Shares of Tremendous Micro Pc (NASDAQ: SMCI) are up greater than 1,000% within the final three years. The inventory can also be down 65% from all-time highs.

The information middle builder and synthetic intelligence (AI) infrastructure accelerator has taken stockholders on a wild experience in current quarters. Income has soared, however there have been issues about buyer attrition and the formation of a possible AI bubble. Just lately, there was a short-seller report from Hindenburg Analysis that drove the inventory down even additional.

Irrespective of how proper or fallacious this brief report is, the long-term monetary fundamentals are what is going to matter for Supermicro’s inventory. Let’s have a look at whether or not now is an effective time to purchase the dip, or if you happen to ought to simply minimize your losses and promote.

Betting on an AI increase

You might say that Supermicro was on the proper place on the proper time two years in the past. The corporate is an assembler and designer of huge computing clusters, placing collectively sophisticated laptop chips and issues like cooling tools to make information facilities run effectively. Corporations similar to Amazon and even Tesla will outsource this and pay Supermicro to be the intermediary for information middle meeting.

After the rise of ChatGPT and the current increase in AI infrastructure spending, the corporate has seen an increase in demand for its companies. It is likely one of the key companions for firms similar to Nvidia that promote the pc chips that energy these new AI instruments. With firms giant and small racing to win in AI, velocity and effectivity in information middle design have been of excessive significance, which is why firms are turning to Supermicro.

And this technique has paid off handsomely. Income for the fiscal yr that led to June was $15 billion, greater than doubling the year-ago final quarter’s determine. Earnings have exploded increased as nicely. Three years in the past, the corporate barely made any cash. Final fiscal yr, its working revenue topped $1 billion.

When quick income progress is a foul signal

One of many greatest errors rookie traders make is to extrapolate current income progress in perpetuity. That is what induced traders in Upstart who purchased in on the high in 2021 to lose greater than 90% of their funding. The corporate was rising income at over 100% yr over yr a number of years in the past. At this time, its income determine is way decrease.

Because the well-known investor Peter Lynch has stated time and time once more, when analyzing an organization, sturdy progress is extra necessary than only a present high-percentage determine. If income progress goes from 100% to flat, the inventory will probably do poorly. I feel this can be a threat for Supermicro.

Earlier than the AI increase, its income had gone nowhere for years. This means that the current surge in income can virtually fully be attributed to AI spending. Subsequently, if AI spending slows, the corporate’s income might simply decelerate and even reverse from this $15 billion degree.

Semiconductors and information facilities are a cyclical market, albeit one which has grown greater all through the previous couple of a long time. There have been many booms and busts alongside the way in which, although.

It isn’t assured to hit a cyclical peak quickly, however traders bullish on Supermicro ought to be cautious. Simply because it’s rising gross sales by 100% yr over yr does not imply it’s mechanically a purchase.

The inventory seems to be low cost: Is it?

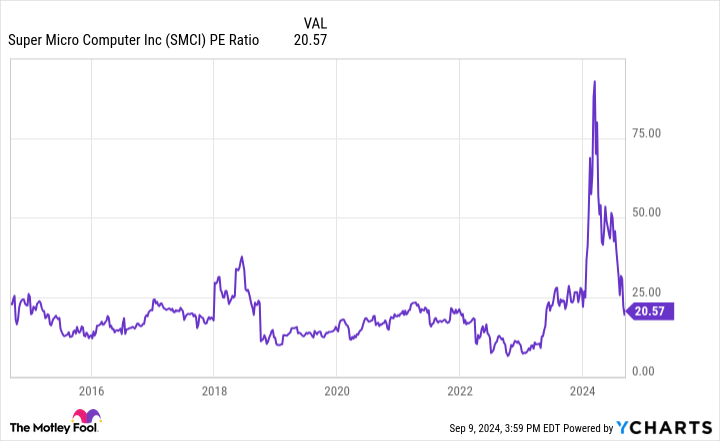

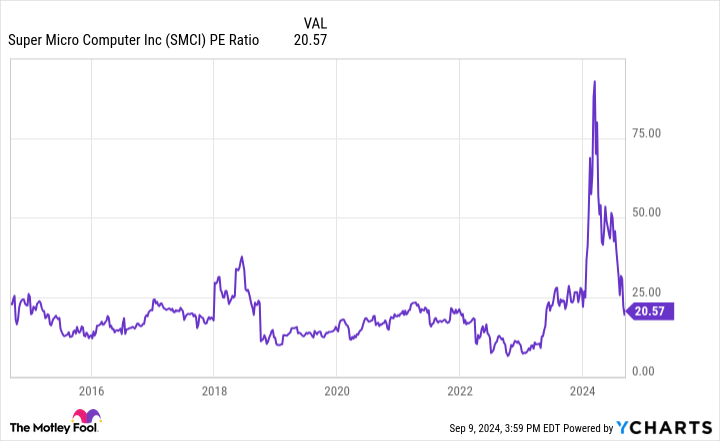

Taking a look at Supermicro’s price-to-earnings ratio (P/E), the determine isn’t too demanding. The P/E is 20.5, which is nicely beneath the S&P 500 broad market common. What this could inform any investor is that — after this 65% drawdown — the market isn’t anticipating a loopy quantity of progress within the coming years.

Believers within the AI increase and continued capital expenditures from the likes of Amazon would possibly like Supermicro inventory right here. Development in spending on AI infrastructure most likely means the inventory does nicely within the brief run.

My concern is the unpredictability of AI spending and the hypercompetitive nature of the trade. After the rabid spending atmosphere of the previous couple of years, does it decelerate? Will clients take extra of their designs in-house? Will direct rivals similar to Dell take clients?

On the finish of the day, additionally it is arduous to see why the corporate has any aggressive benefit. All it’s doing is assembling laptop chips and promoting packaged merchandise to clients.

Nvidia is the corporate really driving innovation on the {hardware} facet of issues, whereas Meta Platforms, OpenAI, and Amazon are driving innovation on the software program facet. It’s a basic smiling-curve state of affairs, the place the intermediary does not earn a lot in income. Because of this Supermicro has an working margin ofless than 10%.

For these causes, I feel it’s best for traders to keep away from Tremendous Micro Pc inventory even after this downturn. The intermediary hardly ever extracts the income in conditions similar to these.

Must you make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for traders to purchase now… and Tremendous Micro Pc wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $662,392!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 9, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Brett Schafer has positions in Amazon. The Motley Idiot has positions in and recommends Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Idiot has a disclosure coverage.

Tremendous Micro Pc Inventory Retains Falling. Ought to You Purchase or Promote? was initially revealed by The Motley Idiot