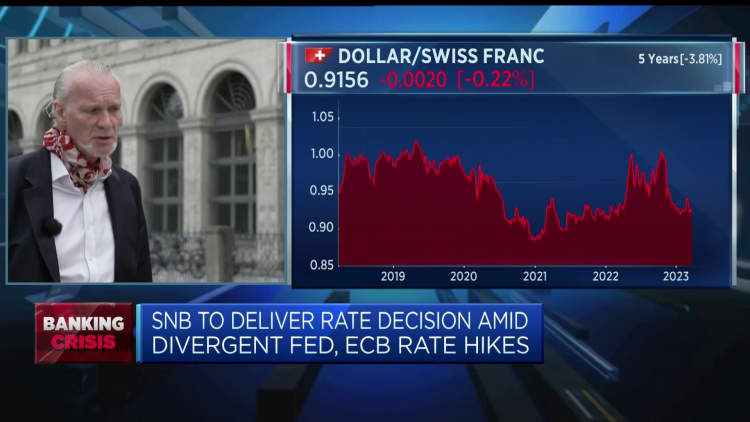

Thomas Jordan, president of the Swiss Nationwide Financial institution (SNB), speaks through the financial institution’s annual normal assembly in Bern, Switzerland, on Friday, April 28, 2023.

Bloomberg | Bloomberg | Getty Photos

The Swiss Nationwide Financial institution on Friday pledged to evaluation banking laws throughout its annual normal assembly in Bern, following latest turmoil involving Credit score Suisse.

Set towards a backdrop of protest over its motion on local weather change and its position within the emergency sale of Credit score Suisse to Swiss rival UBS, Thomas Jordan, chairman of the governing board on the SNB, mentioned banking regulation and supervision should be reviewed in gentle of latest occasions.

“This may require in-depth evaluation … fast fixes should be averted,” he mentioned, based on a press release.

The central financial institution performed a key position in brokering the rescue of Credit score Suisse over the course of a chaotic weekend in March, as a flight of deposits and plummeting share worth took the 167-year-old establishment to the brink of collapse.

The deal stays mired in controversy and authorized challenges, significantly over the dearth of investor enter and the unconventional resolution to wipe out 15 billion Swiss francs ($16.8 billion) of Credit score Suisse AT1 bonds.

The demise of the nation’s second-largest financial institution fomented widespread discontent and severely broken Switzerland’s long-held status for monetary stability. It additionally got here towards a febrile political backdrop, with federal elections developing in October.

Jordan mentioned Friday that future regulation should “compel banks to carry adequate property which they will pledge or switch at any time with out restriction, and which they will thus ship as collateral to present liquidity amenities.” He added that this is able to imply his central financial institution might would be capable of present the mandatory liquidity, in instances of stress, with out the necessity for emergency legislation.

A shareholder holding a placard studying in German: “Put money into the planet and never in its destruction” takes half in a protest forward of a normal assembly of of the Swiss Nationwide Financial institution (SNB) in Bern on April 28, 2023. (Photograph by Fabrice COFFRINI / AFP) (Photograph by FABRICE COFFRINI/AFP by way of Getty Photos)

Fabrice Coffrini | Afp | Getty Photos

The SNB confronted questions and grievances from shareholders in regards to the Credit score Suisse scenario on Friday, however the nation’s community of local weather activists additionally sought to make use of the central financial institution’s undesirable highlight to problem its funding insurance policies.

In contrast to many main central banks, the SNB operates publicly-traded firm, with simply over half of its roughly 25 million Swiss franc ($28.1 million) share capital held by public shareholders — together with varied Swiss cantons (states) and cantonal banks — whereas the remaining shares are held by personal traders.

Greater than 170 local weather activists have now bought a SNB share, based on the SNB Coalition, a devoted strain group spun out of Alliance Climatique Suisse — an umbrella group representing round 140 Swiss environmental marketing campaign teams.

