Shortly after Canada evicted Chinese language buyers from sure important minerals belongings, the U.S. Division of Protection started creating its personal AI program to estimate important mineral costs and predict provides because it pushes to jumpstart U.S. manufacturing that’s important to long-term nationwide and vitality safety.

North America is at a important junction, and the bottom beneath Case Lake in northeastern Ontario holds the prospect of serving to to safe one mineral specifically—the dearth of which poses a big safety downside.

The steel is cesium (Cs), and the Canadian firm that simply launched a brand new drilling marketing campaign at Case Lake concentrating on what may find yourself being the world’s solely new supply of this uncommon mineral has been on the heart of an East-West battle for management of future provide.

As Energy Metals Corp (TSXV:PWM,OTC: PWRMF) drills down into Case Lake’s recognized lithium, tantalum and cesium deposits, it’s develop into a focus of North America’s push to safe home provide and preserve it out of dominating Chinese language palms.

Cesium is central to the USA’ purpose of profitable the 5G race, it performs a key position in plane steering programs, oil and fuel drilling, and international positioning satellites.

Cesium is the rarest and most electropositive of 5 naturally occurring alkali metals, however it’s not mined in the USA, which is totally depending on imports.

And now, this important steel is the sweetener at Energy Steel’s Case Lake lithium play and it’s additionally the centerpiece of a provide energy battle between China one hand, and Australia and North America on the opposite.

When the Canadian authorities in November 2022 ordered the Chinese language to divest from three important minerals mining corporations, Energy Metals was one in all them.

That transfer left Energy Metals in command of two key belongings: a probably high-quality lithium mine and what may find yourself being the one functioning cesium mine on the earth that China doesn’t personal.

It additionally noticed an Australian lithium juggernaut leap into the fray to scoop up the Chinese language stake, after which improve that stake 3 times since.

Now, Energy Metals is in the midst of one other drilling marketing campaign at Case Lake, and outcomes of assays for lithium-tantalum-cesium (LTC) are anticipated within the coming weeks.

The Chinese language jumped in after Energy Metals found cesium whereas it was drilling for lithium. The Australians had been fast to step in for a similar motive. Others may quickly be circling round this play.

Drilling Down on the Case Lake Discovery

The Case Lake Property, in northeastern Ontario, near the border with Quebec, consists of 585 cell claims masking some 95 sq. kilometers with 14 granitic domes and a pegmatite swarm of six spodumene dikes that kind a mineralization pattern extending for 10 kilometers.

Energy Metals (TSXV:PWM,OTC: PWRMF) is drilling 15,700 meters right here between 2017 and 2022, primarily concentrating on lithium, and resulting in a world-glass, high-grade lithium discovery of over 4% at shallow, open depths. The surprising sweetener was a uncommon cesium discovery, with grades as excessive as 24% over good intervals—among the highest-grade cesium present in many years, just like Australia’s well-known Sinclair Mine, in accordance with Energy Metals.

Nevertheless it wasn’t solely the high-grade showings of lithium and cesium that attracted first Chinese language consideration, after which Australian (with just a little assist from a Canadian authorities that could be very eager to maintain important metals out of Chinese language palms) …

It was the anticipated price of extraction.

Energy Metals’ Case Lake property is, in contrast to the common Canadian mining venue, surrounded by infrastructure in place, together with cellphone indicators, and it’s accessible year-round.

It’s additionally uncovered on the floor and working as shallow as below 50 meters deep in elements. From a cost-perspective, geology right here helps to de-risk itself.

These discoveries had been additional bolstered by one other in September 2023, when Energy Metals introduced the invention of latest pegmatite dikes, confirming the presence of a 10-15-meter large spodumene bearing pegmatite strike with Lithium content material as excessive as 1.12%.

On February 29, Energy Metals launched its new drill marketing campaign at Case Lake, with plans to drill a complete of 4,000 meters to delineate and prolong Lithium-Cesium-Tantalum (LCT) mineralization alongside the geological strike and down-dip of Case Lake’s recognized mineralization.

“We’re very excited to be again at Case Lake and stay up for a profitable launch of our winter 2024 exploration program. We consider within the exploration upside at Case Lake, one of many few initiatives on the earth that comprise Cesium mineralization in Pollucite and stay up for drill check the excessive precedence exploration targets our staff have been capable of establish,” Energy Metals Chairman Johnathan Extra, stated in a press launch.

