-

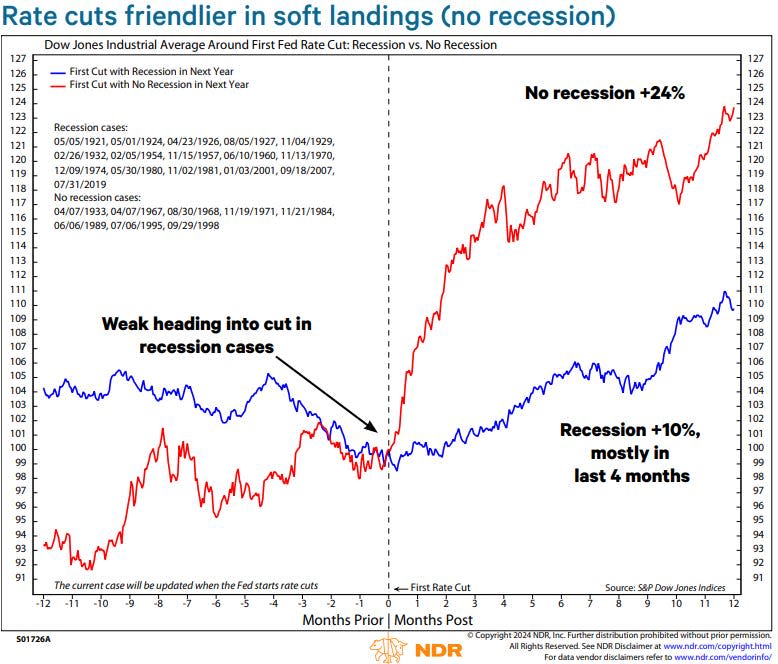

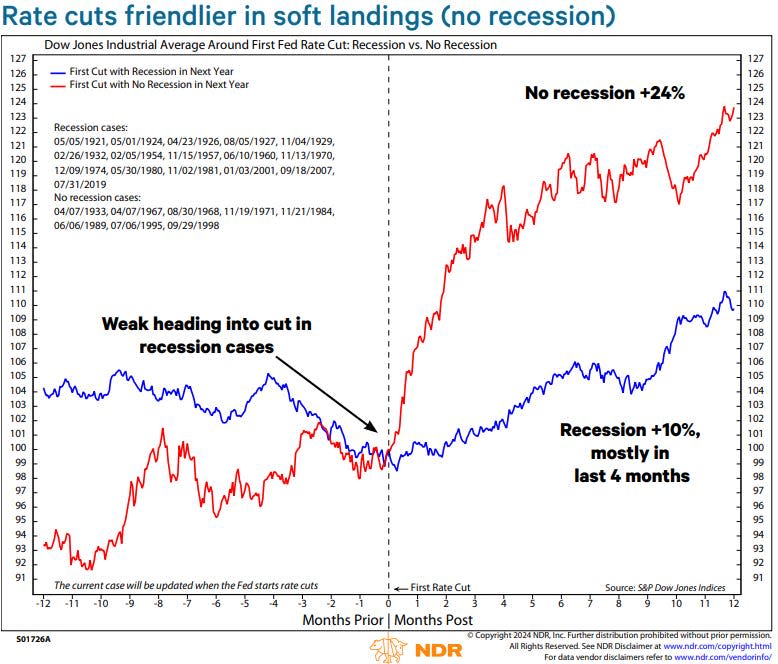

The inventory market might have 24% upside after the Fed launches its first interest-rate minimize later this 12 months.

-

Ned Davis analysis crunched the numbers and located that interest-rate cuts, coupled with no recession, create a really bullish setting for shares.

-

“The underside line is that the inventory market has tended to rally within the 12 months after the primary minimize,” NDR mentioned.

The inventory market is poised for appreciable upside because the Federal Reserve gears up for its first interest-rate minimize since 2019, in accordance with a Thursday be aware from Ned Davis Analysis.

Ed Clissold, chief US strategist at Ned Davis Analysis, crunched the numbers and located that the Dow Jones Industrial Common jumps 15% on common within the first 12 months after the Fed’s first rate of interest minimize. However these good points are even stronger, at 24%, when the rate of interest cuts are coupled with no recession within the economic system.

“The Dow Jones Industrial Common has rallied extra when a recession has not occurred inside a 12 months earlier than or after the primary minimize,” Clissold mentioned.

The Fed has signaled that it plans to chop rates of interest no less than thrice this 12 months after inflation has moderated significantly from its June 2022 peak. In the meantime, strong GDP development and a resilient jobs market has signaled to traders {that a} recession doesn’t seem imminent, setting the inventory market up for strong good points forward.

If the typical 24% acquire after the primary rate of interest minimize throughout a no recession interval had been to materialize, the Dow Jones would commerce to about 47,000. That stage strains up with a latest bullish name from All Star Charts’ JC Parets, who mentioned the Dow Jones might surge to 50,000 if the US greenback breaks down.

“The underside line is that the inventory market has tended to rally within the 12 months after the primary minimize,” Clissold mentioned.

Learn the unique article on Enterprise Insider