[1/2] Employees members work at a packing part at a garment manufacturing unit in Colombo after the Worldwide Financial Fund’s government board authorized a $3 billion bailout for Sri Lanka. March 21, 2023. REUTERS/Dinuka Liyanawatte/File Picture

COLOMBO, June 1 (Reuters) – In an indication of confidence that the worst of Sri Lanka’s monetary disaster is over, its central financial institution shocked markets by reducing rates of interest for the primary time in three years on Thursday, signalling a change in fact to gasoline a rebound within the economic system.

The South Asian island republic plunged into disaster final 12 months as its overseas alternate reserves ran out, meals and power costs spiralled and protesting mobs pressured the ouster of the nation’s then president.

President Ranil Wickremesinghe took the reins in July and negotiated a $2.9 billion bailout from the Worldwide Financial Fund (IMF) in March.

In an handle to the nation on Thursday, Wickremesinghe mentioned Sri Lanka will work to chop authorities spending, enhance overseas funding and create jobs because the nation seeks to return to development.

“The nation’s economic system is step by step recovering from the disaster, because of appropriate insurance policies together with the collective efforts of the individuals.”

Wickremsinghe outlined a number of reform measures together with growing exports, attracting worldwide traders and restructuring loss-making state enterprises to place public funds so as and return to nation to development.

Inflation, which hit a file excessive of round 70% in September, is coming down, authorities revenues are trying up and stress on the nation’s steadiness of funds is easing.

The federal government goals to finish talks to restructure its bilateral debt with different nations by September.

“This may probably be seen as an finish to the disaster,” mentioned Sanjeewa Fernando, a senior vp at Asia Securities in Colombo.

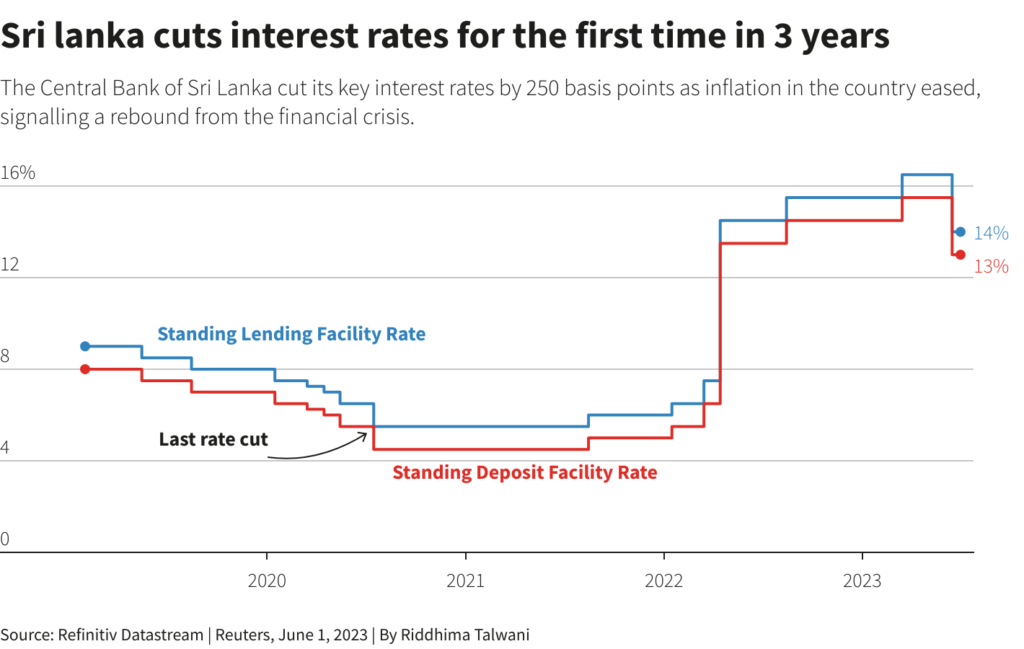

The Central Financial institution of Sri Lanka (CBSL) reduce its standing deposit facility fee and standing lending facility fee by 250 foundation factors – to 13% and 14%, respectively, from 15.5% and 16.5%. The central financial institution mentioned the large fee reduce would “assist steer the economic system in direction of a rebound section.”

Governor P. Nandalal Weerasinghe mentioned the economic system “was getting again to normalcy”.

“Popping out of the disaster is gradual,” he informed reporters. “Can’t say yesterday, day earlier than or tomorrow. It’s a gradual restoration course of.”

Whereas inflation has come down, it stays steep so most analysts had anticipated the financial institution to maintain charges regular. The charges are actually at their lowest degree since March 2022, the beginning of the disaster.

The shock determination was welcomed by markets, with the rupee rising to 288 towards the greenback, its highest since April 2022 and the benchmark Colombo Inventory Change index (.CSE) closing up 1.59%, lifting away from five-month lows.

The speed reduce comes after the important thing Colombo Shopper Worth Index rose 25.2% on 12 months in Might in contrast with 35.3% in April, decreasing some stress on the crisis-hit economic system.

The index peaked at a annual 69.8% surge in September final 12 months. The nationwide inflation fee was at 33.6% in April, easing from 73.7% in September.

SHIFTING GEARS

Analysts mentioned with the CBSL having efficiently handled the runaway inflation, it was turning its consideration to development.

The central financial institution raised charges by a file 950 foundation factors final 12 months to tame inflation and by 100 bps on March 3 this 12 months.

The IMF expects GDP to contract 3% this 12 months after a 7.8% contraction final 12 months. The CBSL has forecast a 2% contraction in 2023 and Weerasinghe mentioned the financial institution expects the economic system to develop from the third quarter onward after a small contraction within the second quarter.

“Hopefully banks will step by step develop their mortgage books and credit score will begin flowing into companies and with that the economic system will begin to get better,” Weerasinghe mentioned.

Inflation is predicted to average additional, with Fernando at Asia Securities predicting a determine of 5% by 12 months finish.

The IMF has set Sri Lanka an inflation goal of 15.2% for this 12 months however the CBSL is eyeing a extra formidable goal of single digit inflation by September which was clearly inside attain, Weerasinghe mentioned.

“Headline inflation is forecast to succeed in single-digit ranges in early Q3-2023, and stabilise round mid-single digit ranges over the medium time period,” the financial institution mentioned.

It mentioned quicker deceleration of inflation and the decrease likelihood of demand stress in the course of the financial rebound “creates area for a gradual coverage leisure within the interval forward.”

Modifying by Shri Navaratnam and Raju Gopalakrishnan

: .