Tesla (TSLA) and BYD Co. (BYDDF) are each fast-growing EV giants. Whereas a number of consideration falls on startups corresponding to Rivian Automotive (RIVN), Lucid (LCID), Nio (NIO), Xpeng (XPEV) and Li Auto (LI), in addition to conventional automakers pushing into EVs, corresponding to Common Motors (GM) and Ford Motor (F), Tesla and BYD are setting the tempo.

X

Tesla reported report deliveries within the third quarter on Oct. 2, however they got here in nicely under views, as China demand considerations develop. On Friday evening, Tesla confirmed off an Optimus humanoid robotic prototype on AI Day, with the humanoid prototype exhibiting very restricted mobility.

BYD will launch Q3 gross sales figures in subsequent day or two. The EV and battery large’s gross sales have surged, whereas increasing into a number of markets, together with Europe.

Tesla inventory is off 2022 lows, however has hit key resistance amid a bear market. BYD inventory has plunged to six-month lows.

Let’s check out Tesla vs. BYD — and Tesla inventory vs. BYD inventory.

Tesla Vs. BYD Gross sales

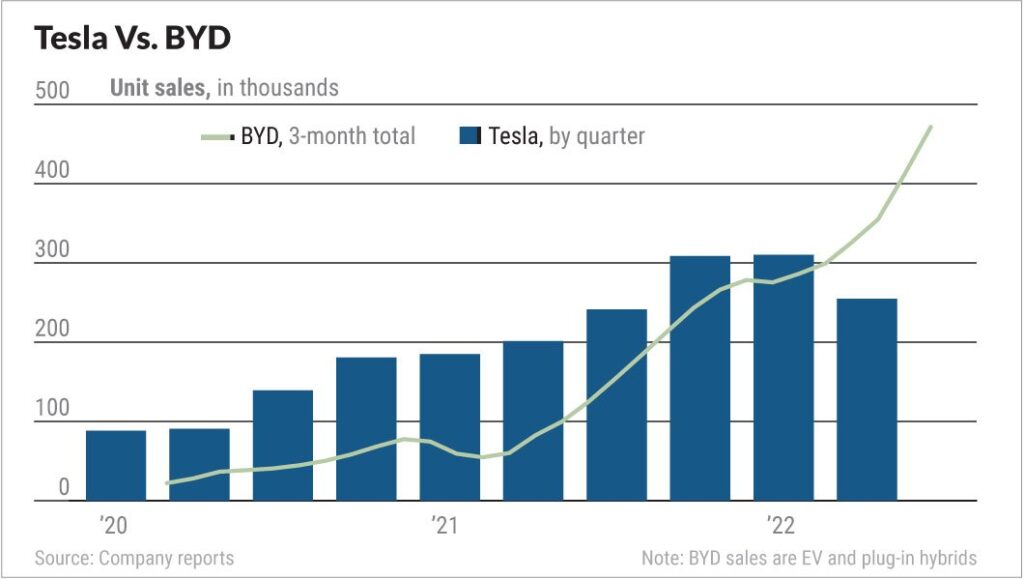

Tesla reported Q3 deliveries of 343,830. That was up 42% vs. a yr earlier and 35% above Q2’s 254,695, when the Shanghai plant confronted a prolonged shutdown and sluggish restoration attributable to Covid lockdowns. The Q3 determine additionally comfortably topped Q1’s report Tesla supply determine of 310,048.

However that was nicely under analysts’ Tesla supply estimates of above 360,000. This wasn’t a case of restricted provide. Tesla produced 365,923 automobiles within the newest quarter, greater than 22,000 above deliveries.

Tesla delivered 325,158 Mannequin 3 and Mannequin Y automobiles in Q3, together with 18,672 Mannequin S and Mannequin X luxurious EVs.

BYD is prone to report Q3 deliveries of nicely over 500,000, vastly extending its lead over Tesla. In fact, BYD gross sales embrace all-electric “BEV” automobiles and plug-in hybrids. Tesla nonetheless leads in BEV deliveries, however BYD is quickly closing the hole.

