The inventory market didn’t take kindly to machine imaginative and prescient firm Cognex Corp.‘s (NASDAQ: CGNX) latest second-quarter earnings report. Sadly, its finish markets are weakening in 2024, and the hoped-for pick-up in orders within the all-important second and third quarters (as prospects put together for the fourth quarter) is extremely unlikely to come back in 2024. Nonetheless, a lot of the unhealthy information is already within the value now, and Cognex is an organization with excellent long-term development prospects. Here is why it is a beautiful inventory to purchase proper now.

Cognex’s disappointing earnings

The corporate’s income declined by 17% in 2023, and the bounce again in 2024 is not going to be as a lot as buyers had been hoping. Cognex’s income declined 1% within the second quarter, and excluding the advantages of acquisitions and international forex actions, it was down by 7%.

Furthermore, administration’s income steering for the third quarter of $225 million to $240 million was beneath market expectations and disappointing, contemplating second-quarter income was $239 million.

Merely put, it is going to be one other disappointing yr for Cognex, and administration wasn’t gradual in highlighting why.

Cognex’s finish markets

Administration estimates its served market at $6.5 billion, with its general market share at about 15%. The desk beneath reveals the relative significance of every market and Cognex’s power inside it.

|

Cognex Finish Market |

Served Market |

Cognex Market Share |

|---|---|---|

|

Automotive |

$1.5 billion |

15% |

|

Electronics |

$1.35 billion |

20% |

|

Logistics |

$2 billion |

15% |

|

Medical associated |

$650 million |

>10% |

|

Others |

$1 billion |

<20% |

Knowledge supply: Cognex.

Administration mentioned these finish markets within the earnings displays, and, sadly, the one two parts that at present have optimistic drivers are logistics and the semiconductor market inside “others.” The remainder are detrimental.

Finish market weak spot in 2024

In Cognex’s historic core finish market of automotives, CEO Rob Willett cited “an additional step down in our broader automotive enterprise, notably in Europe” with “extra tentativeness” of its automotive prospects as a result of weak auto gross sales and “political uncertainty.”

