June 12 (Reuters) – One other quarter percentage-point fee hike from the European Central Financial institution appears like a achieved deal on Thursday, however the important thing query for markets is what number of extra will observe.

Euro space inflation fell quicker than anticipated in Might and the bloc’s financial system is in recession, boosting the case for the quickest mountaineering cycle within the ECB’s 25-year historical past to finish quickly.

“All the things is lastly entering into the suitable course for the ECB,” mentioned Pictet Wealth Administration’s head of macroeconomic analysis Frederik Ducrozet.

Listed here are 5 key questions for markets.

1/ So, only a small hike from the ECB?

Sure, the ECB appears all however sure to stay to a smaller hike having ditched aggressive strikes in Might. The main focus is on what clues ECB chief Christine Lagarde provides in regards to the coverage outlook.

She’s anticipated to strengthen the message that charges must rise to ranges ample to comprise inflation, but in addition must be cautious to maintain the ECB’s choices open with out sounding too dovish.

“The primary subject for the ECB is to not get backed right into a pause nook by the markets the best way the Fed was,” mentioned Mike Kelly, head of multi-asset at PineBridge Investments, referring to the U.S. central financial institution.

2/ The ECB should be proud of slowing inflation?

Markets cheered euro space inflation falling greater than anticipated in Might. Crucially, the ECB will probably be glad to eventually see a slowdown in core inflation, which strips out unstable power, meals, alcohol and tobacco costs.

Nonetheless, at 5.3% it is solely simply off a report excessive. Wage progress is at twice the speed according to the ECB’s inflation goal.

“The ECB reiterated that they take a look at core inflation and whether or not it begins displaying a downward pattern. From that standpoint, the final knowledge was very encouraging,” mentioned HSBC fee strategist Chris Attfield.

“The ECB will react to these numbers by saying that financial coverage is working, their messaging is working, and so they should keep the course.”

3/ Will the ECB pause quickly?

Markets hope so, betting ECB hikes will probably be achieved after one other 25 bps hike by September. That can more than likely are available in July given a number of policymakers have virtually pre-committed to a transfer then.

Inflation, although nonetheless excessive, is slowing. Demand for loans is falling and lending requirements are tightening at a historic tempo.

Flavio Carpenzano, funding director at Capital Group, mentioned a weakening financial system in Europe would restrict scope to lift charges a lot additional.

Nonetheless, hawks akin to Germany’s Joachim Nagel are maintaining hikes past the summer time on the desk.

4/ What’s going to new ECB employees projections present?

Powerhouse financial system Germany dragged the bloc right into a recession within the first quarter that many anticipated it had dodged, and the outlook is weakening, so progress forecasts could possibly be revised down.

A key query is whether or not the ECB lowers its 2.1% inflation forecast for 2025, placing it at its 2% goal.

In regular occasions, earlier than it centered extra closely on present inflation, such a revision would have allowed the ECB to pause.

“If that comes out at 2%, I feel markets will deal with this as a danger that the ECB has then delivered its last hike (on Thursday),” mentioned Danske Financial institution chief analyst Piet Christiansen.

5/ Will the ECB be capable to preserve mountaineering if the Fed stops?

Markets anticipate the Federal Reserve will preserve charges unchanged in June earlier than delivering a last fee hike in July.

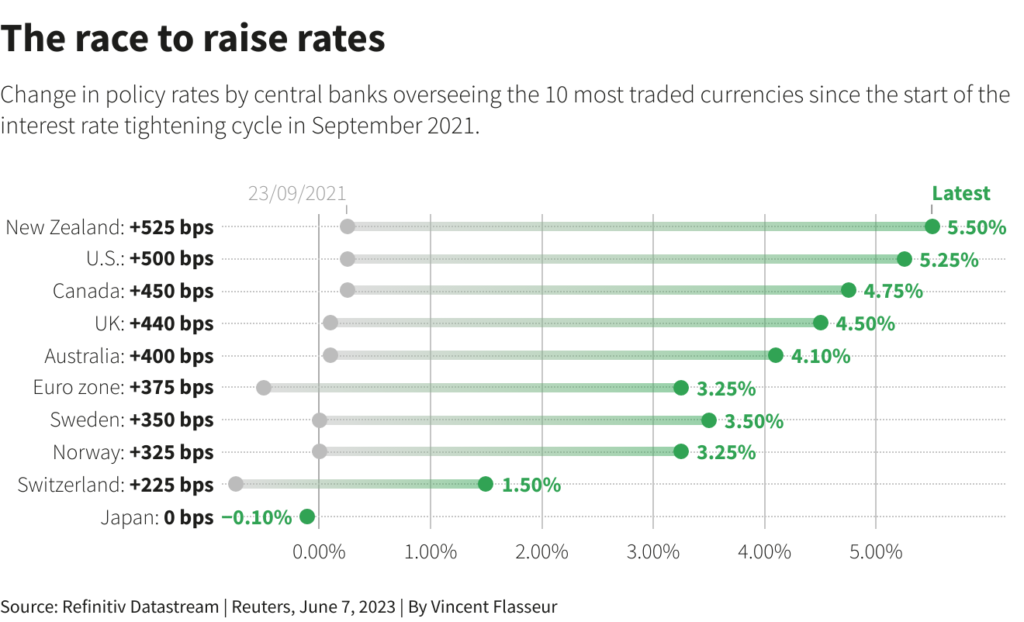

A Fed pause would usually be a headache for the ECB, but it surely’s much less of a difficulty this cycle because the ECB began later and needs to be achieved quickly.

A rally within the euro that dampens exercise would even be welcome by the ECB given excessive inflation, Pictet’s Ducrozet mentioned.

One other subject is the speed cuts merchants are pricing in subsequent 12 months, prompting pushback from fee setters. But when the Fed cuts charges due to a recession, the ECB could need to rethink when the bloc’s financial system feels the sting.

Reporting by Yoruk Bahceli and Stefano Rebaudo, further reporting by Dhara Ranasinghe; Graphics by Vincent Flasseur, Kripa Jayaram and Riddhima Talwani; Modifying by Dhara Ranasinghe and Hugh Lawson

: .