On Sept. 3, BYD reported report August gross sales of 174,915 EVs and plug-in hybrids, up 185% vs. a yr earlier and seven.6% above July’s 162,530. Of the 173,977 passenger automobiles, gross sales of pure electrics leapt 172% to 82,678. PHEV gross sales soared 203% to 91,299 models.

Tesla Vs. BYD Enlargement

Tesla opened its vegetation close to Berlin, Germany, and Austin, Texas in March and April, respectively. Mannequin Y manufacturing stays sluggish for these websites, however ought to step by step enhance.

Simply-finished upgrades to the Tesla Shanghai facility considerably boosts manufacturing capability going ahead, although that impacted output in July and early August.

There have been a number of indications that Tesla China demand is struggling to maintain up with elevated manufacturing.

Tesla China wait occasions for brand spanking new automobiles fell sharply in September, although they’ve elevated modestly as Shanghai returns to exporting automobiles at first of the brand new quarter.

In the meantime, Tesla launched an insurance coverage subsidy in mid-September, and just lately prolonged that by year-end. That serves as a de facto worth minimize, with hypothesis that Tesla will announce outright China worth cuts quickly.

Remember, Tesla manufacturing ought to be a lot larger in This fall, so world demand may also have to ramp up.

Tesla might export much more Shanghai manufacturing to ease native demand considerations, and there are some indications that it is already doing that. Nevertheless, European backlogs even have began coming down. In August, Tesla started promoting a brand new low-end Mannequin Y in Europe at a big low cost to the prior base Y, with the worth various fairly a bit per nation.

BYD is also including important EV and battery capability.

The auto large stated earlier this yr it plans to promote a minimum of 1.5 million NEVs in 2022, presumably 2 million. Deliveries appear prone to simply prime 1.75 million.

On Sept. 2, BYD Chairman Wang Chuanfu stated the automaker is concentrating on 280,000 automobile deliveries a month by year-end. He set a aim for 2023 deliveries to hit 4 million. He additionally stated BYD had a backlog of 700,000 automobiles.

Tesla, concentrating on the posh and inexpensive luxurious markets, has far larger promoting costs than BYD.

Nearly all of BYD’s EVs and hybrids promoting for $15,000-$34,000, although some automobiles prime $40,000. However promoting costs are on the rise.

The China EV large does plan to maneuver upscale considerably.

BYD stated on Aug. 30 {that a} high-end model, concentrating on the 800,000 yuan ($115,960) to 2 million yuan market, will launch in June 2023, with plans for an off-road automobile, a luxurious sedan, a high-end SUV and a brilliant automotive.

BYD’s Denza unit, 10% owned by Mercedes-Benz, will start D9 minivan deliveries within the coming days. The corporate predicts 3,000 deliveries in October and 10,000 by December. Coming in EV and PHEV variants, it begins at slightly below $50,000.

Denza unveiled a sporty SUV on Aug. 27. It is technically an idea automobile, however an identical manufacturing automobile ought to launch in Q1 2023.

BYD Vs. Tesla: Tesla Electrical Autos

Tesla produces 4 electrical automobiles: the posh Mannequin S sedan and Mannequin X SUV in addition to the Mannequin 3 sedan and Mannequin Y crossover. The overwhelming majority are the Mannequin 3 and Mannequin Y.

The Roadster, Semi and Cybertruck have been pushed again a number of occasions. Musk says the Cybertruck is on monitor for mid-2023. However costs and specs — formidable even in comparison with different Tesla automobiles — will doubtless be completely different than the preliminary Cybertruck claims again in 2019, he says.

Musk stated just lately that the Tesla Semi, first unveiled in 2017, will start deliveries this yr.

It is unclear if the Semi might be produced in quantity or in token quantities, assuming deliveries do start by year-end. In the meantime, the Cybertruck doubtless will largely serve the U.S. market. So Tesla might not have a brand new passenger EV for many of the world till 2024 or later.

