Upstart (NASDAQ: UPST) inventory closed out Wednesday’s every day buying and selling session with enormous beneficial properties. The corporate’s share worth ended the day’s buying and selling up 20.3%, in keeping with information from S&P World Market Intelligence. In the meantime, the S&P 500 index closed out the every day session up roughly 1.4%.

Shares rallied on Wednesday following information that the Federal Reserve would hold rates of interest at present ranges quite than serve up one other fee hike. That is significantly excellent news for fintech corporations, together with Upstart, which have usually been battered by the central banking authorities’ program of fast fee hikes.

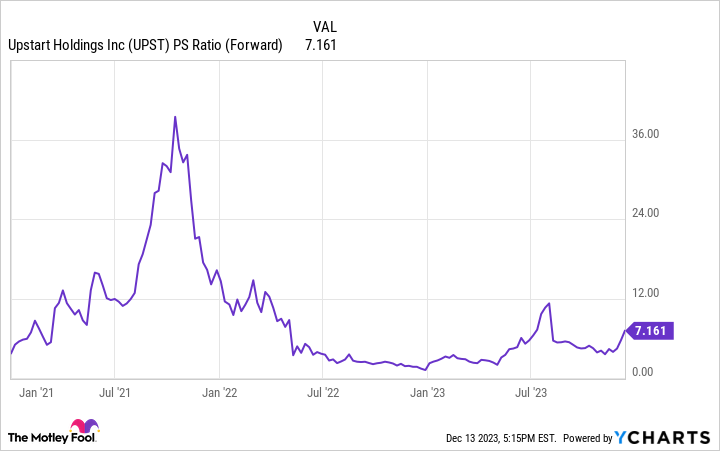

Including to the momentum for Upstart inventory at present, the corporate introduced {that a} new accomplice had joined its platform. However even with at present’s explosive rally, the fintech’s share worth continues to be down 89% from its excessive.

A brand new accomplice and stabilizing macro circumstances

Upstart goals to make loans out there to a wider vary of potential debtors. By its proprietary artificial-intelligence-powered system, the corporate goals to scale back the necessity for reliance on FICO scores and take a wider vary of related standards into consideration when assessing creditworthiness.

Right now, Upstart introduced that Mutual Safety Credit score Union would start utilizing the corporate’s platform to develop the accessibility of private loans for its clients. Given the backdrop of macroeconomic uncertainty that has formed a lot of this 12 months’s buying and selling, the addition of main new banking companions is undoubtedly an excellent signal.

Even higher, indicators counsel that the general backdrop might be shifting in instructions which might be extra favorable for Upstart and its shareholders. Many analysts now count on that the Fed may pivot to a rate-cutting coverage someday subsequent 12 months.

In that case, that would pave the best way for Upstart inventory’s rebound to proceed. Decrease rates of interest would imply that it is much less dangerous to lend, and the corporate may attain a wider buyer base via its community and banking companions. If general financial circumstances enhance, that might additionally work to decrease the chance of defaults.

Is Upstart inventory a purchase now?

Upstart is now buying and selling at roughly 7.2 occasions anticipated gross sales — a extremely growth-dependent valuation. Whereas the corporate’s gross sales development can fairly be anticipated to proceed within the quick time period, its earnings trajectory might be way more uneven. However, it might be within the early phases of getting disruptive impacts on the lending trade that pave the best way for long-term shareholders to see stellar returns.

For risk-tolerant traders, Upstart inventory might be a worthwhile portfolio addition proper now. Whereas the corporate’s long-term outlook stays considerably speculative, the potential for large upside continues to be there even after at present’s large pop.

Must you make investments $1,000 in Upstart proper now?

Before you purchase inventory in Upstart, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Upstart wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 11, 2023

Keith Noonan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Upstart. The Motley Idiot has a disclosure coverage.

Nonetheless Down 89% After Explosive Beneficial properties Right now, Is Upstart Inventory a Purchase? was initially printed by The Motley Idiot