“The present drilling has recognized coarse spodumene mineralization between 2cm – 10cm grain measurement, these zones displayed between 6% – 15 % spodumene mineralization that happen in a collection of stacked pegmatites at Primary Zone,” the firm stated.

Final week, drilling moved to West Joe at Case Lake to check mineralization extensions to the high-grade cesium mineralization discovered through the 2017-2022 drilling.

The information circulate for Energy Metals is anticipated to select up tempo now, with new acquisitions conserving tempo and first outcomes from the brand new drilling marketing campaign anticipated in the direction of the top of April.

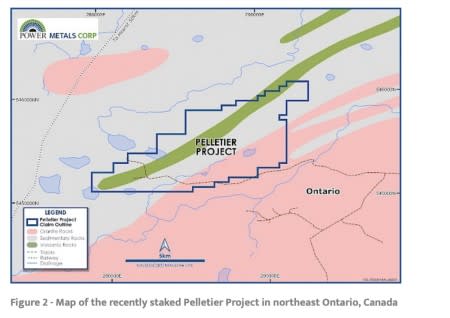

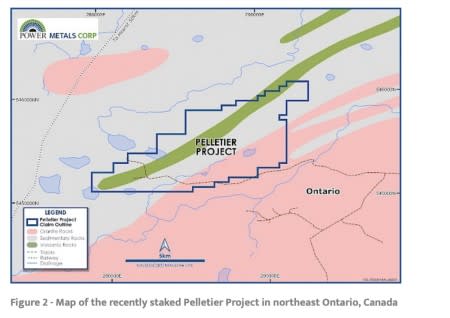

On the acquisition facet, Energy Metals on March 19 staked the Pelletier Venture, with 337 mineral claims over a complete floor space of seven,000 hectares in northeast Ontario. Pelletier, one other lithium – cesium – tantalum play, has seen earlier work accomplished the Ontario Geological Survey, displaying advanced granitic pegmatites with anomalous rubidium, cesium, and the potassium to rubidium ratio.

New Drill Marketing campaign with Australian Lithium Big on Board

In 2022, when Canada pressured the Chinese language to divest its stake in Energy Metals, Australia’s Winsome Sources (ASX:WR1) was fast to seize Chinese language mining big Sinomine Useful resource Group’s 5.7% stake, after which increase it twice. In the present day, Winsome owns 19.59% and has a seat on the board, lending Australian lithium and cesium experience at a important time.

That is battle, and it’s very territorial.

International technological dominance is at stake right here. The U.S. can not win the 5G race with out cesium, nor can it manufacture plane steering programs or international positioning satellites—all key components that outline geopolitics and the worldwide steadiness of energy.

In opposition to this backdrop, Case Lake turns into a extremely strategic asset. Cesium is an elite and uncommon important steel, and there are solely three cesium mines on the earth. Australia’s Sinclair cesium mine extracted its final cesium in 2019. The Tanco mine in Manitoba, Canada, shut down after a collapse in 2015. The Bikita mine in Zimbabwe was depleted in 2018. That leaves Energy Metals (TSXV:PWM,OTC: PWRMF) with probably the one new cesium mine on the earth. The Chinese language realize it. The Australians realize it. By the top of April when the subsequent outcomes are available from the 2024 drilling marketing campaign, everybody will realize it.

Different corporations to control:

BHP Group’s (NYSE:BHP) expansive operations embody a various vary of mining belongings. In Australia, the corporate operates main iron ore mines within the Pilbara area of Western Australia, which account for a good portion of worldwide iron ore manufacturing. BHP additionally has copper, coal, and nickel operations in Australia, in addition to substantial vitality belongings, together with oil and fuel fields. In North and South America, the corporate has copper and iron ore mines in Chile, Peru, and Colombia, in addition to coal operations in the USA. BHP’s international attain and diversified portfolio of commodities permit it to satisfy the calls for of consumers around the globe and contribute to the worldwide provide of important assets.

BHP Group is dedicated to working in a accountable and sustainable method. The corporate acknowledges the significance of environmental safety and has carried out numerous initiatives to scale back its environmental impression. BHP has set formidable targets to scale back its greenhouse fuel emissions and has invested in applied sciences to enhance water utilization effectivity. The corporate additionally works intently with native communities to reduce the social and environmental impacts of its operations. BHP’s dedication to sustainability has been acknowledged by numerous organizations, together with the Dow Jones Sustainability Index, which has ranked BHP as a world chief in sustainability for a number of consecutive years.

