(Bloomberg) — 4 main occasions over the subsequent 13 buying and selling periods would be the key catalysts in figuring out whether or not this yr’s stock-market revival will get derailed or begins rolling once more after a February stoop.

Most Learn from Bloomberg

All of it begins Tuesday, when Federal Reserve Chair Jerome Powell delivers his two-day biannual financial coverage testimony on Capitol Hill. With the S&P 500 Index coming off its greatest week in a month, traders will likely be looking for any trace on the central financial institution’s interest-rate mountain climbing path.

“The market is clinging to each single optimistic factor Powell says,” Emily Hill, founding associate at Bowersock Capital, mentioned. “The minute the phrase ‘disinflation’ left his lips in a speech earlier this yr, the market soared.”

Certainly, the rally on the finish of final week was spurred by Atlanta Fed chief Raphael Bostic saying the central financial institution may pause this summer season.

After Powell, comes the February jobs report on March 10 and consumer-price index on March 14. One other sizzling studying on employment progress and inflation may sprint any hopes that the Fed will pullback quickly.

“There are such conflicting indicators within the economic system,” Hill mentioned. “So that you’re going to see overreactions from traders to the upcoming information.”

Then, on March 22, the Fed will give its coverage determination and quarterly interest-rate projections, and Powell will maintain his press convention. After that, traders ought to have a fairly clear concept of whether or not the central financial institution will halt its price hikes a while within the coming months.

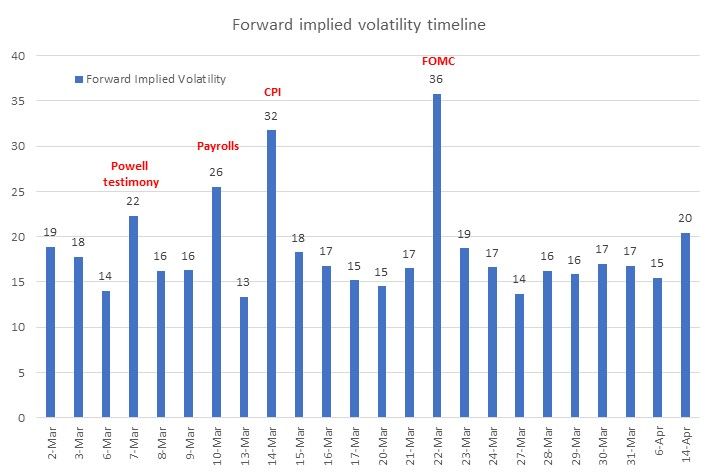

Traders are anxious about most of this. Ahead implied volatility is again within the low 30s for the consumer-price-index day and nearing 40 for Fed rate-decision day later, that means merchants are betting on some massive swings, information compiled by Citigroup present. Nevertheless, a ahead implied volatility studying of 26 on jobs information day signifies the market is underpricing that threat, in accordance with Stuart Kaiser, Citigroup’s head of US fairness buying and selling technique.

As for the inventory market itself, the prevailing sense has been calm. The S&P 500 posted a day by day transfer of lower than 0.5% in both route for the three-trading days ending March 1, a streak of tranquility final seen in January when traders boosted their bets that the US economic system might avert a recession as inflation ebbs.

Right here’s what merchants will likely be monitoring.

Powell Testimony

The Fed chair’s biannual financial coverage report back to the US Senate Banking Committee on Tuesday and the Home Monetary Providers Committee on Wednesday are more likely to supply hints on the US financial outlook, particularly inflation, wage pressures and employment. Merchants may even search for clues on extra steps the Fed will take to manage elevated costs.

Jobs Report

The labor market was sturdy in January. That’s an essential driver of inflation, as a result of wage progress can maintain costs greater. And it’s a threat for inventory costs as a result of sticky inflation would forestall the Fed from pausing price hikes. Economists predict that the February unemployment price will are available in at 3.4%, unchanged from January. Nonfarm payrolls progress is anticipated to drop to 215,000 after a shocking burst of 517,000 jobs a month earlier. However finally the information comes right down to wages and whether or not the Fed thinks they’re slowing quick sufficient to drive inflation decrease.

Inflation Knowledge

The February shopper value index studying is essential, after it jumped to start out the yr. Any signal of persistent inflation may push the Fed to lift charges even greater than already anticipated. The forecast for February’s CPI is 6%, an enchancment from January’s 6.4%. Core CPI, which strips out the risky meals and vitality parts and is seen as a greater underlying indicator than the headline measure, is projected to rise 5.4% from February 2022 and 0.4% from a month earlier. The Fed’s inflation goal, which takes in additional than simply the CPI studying, is 2%.

Fed Choice

The market is pricing in a September peak in rates of interest at 5.4%, almost a proportion level above the present efficient federal funds price. Merchants are making ready for the potential for the Fed returning to jumbo price hikes, with in a single day index swaps pricing in about 31 foundation factors of tightening later this month.

In fact, the Fed’s ahead expectations and Powell’s feedback after the choice will have an effect on market sentiment. Nevertheless it’s about massive misses, like inflation readings coming in a lot hotter than anticipated, that will derail the inventory market’s restoration makes an attempt, in accordance with Michael Antonelli, market strategist at Baird.

“If the terminal price goes from 5% to five.5%, that will likely be a headwind, however it received’t crater the inventory market the best way it did final yr,” Antonelli mentioned in a cellphone interview. “Final yr, we didn’t know what the worse-case eventualities was going to appear like, however this yr the window of potential outcomes is way narrower. And traders like that.”

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.