The Federal Reserve will hike rates of interest to as excessive as 5.1% in 2023 earlier than the central financial institution ends its battle towards runaway inflation, in line with its median forecast launched Wednesday.

The anticipated “terminal price” of 5.1% is equal to a goal vary of 5%-5.25%. The forecast is larger than the 4.6% projected by the Fed in September.

The Fed introduced a 50 foundation level price hike Wednesday, taking the borrowing price to a focused vary between 4.25% and 4.5%, the very best degree in 15 years.

The so-called dot plot, which the Fed makes use of to sign its outlook for the trail of rates of interest, confirmed 17 of the 19 “dots” would take charges above 5% in 2023. Seven of the 19 committee members noticed charges rising above 5.25% subsequent 12 months.

For 2024, the rate-setting Federal Open Market Committee projected that charges would fall to 4.1%, a better degree than beforehand indicated.

Listed here are the Fed’s newest targets:

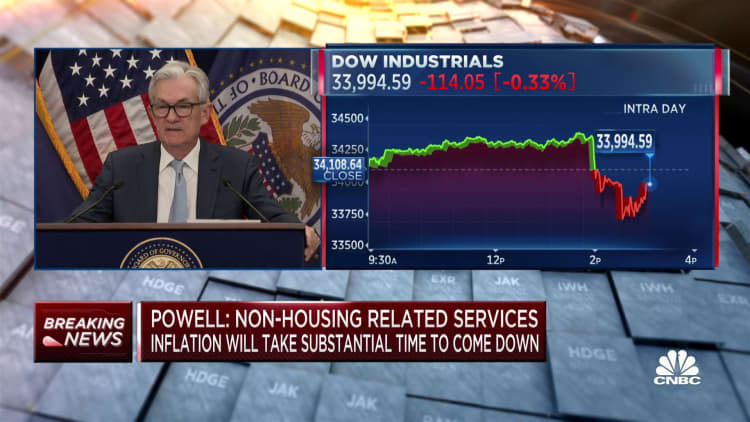

“The historic document cautions strongly towards prematurely loosening coverage. We’ll keep the course, till the job is completed,” Fed Chairman Jerome Powell stated throughout a information convention Wednesday.

The sequence of price hikes is predicted to decelerate the financial system. The Abstract of Financial Projections from the Fed confirmed the central financial institution anticipated a GDP achieve of 0.5% for 2023, barely above what can be thought of a recession.

The committee additionally raised its median anticipation of its favored core inflation measure to 4.8%, up 0.3 share level from the September projections.