We’re within the midst of a serious financial transition, one which will ultimately match the modifications of the Industrial Revolution. The change, in fact, is the appearance of the inexperienced economic system, and the change from fossil gas power sources to renewable power. Whereas wind and solar energy are absorbing the headlines, a extra believable long-term inexperienced energy supply is already close to at hand: hydrogen.

Hydrogen, the most typical component within the universe, is throughout us – extremely reactive and non-polluting. When used as an influence supply in chemical gas cells, the chief byproduct is straightforward water. Hydrogen-fueled energy methods have the potential to exchange a bunch of combustion engine purposes and automobiles.

We’re already witnessing this on a small scale in Canada, the place a hydrogen practice, manufactured by the French agency Alstom, is at present working a 3-month demo in Quebec. Carrying 120 passengers, the practice matches the efficiency of standard diesel engines. As soon as the Canadian demo wraps up in September, the plan is to tour different North American cities. In the meantime, in Europe, such trains are already in service in 8 international locations, together with Germany, Italy, and France.

In contrast to wind and solar energy, which require in depth set up amenities, the US already produces 10 million metric tons of hydrogen yearly, primarily to be used in oil refining and ammonia manufacturing.

Consequently, publicly traded firms within the US are already banking on hydrogen energy and producing the gas cell and electrolyzer expertise wanted for a nationwide hydrogen energy community. In line with TipRanks’ database, two of the trade leaders have garnered a ‘Purchase’ ranking from analysts, with a possible upside of over 50% for the upcoming 12 months. Let’s take a more in-depth look.

Plug Energy (PLUG)

First up is Plug Energy, an organization engaged on hydrogen gas cells that energy the choice power economic system. The corporate operates at an industrial and utility-grade scale in any respect levels of the method, from growth to deployment. Along with gas cells, it additionally builds energy storage methods and the mandatory bodily supply infrastructure to convey gas cell era on-line at an industrial and utility-grade scale.

Like all hydrogen gas cells, Plug’s methods generate electrical energy by electrochemical reactions primarily based on hydrogen. The corporate can produce, liquefy, transport, and retailer fuel-grade hydrogen, deriving the gas supply from plain, clear water. The corporate’s gas cell merchandise have zero polluting emissions and have discovered purposes as backup energy era and as battery energy sources for industrial and warehousing equipment. The corporate counts main names, corresponding to Amazon, Carrefour, and Walmart, amongst its buyer base.

Plug boasts that it’s the world chief in hydrogen gas methods and use. Up to now, the corporate has deployed greater than 60,000 gas cell methods and constructed out a fueling community with greater than 180 stations. Plug is the world’s largest purchaser of liquefied hydrogen.

Whereas the enlargement of the hydrogen sector is pretty new, Plug has been capable of leverage it for rising revenues during the last a number of years. As the corporate prepares to report its 2Q23 outcomes on August 9, let’s have a look again at Q1 to get an thought of the place it stands.

Throughout Q1, Plug reported $210.3 million on the prime line, exhibiting a powerful 49% year-over-year development and surpassing the forecast by $2.63 million. Nevertheless, the underside line was much less rosy, with Plug’s earnings losses deepening. The corporate recorded a detrimental EPS of 35 cents, which was 9 cents deeper than anticipated. Furthermore, Plug confronted challenges with money burn, using $277 million in comparison with $210 million within the earlier 12 months’s quarter. In 1Q22, Plug had $3.1 billion in money readily available, however by 1Q23, it decreased to $1.37 billion. Moreover, Plug’s full-year income steering for 2023 fell wanting expectations, with projected figures starting from $1.2 billion to $1.4 billion, in comparison with the forecast of $2.04 billion.

On the optimistic aspect, Plug has introduced some current offers that promise to increase its enterprise globally. Certainly one of these, in Europe, is a secured order for 100 megawatts of PEM electrolyzers, and the second, in Australia, is an order for 2 5-megawatt PEM electrolyzer items to be put in within the state of Tasmania.

The general prospect for the hydrogen sector, and Plug’s built-in benefit as a frontrunner in it, caught the attention of Northland analyst Abhishek Sinha, who writes, “We see PLUG’s momentum build up as its compounding alternatives are evolving within the hydrogen world. The corporate’s current spate of mission bulletins in Europe is a testomony to that… We really feel that PLUG is now properly positioned for a future and barring any operational hiccups, ought to begin producing FCF subsequent 12 months.”

Sinha follows up these feedback with an Outperform (i.e. Purchase) ranking on the inventory, and a $22 worth goal that means a 90% upside for the 12 months forward. (To look at Sinha’s monitor document, click on right here)

So, that’s Northland’s view, let’s flip our consideration now to remainder of the Road: PLUG’s 11 Buys and 5 Holds coalesce right into a Average Purchase ranking. There’s loads of upside – 69% to be actual – ought to the $18.68 common worth goal be met over the subsequent months. (See PLUG inventory forecast)

Bloom Power (BE)

The second inventory we’re is Bloom Power, one other clean-energy firm within the hydrogen gas cell sector. Bloom is concentrated on electrical energy era through stable oxide gas cell expertise, a clear energy tech that makes use of a chemical response, particularly, the oxidation of a gas, to supply usable electrical energy.

