

For extra on this, learn “Most experts cannot beat the market 🥊“

Most shoppers count on shares to fall

From the NY Fed’s Survey of Client Expectations: “The imply perceived likelihood that U.S. inventory costs might be greater 12 months from now decreased by 0.8 proportion level to 34.9%.“

For extra on this, learn “Most of us are horrible inventory market forecasters 🤦♂️.“

BONUS: Execs are speaking sh*t on earnings calls

From the FT’s Robin Wigglesworth: “Utilizing AlphaSense/Sentieo’s transcription search operate, we will see that the ‘polycrisis’ of runaway inflation, pandemics, rate of interest will increase, provide chain snafus and wars helped elevate swearing on earnings calls and investor days to a brand new document excessive in 2022. Sadly, after we first regarded into this final 12 months it turned out that a lot of the redacted swear phrases had been fairly plain vanilla, like ‘shit’ and ‘bullshit.’“

It’s loads to course of. Certainly, investing within the inventory market might be sophisticated.

Total, there appear to be numerous causes to be optimistic. And the explanations to be pessimistic aren’t significantly out of the peculiar.

For a lot of extra charts on the inventory market, learn “2022 was an uncommon 12 months for the inventory market 📉.“

–

Associated from TKer:

Share

Reviewing the macro crosscurrents 🔀

There have been just a few notable knowledge factors from final week to think about:

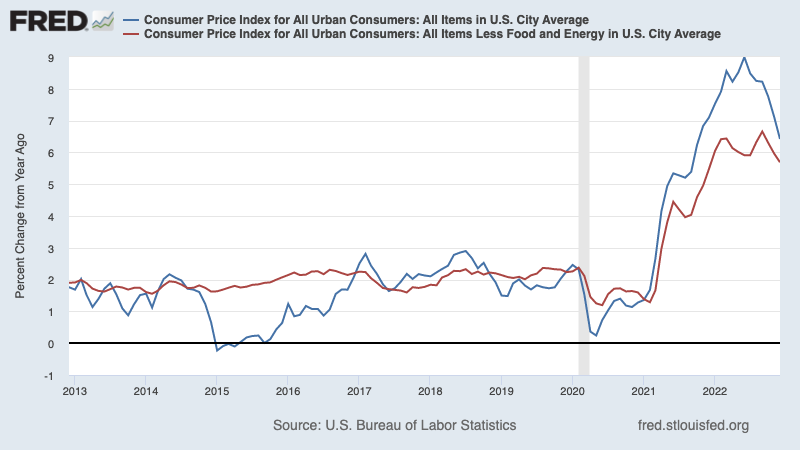

🎈 Inflation continues to chill. The patron value index (CPI) in December was up 6.5% from a 12 months in the past, down from 7.1% in November. Adjusted for meals and vitality costs, core CPI was up 5.7%, down from 6.0%.

On a month-over-month foundation, CPI was down 0.1% and core CPI was up 0.3%.

For those who annualized the three-month development within the month-to-month figures, CPI is rising at a cool 1.8% fee and core CPI is climbing at a just-above-target 3.1% fee.

For extra on the implications of cooling inflation, learn “The bullish ‘goldilocks’ gentle touchdown state of affairs that everybody desires 😀.“

