Tremendous Micro Laptop (NASDAQ: SMCI) inventory jumped once more in Wednesday’s buying and selling. The corporate’s share value closed out the day by day session up 11.3%, in keeping with knowledge from S&P World Market Intelligence.

On Tuesday, Barclays analysts revealed a be aware on Tremendous Micro (often called Supermicro) inventory. The agency’s analysts raised their one-year value goal from $691 per share to $961 per share as a result of indications that synthetic intelligence (AI) would proceed to energy robust demand for Supermicro’s rack servers. Primarily based on right now’s closing value, the brand new goal from the Barclays analysts suggests extra potential upside of 9% for the inventory.

Moreover, it is probably that Supermicro inventory bought a lift from a bullish report on Nvidia inventory from Susquehanna that was revealed right now. Within the Susquehanna be aware, analyst Christopher Rolland stated that he anticipated Nvidia to document fourth-quarter income that beat the market’s present targets because of AI-driven demand. With Supermicro additionally benefiting from surging AI-related associated demand, excellent news for Nvidia might bode nicely for the server and storage firm’s personal outlook.

Is Tremendous Micro Laptop inventory nonetheless a purchase?

Supermicro’s inventory has been on an unbelievable tear. The corporate’s share value is already up roughly 210% throughout 2024’s buying and selling, and it is rocketed 872% greater over the past yr.

To its credit score, the corporate has been posting spectacular outcomes to again up the rally. On the finish of January, Supermicro revealed outcomes for the second quarter of its present fiscal yr — a interval that closed on the finish of final December. Along with posting gross sales and earnings efficiency within the interval that got here in higher than the massively improved steerage it issued shortly earlier than publishing the report, ahead steerage additionally crushed Wall Road’s targets.

The corporate expects to document income between $14.3 billion and $14.7 billion in its present fiscal yr, suggesting that gross sales will greater than double in comparison with the $7.12 billion in gross sales that it posted in its final fiscal yr. AI is driving an enormous uptick in demand for Supermicro’s high-performance rack servers, and the development might final for some time.

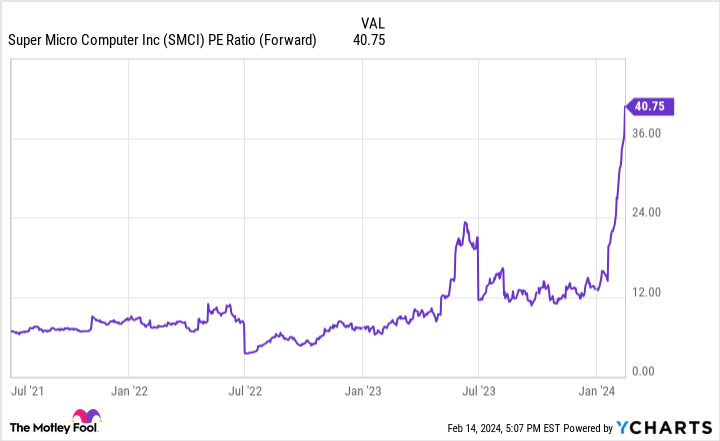

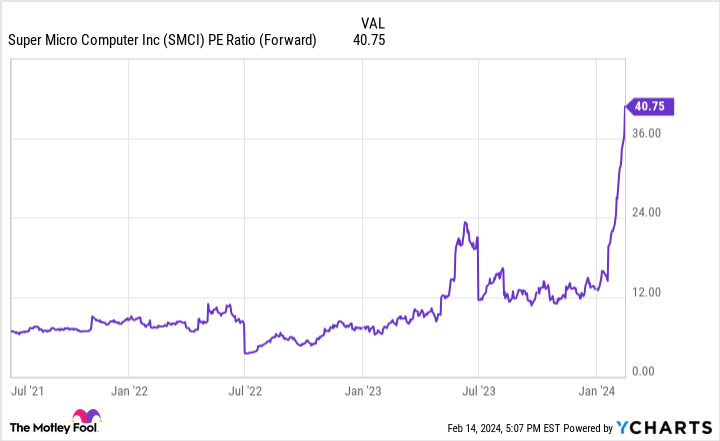

Supermicro’s efficiency outlook is promising, however traders must also maintain the huge run-up for the inventory in thoughts.

Buying and selling at roughly 41 occasions this yr’s anticipated earnings, Supermicro inventory has develop into a lot riskier on the heels of its unbelievable run. Wanting forward, the corporate is valued at roughly 31 occasions subsequent yr’s anticipated income. Given the hypothesis and uncertainty concerned in charting the tech specialist’s enterprise trajectory, Supermicro’s present valuation might be too wealthy for traders with out excessive ranges of threat tolerance.

Then again, it is attainable that the corporate remains to be within the early levels of benefiting from highly effective long-term demand tailwinds because of AI. With Supermicro valued at roughly $49 billion, the inventory might nonetheless have large upside potential if synthetic intelligence continues to energy speedy gross sales and earnings development. Shares have develop into riskier and might be risky, however the stars might be aligning for the corporate to proceed crushing expectations.

Do you have to make investments $1,000 in Tremendous Micro Laptop proper now?

Before you purchase inventory in Tremendous Micro Laptop, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for traders to purchase now… and Tremendous Micro Laptop wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 12, 2024

Keith Noonan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot recommends Barclays Plc and Tremendous Micro Laptop. The Motley Idiot has a disclosure coverage.

Tremendous Micro Laptop Surged As we speak — Is It Too Late to Purchase the Purple-Sizzling Synthetic Intelligence (AI) Progress Inventory? was initially revealed by The Motley Idiot