(Bloomberg) — The historic bond selloff has wreaked havoc throughout international markets all 12 months, whereas fueling a disaster of confidence in all the pieces from the 60-40 portfolio advanced to the world of Large Tech investing.

Most Learn from Bloomberg

Now, heading right into a potential financial downturn, the near-$24 trillion Treasury market is trying much less harmful swiftly.

The newest US client value information recommend inflation could also be cooling in the end, driving buyers again to the asset class in droves on Thursday as merchants pared bets on the Federal Reserve’s hawkishness. One more reason why this once-reliable secure haven seems safer than it has shortly: Even rising rates of interest have much less energy to crush bond portfolios like they’ve over the previous two years.

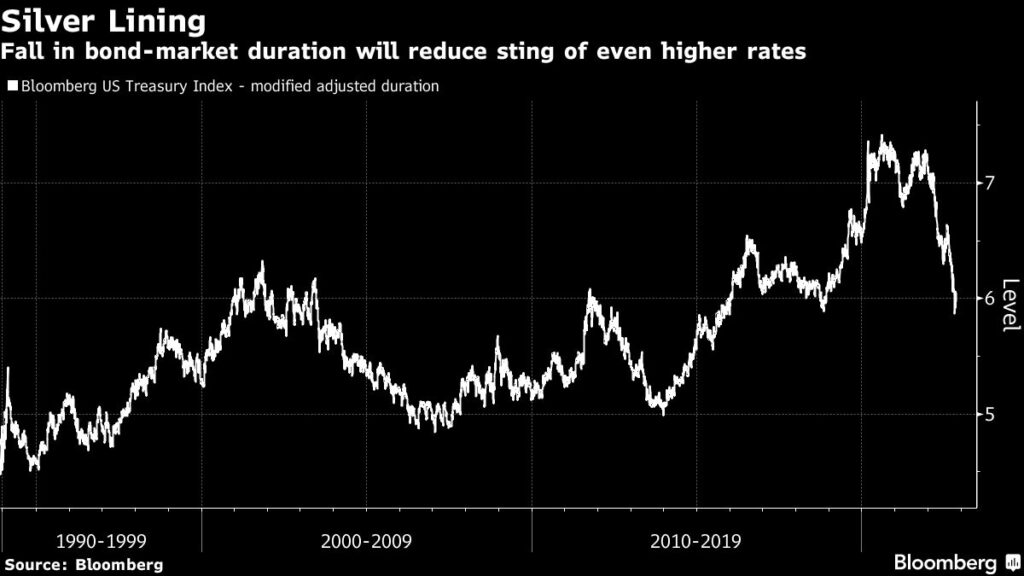

Simply have a look at period, which measures the sensitivity of bond costs to modifications in yields. It’s a tried-and-tested gauge of danger and reward that guides all flavors of fixed-income investing — and it’s fallen sharply this 12 months.

With the Fed’s aggressive policy-tightening marketing campaign this 12 months pushing Treasury yields to round decade-highs, the margin of security for anybody shopping for US debt proper now has improved notably in contrast with the low-rate period, earlier than the bull market collapsed within the inflationary aftermath of the pandemic.

Due to greater yields and coupon funds, easy bond math exhibits period danger is decrease, which means a recent selloff from right here would inflict much less ache for cash managers. That’s a merciful prospect after two years of gut-wrenching losses on a scale largely unseen within the trendy Wall Road period.

“Bonds are getting a bit much less dangerous,” stated Christian Mueller-Glissmann, head of asset allocation technique at Goldman Sachs Group Inc., who shifted from underweight positions in bonds to impartial on the finish of September. “The overall volatility of bonds is more likely to fall since you don’t have the identical quantity of period, and that’s wholesome. Web-net, bonds have gotten extra investible.”

Think about the two-year Treasury word. Its yield would wish to rise a whopping 233 foundation factors from earlier than holders would truly incur a total-return loss over the approaching 12 months, primarily because of the cushion supplied by beefy curiosity funds, in line with evaluation performed by Bloomberg Intelligence strategist Ira Jersey.

With greater yields, the quantity an investor is compensated for every unit of period danger has risen. And it’s elevated the bar earlier than an additional rise in yields creates a capital loss. Larger coupon funds and shorter maturities may serve to cut back interest-rate danger.

