Oil and gasoline producers seemingly have settled on a technique. OPEC and Russia will restrict manufacturing and let costs rise throughout a world war-famine-pandemic. OPEC units the worth umbrella whereas the Russians low cost the worth for apparent geopolitical causes. All different large oil producers adhere to pricing and provide self-discipline figuring out that OPEC’s prices of manufacturing are so low that OPEC can undercut any oil producer that ignores pricing self-discipline. The massive US producers say they won’t expend capital to extend provide once they lack assurance of continued demand. As for top costs, they end result from competitors out there, the oil CEOs say. Everyone knows how it will finish, because it at all times does: demand will weaken and producers who would relatively get a cheaper price than let another producer get the enterprise will cheat. However not for some time.

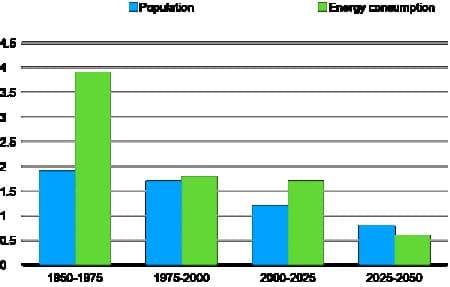

What about power demand over the long run? Most forecasters predict world demand by way of 2050 will develop at round 1% a 12 months or much less. Some get their numbers from econometric fashions, others from a painstaking evaluation of end-use demand. We advise a easy approach to take a look at these projections utilizing one other projection prone to be moderately correct, specifically inhabitants development. Determine 1 compares charges of development for world inhabitants and world power utilization. (Precise numbers for 1950, 1975, and 2000, and estimates for 2025 and 2050 (from normal sources)).

Determine 1. Annual charges of development (%).

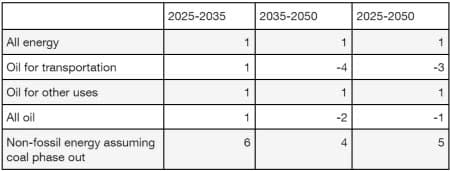

After OPEC’s assault on the worldwide order within the Nineteen Seventies, which dramatically raised oil costs, development in power consumption slackened. Shoppers discovered to make use of much less. Would possibly that occur once more? Projections put power demand development a bit beneath inhabitants development. So let’s make a couple of conservative assumptions. Previously, power utilization grew sooner than inhabitants. So, let’s use 1% per 12 months at the least quantity for power demand development. Now to grease. Demand, beneath regular circumstances, should develop according to all power. Transportation accounts for roughly 60% of oil consumption, and the variety of automobiles on the highway grows by roughly 1% per 12 months. However someday round 2035 car producers will cease making autos with inside combustion engines. From that time ahead, petroleum gross sales to transportation will fall, possibly by 4% per 12 months, as shoppers retire outdated automobiles and change them with electrical autos. Assuming that non-transportation oil utilization continues to develop by 1% per 12 months, total oil consumption in 2050 would fall 14% from 2025 ranges. Inexperienced power assets, to fill the hole, must develop a number of occasions sooner than demand for power as an entire, particularly if coal is phased out of use as a boiler gas. Desk 1 exhibits the expansion charges:

Desk 1. Annual development charges for power consumption (%)

If you’re an government or director within the oil enterprise, you already know the image, however you need to extract as a lot money out as you’ll be able to earlier than the route of demand turns into clearer. You don’t need to scare traders (as a result of you’ve got an enormous stake in inventory choices). You need to encourage staff current and future. And you want to impress on politicians that the gloomy way forward for the enterprise is because of unreasonably impatient local weather activists and the federal government has to assist. However that’s all for the company communications individuals to hash out. What do you do with all of the money pouring in as a result of oil costs are excessive and you’ve got saved the drilling finances low since you don’t count on drilling to earn a return commensurate with danger?

Oil corporations flush with money might put money into one other enterprise, corresponding to renewables, as European power corporations have completed. Or they’ll return extra money to shareholders as dividends or inventory buybacks however that is an admission that future funding prospects in oil are poor. Paying greater dividends has three drawbacks. First, the next dividend triggers greater revenue taxes for the stockholders on the regular tax price. Second, it would take too lengthy to pay out the cash. Third, setting the company dividend coverage at the next stage creates expectations that the corporate pays greater dividends sooner or later, as nicely, and that is clearly not the expectation the corporate desires to create.

Instead, corporations can use money to repurchase inventory. By doing so that they increase the inventory value so shareholders get a greater value in the event that they promote, and decrease the variety of shares excellent, thereby elevating earnings per share. Those that promote their inventory at a revenue solely pay a capital beneficial properties tax, which is normally decrease than the tax price on dividend revenue. In contrast to modifications in dividend coverage, corporations can execute share buybacks shortly and flexibly, a plus. Executives whose bonus and inventory choices are based mostly on earnings per share and inventory value can earn extra, too. Which will tilt the choice to share buybacks relatively than elevated dividends.

What messages do share buybacks ship? First, companies purchase again shares once they can’t provide you with one thing higher to do with extra money move. That claims rather a lot about senior administration’s view of the prospects for his or her enterprise. Second, oil corporations might face big-time litigation. Do not forget that Texas legislation that empowered anybody to sue anybody related to an abortion? Or the California legislation that allowed anybody to sue any one that offered an assault rifle? Nicely, NY politicians are fascinated by a legislation to permit anybody to sue these inflicting local weather injury. And, little doubt some will accuse fossil gas corporations and customers of deceptive traders about local weather change. Extra lawsuits? Transferring the cash out of the enterprise makes the oil firm a much less engaging goal for a mammoth lawsuit. Once more, not an encouraging message.

So, what’s an acceptable technique for oil firm executives given the uncertainties we’ve mentioned? From a short-term enterprise perspective, oil corporations ought to aggressively return money to shareholders, chorus from new funding, and, if they’ve sufficient politicians nonetheless beholden to them, stall local weather mitigation so long as doable whereas reaping the reward of excessive costs. And stave off requires any extra earnings taxes. However what about the long run, the influence of excessive costs on demand, and the reputational injury completed by having fun with excessive earnings throughout a interval of misery, famine, and struggle? We might conclude, from the unwillingness to take a position and the inventory buybacks that oil firm managers themselves have misplaced religion in the way forward for oil. So, in the event you don’t see a lot of a future in what you are promoting, and no one stands in your approach, and it’s authorized, you may as nicely maximize what you’ll be able to gather now. As John Heywood put it, again in 1546, “When the solar shineth, make hay.” That’s capitalism, isn’t it?

By Leonard S. Hyman and William I. Tilles

Extra High Reads from Oilprice.com:

Learn this text on OilPrice.com