BHP Group’s deal with sustainability is just not solely helpful for the setting but additionally aligns with rising shopper and investor demand for ethically sourced and environmentally pleasant merchandise. By prioritizing sustainability, BHP is positioning itself as a pacesetter within the mining trade and demonstrating its dedication to long-term worth creation for its stakeholders. The corporate’s dedication to sustainability is a key differentiator and a supply of aggressive benefit in an trade that’s more and more targeted on environmental and social accountability.

Lithium Americas (NYSE:LAC) is a lithium mining firm headquartered in Vancouver, Canada. The corporate was based in 2007 and has since develop into a significant participant within the international lithium market. Lithium is a key element within the manufacturing of batteries for electrical autos (EVs) and different digital gadgets, and demand for lithium is anticipated to develop considerably within the coming years. Lithium Americas has plenty of initiatives in improvement, together with the Thacker Cross lithium mine in Nevada, which is without doubt one of the largest recognized lithium deposits on the earth.

Lithium Americas is well-positioned within the international lithium market. The corporate has plenty of promising initiatives in improvement, and it has not too long ago secured important investments and partnerships. Lithium Americas is well-positioned to profit from the rising demand for lithium and may very well be a significant provider to the EV trade within the coming years.

Regardless of its sturdy place, Lithium Americas faces some challenges. These embrace the necessity to safe funding for its initiatives and the danger of delays in allowing and development. The corporate additionally faces competitors from different lithium producers, resembling Albemarle and Sociedad Quimica y Minera de Chile (SQM). Nonetheless, Lithium Americas is well-positioned to beat these challenges and develop into a significant participant within the international lithium market.

Albemarle Company (NYSE:ALB) is a world specialty chemical compounds firm headquartered in Charlotte, North Carolina. The corporate operates in three segments: Lithium, Bromine Specialties, and Catalysts. Albemarle is the world’s largest producer of lithium, a key element in electrical car batteries. The corporate additionally produces quite a lot of different specialty chemical compounds, together with bromine, catalysts, and prescription drugs.

Albemarle was based in 1887 because the Albemarle Paper Manufacturing Firm. The corporate initially produced paper and pulp, but it surely diversified into different chemical compounds within the Nineteen Sixties. In 1994, Albemarle merged with Ethyl Company, a producer of specialty chemical compounds. The mixed firm was renamed Albemarle Company.

Lately, Albemarle has benefited from the rising demand for lithium-ion batteries. The corporate has invested closely in increasing its lithium manufacturing capability. In 2021, Albemarle introduced plans to speculate $500 million in a brand new lithium hydroxide plant in North Carolina. The plant is anticipated to be operational in 2025. Albemarle can also be exploring different alternatives to broaden its lithium enterprise, together with potential acquisitions.

Piedmont Lithium Restricted (NASDAQ:PLL) is an Australian lithium mining firm targeted on creating its flagship asset, the Piedmont Lithium Venture in North Carolina, United States. The Piedmont Lithium Venture is a spodumene-rich lithium deposit that’s anticipated to provide 30,000 tonnes of lithium hydroxide per 12 months as soon as operational. The corporate can also be creating the Carolina Tin-Lithium Venture in North Carolina, which is house to one of many largest undeveloped exhausting rock lithium deposits in the USA.

Piedmont Lithium has made important progress lately. In 2021, the corporate accomplished a pre-feasibility research for the Piedmont Lithium Venture, which confirmed the challenge’s financial viability. The corporate additionally secured a $75 million funding from Koch Industries, which is without doubt one of the largest non-public corporations in the USA. This funding will assist Piedmont Lithium to advance the event of its initiatives. In 2022, the corporate introduced that it had entered right into a partnership with LG Chem, a world chief in battery manufacturing. This partnership will assist Piedmont Lithium to safe long-term offtake agreements for its lithium merchandise.

Piedmont Lithium is well-positioned to profit from the rising demand for lithium. Lithium is a key element of batteries utilized in electrical autos and different digital gadgets. The demand for lithium is anticipated to develop considerably within the coming years because the world transitions to a clear vitality economic system. Piedmont Lithium is without doubt one of the few corporations that’s creating lithium initiatives in the USA, which is a significant benefit. The corporate can also be well-funded and has a powerful administration staff. Piedmont Lithium is a promising firm with the potential to develop into a significant participant within the international lithium market.