Round 50 of the activist shareholders have been attendance on Friday, and activists had deliberate to make round a dozen speeches on stage on the AGM, local weather campaigner Jonas Kampus advised CNBC on Wednesday. Protests have been additionally held exterior the occasion.

The group is asking for the SNB to get rid of its inventory holdings of “corporations that trigger severe environmental injury and/or violate basic human rights,” pointing to the central financial institution’s personal funding tips.

Specifically, campaigners have highlighted SNB holdings in Chevron, Shell, TotalEnergies, ExxonMobil, Repsol, Enbridge and Duke Power.

Members of a Ugandan group objecting to TotalEnergies’ East African Crude Oil Pipeline, have been additionally set to attend on Friday, with one planning to talk on stage on to the SNB directorate.

In addition to a full exit from fossil gasoline investments, activists are demanding that the SNB implement the “one for one rule,” — a capital requirement designed to forestall banks and insurers benefiting from actions which can be detrimental for the transition to internet zero.

On this context, the SNB could be required to put aside one Swiss franc of its personal funds to cowl potential losses for every franc allotted to financing new fossil gasoline exploration or extraction.

Forward of the AGM, the central financial institution declined on authorized grounds to schedule three motions tabled by the activists, and mentioned on Wednesday that it might not touch upon protest plans, as a substitute directing CNBC to its formal agenda. But Kampus instructed that simply the method of submitting the motions itself had helped develop public and political consciousness of the problems.

“From all sides, there may be public strain and in addition political strain that the SNB wants to alter issues. At this second, the SNB is admittedly far behind when it comes to their actions taken in comparison with different central banks,” Kampus advised CNBC by way of phone, including that the SNB takes a “very conservative view” of its mandate concerning worth stability and monetary stability, which is “very slim.”

The shareholders’ trigger can also be backed by a movement in parliament, with help from lawmakers starting from the Inexperienced Get together to the Centre [center-right party], which calls for an extension of the SNB’s mandate to cowl local weather and environmental dangers.

“Whereas different central banks world wide are going effectively past the steps taken by the SNB in this respect — the SNB has repeatedly taken the place that its mandate doesn’t give it adequate leeway to take local weather dangers absolutely into consideration in its selections and financial coverage devices,” reads the movement, filed on March 16 by Inexperienced Get together lawmaker Delphine Klopfenstein Broggini.

“The current parliamentary initiative is meant to make sure this leeway and to make it clear that the SNB should take local weather dangers into consideration when conducting financial coverage.”

The movement argues that local weather dangers are “categorized worldwide as important monetary dangers that may endanger monetary and worth stability,” concluding that it’s in “Switzerland’s general curiosity that the SNB proactively deal with these points” as different central banks are looking for to do.

Kampus and his fellow activists hope the nationwide give attention to the SNB after the Credit score Suisse disaster supplies fertile floor to advance considerations about local weather threat, which he mentioned poses a threat to the monetary system that’s “a number of instances bigger” than the potential fallout from Credit score Suisse’s collapse.

“We really feel that there’s additionally a window of alternative on the SNB facet in that they possibly this time are a bit extra humble, as a result of they clearly even have carried out some issues mistaken when it comes to the Credit score Suisse crash,” Kampus mentioned.

He famous that the central financial institution has at all times asserted that local weather threat was included into its fashions and that there was “no want for additional trade with the general public of additional transparency.”

“Very central to the SNB’s work is that the general public simply must belief them. Belief is one thing that is essential to the central financial institution, and to demand belief from the general public with out main as much as it or supporting it with additional proof that we will belief them in the long term is kind of scary, particularly after we do not know what their local weather mannequin is,” he mentioned.

The SNB has lengthy argued that its passive funding technique, which invests in world indexes, is a part of its mandate to stay market impartial, and that it isn’t for the central financial institution to interact in local weather coverage. Activists hope mounting political strain will finally power a change in laws to broaden the SNB’s mandate to accommodate local weather and human rights as dangers to monetary and worth stability.

UBS and Credit score Suisse additionally confronted protests from local weather activists at their respective AGMs earlier this month over funding in fossil gasoline corporations.