This yr began with a powerful rally within the markets, however the previous month has seen the constructive sentiments begin to sputter. The failure of Silicon Valley Financial institution began fears of a contagion and consequent financial institution runs, which have been solely partially offset by Federal regulatory actions. However there’s a rising consensus that it was the Federal actions that set the circumstances for the financial institution disaster, when the central financial institution raised rates of interest to battle inflation. Now, buyers are attempting to deal with the fallout: a simmering financial institution troubles, persistent excessive inflation, and elevated rates of interest.

However not all is doom and gloom. Based on Mike Wilson, the chief US fairness strategist at Morgan Stanley, what we’re seeing now might herald the start of the top within the bear market. Whereas the market is risky, Wilson describes a constructive set-up for buyers trying to maintain shares for the long-term.

“From an fairness market perspective, the [recent] occasions imply that credit score availability is reducing for a large swath of the economic system, which would be the catalyst that lastly convinces market individuals that earnings estimates are too excessive. We’ve been ready patiently for this acknowledgment as a result of with it comes the true shopping for alternative… We predict that is precisely how bear markets finish,” Wilson opined.

The inventory analysts at Morgan Stanley are following Wilson’s lead, and declaring the equities that provide strong alternatives for the long-term. Utilizing the TipRanks platform, we’ve regarded up the main points on three of those picks; every holds a Sturdy Purchase score from the Avenue together with a double-digit upside potential. Let’s take a better look.

UnitedHealth Group

First up is the world’s largest well being insurer, UnitedHealth (UNH). The corporate is primarily a supplier of medical health insurance insurance policies, and in partnership with employers, suppliers, and governments, it makes healthcare accessible to greater than 151 million individuals.

The dimensions of this enterprise is seen within the firm’s earnings studies. Within the final reported quarter, 4Q22, UnitedHealth confirmed a quarterly high line of $82.8 billion, up 12% year-over-year and a few $270 million forward of expectations. On the backside line, the corporate had a non-GAAP EPS of $5.34, up 19% y/y, and above consensus estimate of $5.17. For the complete yr, UnitedHealth had revenues of $324 billion, for a 13% y/y acquire. The agency’s full-year adjusted web earnings got here to $22.19 per share.

Trying forward, UNH is guiding towards $357 billion to $360 billion in revenues for 2023, and is projecting to usher in $24.40 to $24.90 in adjusted web EPS.

Protecting this inventory for Morgan Stanley, 5-star analyst Erin Wright lays out a easy case for buyers to contemplate, saying, “In medical health insurance, scale is king and UNH is the biggest nationwide insurer with top-three place in virtually all insurance coverage finish markets. We consider the resiliency of UNH’s diversified companies will generate long-term double-digit earnings progress with excessive visibility as a best-in-class vertically built-in MCO in a extremely defensive class.”

To this finish, Wright charges UNH shares an Chubby (i.e. Purchase), and her worth goal of $587 implies a acquire of ~22% on the one-year time horizon. (To observe Wright’s monitor file, click on right here)

