SoundHound (NASDAQ: SOUN) inventory sank in Thursday’s buying and selling. The corporate’s share value ended the every day session down 15.8%, in response to information from S&P International Market Intelligence.

SoundHound inventory fell following a bearish activate the corporate from analysts at Cantor Fitzgerald. The agency printed a be aware on the corporate this morning and downgraded its score on the inventory from purchase to promote.

SoundHound inventory continues to see risky buying and selling

Cantor Fiztgerald’s downgrade on SoundHound inventory was notable for a number of causes. For starters, the agency’s analysts downgraded the inventory straight from purchase to promote — utterly skipping over the intermediate impartial score. The corporate additionally issued a one-year value goal of $4.90 per share on the inventory, suggesting extra draw back of roughly 27% from its value at Thursday’s market shut.

Cantor’s downgrade on the inventory adopted a scathing quick vendor’s report printed by Capybara Analysis on Tuesday. In its report Capybara stated that it believed that SoundHound’s Houndify was a commodity product with unremarkable know-how.

The quick vendor indicated that SoundHound had no actual benefit in comparison with resource-rich opponents, together with Amazon, Alphabet, and Microsoft, and it additionally advised that the audio-technology firm was hiding the lack of massive clients, together with Netflix, Mercedes-Benz, and Deutsche Telekom. Capybara stated it believed SoundHound inventory was value $1 per share or much less.

Is the bearish swing truly a shopping for alternative?

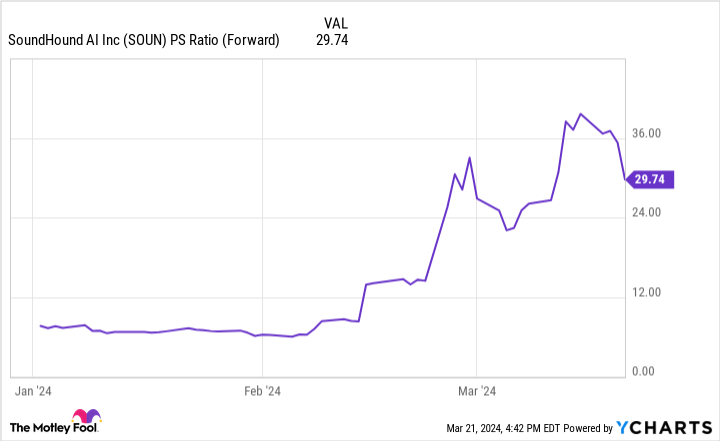

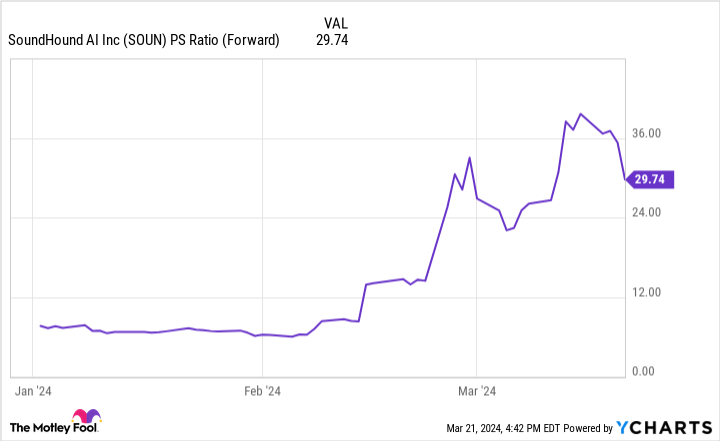

Regardless of immediately’s sell-off, SoundHound AI inventory remains to be up 215% throughout 2024’s buying and selling. Valued at roughly 30 instances this yr’s anticipated gross sales, it is in all probability truthful to say that the corporate is likely one of the riskiest sizzling AI shares in the marketplace proper now.

SoundHound elevated its income roughly 80% in final yr’s fourth quarter and is guiding for gross sales to extend roughly 53% this yr. The corporate additionally stated that it ended final yr with a cumulative bookings and subscriptions backlog of $661 million — roughly doubling in comparison with the tip of the earlier yr.

However, the corporate famous that “subscriptions backlog refers to potential income achievable for the corporate” and assumes that gross sales from current clients will scale alongside a specific trajectory. SoundHound can be nonetheless working at a loss, and it isn’t clear when the enterprise would possibly shift into profitability.

Because it stands, SoundHound AI inventory remains to be too dangerous for many traders even after immediately’s pullback. The corporate’s outlook stays extremely unsure, and the dramatic beneficial properties it scored this yr counsel there’s nonetheless loads of draw back danger.

Do you have to make investments $1,000 in SoundHound AI proper now?

Before you purchase inventory in SoundHound AI, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and SoundHound AI wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 21, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Keith Noonan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Microsoft, and Netflix. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

SoundHound AI Plummeted Right this moment — May This Truly Be a Likelihood to Purchase the Synthetic Intelligence (AI) Inventory? was initially printed by The Motley Idiot