An ageing mannequin lineup might be an element going ahead, particularly in China.

Musk just lately stated Tesla isn’t engaged on a $25,000 automobile, a aim he had touted for years. Even now, such a mannequin would run into dozens of current rivals, largely from Chinese language EV makers corresponding to BYD.

BYD Vs. Tesla: BYD EVs Massive And Small

BYD has a slew of fashions, some with electrical and hybrid variations. The automaker is rolling out a number of new EV-only and hybrid-only fashions within the subsequent a number of months.

The Seal sedan is BYD’s first clear head-to-head competitors vs. Tesla. The BYD Seal has roughly equal dimensions and vary to a Mannequin 3 — and $10,000 cheaper. The Seal begins at 212,800 RMB ($31,130) vs. 279,900 RMB ($41,950) for a made-in-China Mannequin 3.

BYD began Seal deliveries in late August, with manufacturing ramping up over the subsequent two months.

A profitable Seal launch wouldn’t solely additional enhance speedy gross sales progress, however might burnish BYD’s model because it expands into new markets.

On the low finish, a BYD Seagull hatchback will quickly launch with a price ticket round $12,000.

In a couple of months, BYD will unveil the Seal Lion, an all-electric SUV that would tackle the Tesla Mannequin Y with a much-cheaper worth.

BYD just lately unveiled the Frigate 07, a mid-sized SUV that is the second mannequin within the Warship line of plug-in hybrids. The Destroyer PHEV sedan launched this spring and continues to construct gross sales.

BYD additionally is among the greatest makers of electrical buses, with vegetation within the U.S. and plenty of different international locations in addition to China. BYD additionally makes EV supply vans, massive rigs, rubbish vans and extra.

BYD makes buses, massive rigs and different heavy automobiles for the U.S. market at its Lancaster, Calif., plant.

The Finest EV Shares To Purchase And Watch

Tesla Inventory Vs. BYD Inventory: EV Markets

Tesla is a world EV large, with main gross sales in North America, Europe and China. It has notable enterprise in Korea and another Asian markets. It has 4 vegetation, beginning with Fremont, Calif., and Shanghai, joined by the Austin, Texas, and Berlin-area vegetation. Tesla already exports to Europe, largely from Shanghai.

Because the Berlin plant ramps up, the Shanghai plant will export far fewer Mannequin Ys to Europe, although Mannequin 3 shipments will doubtless proceed.

Whereas Tesla capability is hovering, it has no main new markets to enter or new automobiles within the close to future.

Tesla on Aug. 26 started promoting a brand new decrease base-model Mannequin Y to Europe, with shorter vary however a much-cheaper worth. The costs range considerably, undercutting the Mannequin 3 in some international locations.

The U.S. simply accepted new EV tax credit. Tesla, not eligible underneath the previous program, ought to be a winner. Earnings and automobile worth caps might considerably impression Tesla automobiles’ and patrons’ eligibility. A requirement for a excessive and rising share of battery supplies and elements from North America additionally might complicate issues.

However, if nothing else, the brand new guidelines — which mandate EV meeting in North America — minimize off tax credit to many Tesla rivals.

BYD’s auto vegetation are in China, with nearly all its gross sales there, however these are each about to vary.

BYD will construct a producing plant in Thailand, the corporate stated Sept. 8, confirming reviews earlier within the week. The plant ought to begin operation in 2024 with annual manufacturing capability of 150,000 automobiles.

BYD stated in August that it will enter the Thai market, because the China-focused auto large goes actually world. Exports rose to a report 5,092 in August from July’s 4,026. That determine ought to surge within the subsequent few months.

BYD has began Atto 3 deliveries in New Zealand and Australia. The Atto 3 is the Yuan Plus’ title for many abroad markets. A number of different Asian international locations will comply with within the subsequent few weeks and months.