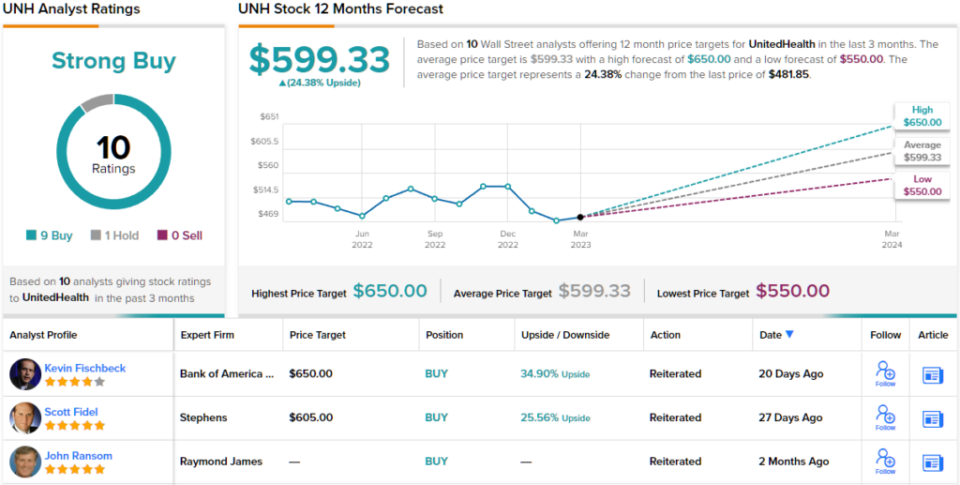

Total, the Sturdy Purchase consensus on this inventory is backed by 10 current analyst critiques, that includes a 9 to 1 breakdown favoring Buys over Holds. The inventory’s common worth goal of $599.33 signifies potential for a 24% one-year upside from the present share worth of $481.82. As a small bonus, the corporate additionally pays common dividends that at present yield 1.4% yearly. (See UNH inventory forecast)

T-Cell US

The subsequent Morgan Stanley choose we’re taking a look at is one other large of its {industry}. T-Cell (TMUS) is likely one of the best-known names within the US wi-fi enterprise, and is the second-largest supplier of wi-fi networking companies within the US market.

As of the top of 2022, the corporate had 1.4 million new postpaid accounts for the yr, and a complete web buyer depend of 113.6 million. T-Cell is a pacesetter within the rollout of 5G companies within the US, and boasted 2.6 million high-speed web clients on the finish of 2022.

Massive buyer counts and hefty market share have led to robust earnings outcomes. T-Cell’s final quarterly launch, for 4Q22, confirmed $1.18 in GAAP EPS, beating the forecast by 8 cents, or 7%, and rising a formidable 247% year-over-year.

The corporate achieved these earnings outcomes regardless of a modest miss in income. The quarterly high line of $20.3 billion was $39 million under expectations, and slipped 2.4% y/y.

The free money circulate, nonetheless, actually stood out. T-Cell generated $2.2 billion in FCF for This fall, and its full-year FCF determine, of $7.7 billion, proven an ‘industry-leading’ enhance of 36% whereas additionally beating beforehand printed steerage. The corporate’s money era made it potential to help share worth by repurchasing 21.4 million shares in 2022 for a complete of $3 billion.

This inventory bought the nod from Simon Flannery, one other of Morgan Stanley’s 5-star analysts. Flannery wrote of TMUS: “The corporate has a transparent progress technique predicated totally on share beneficial properties in key, underpenetrated markets: small city/rural, enterprise and high 100 market community seekers. Moreover, T-Cell has led the best way on mounted wi-fi dwelling broadband as a model new market alternative for the corporate that’s anticipated to scale to 7-8mn subs by 2025.”

Monitoring this stance ahead, Flannery charges TMUS shares an Chubby (i.e. Purchase) with a $175 worth goal indicating ~22% upside for the following 12 months. (To observe Flannery’s monitor file, click on right here)

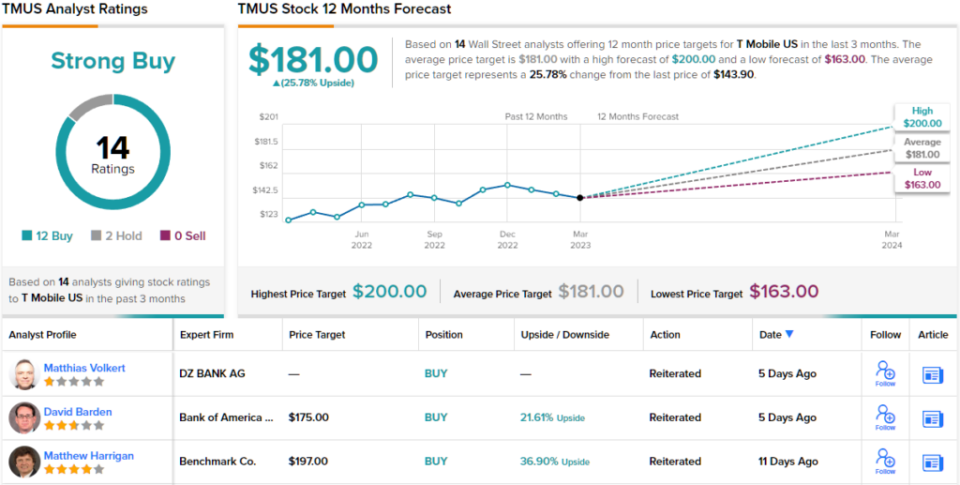

No fewer than 14 of Wall Avenue’s analysts have reviewed T-Cell’s shares not too long ago, and so they’ve given the inventory 12 Buys and a pair of Holds for a Sturdy Purchase consensus score. The shares are buying and selling for $143.90, with a mean worth goal of $181 to counsel ~26% upside potential by the top of this yr. (See TMUS inventory forecast)