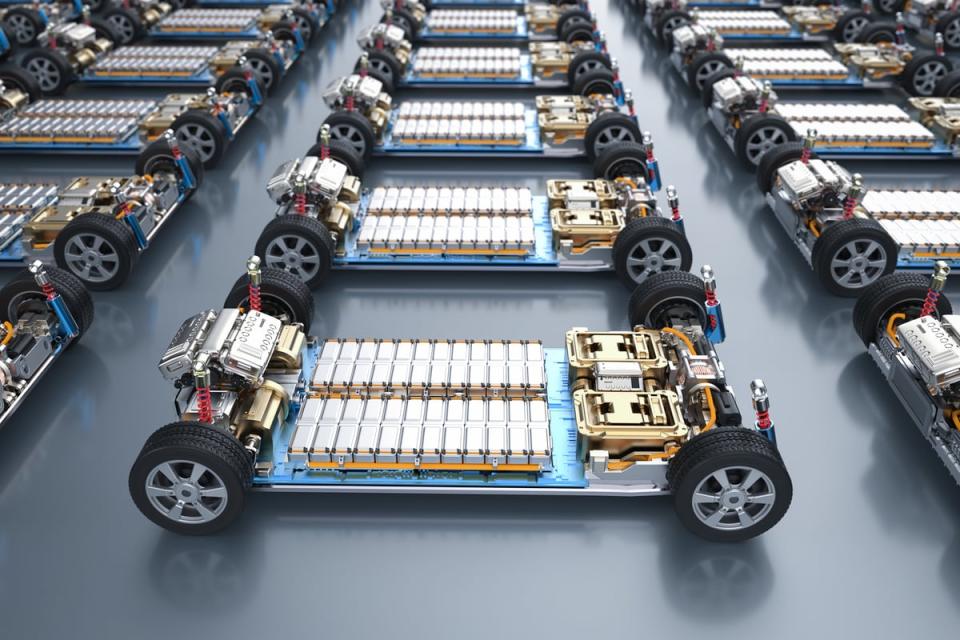

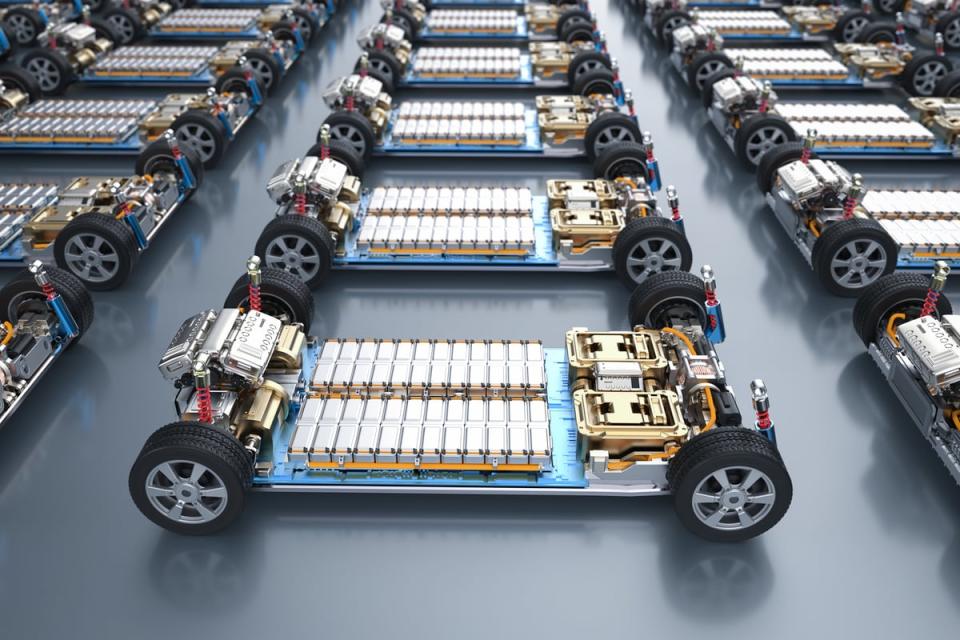

As if that wasn’t unhealthy sufficient, Willett additionally stated electrical car (EV) battery prospects had been reducing again on tasks, and their income declined within the second quarter. That is not good, because it’s alleged to be a development space for Cognex.

Administration additionally tempered development expectations in client electronics (Apple has been a major buyer previously), with Willett citing weak client demand and “specific weak spot” in China. It additionally famous “uncertainty” across the timing and measurement of its prospects’ investments.

Logistics (machine imaginative and prescient is utilized in e-commerce success facilities) is a brilliant spot, with double-digit income development within the first half. It’s recovering from a interval of extreme retraction following the growth in spending in the course of the pandemic-related lockdown intervals.

Why Cognex is an excellent inventory to purchase

It is indeniable that Cognex is working in some difficult markets proper now. Nonetheless, buyers should admire that its income development has all the time been risky. A lot of the earlier volatility comes right down to the event of great order development, corresponding to with Apple in 2014, or the expansion in its logistics finish market in the course of the lockdowns, interspersed with slowdowns as these development bursts do not show sustainable.

Nonetheless, that is how development firms work, and the present cyclical weak spot of their finish markets primarily outcomes from their publicity to comparatively excessive rates of interest. Greater rates of interest make vehicle purchases costlier and stress client spending on discretionary objects corresponding to client electronics.

As such, Cognex’s finish markets will probably enhance in a extra benign rate of interest atmosphere.

As well as, the long-term drivers of machine imaginative and prescient adoption stay robust. It is a important a part of the automated processes in factories and warehouses and helps examine and information more and more advanced processes. Furthermore, advances in synthetic intelligence (AI) (Cognex is infusing extra AI functions into its merchandise) will assist picture recognition and allow extra advanced operations.

A inventory to purchase

Administration estimates its finish markets will develop 13% yearly over the long run and sees Cognex’s annual development at 15%. Historical past means that would be the case, and the present weak spot will not final ceaselessly. As such, the inventory’s whopping 62% decline from its all-time excessive makes it a extremely engaging inventory to select up on weak spot.

Do you have to make investments $1,000 in Cognex proper now?

Before you purchase inventory in Cognex, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Cognex wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $641,864!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 6, 2024

Lee Samaha has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple and Cognex. The Motley Idiot has a disclosure coverage.

Take Benefit of the Dip to Purchase This Unstoppable Lengthy-Time period Progress Inventory was initially revealed by The Motley Idiot