Inventory splits have been pretty widespread amongst firms related to synthetic intelligence (AI). It’s because they’ve carried out so effectively over the previous year-and-a-half that their inventory costs have reached a degree the place a break up is a good suggestion.

One firm that has lately joined this membership is Tremendous Micro Laptop (NASDAQ: SMCI), generally generally known as Supermicro. It introduced a 10-for-1 inventory break up efficient Oct. 1, which can take its inventory value from round $630 to $63 per share.

Whereas the inventory break up is thrilling information, I feel there may be an excellent higher cause to purchase the inventory now earlier than the break up happens.

Its knowledge middle merchandise have been in large demand

Whereas Nvidia might get all of the headlines as a result of it’s related to the AI infrastructure being constructed out, many extra firms are benefiting from the identical tailwinds. Supermicro is one in every of them as its merchandise, starting from knowledge middle {hardware} to finish racks, are in excessive demand.

Whereas many firms present comparable merchandise to Supermicro’s, they stand out among the many competitors for 2 causes. One, Supermicro’s servers are extremely configurable and may be tailor-made to go well with a workload of any dimension. Two, Supermicro’s servers are extra energy-efficient than the competitors, which is a big consideration as a result of vitality enter prices are vital over the lifetime of the server.

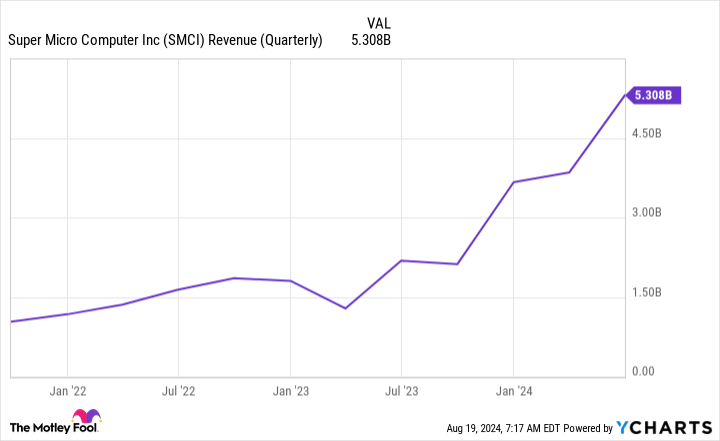

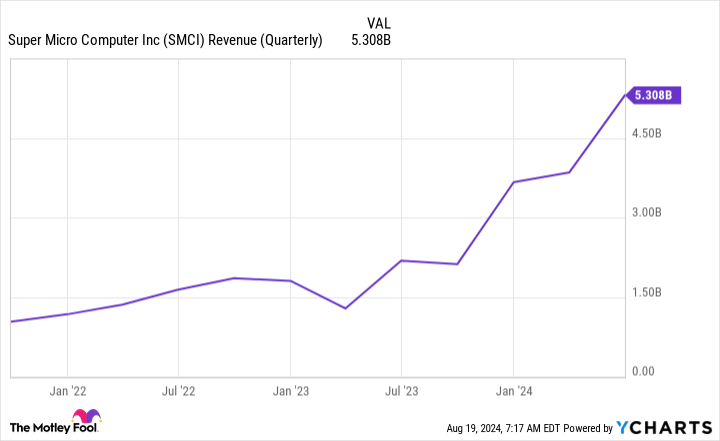

These benefits have induced Supermicro’s income to blow up over the previous yr, and extra development is slated to happen as effectively.

Waiting for its fiscal 2025’s first quarter (ending Sept. 30), administration expects $6 billion to $7 billion in income, starting from 183% to 230% development. For fiscal 2025, it anticipates $26 billion to $30 billion in income, which might be 74% to 101% year-over-year development.

That’s vital progress and an enormous cause to put money into the inventory proper now. On the finish of fiscal 2023, Supermicro had a long-term annual income aim of $20 billion. And on the finish of fiscal 2023’s second quarter, this goal was solely $10 billion.