On Sept. 28, BYD held launch occasion for Europe, and its three preliminary fashions, the Tang SUV, the Han sedan and the Atto 3. Deliveries will start throughout a lot of Europe in October or by year-end. BYD has been promoting the Tang SUV in Norway since late 2021. BYD set European pricing nicely above the sticker worth for these automobiles in China, suggesting the automaker is seeking to set up itself as premium or near-premium model on the Continent.

BYD has launched EV gross sales for the person market in India, with the Atto 3 becoming a member of the lineup in October.

The EV large will enter Japan with the Atto 3 in early 2023, the Dolphin/Atto 2 mid-year and Seal/Atto 4 in late 2023.

Many of those international locations, together with Australia, Thailand, Japan and India, are right-hand drive markets, just like the U.Okay. The Thai plant might give attention to RHD automobiles.

BYD is rising its gross sales in Latin America, ramping up in Brazil specifically.

America is not formally in BYD’s sights when it comes to private EVs. Tariffs on China-made autos make exports to the U.S. value prohibitive. BYD does make some EV buses right here, with a number of further house at its Lancaster, Calif., website outdoors Los Angeles.

EV ‘Freak-Out’ Second Looms Over Lithium, Uncommon Earths

Tesla Vs. BYD Batteries

Tesla would not mass produce battery cells. The Sparks, Nevada, gigafactory is a three way partnership with Panasonic, which makes the cells. In China and more and more within the U.S., Tesla buys off-the-shelf batteries from CATL.

It is more and more shifting to lithium iron phosphate batteries. LFPs have some value benefits, which have grown as a result of they do not require any cobalt or nickel, not like lithium-ion batteries.

Tesla has lengthy led in getting extra out of its batteries, although the high-end Lucid Air has larger battery effectivity than Tesla.

Tesla is growing its personal 4680 battery cells in a pilot program. The 4680 batteries do not contain new chemistry. The bigger kind issue gives the potential for value financial savings, however technical challenges stay.

That might have an effect on the timetable for the Cybertruck in addition to different automobiles such because the Semi and Roadster.

BYD batteries, in contrast, are actually in home. The BYD Blade batteries, a specialised LFP battery, are seen as among the many most secure accessible for EVs.

BYD handed LG to be the world’s No. 2 EV battery maker in July, however is nicely behind China’s CATL. Development has largely come from BYD batteries in its personal automobiles, however that can begin to change.

BYD is now supplying Blade batteries to Tesla Berlin. It is a main validation for BYD, because it goals to be a serious battery provider to third-party automakers.

The made-in-China Ford Mustang Mach-E makes use of BYD batteries.

Toyota (TM) will use BYD batteries and motors in an upcoming small EV for the Chinese language market, the bZ3. BYD could also be actively concerned in Toyota’s wider EV push within the coming years.

BYD and Tesla are on the forefront of automakers attempting to lock up provides of lithium and different key battery uncooked supplies.

Musk has mentioned Tesla getting concerned in lithium mining, however hasn’t performed so. Tesla just lately has proposed a lithium processing plant in Tesla.

BYD is concerned in a number of lithium mining tasks already.

Time The Market With IBD’s ETF Market Technique

Tesla Past EVs

Tesla and BYD are extra than simply EV makers.

Tesla has photo voltaic and battery storage companies, however each are only a small a part of complete income.

Tesla additionally generates income by way of its Supercharger community. It is beginning to open its Supercharger community to non-Tesla automobiles in elements of Europe, the place third-party charging stations are frequent. Within the U.S., the Supercharger community remains to be an enormous moat for Tesla, however the automaker appears poised to open a minimum of some stations to draw new subsidies.

Tesla’s self-driving efforts have been a key income driver and model builder. If Tesla is ready to create an inexpensive, vision-only system that’s absolutely autonomous, the payoff might be big. However Full Self-Driving isn’t full self-driving. Even FSD Beta is a Stage 2 driver-assist system.