MP Supplies Corp. (NYSE:MP) is a publicly traded firm headquartered in Las Vegas, Nevada. The corporate’s Mountain Cross mine in California is the one absolutely built-in uncommon earth mining and processing facility in the USA. This provides MP Supplies a big aggressive benefit and allows it to supply prospects with a dependable and safe provide of uncommon earth supplies.

MP Supplies produces uncommon earth oxides and metals, that are important parts in a variety of functions, together with electrical autos, smartphones, and renewable vitality applied sciences. The corporate is a vertically built-in producer, which means it controls all levels of the manufacturing course of, from mining to refining to manufacturing. This enables MP Supplies to make sure the standard and consistency of its merchandise and to satisfy the precise wants of its prospects.

Lately, MP Supplies has made important investments in its Mountain Cross mine and processing services. The corporate has additionally expanded its product portfolio and entered into strategic partnerships with main expertise corporations. These developments have positioned MP Supplies as a world chief within the uncommon earth trade. The corporate is well-positioned to profit from the rising demand for uncommon earth supplies, pushed by the transition to a clear vitality economic system. MP Supplies is a number one provider of uncommon earth supplies to the worldwide expertise trade.

Uncommon Factor Sources Ltd. (TSX:RES) is a Canadian exploration and improvement firm targeted on uncommon earth components (REEs). The corporate’s flagship challenge is the Bear Lodge challenge in Wyoming, which accommodates one of many largest undeveloped REE deposits on the earth. The Bear Lodge challenge has the potential to provide quite a lot of REEs, together with neodymium, praseodymium, dysprosium, and terbium. These REEs are important to the manufacturing of unpolluted vitality applied sciences resembling electrical autos and wind generators.

Along with the Bear Lodge challenge, REE can also be creating the Separation Rapids challenge in Ontario. The Separation Rapids challenge accommodates niobium and REEs. Niobium is a steel that’s used within the manufacturing of metal and superalloys. The Separation Rapids challenge has the potential to provide a big quantity of niobium, in addition to REEs. REE is dedicated to sustainable and accountable mining practices. The corporate has developed a complete environmental administration plan for the Bear Lodge challenge that features measures to guard water high quality, air high quality, and wildlife. REE can also be working with native communities to make sure that the Bear Lodge challenge advantages the area.

REE has made important progress on the Bear Lodge challenge. The corporate has accomplished a preliminary financial evaluation (PEA) for the challenge, which outlined the potential for a large-scale, long-life mining operation. REE is at the moment engaged on a feasibility research for the challenge, which is anticipated to be accomplished in 2023. The corporate can also be working to safe the mandatory permits and approvals for the challenge. REE is well-positioned to develop into a number one producer of REEs to satisfy the rising demand for these supplies in clear vitality and expertise functions.practices and has carried out plenty of measures to reduce the environmental impression of its operations.

Avalon Superior Supplies Inc. (TSX:AVL) is a Canadian firm that has made important contributions to the event and manufacturing of specialty supplies for numerous industries. The corporate makes a speciality of purposeful supplies like conductive inks and adhesives, in addition to specialty chemical compounds resembling phosphors and battery supplies. Avalon Superior Supplies has established itself as a world chief in producing high-purity metals and alloys utilized in electronics, aerospace, and biomedical gadgets.

Avalon Superior Supplies has been specializing in increasing its portfolio of supplies for the vitality storage trade. The corporate is actively concerned within the improvement of supplies for lithium-ion batteries and solid-state batteries, that are important parts of electrical autos and renewable vitality programs. Avalon’s dedication to innovation has resulted within the profitable creation of superior supplies that improve the efficiency and effectivity of vitality storage options.

Along with its core enterprise, Avalon Superior Supplies has additionally ventured into different areas of supplies science. The corporate has developed specialty coatings for the automotive and development industries, offering enhanced safety in opposition to corrosion and put on. Avalon’s experience in supplies engineering has enabled it to create progressive options that deal with particular challenges confronted by numerous sectors, contributing to technological developments and industrial progress.

First Quantum Minerals Ltd (TSX:FM) is a Canadian-based mining and metals firm with a deal with copper, nickel, gold, and zinc manufacturing. The corporate operates mines and initiatives in numerous international locations, together with Zambia, the Democratic Republic of Congo, Mauritania, Finland, Spain, Turkey, Argentina, and Peru.

