(Bloomberg) — The revenue outlook for firms within the S&P 500 Index is quickly deteriorating — but analysts can’t increase their stock-price targets quick sufficient.

Most Learn from Bloomberg

Take into account it the stock-market disconnect of 2023.

The 2 seemingly incompatible developments replicate how a lot fairness costs are being pushed by hypothesis that the Federal Reserve is nearing the tip of its most aggressive rate-hiking cycle in many years. That significantly bodes properly for the valuations of development and tech shares, which have held on to this week’s huge good points even after disappointing earnings studies from Apple Inc., Alphabet Inc. and Amazon.com Inc.

However the diploma to which analysts are elevating stock-price targets whereas slashing the earnings estimates is puzzling for these used to seeing the market hinge on the underlying power of company America.

“Rates of interest have come down and your low cost charge has come down, so although your earnings aren’t going up, you may assign the next value [on the stock] simply due to the decrease low cost charge,” mentioned Crit Thomas, international market strategist at Touchstone Investments. “They’re saying, ‘Hey, we’re going to be out of this inside six to 12 months, so let’s simply look by means of it.”

Fourth-quarter reporting season has performed little to help optimism in regards to the fundamentals. Earnings in sectors from power to shopper discretionary have been coming in under pre-season estimates and corporations are dialing again outlooks based mostly on expectations development will gradual. In reality, Bloomberg Intelligence’s mannequin exhibits that such earnings steerage for the primary quarter has been reduce by essentially the most since at the least 2010.

That’s compelled analysts who caught to rosier estimates to observe. Amongst all adjustments analysts made to their earnings projections final month, simply 37% have been upgrades, knowledge compiled by Citigroup Inc. present. The extent has been related to the previous three financial recessions and is 30% under a historic common.

“To us, 2023 analyst numbers appeared too aggressive,” Drew Pettit, director of ETF evaluation and technique at Citigroup, mentioned in an electronic mail. They’re “rapidly getting revised down to higher match the financial actuality.”

There stays appreciable uncertainty in regards to the route of the economic system, particularly with Friday’s speedy job development numbers suggesting it’s nonetheless increasing at a stable tempo. General, nevertheless, economists broadly count on development to gradual and even contract as a consequence of tighter monetary situations.

Learn extra: Inventory-Market Vigilantes Dial Again Penalties for Earnings Misses

“We’re beginning to see a few of these firms come out and provides lower than perfect steerage on development,” mentioned Brian Jankowski, senior funding analyst at Fort Pitt Capital Group. “We’re beginning to see these enterprise forecasts for development line up higher with GDP, which is predicted to be little or no to flat.”

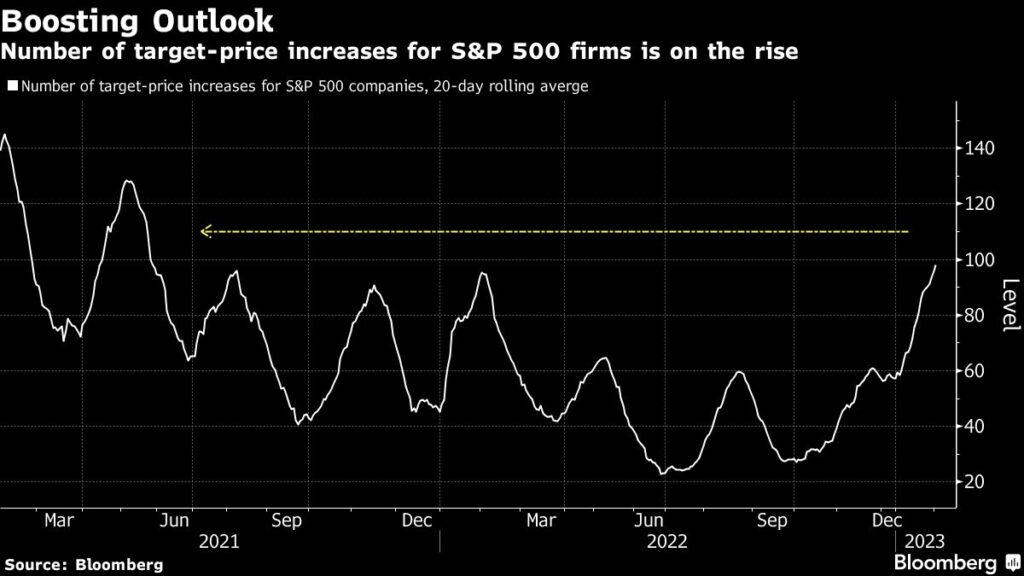

That has largely been brushed apart within the inventory market by hypothesis that rates of interest are nearing their peaks of the cycle, a view that was supported by the Fed’s determination Wednesday to dial again the tempo of its transfer. Promote-side analysts who cowl the S&P 500 firms — and already skew bullish — have responded by elevating their share-price estimates on the quickest tempo for the reason that spring of 2021.

The Fed’s central position within the outlook for fairness costs was underscored by how properly the market carried out this week within the face of some detrimental earnings surprises from main firms.

Apple reported a steeper gross sales decline in its vacation interval than Wall Road anticipated, whereas Ford Motor Co. posted a revenue miss amid a seamless provide scarcity. Google mum or dad Alphabet’s outcomes signaled a decrease demand for its search promoting throughout a slowing economic system.

But on Friday main inventory indexes have been little modified for a lot of the day earlier than closing decrease. Even so, the S&P 500 notched its second straight weekly achieve.

Elsewhere in company earnings:

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.