-

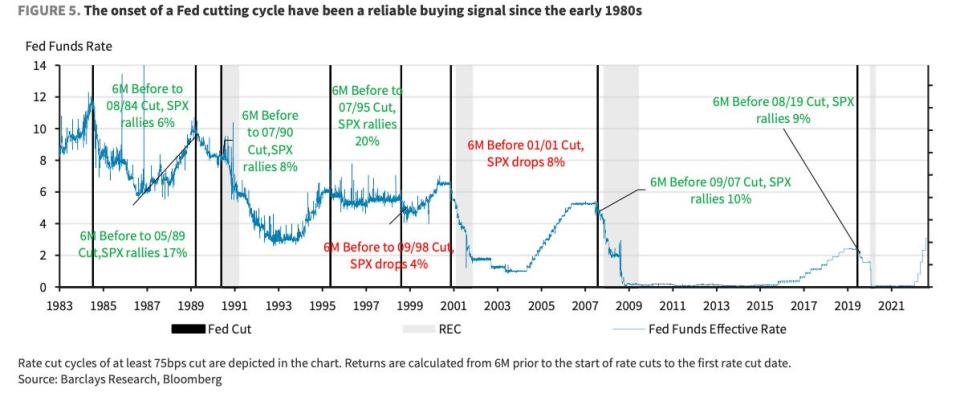

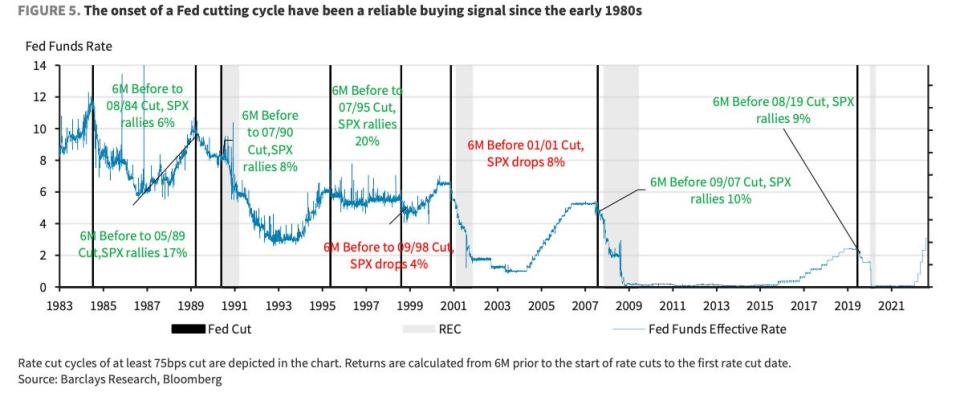

The Fed pausing charge hikes has been a dependable shopping for indicators for shares for 40 years, Barclays stated.

-

An anticipated Fed pivot to charge cuts subsequent 12 months will match the sample.

-

However Wall Road could possibly be too optimistic a few rally this time round, analysts stated.

A dovish flip in financial coverage has lengthy been a strong bull sign for shares, typically paving the best way for equities to succeed in new market highs, Barclays stated in a observe.

Up to now 40 years, the time between the final Federal Reserve charge hike and an eventual recession has virtually all the time led the S&P 500 to hit an all-time excessive. Solely in 2001 did the development fail, although the index nonetheless rose 11%.

With the Fed’s July charge hike now wanting like its ultimate one of many tightening cycle, the sample seems to be prefer it’s about to repeat itself. In the meantime, markets have surged on hopes a pivot to charge cuts is coming subsequent 12 months. However Barclays is cautious.

“This cycle is decidedly totally different than any we now have skilled for the final a number of a long time, because of the overhang of excessive inflation,” analysts stated.

Up to now, the Fed has been capable of pause charge hikes properly earlier than a recession arrives, paving the best way for contemporary inventory market highs earlier than the eventual downturn, they defined.

However in durations when the central financial institution was making an attempt to carry down excessive inflation, the span between a Fed pause and a recession tends to shrink, typically even overlapping.

If that is the case at present, it may spell bother for shares, Barclays warned.

“If a recession have been to materialize, previous durations recommend important further draw back from right here,” it stated. “Sturdy jobs knowledge stays the important thing holdout amongst in any other case weakening main indicators, however we see indicators that this can be approaching an inflection level.”

Nonetheless, Barclays acknowledged that the financial system’s stunning resilience for now brings the present cycle extra consistent with these bullish patterns over the previous 40 years.

“The recession that was all the time 6 months away is wanting an increasing number of just like the recession that by no means was, with main indicators which have been off the mark for properly over a 12 months now,” analysts wrote.

Learn the unique article on Enterprise Insider