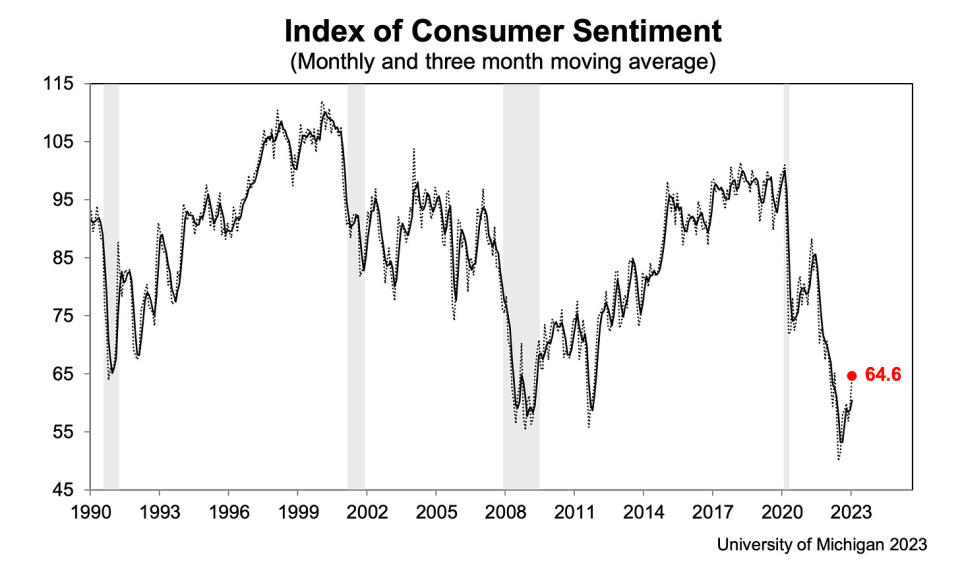

👍 Client sentiment improves. From the College of Michigan’s December Survey of Shoppers: “Client sentiment remained low from a historic perspective however continued lifting for the second consecutive month, rising 8% above December and reaching about 4% under a 12 months in the past. Present assessments of private funds surged 16% to its highest studying in eight months on the idea of upper incomes and easing inflation… 12 months-ahead inflation expectations receded for the fourth straight month, falling to 4.0% in January from 4.4% in December. The present studying is the bottom since April 2021 however stays nicely above the two.3-3.0% vary seen within the two years previous to the pandemic.“

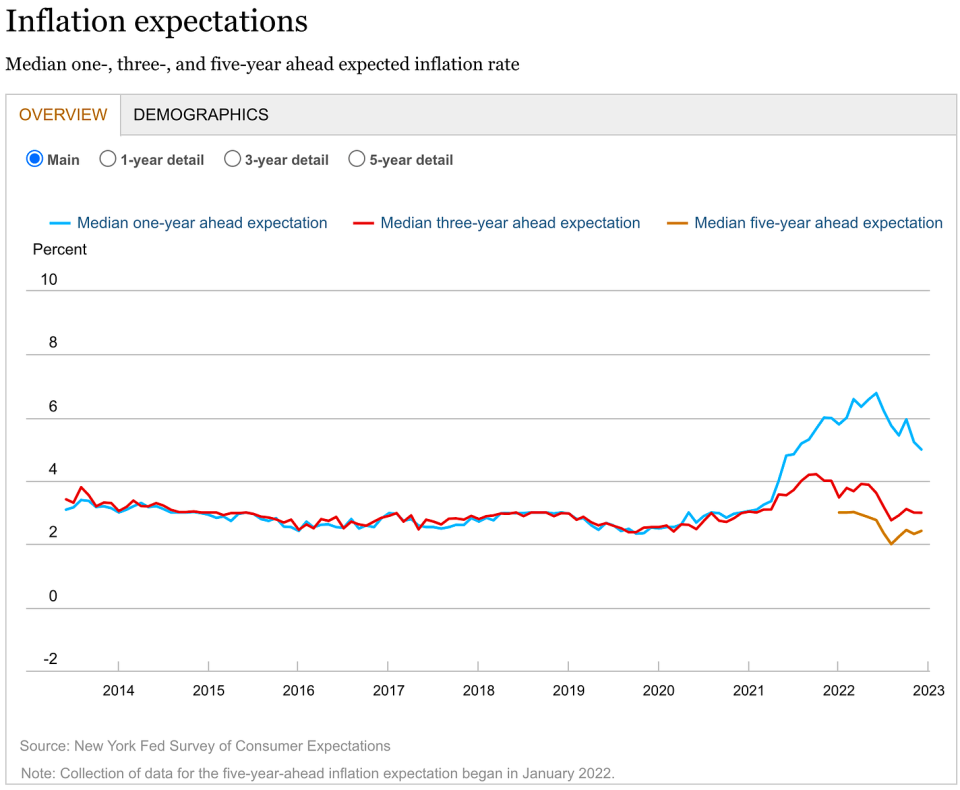

👍 Expectations for inflation enhance. From the NY Fed’s December Survey of Client Expectations: “Median one-year-ahead inflation expectations declined to five.0%, its lowest studying since July 2021, in accordance with the December Survey of Client Expectations. Medium-term expectations remained at 3.0%, whereas the five-year-ahead measure elevated to 2.4%.“

💳 Shoppers are taking over extra debt. In accordance with Federal Reserve knowledge launched Monday, complete revolving client credit score excellent elevated to $1.19 trillion in November. Revolving credit score consists largely of bank card loans.

💳 Bank card rates of interest are up. From Axios: “The Federal Reserve’s most up-to-date report on prices of client credit score confirmed common rates of interest on bank-issued bank cards touching 19.1% within the fourth quarter. That beats the earlier document excessive — 18.9% — set within the first quarter of 1985.“

💳 Bank card delinquencies are low, however normalizing. From JPMorgan Chase’s This fall earnings announcement: “We count on continued normalization in credit score in 2023.“ The financial institution’s outlook assumes a “gentle recession within the central case.“ For extra on this, learn “Client funds are in remarkably fine condition 💰“

💰 Total client funds are steady. From Apollo World Administration’s Torsten Slok: “…households throughout the earnings distribution proceed to have the next degree of money out there than earlier than the pandemic, and the velocity with which households are working down their money balances in latest quarters has been very sluggish. Mixed with continued strong job progress and strong wage inflation, the underside line is that there stays a strong tailwind in place for US client spending.“

