-

The primary AI commerce has already unfolded within the inventory market as buyers bid up the “enablers” like Nvidia.

-

However there is a second, long-term AI commerce available within the inventory market, in response to Goldman Sachs.

-

The “AI commerce after the commerce” is targeted on corporations that ought to see a large labor productiveness increase from AI.

There are two trades available within the inventory market associated to the emergence of synthetic intelligence applied sciences, and buyers higher listen, in response to a Monday observe from Goldman Sachs.

The promise of AI has taken over the inventory market in 2023, serving to put it aside from a painful bear market and catapulting one firm to a greater than $1 trillion market valuation: Nvidia.

Nvidia is an AI “enabler” and is among the many first leg of the AI inventory market commerce, by which buyers bid up corporations which can be poised to instantly profit from the expertise.

Different shares that can see massive near-term beneficial properties from AI embody “hyperscalers” like cloud computing giants Microsoft, Alphabet, and Amazon, in addition to “empowered customers” like Meta Platforms, Salesforce, Adobe, ServiceNow, and Intuit.

However whereas enablers, hyperscalers, and empowered customers signify the early AI commerce to hit the inventory market, there is a second, long-term AI commerce that buyers can nonetheless reap the benefits of, in response to the observe.

The financial institution put collectively a basket of “AI commerce after the commerce” shares which can be poised see surging company earnings from labor productiveness beneficial properties which can be unlocked by the adoption of synthetic intelligence applied sciences.

“The estimated AI-driven earnings increase is prone to happen over the following few years, however must be mirrored in inventory valuations sooner,” Goldman Sachs mentioned. “The broader, longer-term profit from AI adoption will accrue to corporations as they harness AI to enhance productiveness, resulting in better revenues, greater margins, or a mixture of each.”

Between 2025 and 2030, Goldman expects AI applied sciences to take maintain inside corporations and have a noticeable impression on the macroeconomy as adoption picks up.

The financial institution estimates that the median Russell 1000 inventory might see earnings rise 19% on effectivity beneficial properties from AI, whereas about 8% of Russell 1000 companies will see earnings rise greater than 60%.

Listed below are the highest 10 corporations in Goldman Sachs’ second AI commerce basket.

10. Tenet Healthcare

Ticker: THC

Potential change to earnings from AI: 135%

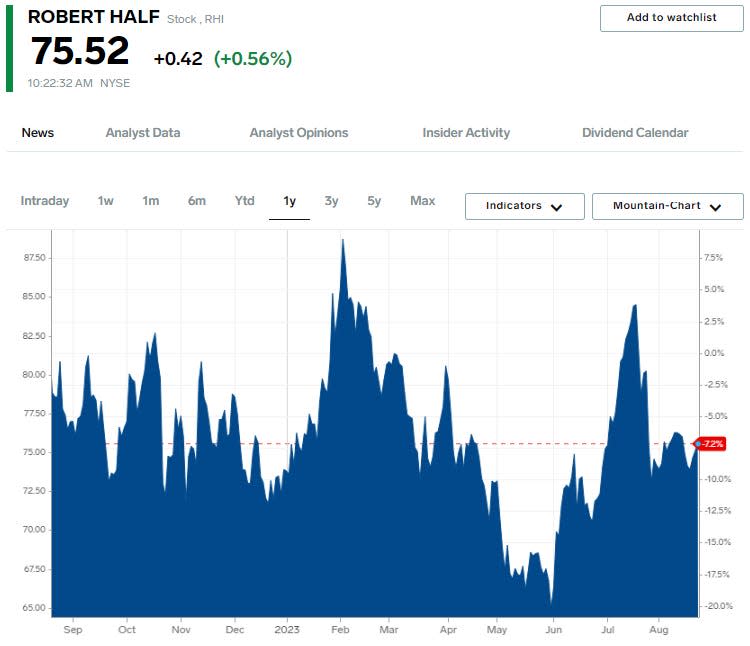

9. Robert Half

Ticker: RHI

Potential change to earnings from AI: 150%

8. Snowflake

Ticker: SNOW

Potential change to earnings from AI: 154%

7. Pinterest

Ticker: PINS

Potential change to earnings from AI: 162%

6. Smartsheet

Ticker: SMAR

Potential change to earnings from AI: 171%

5. Nutanix

Ticker: NTNX

Potential change to earnings from AI: 177%

4. MongoDB

Ticker: MDB

Potential change to earnings from AI: 193%

3. Alteryx

Ticker: AYX

Potential change to earnings from AI: 203%

2. Clarivate

Ticker: CLVT

Potential change to earnings from AI: 232%

1. Guidewire Software program

Ticker: GWRE

Potential change to earnings from AI: 388%

Learn the unique article on Enterprise Insider