The Nationwide Freeway Site visitors Security Administration has expanded an Autopilot probe a number of occasions. The investigation started in 2021 with a take a look at Autopilot-related crashes into stationary emergency automobiles. The NHTSA can also be wanting into “phantom braking,” when Tesla automobiles all of the sudden brake whereas on Autopilot.

There was a spate of Tesla automobiles rear-ending bikes on highways, resulting in some fatalities.

The California DMV in July accused the EV large of deceptive prospects about Autopilot and FSD.

On Aug. 18, the NHTSA requested details about Tesla’s in-cabin digital camera. Many, however not all, Tesla automobiles have in-cabin cameras for driver monitoring, however they don’t seem to be essentially positioned nicely and lack key options to be an efficient DMS.

The NHTSA additionally requested information on how Tesla assembles its quarterly reviews that tout Autopilot’s security advantages. The reviews should not adjusted for sort of street, driver age, automobile age, climate situations and different key elements.

Regardless of all that, Musk stated Aug. 21 that Tesla will elevate the worth of FSD in North America to $15,000 from $12,000 on Sept. 5, after the deliberate broad launch of FSD Beta 10.69.2.

Musk has stated Tesla is placing a number of effort on growing the Tesla Bot, or Optimus. An Optimus prototype was unveiled at Tesla AI Day on Sept. 30, with restricted mobility. Musk stated Optimus ought to go on sale in 3-5 years for lower than $20,000. Most specialists say normal function humanoid robots are many years away.

BYD Semiconductor, Photo voltaic And Extra

BYD makes its personal chips, which has helped it quickly develop over the previous yr whereas the business needed to idle manufacturing.

The corporate additionally has photo voltaic and vitality storage companies, in addition to a wide range of different operations.

BYD’s chairman stated Sept. 2 that the automaker will add driver-assist techniques in 2023.

It has a number of autonomous driving partnerships. BYD has stated it would undertake Nvidia’s Drive system for autonomous driving. That follows a self-driving partnership with Baidu (BIDU). Baidu and Nvidia (NVDA) have lengthy been autonomous-driving companions.

BYD additionally says it would use chips from Horizon Robotics in some 2023 fashions. That follows a driver-assist enterprise with China’s Momenta. BYD additionally has taken a stake in Lidar provider RoboSense.

BYD is beginning work by itself in-house chip for good driving, native media reported in mid-July.

5 Finest Chinese language Shares To Watch Now

Tesla Inventory Vs. BYD Fundamentals

Tesla earnings greater than tripled to $2.26 a share in 2021, vs. 75 cents in 2020 and simply 1 cent in 2019.

Tesla earnings rose 57% in Q2 whereas income grew 42%, each topping views. That got here regardless of important challenges, notably the prolonged Shanghai manufacturing shutdown and sluggish return. Earnings and income fell vs. Q1.

BYD earnings declined in 2021. Capital spending final yr exceeded capex from 2018-20 mixed, with big outlays for brand spanking new auto, battery and chip vegetation. EV and PHEV manufacturing capability has surged in current months and continues to extend. That’s spurring huge income and revenue features this yr and past.

On Aug. 29, BYD reported Q2 internet revenue shot up 197% vs. a yr earlier in native foreign money phrases, with income up 68%. Internet revenue leapt 245% vs. Q1.

First-half internet earnings was 3.598 billion yuan. That was on the excessive finish of the EV large’s July 14 preliminary first-half estimate of two.8 billion-3.6 billion yuan.

Analysts see profitability and margins enhancing additional within the second half, as BYD expands manufacturing and strikes upscale.

Tesla Inventory Vs. BYD Inventory Technicals

Tesla inventory is down 24.7% this yr as of Sept. 30, in line with MarketSmith evaluation, however off 2022 lows. It is outperforming BYD inventory, which is off 27.3% after wiping out strong 2022 features from its late June report highs.

TSLA inventory hit a report 414.46 in November. Shares approached these ranges in April, however then bought off onerous. On Might 24, shares tumbled to an 11-month intraday low of 206.84, down simply over 50% from its report excessive.

