Let’s get able to rumble.

The Federal Reserve and traders seem like locked in what one veteran market watcher has described as an epic sport of “rooster.” What Fed Chair Jerome Powell says Wednesday might decide the winner.

Right here’s the battle. Fed coverage makers have steadily insisted that the fed-funds price, now at 4.25% to 4.5%, should rise above 5% and, importantly, keep there because the central financial institution makes an attempt to carry inflation again to its 2% goal. Fed-funds futures, nevertheless, present money-market merchants aren’t absolutely satisfied the speed will prime 5%. Maybe extra galling to Fed officers, merchants count on the central financial institution to ship cuts by year-end.

Inventory-market traders have additionally purchased into the latter coverage “pivot” state of affairs, fueling a January surge for crushed down know-how and progress shares, that are significantly curiosity rate-sensitive. Treasury bonds have rallied, flattening yields throughout the curve. And the U.S. greenback has weakened.

Cruisin’ for a bruisin’?

To some market watchers, traders now seem manner too huge for his or her breeches. They count on Powell to try to take them down a peg or two.

How so? Search for Powell to be “unambiguously hawkish,” when he holds a information convention following the conclusion of the Fed’s two-day coverage assembly on Wednesday, stated Jose Torres, senior economist at Interactive Brokers, in a telephone interview.

“Hawkish” is market lingo used to explain a central banker sounding robust on inflation and fewer fearful about financial progress.

In Powell’s case, that might seemingly imply emphasizing that the labor market stays considerably out of stability, calling for a big discount in job openings that may require financial coverage to stay restrictive for a protracted interval, Torres stated.

If Powell sounds sufficiently hawkish, “monetary circumstances will tighten up shortly,” Torres stated, in a telephone interview. Treasury yields “would rise, tech would drop and the greenback would rise after a message like that.” If not, then count on the tech and Treasury rally to proceed and the greenback to get softer.

Hanging unfastened

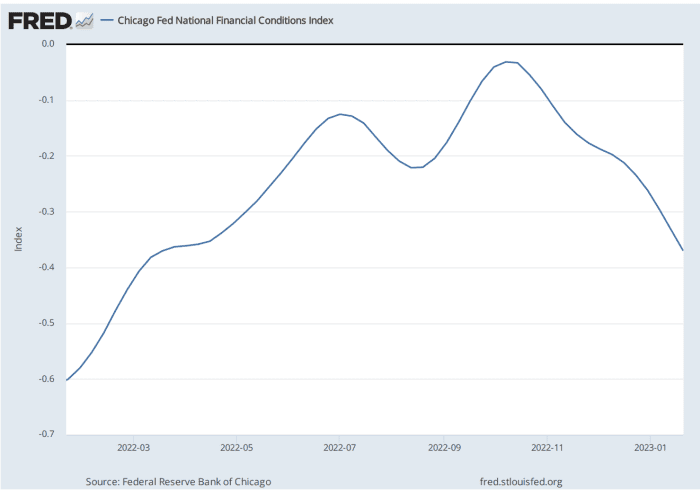

Certainly, it’s a loosening of economic circumstances that’s seen attempting Powell’s persistence. Looser circumstances are represented by a tightening of credit score spreads, decrease borrowing prices, and better inventory costs that contribute to speculative exercise and elevated threat taking, which helps gas inflation. It additionally helps weaken the greenback, contributes to inflation via greater import prices, Torres stated, noting that indexes measuring monetary circumstances have fallen for 14 straight weeks.

The Chicago Fed’s Nationwide Monetary Circumstances Index gives a weekly replace on U.S. monetary circumstances. Optimistic values have been traditionally related to tighter-than-average monetary circumstances, whereas adverse values have been traditionally related to looser-than-average monetary circumstances.

Federal Reserve Financial institution of Chicago, fred.stlouisfed.org

Powell and the Fed have definitely expressed considerations in regards to the potential for unfastened monetary circumstances to undercut their inflation-fighting efforts.

The minutes of the Fed’s December assembly. launched in early January, contained this attention-grabbing line: “Individuals famous that, as a result of financial coverage labored importantly via monetary markets, an unwarranted easing in monetary circumstances, particularly if pushed by a misperception by the general public of the Committee’s response perform, would complicate the Committee’s effort to revive value stability.”

That was taken by some traders as an indication that the Fed wasn’t desirous to see a sustained inventory market rally and would possibly even be inclined to punish monetary markets if circumstances loosened too far.

Learn: The Fed delivered a message to the inventory market: Huge rallies will lengthen ache

If that interpretation is right, it underlines the notion that the Fed “put” — the central financial institution’s seemingly longstanding willingness to reply to a plunging market with a loosening of coverage — is basically kaput.

The tech-heavy Nasdaq Composite logged its fourth straight weekly rise final week, up 4.3% to finish Friday at its highest since Sept. 14. The S&P 500

SPX,

superior 2.5% to log its highest settlement since Dec. 2, and the Dow Jones Industrial Common

DJIA,

rose 1.8%.

In the meantime, the Fed is nearly universally anticipated to ship a 25 foundation level price enhance on Wednesday. That may be a downshift from the collection of outsize 75 and 50 foundation level hikes it delivered over the course of 2022.

See: Fed set to ship quarter-point price enhance together with ‘one final hawkish sting within the tail’

Information exhibiting U.S. inflation continues to gradual after peaking at a roughly four-decade excessive final summer time alongside expectations for a a lot weaker, and doubtlessly recessionary, economic system in 2023 have stoked bets the Fed gained’t be as aggressive as marketed. However a pickup in gasoline and meals costs might make for a bounce in January inflation readings, he stated, which might give Powell one other cudgel to beat again market expectations for simpler coverage in future conferences.

Jackson Gap redux

Torres sees the setup heading into this week’s Fed assembly as much like the run-up to Powell’s speech at an annual central banking symposium in Jackson Gap, Wyoming, final August, by which he delivered a blunt message that the struggle in opposition to inflation meant financial ache forward. That spelled doom for what proved to be one other of 2023’s many bear-market rallies, beginning a slide that took shares to their lows for the yr in October.

However some query how pissed off coverage makers actually are with the present backdrop.

Certain, monetary circumstances have loosened in latest weeks, however they continue to be far tighter than they had been a yr in the past earlier than the Fed launched into its aggressive tightening marketing campaign, stated Kelsey Berro, portfolio supervisor at J.P. Morgan Asset Administration, in a telephone interview.

“So from a holistic perspective, the Fed feels they’re getting coverage extra restrictive,” she stated, as evidenced, for instance, by the numerous rise in mortgage charges over the previous yr.

Nonetheless, it’s seemingly the Fed’s message this week will proceed to emphasise that the latest slowing in inflation isn’t sufficient to declare victory and that additional hikes are within the pipeline, Berro stated.

Too quickly for a shift

For traders and merchants, the main target can be on whether or not Powell continues to emphasise that the most important threat is the Fed doing too little on the inflation entrance or shifts to a message that acknowledges the chance the Fed might overdo it and sink the economic system, Berro stated.

She expects Powell to ultimately ship that message, however this week’s information convention might be too early. The Fed gained’t replace the so-called dot plot, a compilation of forecasts by particular person coverage makers, or its employees financial forecasts till its March assembly.

That might show to be a disappointment for traders hoping for a decisive showdown this week.

“Sadly, that is the type of assembly that might find yourself being anticlimactic,” Berro stated.