Forward of Chipotle Mexican Grill‘s deliberate 50-for-1 inventory cut up, buyers could also be questioning which inventory could possibly be subsequent.

One candidate is Nvidia (NASDAQ: NVDA), whose inventory has skyrocketed 230% over the previous 12 months and is now hovering round $950 per share. So, let’s discover why an organization may cut up its inventory, Nvidia’s historical past of inventory splits, and whether or not buyers can purchase the chipmaker.

What’s a inventory cut up?

A inventory cut up is a company motion wherein an organization divides its present shares into a number of shares, successfully rising the excellent shares whereas sustaining the identical market capitalization. This leads to its shareholders receiving extra shares, whereas their possession stake and the entire worth of their funding stay unchanged.

As an example, if an investor holds 5 shares of an organization priced at $1,000 per share and the corporate executes a 10-for-1 inventory cut up, the investor would then personal 50 shares priced at $100 every, with the entire funding worth remaining at $5,000.

Why would an organization cut up its inventory?

Whereas many brokerages let retail buyers buy fractional shares, others, like Vanguard, do not provide this selection. So, when a inventory like Nvidia trades at a excessive worth, it’d change into too costly for a lot of potential buyers. Having a decrease share worth might make a inventory extra inexpensive, probably resulting in extra demand for the corporate’s shares, which can enhance its total market capitalization.

One other profit is {that a} decrease inventory worth can assist entice and hold gifted employees. Nvidia co-founder, president, and CEO Jensen Huang helps this reasoning, saying it offers employees better flexibility of their possession of firm inventory via compensation or inventory plans.

Nvidia has cut up its inventory earlier than

Nvidia is not any stranger to inventory splits. Since going public in 1999, it has cut up its inventory on 5 events, all underneath Huang. The corporate’s most up-to-date one, a 4-for-1 cut up, occurred in July 2021.

Notably, when the corporate introduced its final inventory cut up, its inventory traded close to $600 per share, properly beneath its present worth of $950 per share.

When Jim Cramer requested about it in March, Huang stated, “We’ll give it some thought,” and reiterated why he likes the observe, saying: “It is a good factor. We need to be sure that we care for our staff.”

Is Nvidia a purchase forward of a possible inventory cut up?

Though inventory splits might spark curiosity, buyers are suggested to chorus from basing their funding choices solely on this issue. As a substitute, the corporate’s monetary efficiency and administration’s steering wield far better affect on its long-term inventory efficiency.

In Nvidia’s fiscal 2024, the corporate generated $60.9 billion in income and $29.8 billion in web earnings, an enchancment of 126% and 581%, respectively, in comparison with its fiscal 2023. The meteoric rises had been largely pushed by the rising demand for its costly H100 chip, which is the engine behind the generative synthetic intelligence increase.

Huang summed up the unprecedented fiscal 12 months by saying within the firm’s fourth-quarter earnings launch: “Accelerated computing and generative AI have hit the tipping level. Demand is surging worldwide throughout corporations, industries and nations.”

Nvidia’s administration guided for roughly $24 billion in income for fiscal Q1 2025, which might signify a 234% year-over-year enhance. Additionally, administration projected its typically accepted accounting rules (GAAP) gross margin to be between 76.3% and 77%, leading to a major year-over-year enhance from 64.6%. Anytime an organization can enhance its gross margin, it shows its pricing energy, which Nvidia has in its industry-leading chips.

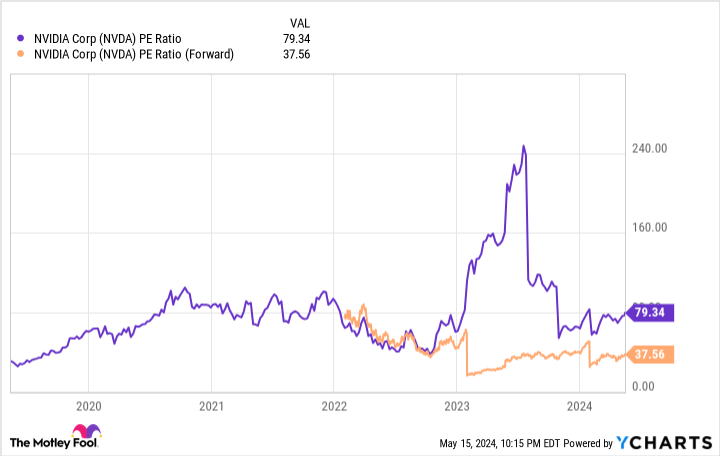

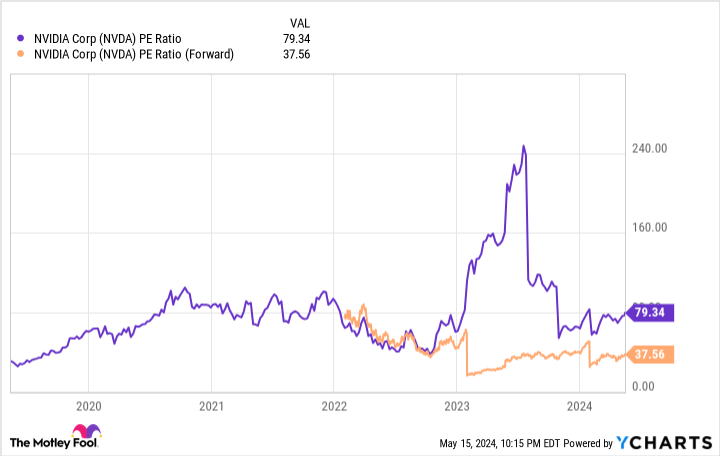

Regardless of how shortly an organization is rising, buyers nonetheless want to concentrate to valuation to make sure that they don’t overpay for its inventory. For a mature firm like Nvidia, the price-to-earnings (P/E) ratio is a regular valuation metric that appears at an organization’s inventory worth in comparison with its trailing 12 months of earnings. As of this writing, Nvidia trades at 79.3 occasions trailing earnings, greater than its five-year median of 71.9. Nonetheless, if you happen to take a look at Nvidia’s ahead P/E ratio, which compares the inventory worth to the corporate’s anticipated earnings over the subsequent 12 months, its inventory trades at a extra affordable 37.6.

Whereas worth buyers might scoff at Nvidia’s valuation, contemplating the typical trailing P/E ratio of the S&P 500 is 23.2 occasions earnings, it is vital to underscore that the unprecedented progress that Nvidia has seen by way of sheer income and web earnings over the previous 12 months. For these causes, coupled with the continued progress of generative synthetic intelligence, long-term progress buyers ought to take into account shopping for or including to Nvidia. Traders can all the time implement a dollar-cost averaging technique to construct a place over time with out the stress of short-term volatility.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $566,624!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Could 13, 2024

Collin Brantmeyer has positions in Chipotle Mexican Grill and Nvidia. The Motley Idiot has positions in and recommends Chipotle Mexican Grill and Nvidia. The Motley Idiot has a disclosure coverage.

Inventory Cut up Watch: Is Nvidia Subsequent? was initially printed by The Motley Idiot