Thermo Fisher Scientific

We’ll wrap up this checklist of Morgan Stanley’s long-term inventory picks with Thermo Fisher Scientific (TMO), an vital participant within the area of laboratory analysis.

Thermo Fisher is a maker and provider of laboratory gear – scientific devices, chemical substances and reagents, sampling and testing provides, and even lab-related software program methods. Thermo Fisher works with a broad buyer base, serving any shoppers in any area involving lab work; the corporate incessantly offers with teachers, medical researchers, and authorities entities.

Whereas Thermo Fisher occupies a extremely specific area of interest, supplying analysis labs has been worthwhile within the post-pandemic world. The corporate’s 4Q22 outcomes noticed each the highest and backside line beat expectations, even when they didn’t increase year-over-year. On the high line, the quarterly income of $11.45 billion was a full $1.04 billion above the forecast, whereas on the backside line the non-GAAP EPS of $5.40 was 20 cents forward of consensus estimates.

Thermo Fisher caught the attention of Morgan Stanley analyst Tejas Savant who writes: “We like TMO for the breadth of its portfolio, diversified buyer base and scale – attributes that we consider will show advantageous in navigating a possible recession, along with inflationary pressures and geopolitical uncertainty. TMO’s favorable finish market publicity, PPI enterprise system, and monitor file of constant all-weather execution underpin our confidence in administration’s long-term core natural progress goal of 7- 9% with mid-teens EPS progress.”

Unsurprisingly, Savant charges TMO shares an Chubby (i.e. Purchase), whereas his $670 suggests the inventory will develop 19% within the yr forward. (To observe Savant’s monitor file, click on right here)

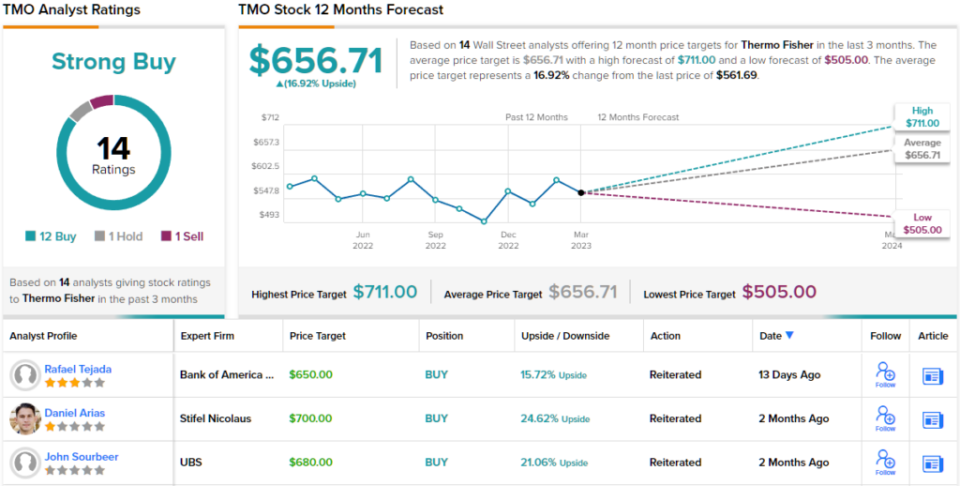

Total, this inventory has picked up 14 current analyst critiques, and these embody 12 Buys that overbalance 1 Maintain and 1 Promote for a Sturdy Purchase consensus score. The inventory’s common worth goal of $656.71 implies ~17% one-year acquire from the present share worth of $561.69. (See TMO inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather vital to do your individual evaluation earlier than making any funding.