On July 21, TSLA surged following earnings, blasting above short-term ranges after clearing the 50-day line a couple of days earlier.

On Sept. 21, TSLA inventory practically topped its Aug. 16 short-term highs, however reversed decrease with the market following the Fed fee hike. Shares went on to tumble under their 200-day and 50-day strains by Sept. 23.

Tesla inventory now has quick consolidation beginning Aug. 16 throughout the much-larger base, with a 314.74 purchase level. Shares have tumbled previously two weeks amid the market sell-off, nearing the low of its bottoming base.

The RS line has pulled again barely is close to the most effective ranges since early April.

BYD dived July 12 on rumors that Warren Buffett would promote or all of his longtime stake. Berkshire Hathaway on Aug. 24 bought 1.33 million H-shares, in line with a Hong Kong change submitting on Aug. 30. On Sept. 1, Berkshire bought 1.72 million shares.

Berkshire purchased 225 million H-shares in BYD in September 2008. Fears that Buffett will proceed promoting BYD inventory spurred a rush to the exit. Berkshire owns lower than 8% of BYD, primarily based on all share courses.

BYD inventory tumbled on Aug. 30, under its 200-day line. Shares have saved promoting off, skidding to six-month lows.

Tesla Inventory Market Cap

When it comes to market cap, Tesla inventory vs. BYD inventory isn’t any contest. Tesla is price $831.15 billion. That is leagues above BYD’s $67.4 billion.

BYD’s market cap exceeds that of Rivian inventory and Lucid inventory mixed. It is also above the valuations of GM and Ford.

An S&P 500 large, Tesla inventory has an array of institutional sponsorship, together with many IBD-style mutual funds and different A+ funds. TSLA inventory stays a serious holding throughout Ark Make investments’s ETFs.

BYD inventory has far-less massive sponsorship, although Buffett’s Berkshire has been a notable investor for years. Cathie Wooden’s Ark additionally owns a small stake. Only a few shares can boast each Buffett and Wooden as buyers.

BYD inventory is listed in Hong Kong and Shenzhen, and solely trades over-the-counter within the U.S. That additionally means the BYDDF inventory chart reveals a number of minigaps.

Tesla Inventory Vs. BYD Inventory

In some ways BYD is what Tesla claims or aspires to be. BYD makes its personal batteries and chips, in addition to many different key elements. It is promoting its batteries to different automakers, together with Tesla itself quickly. Musk has lengthy touted a aim of a $25,000 Tesla. BYD already sells many EVs at or under $25,000, and at a revenue. Musk has mulled getting concerned in lithium mining. BYD already is.

BYD’s EV and PHEV unit gross sales have raced previous Tesla’s unit gross sales, with the automaker accelerating manufacturing and transferring towards more-upscale choices. For now, Tesla sells extra much more pure electrics than BYD — although the hole is narrowing — and at much-higher worth factors. Each are reporting booming earnings.

BYD is increasing into a number of massive markets, with a number of extra within the subsequent few weeks and months.

Each EV giants are delivering much more automobiles than rivals, although Tesla does face some demand considerations.

Tesla inventory and BYD inventory have been among the many greatest EV winners in 2021. Each are down sharply for the yr. TSLA inventory, although under key ranges, is not that removed from potential purchase factors, even amid Tesla demand considerations in China. BYD inventory is nicely off highs and desires a number of restore work, although the enterprise itself is prospering.

So, Tesla inventory vs. BYD inventory? Buyers ought to preserve their eyes on them.

Please comply with Ed Carson on Twitter at @IBD_ECarson for inventory market updates and extra.

YOU MAY ALSO LIKE:

Why This IBD Instrument Simplifies The Search For Prime Shares

Need To Get Fast Income And Keep away from Massive Losses? Attempt SwingTrader

IBD Digital: Unlock IBD’s Premium Inventory Lists, Instruments And Evaluation At present

How To Make investments In Electrical Autos

Third Leg For Bear Market? Tesla Deliveries Fall Quick