Shopping for Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) inventory isn’t a nasty concept.

Think about choosing up $1,000 of Alphabet inventory on Feb. 25, 2014. That turned out to be the worst day of that 12 months to get into the know-how big’s shares. The day’s peak, with a document value of $30.50 per split-adjusted share, was adopted by an 18% plunge over the subsequent 10 months. The bear bait stacked up as European regulators thought-about breaking apart the corporate, Android cellphone gross sales struggled, high executives left, and new product concepts like Google Glass and Waymo self-driving vehicles weren’t catching on.

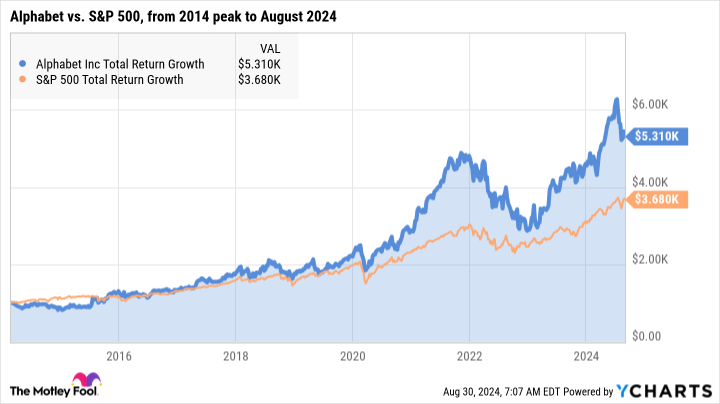

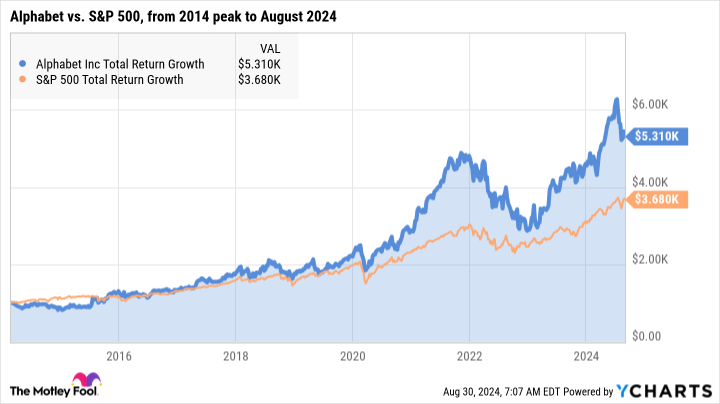

That is all proper, although. Should you had held on to that $1,000 funding via thick and skinny, you’d have a market-beating $5,310 in your pocket roughly 10 years later.

Alphabet’s inventory has stumbled earlier than — and are available again swinging

You’d after all have executed even higher should you invested in Alphabet on every other day of that 12 months, however the firm overcame its points and stomped the broader market even from the worst doable place to begin of 2014. I count on future generations to say comparable issues about shopping for Alphabet inventory in 2024 — that funding ought to beat the marketplace for a few years and even many years to come back, regardless of how poorly you’ll have timed the acquisition.

Time out there beats timing the market, you realize. And this firm was constructed to final for a really very long time.

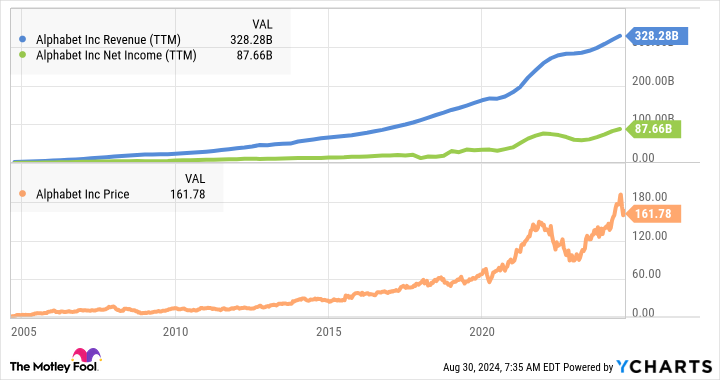

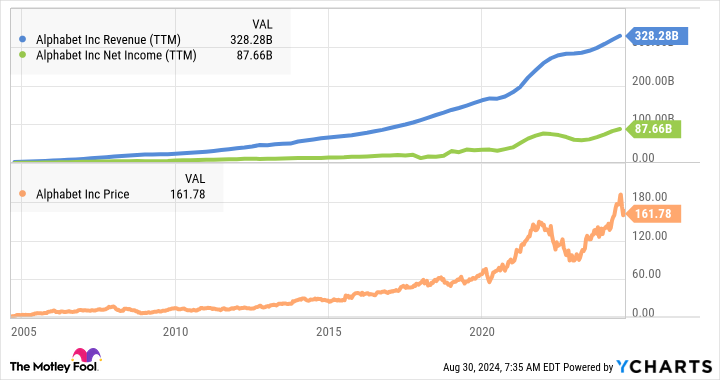

I can not consider any single firm extra probably than Alphabet to ship sturdy returns in 2040, 2050, and past. That horrible value drop in 2014 is a barely detectable chart squiggle by now. And Alphabet’s enterprise outcomes simply continued to develop:

Alphabet’s inventory is a cut price proper now

Wait — it nonetheless will get higher. On high of Alphabet’s tank-like endurance, the inventory occurs to be unusually reasonably priced proper now.

After reaching one other all-time document of $191.40 per share in July, Alphabet shares have retreated 15% to roughly $162 per share. As I write this, they commerce at 23.4 instances trailing earnings with a price-to-earnings-to-growth (PEG) ratio of 1.1. These are probably the most reasonably priced earnings-based valuation ratios among the many “Magnificent Seven” of tech giants.

Furthermore, Alphabet has taken a number one function within the synthetic intelligence (AI) increase. Google Cloud is a well-liked cloud computing platform the place different firms can prepare and run their very own AI platforms. The Google Gemini chatbot competes immediately with OpenAI’s ChatGPT in language understanding and technology. The corporate is poised to profit from generative AI as a long-term development catalyst.

I may go on, however you get my level. Alphabet’s inventory was a wonderful funding earlier than the latest sell-off, and it is a good higher purchase at this time. Market sell-offs will be your pal once you’re seeking to spend money on an awesome firm like Alphabet.

Do you have to make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Alphabet wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $731,449!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 26, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Anders Bylund has positions in Alphabet and Vanguard S&P 500 ETF. The Motley Idiot has positions in and recommends Alphabet and Vanguard S&P 500 ETF. The Motley Idiot has a disclosure coverage.

The Latest Tech Promote-Off Made This Synthetic Intelligence (AI) Inventory an Even Higher Purchase was initially revealed by The Motley Idiot