Clearly, this market is quickly increasing, and the urge for food for Supermicro’s merchandise is rising alongside it. Nevertheless, this goal has as soon as once more been raised in its most up-to-date outcomes to an astonishing determine of $50 billion in annual income. That is a large upside from its present projections, and I feel it’s a phenomenal cause to personal the inventory, as Supermicro has constantly reached its long-term targets.

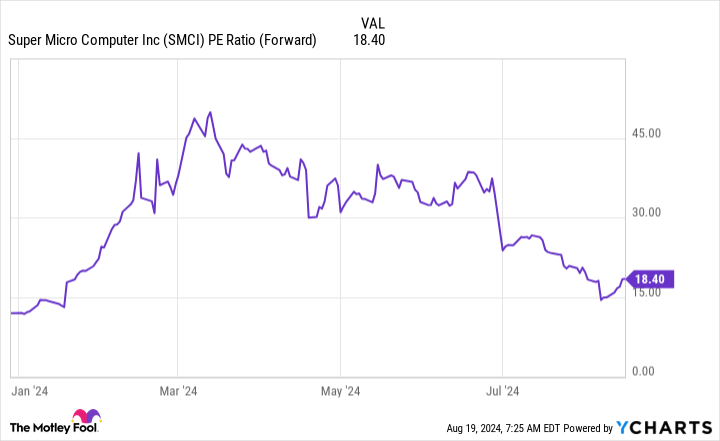

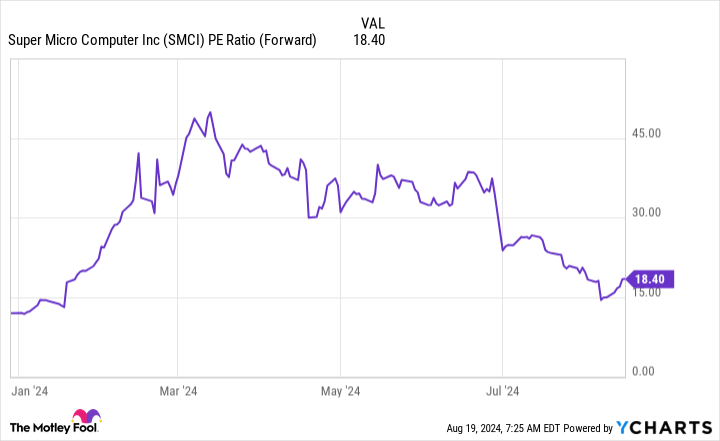

Nevertheless, following its This fall 2024 earnings announcement, the inventory plunged 20%. This looks as if an odd response, however that is as a result of one other vital metric noticed some weak spot.

The inventory is priced pretty low-cost in comparison with friends

Whereas income development is vital and grabs headlines, traders should additionally see rising income. Supermicro’s margins plunged in This fall as a consequence of new product launches, and that weak spot is predicted to final for many of fiscal 2025. Nevertheless, this drop is short-sighted pondering as a result of if Supermicro recovers its margins by the top of fiscal 2025, it’ll characterize a large worth alternative.

Proper now, the inventory trades at 18.4 occasions ahead earnings. In comparison with most shares out there, this determine is fairly low-cost. It additionally signifies 72% earnings development over the subsequent yr.

Supermicro’s administration has already projected 74% income development on the low aspect, so its earnings must keep at this decrease state for your entire yr for the present valuation to make sense.

This disconnect represents a robust shopping for alternative for the inventory, and a affected person investor might see a satisfying return from an funding if Supermicro’s margins recuperate over the subsequent yr.

Must you make investments $1,000 in Tremendous Micro Laptop proper now?

Before you purchase inventory in Tremendous Micro Laptop, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Tremendous Micro Laptop wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $792,725!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 22, 2024

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

Tremendous Micro Laptop Introduced a Inventory Cut up. However There’s an Even Higher Purpose to Purchase Proper Now. was initially revealed by The Motley Idiot