“The easy bond math of yields going up brings period down,” stated Dave Plecha, international head of mounted revenue at Dimensional Fund Advisors.

And take the Sherman ratio, an alternate measure of interest-rate danger named after DoubleLine Capital Deputy Chief Funding Officer Jeffrey Sherman. On the Bloomberg USAgg Index, it’s elevated from 0.25 a 12 months in the past to 0.76 at this time. Which means it might take an 76 basis-point rise in rates of interest over one 12 months to offset the yield of a bond. A 12 months in the past it might have taken simply 25 foundation factors — equal to a single regular-sized hike from the Fed.

All advised a key measure of period on the Bloomberg US Treasury index, which tracks roughly $10 trillion, has fallen from a report 7.4 to six.1. That’s the least since round 2019. Whereas a 50 basis-point rise in yields inflicted a greater than $350 billion loss on the finish of final 12 months, at this time that very same hit is a extra modest $300 billion.

That’s removed from the all-clear, however it does cut back the draw back danger for these wading again into Treasuries interested in the revenue — and the prospect that decrease inflation or slowing progress will enhance bond costs forward.

Learn extra: Excessive-Grade Period Has Steepest Decline Since Volcker Hikes

In spite of everything, cooling US client costs for October provide hope that the most important inflation shock in many years is easing, in what could be a welcome prospect for the US central financial institution when it meets subsequent month to ship a possible 50 basis-point enhance in benchmark charges.

Two-year Treasury yields surged this month to as excessive as 4.8% — probably the most since 2007 — but plunged 25 foundation factors Thursday on the CPI report. The ten-year word yield, which now hovers round 3.81%, up from 1.51% on the finish of 2021, additionally slid 35 foundation factors over the previous week, which was shortened as a consequence of Friday’s Veteran’s Day vacation.

The counterpoint is that purchasing bonds is way from a slam-dunk commerce given the continued uncertainty over the inflation trajectory whereas the Fed is threatening additional aggressive price will increase. However the math does suggests buyers are actually considerably higher compensated for the dangers throughout the curve. That, together with the darkening financial backdrop, is giving some managers the conviction to slowly rebuild their exposures from multi-year lows.

“We’ve been overlaying period underweights,” stated Iain Stealey, CIO for mounted revenue at JPMorgan Asset Administration. “I don’t assume we’re fully out of the woods but, however we’re undoubtedly nearer to the height in yields. We’re considerably much less underweight than we have been.”

And naturally the current rally suggests an asset class that’s fallen sharply out of favor over the previous two years is lastly turning the nook.

The defining narrative of 2023 shall be “a worsening labor market, a low progress setting and moderating wages,” BMO strategist Benjamin Jeffery stated on the agency’s Macro Horizons podcast. “All of that may reinforce this safe-haven dip-buying that we argue has began to materialize over the previous few weeks.”

What to Watch

-

Financial calendar:

-

Nov. 15: Empire manufacturing; PPI; Bloomberg November US financial survey

-

Nov. 16: MBA mortgage purposes; retail gross sales; import and export value index; industrial manufacturing; enterprise inventories; NAHB housing index; TIC flows

-

Nov. 17: Housing begins/permits; Philadelphia Fed enterprise outlook; weekly jobless claims; Kansas Metropolis Fed manufacturing

-

Nov. 18: Present house gross sales; main index

-

-

Fed calendar:

-

Nov. 14; Fed Vice Chair Lael Brainard; New York Fed President John Williams

-

Nov. 15: Philadelphia Fed President Patrick Harker; Fed Governor Lisa Prepare dinner; Fed Vice Chair for Supervision Michael Barr

-

Nov. 16; Williams delivers keynote remarks on the 2022 US Treasury market Convention; Barr; Fed Governor Christopher Waller;

-

Nov. 17: St. Louis Fed President James Bullard; Fed Governor Michelle Bowman; Cleveland Fed President Loretta Mester; Fed Governor Philip Jefferson; Minneapolis Fed President Neel Kashkari

-

-

Public sale calendar:

-

Nov. 14: 13- and 26-week payments

-

Nov. 16: 17-week payments; 20-year bonds

-

Nov. 17: 4- and 8-week payments; 10-year TIPS Reopening

-

–With help from Sebastian Boyd and Brian Chappatta.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.