The cells provide options to problems with resiliency and sustainability that crop up within the clear power sector; Bloom’s gas cell tech relies on a proprietary stable oxide formulation that converts a wide range of fuels, together with pure fuel, biogas, or easy hydrogen, into electrical power with out resorting to combustion. The result’s an influence supply with ultra-low or zero carbon dioxide emissions, and with water or elemental hydrogen because the chief ‘exhaust.’

The corporate’s platform known as the Power Saver. It’s designed as an ‘at all times on’ system, capable of present energy on demand each time the client needs or wants it. Bloom has designed the Power Saver to be simply scalable, permitting installations to be fine-tuned to the client’s wants and to be readily adaptable to enlargement when required. The attraction of such a versatile power supply is evident, and Bloom has supplied its energy era providers to vital firms corresponding to Baker Hughes, the oil discipline providers agency.

Bloom has additionally established long-term partnerships, working with numerous industrial companies to develop the potential of hydrogen gas cells. One distinguished partnership is with Korea’s Samsung Heavy Industries, within the marine transport section. Bloom is working with Samsung to develop ‘eco-friendly’ ships that can function on electrical energy generated by onboard gas cells. Bloom is creating cells powered by liquid hydrogen and a polymer electrolyte, able to assembly the ability wants of a giant oceangoing service provider vessel. This partnership dates again to 2019, and late final 12 months, Samsung handed a milestone, receiving ‘approval in principal’ from the classification society DNV.

In Bloom’s final earnings report, for 2Q23, the corporate posted a prime line of $301.1 million, up from $275 million within the earlier quarter and representing a 23% achieve year-over-year. On the detrimental aspect, the analysts had been in search of increased income; Bloom missed the forecast by $10.27 million.

Bloom’s non-GAAP EPS confirmed an analogous sample, bettering year-over-year however lacking the expectations. The corporate reported a lack of -$0.17 per share, an enchancment in comparison with the earnings of -$0.20 within the earlier 12 months’s quarter. However, analysts had been anticipating a lack of -$0.14 per share.

In his protection of Bloom for Raymond James, 5-star analyst Pavel Molchanov sees the corporate’s strongest go well with as the flexibleness of its merchandise. Molchanov says of BE shares, “Bloom’s well-established positioning in gas cells represents a play on local weather adaptation, particularly the rising prevalence of grid outages. Entry into electrolyzers is a play on the nascent inexperienced hydrogen market, bolstered by European local weather coverage and the urgency of power safety, albeit the product rollout is taking longer than we had thought. The marine transport collaboration with Samsung is a good earlier-stage alternative.”

Trying forward, Molchanov charges BE as an Outperform (i.e. Purchase), and he units a $25 worth goal to indicate a possible upside of 59% within the subsequent 12-months. (To look at Molchanov’s monitor document, click on right here)

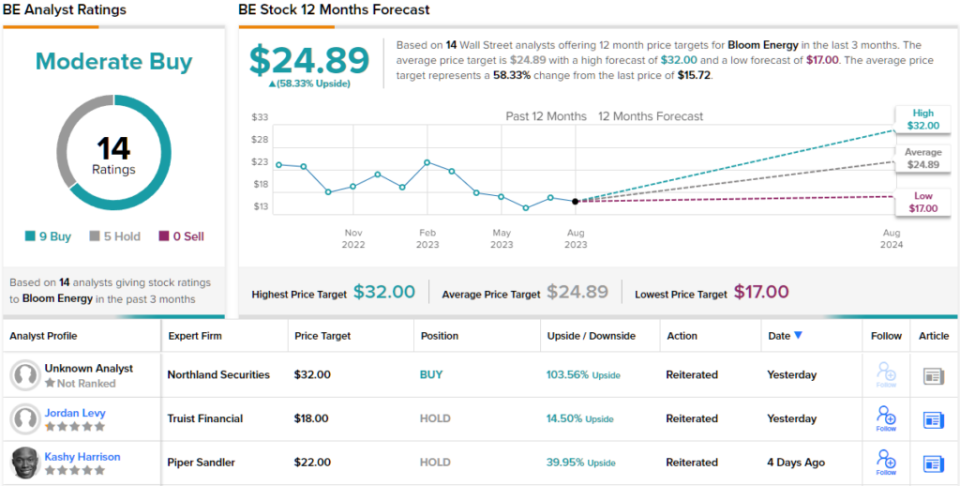

Total, there are 14 current analyst opinions on Bloom Power, with a breakdown of 9 Buys in opposition to 5 Holds, for a Average Purchase consensus. Bloom Power shares have a median worth goal of $24.89, which suggests a 58% one-year upside from the present buying and selling worth of $15.72. (See BE inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather vital to do your personal evaluation earlier than making any funding.