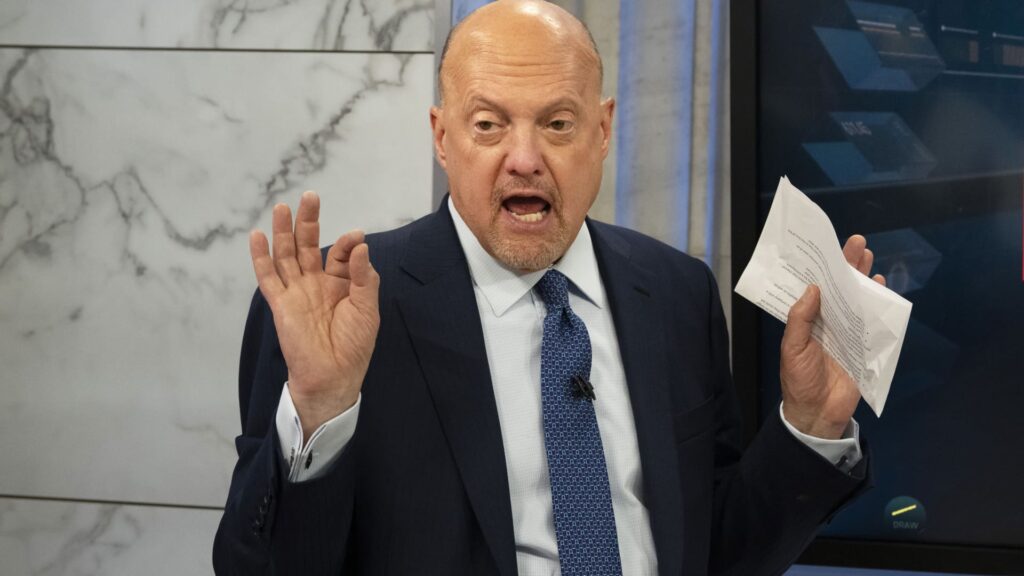

Each weekday the CNBC Investing Membership with Jim Cramer holds a “Morning Assembly” livestream at 10:20 a.m. ET. This is a recap of Wednesday’s key moments. Maintain onto recession-proof shares Fast mentions: PG, HAL, PXD, DIS 1. Maintain onto recession-proof shares Amid ongoing market volatility, the Membership stays centered on corporations that may stand up to an impending recession and have stable stability sheets. Particularly, we like shares within the healthcare, monetary and power sectors. Healthcare and power are nonetheless requirements in an financial slowdown, whereas banks are benefiting from greater rates of interest. “We’re centered uniquely on…corporations that do nicely in a recession and urge you to not promote them, notably ones with an amazing stability sheet,” Jim Cramer stated Wednesday. Shares had been principally decrease, with the S & P 500 down 0.38%, following two consecutive days of good points. We consider that the market merely would not have what it takes to take care of a sustained rally, given persistent headwinds like rising rates of interest, a powerful U.S. greenback and cussed inflation. 2. Fast Membership mentions: PG, HAL, PXD, DIS Procter & Gamble (PG) beat Wall Road estimates on earnings and income in its newest quarter reported Wednesday, aided by greater pricing that helped offset a decline in gross sales volumes and the robust U.S. greenback. We consider the corporate’s efficiency demonstrates client willingness to pay for high quality merchandise regardless of value hikes, and stay bullish on the inventory. Shares of PG had been up round 2% in mid-morning buying and selling, at roughly $131 a share. Jeffries initiated protection on Halliburton (HAL) with a $40 value goal and purchase score. We like HAL, notably as a consequence of its robust free money move development, and stand by the oil providers firm. Shares of HAL had been up greater than 3.5% Wednesday, at roughly $31.5 a share. Morgan Stanley downgraded Pioneer Pure Assets (PXD) to underweight. Nonetheless, we have now religion that CEO Scott Sheffield is steering the corporate in the best course, and suggest traders purchase the inventory into any weak spot. “Within the oil enterprise, you go along with the operator,” Jim stated. Netflix (NFLX) on Wednesday stated it added 2.41 million web world subscribers within the third quarter, greater than double the expansion the corporate projected 1 / 4 prior, whereas beating earnings and gross sales estimates. The inventory soared greater than 14% on the information. Whereas we do not personal Netflix, we consider it is a constructive readthrough for membership holding Disney (DIS), and urge traders to purchase the inventory. Shares of Disney had been up greater than 2% in mid-morning buying and selling, at roughly $100.55 a share. (Jim Cramer’s Charitable Belief is lengthy DIS, HAL, PG, PXD. See right here for a full checklist of the shares.) As a subscriber to the CNBC Investing Membership with Jim Cramer, you’ll obtain a commerce alert earlier than Jim makes a commerce. Jim waits 45 minutes after sending a commerce alert earlier than shopping for or promoting a inventory in his charitable belief’s portfolio. If Jim has talked a couple of inventory on CNBC TV, he waits 72 hours after issuing the commerce alert earlier than executing the commerce. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Related Posts

Add A Comment