First Quantum Minerals is a big participant within the international mining trade, with a observe document of profitable exploration, improvement, and operation of mining initiatives. The corporate’s operations contribute to the financial improvement of the international locations wherein it operates, creating jobs and producing tax income. First Quantum Minerals additionally maintains a powerful dedication to environmental stewardship and sustainable practices, implementing numerous initiatives to reduce the environmental impression of its operations.

The corporate’s deal with copper, nickel, gold, and zinc manufacturing is pushed by the rising international demand for these metals. Copper is an important element in electrical and digital merchandise, whereas nickel is used within the manufacturing of chrome steel and different alloys. Gold is a valuable steel with an extended historical past of use in jewellery and as a retailer of worth, and zinc is utilized in a variety of functions, together with galvanizing metal, producing batteries, and manufacturing rubber. First Quantum Minerals’ manufacturing of those metals performs an important position in assembly the worldwide demand for these important supplies.

Allkem Restricted (TSX:AKE) is an Australian mining firm that was fashioned in 1993. The corporate primarily focuses on the manufacturing and exploration of lithium, a important mineral utilized in electrical car (EV) batteries. Allkem operates a number of lithium mines and initiatives in Australia, Argentina, and Canada, with a big presence within the Salar de Atacama, one of many world’s richest lithium brine deposits.

Allkem’s operations span your complete lithium worth chain, from exploration to manufacturing and refining. The corporate has a powerful observe document of profitable exploration and improvement, having found and developed a number of main lithium deposits. Allkem’s portfolio contains the Olaroz lithium brine challenge in Argentina, the James Bay lithium challenge in Canada, and the Mt Cattlin spodumene mine in Australia. These operations are anticipated to contribute considerably to the worldwide provide of lithium within the coming years.

Allkem’s work is necessary due to the important position that lithium performs within the clear vitality transition. Lithium is a key element in EV batteries, that are important for lowering greenhouse fuel emissions and mitigating local weather change. Because the world shifts in the direction of sustainable transportation, the demand for lithium is anticipated to soar. Allkem’s operations will contribute to assembly this demand by offering a dependable and sustainable provide of lithium to battery producers.

Teck Sources Restricted (TSX:TECK) is a diversified mining firm headquartered in Vancouver, Canada. It is without doubt one of the world’s largest producers of zinc and copper and in addition produces different commodities resembling coal, lead, and silver. Teck operates mines and processing services in Canada, the USA, Chile, and Peru.

Teck’s zinc operations are situated in Canada, the USA, and Peru. The corporate is the world’s second-largest producer of zinc, with a manufacturing capability of over 800,000 tonnes per 12 months. Teck’s zinc is utilized in quite a lot of functions, together with galvanized metal, batteries, and chemical compounds.

Teck’s operations are additionally important for his or her contribution to the worldwide provide of battery metals. Zinc is a key element of many sorts of batteries, together with lead-acid batteries and nickel-zinc batteries. Teck’s zinc manufacturing is due to this fact important for the rising demand for batteries in electrical autos and different functions.

By. Tom Kool

IMPORTANT NOTICE AND DISCLAIMER FORWARD LOOKING STATEMENTS.

This publication accommodates forward-looking data which is topic to quite a lot of dangers and uncertainties and different components that might trigger precise occasions or outcomes to vary from these projected within the forward-looking statements. Ahead trying statements on this publication embrace that the Canadian mining sector will proceed to guard its provide of important minerals with out involvement of China; that cesium and different metals will stay as important minerals will proceed as a nationwide safety challenge for Western international locations; that entry to uncommon metals, and specifically cesium, might be important to gaining technical superiority; that cesium and different uncommon earth metals will proceed to be a important to be used in numerous applied sciences, together with the 5G mobile and wi-fi applied sciences; that cesium will proceed to be a important mineral and regarded as matter of nationwide safety for Western international locations; that Energy Metals Corp. (the “Firm”) and its all-Western buyers might be in command of the one cesium mine that China doesn’t personal; that the Firm’s properties will be capable to commercially produce cesium, lithium, tantalum and different important minerals; that the Firm will be capable to finance and operationally set up mines on its properties to viably and commercially extract the important minerals; that Australian shareholders and buyers within the Firm will present improvement and different experience to help the Firm; that Winsome Sources will proceed to personal a big stake within the Firm; that the Firm’s property will at some point have one of many solely potential mines producing cesium; that the Firm can finance ongoing operations and improvement; that the Firm can obtain its enterprise plans and goals as anticipated. These forward-looking statements are topic to quite a lot of dangers and uncertainties and different components that might trigger precise occasions or outcomes to vary materially from these projected within the forward-looking data. Dangers that might change or stop these statements from coming to fruition embrace the event of other applied sciences that don’t require using metals and assets at the moment thought of as important; that different assets are utilized in future in favour of uncommon earth metals resembling cesium; that different applied sciences make the most of different assets or that cesium, lithium, and tantalum usually are not utilized; that different corporations uncover assets of cesium and different battery metals which are extra favorable or extra simply developed into industrial manufacturing that the Firm’s property; that the Firm’s properties are unable to provide industrial quantities of cesium, lithium, tantalum or different important metals; that the Firm might be unable to finance or operationally set up mines on its properties for industrial extraction of any important minerals; that the Firm’s Australian buyers won’t be able to supply improvement and different experience to significant help the Firm; that Winsome Sources could for numerous causes divest its stake within the Firm in future; that the Firm’s properties could fail to develop mines producing cesium; that the Firm could also be unable to finance its ongoing operations and improvement; that the enterprise of the Firm could also be unsuccessful for numerous causes. The forward-looking data contained herein is given as of the date hereof and we assume no accountability to replace or revise such data to mirror new occasions or circumstances, besides as required by legislation.