“The U.S. economic system at the moment stays sturdy with shoppers nonetheless spending extra money and companies wholesome,” Jamie Dimon, CEO of JPMorgan Chase, said on Friday. For extra on this, learn “Client funds are in remarkably fine condition 💰“

🛍️ Client spending is steady. From BofA: “Though upper-income (<125k) spending modestly outperformed lower-income (<50k) spending in the course of the holidays, we see no clear indicators of cracks within the latter. Decrease-income HHs are nonetheless allocating a bigger share of complete card spending to discretionary classes than they had been earlier than the pandemic (Exhibit 7). This implies they aren’t but transferring to a extra precautionary stance. Decrease-income HHs additionally don’t but seem like going through liquidity points, since they’re allocating a smaller share of complete card spending to bank cards than they did in 2019 (Exhibit 8).“ For extra financial indicators which can be holding up, learn “9 causes to be optimistic in regards to the economic system and markets 💪.“

💼 Unemployment claims stay low. Preliminary claims for unemployment advantages fell to 205,000 in the course of the week ending Jan. 7, down from 206,000 the week prior. Whereas the quantity is up from its six-decade low of 166,000 in March, it stays close to ranges seen during times of financial enlargement.

🤒 Many are out sick. From KPMG’s Diane Swonk: “Almost 70% extra staff out sick every month than pre-pandemic common. The scars of the pandemic are including to staffing shortages. The variety of these out sick and unable to work hit 1.6 million in November; that left practically 700,000 extra individuals on the sidelines than in any month of the 2010s. Fatalities so far are greater than different developed economies. Many older staff had COVID and are unable to work because of lengthy COVID. Youthful retirees are actually wanted to look after grandchildren and aged dad and mom, because of acute scarcity of kid and long-term care staff. These out from work because of childcare issues reached an all-time excessive in October as extra youngsters had been sick with RSV, Flu, and COVID-19.“

💼 Job openings are ticking decrease. From labor market knowledge agency LinkUp: “…labor demand continued to say no via the top of 2022 as complete lively job listings dropped 4.5% within the U.S. from November to December, in comparison with the 6.9% lower in itemizing quantity from October to November, and declined throughout practically all states and industries as nicely. Employers additionally created fewer listings in December, because the rely of latest job listings dropped 3.2% month-over-month. Nevertheless, whereas we noticed declines in each new and complete listings, eliminated listings grew by 3.5% from November to December.“ For extra on this, learn “How job openings clarify all the things proper now 📋“

📈 Stock ranges are up. In accordance with Census Bureau knowledge launched Tuesday, wholesale inventories climbed 1.0% to $933.1 billion in November, bringing the inventories/gross sales ratio to 1.35. For extra, learn “We will cease calling it a provide chain disaster ⛓.”

Placing all of it collectively 🤔

We’re getting numerous proof that we might get the bullish “Goldilocks” gentle touchdown state of affairs the place inflation cools to manageable ranges with out the economic system having to sink into recession.

However for now, inflation nonetheless has to return down extra earlier than the Federal Reserve is snug with value ranges. So we should always count on the central financial institution to proceed to tighten financial coverage, which implies tighter monetary circumstances (e.g. greater rates of interest, tighter lending requirements, and decrease inventory valuations). All of this implies the market beatings are more likely to proceed and the danger the economic system sinks right into a recession will intensify.

Nevertheless, we might quickly hear the Fed change its tone in a extra dovish approach if we proceed to get proof that inflation is easing.

It’s vital to do not forget that whereas recession dangers are elevated, shoppers are coming from a really sturdy monetary place. Unemployed persons are getting jobs. These with jobs are getting raises. And plenty of nonetheless have extra financial savings to faucet into. Certainly, sturdy spending knowledge confirms this monetary resilience. So it’s too early to sound the alarm from a consumption perspective.

At this level, any downturn is unlikely to show into financial calamity on condition that the monetary well being of shoppers and companies stays very sturdy.

As all the time, long-term buyers ought to do not forget that recessions and bear markets are simply a part of the deal once you enter the inventory market with the intention of producing long-term returns. Whereas markets have had a horrible 12 months, the long-run outlook for shares stays constructive.

For extra on how the macro story is evolving, take a look at the earlier TKer macro crosscurrents »

For extra on why that is an unusually unfavorable setting for the inventory market, learn “The market beatings will proceed till inflation improves 🥊“ »

For a more in-depth take a look at the place we’re and the way we bought right here, learn “The sophisticated mess of the markets and economic system, defined 🧩”

This put up was initially publihed onn TKer.co

Sam Ro is the founding father of TKer.co. Observe him on Twitter at @SamRo