(Bloomberg) — It’s the week everybody’s been ready for. With the discharge a key measure of inflation, the Federal Reserve interest-rate resolution and Chair Jerome Powell’s feedback afterward, traders are hoping to lastly have a transparent view of what’s forward for a beaten-down inventory market and economic system in 2023.

Most Learn from Bloomberg

However after a tumultuous 12 months that has the S&P 500 Index taking a look at its greatest annual loss since 2008, fairness merchants are ready for one certain factor over the approaching classes: extra volatility.

Inflation reviews have been rocking equities all 12 months, leaving markets to gauge the central financial institution’s possible coverage path amid relentlessly surging costs. This week’s client value index studying is essential, as indicators of ebbing inflation may buoy shares into year-end by tempering expectations for additional Fed hikes.

Over the previous six months, the S&P 500 has seen a mean transfer of about 3% in both course on the day CPI has been launched, in line with information compiled by Bloomberg. That’s the very best since 2009. The S&P 500 has fallen on seven of the 11 CPI reporting days this 12 months.

The US central financial institution is broadly anticipated to ship a half-point hike on the shut of its assembly on Dec. 14. So fairness traders are extra centered on what Powell has to say at his press convention afterward, in search of any hints on the trail ahead for rates of interest. The Fed’s outlook for the US economic system may also be a spotlight, together with any adjustments in central bankers’ price projections.

Learn extra: Fed’s Peak Charges Seen Dashing Wall Road’s Hopes for 2023 Cuts

After all, international cash managers are hoping 2022 will finish on a excessive be aware after the S&P 500 posted two consecutive month-to-month advances for the primary time in additional than a 12 months in October and November. However, betting on the place issues go within the coming months with the S&P 500 looking at its first down 12 months since 2018 is especially difficult.

“Getting the precise place is awfully tough for traders proper now,” stated Erik Ristuben, chief funding strategist at Russell Investments. “Fed coverage is admittedly placing a damper on the stock-market celebration till Wall Road is assured that the central financial institution is near being executed with elevating charges.”

Buyers’ lack of conviction heading into this key week is obvious within the choices markets. The Cboe Volatility Index, or VIX, has declined on 80% of the times over the previous 10 weeks ending Dec. 2. That has solely occurred three different instances because the inception of Wall Road’s so-called worry gauge, information compiled by Bespoke Funding Group present.

“There’s this sense that the VIX has dropped an excessive amount of, contemplating the large occasions just like the CPI information and the interest-rate resolution subsequent week,” stated Brent Kochuba, founding father of analytic service SpotGamma. “Individuals are beginning to get up to the truth that possibly issues have grow to be a bit too complacent.”

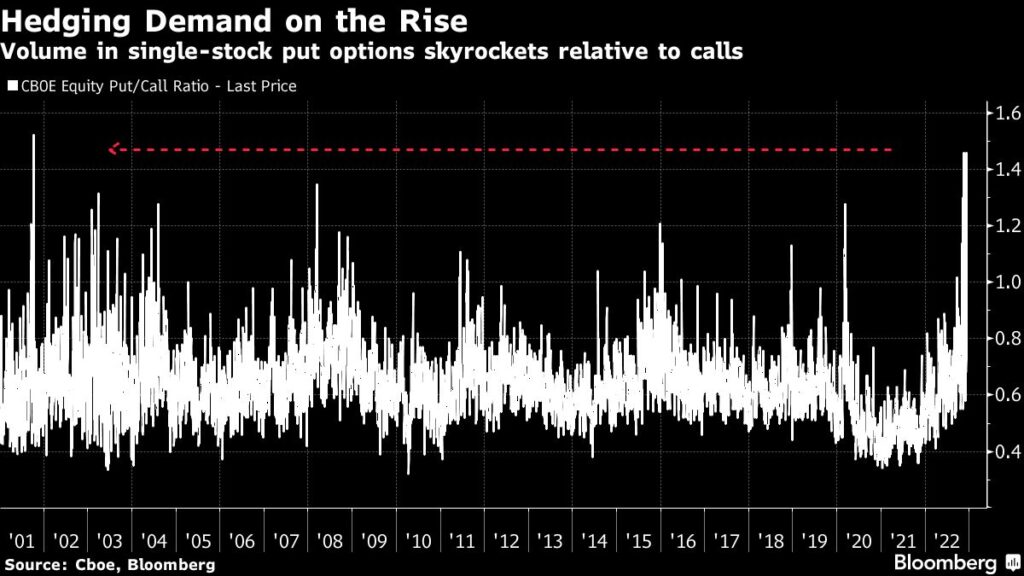

In the meantime, demand for hedges towards single-stock losses pushed the Cboe fairness put-to-call ratio to 1.5 on Wednesday — the very best degree since 2001 and greater than double this 12 months’s common.

Pricing within the futures market exhibits the Fed’s coverage price peaking at round 4.9% within the first half of 2023. Which means there’s nonetheless room for the Fed to elevate charges because it tames stubbornly excessive costs. Previously eight rate-hiking cycles, the Fed continued to elevate borrowing prices till they had been above CPI, in line with Carson Funding Analysis.

A half-point hike on Dec. 14 would go away the fed funds price in a spread of 4.25%-4.5%. In the meantime, Tuesday’s CPI report is predicted to indicate the index eased to a 7.3% annual improve in November, from 7.7% the month earlier than. However nothing is assured. Shares wobbled on Friday after a hotter-than-expected report on producer costs.

“It’s undoubtedly a tough time for traders,” stated Stephanie Lang, chief funding officer at Homrich Berg, whose agency recommends being defensively positioned in favor of client staples and health-care corporations. “If historical past is any indication of the Fed’s observe document of overshooting, that makes us cautious on equities.”

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.