INDEMNIFICATION/RELEASE OF LIABILITY. By studying this communication, you acknowledge that you’ve learn and perceive this disclaimer, and additional that to the best extent permitted below legislation, you launch the Writer, its associates, assigns and successors from any and all legal responsibility, damages, and damage from this communication. You additional warrant that you’re solely answerable for any monetary consequence that will come out of your funding choices.

DISCLAIMER. This communication is just not, and shouldn’t be construed to be, a suggestion to promote or a solicitation of a suggestion to purchase any safety. Neither this communication nor the Writer purport to supply a whole evaluation of any firm or its monetary place. The Writer is just not, and doesn’t purport to be, a broker-dealer or registered funding adviser. This communication is just not, and shouldn’t be construed to be, customized funding recommendation directed to or acceptable for any specific investor. Any funding must be made solely after consulting an expert funding advisor and solely after reviewing the monetary statements and different pertinent company details about the corporate. Additional, readers are suggested to learn and thoroughly think about the Danger Elements recognized and mentioned within the marketed firm’s SEC, SEDAR and/or different authorities filings. Investing in securities, notably microcap securities, is speculative and carries a excessive diploma of threat. Previous efficiency doesn’t assure future outcomes. This communication relies on data typically obtainable to the general public and doesn’t comprise any materials, personal data. The data on which it’s based mostly is believed to be dependable. However, the Writer can not assure the accuracy or completeness of the data. Neither the creator nor the writer, Oilprice.com, was paid to publish this communication regarding Energy Metals Corp. The proprietor of Oilprice.com owns shares and/or inventory choices of the featured firm and due to this fact has an incentive to see the featured firm’s inventory carry out effectively. Though the proprietor of Oilprice.com continues to totally help and consider within the firm, its administration and the corporate’s close to time period and long run prospects, he has a sizeable place and should take this chance to liquidate a portion of it shortly after publication of this text. This share possession and said intention to promote must be seen as a significant battle with our potential to be unbiased. That is why we stress that you simply conduct intensive due diligence in addition to search the recommendation of your monetary advisor or a registered broker-dealer earlier than investing in any securities.

Readers ought to beware that third events, profiled corporations, and/or their associates could liquidate shares of the profiled corporations at any time, together with at or close to the time you obtain this communication, which has the potential to harm share costs. Steadily corporations profiled in our articles expertise a big improve in quantity and share value through the course of investor consciousness advertising and marketing, which regularly ends as quickly because the investor consciousness advertising and marketing ceases. The investor consciousness advertising and marketing could also be as transient as at some point, after which a big lower in quantity and share value could doubtless happen.

TERMS OF USE. By studying this communication you agree that you’ve reviewed and absolutely comply with the Phrases of Use discovered right here http://oilprice.com/terms-and-conditions If you don’t comply with the Phrases of Use http://oilprice.com/terms-and-conditions, please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is the Writer’s trademark. All different logos used on this communication are the property of their respective trademark holders. The Writer is just not affiliated, related, or related to, and isn’t sponsored, authorised, or originated by, the trademark holders until in any other case said. No declare is made by the Writer to any rights in any third-party logos.

Learn this text on OilPrice.com