-

The S&P 500 has pushed its manner into a brand new bull market, however consultants are torn over whether or not the rally can final.

-

AI hype and resilient earnings from US firms have pushed the rally in 2023.

-

However that comes as consultants warn that the US is near tipping right into a recession.

The S&P 500 is now up over 20% from its low in October, a technical sign that it’s formally in a brand new bull market — however Wall Road stays torn on whether or not the present rally is really the beginning of a brand new bull run, or a head faux earlier than shares inevitably crash once more.

The benchmark index has largely been boosted by the rally in mega-cap tech shares, because of Wall Road’s enthusiasm for synthetic intelligence. Analysts say AI may enhance productiveness, earnings, and take shares larger in coming years, overlooking considerations for now {that a} dot-com fashion bubble is forming within the sector.

Consultants stay involved a couple of looming recession, with alarms coming from all types of financial indicators, from falling cardboard demand to declining RV gross sales. The US now has a 70% probability of tipping into recession by Could 2024, per the newest projections from the New York Fed – an occasion that might simply throw the rally in shares to the wayside.

This is what Wall Road commentators should say on whether or not the present rally in shares nonetheless has room to run.

David Rosenberg, founding father of Rosenberg Analysis

The rally in shares is not backed by fundamentals and it will not final lengthy, because the US is virtually assured to enter a recession this yr, in accordance with high economist David Rosenberg.

That is as a result of the S&P 500’s sturdy efficiency this yr is at odds with financial information, Rosenberg mentioned. Unemployment claims, as an example, rose one other 1,000 to 262,000 over the previous week, sticking to the best degree since October 2021.

In the meantime, rising rates of interest over the previous yr are tightening monetary circumstances, making recession extra seemingly. And although central bankers stored charges regular at their coverage assembly on Wednesday, officers prompt extra hikes could possibly be in retailer later this yr as inflation stays a risk.

“This market continues to be nothing greater than a short-term momentum play,” Rosenberg mentioned in a latest word. “You possibly can consider the press headlines or you possibly can consider the main indicators — which recommend that we do certainly have a 99.15% probability of an official NBER-defined recession,” he mentioned.

Jeremy Siegel, economist and Wharton College professor of finance

Traders can count on the rally in shares to finish because the US enters a gentle recession this yr, in accordance with high economist Jeremy Siegel.

Siegel has been a loud critic of the Fed coverage within the final yr, and has urged central bankers to drag again on rates of interest will increase to be able to keep away from inflicting a recession.

Although he beforehand predicted a 15% improve for the S&P 500, he is turned extra bearish available on the market as recession odds improve. Shares will seemingly slip because the US is on the trail to a shallow recession this yr, he predicted, although equities are unlikely to drop again to lows reached in October of final yr.

“This latest bull market transfer isn’t any assure we’re out of the woods from the downturn,” Siegel mentioned in his weekly commentary piece for WisdomTree on Monday. “I stay cautious and I don’t assume we have now the beginning of a significant up transfer right here,” he added.

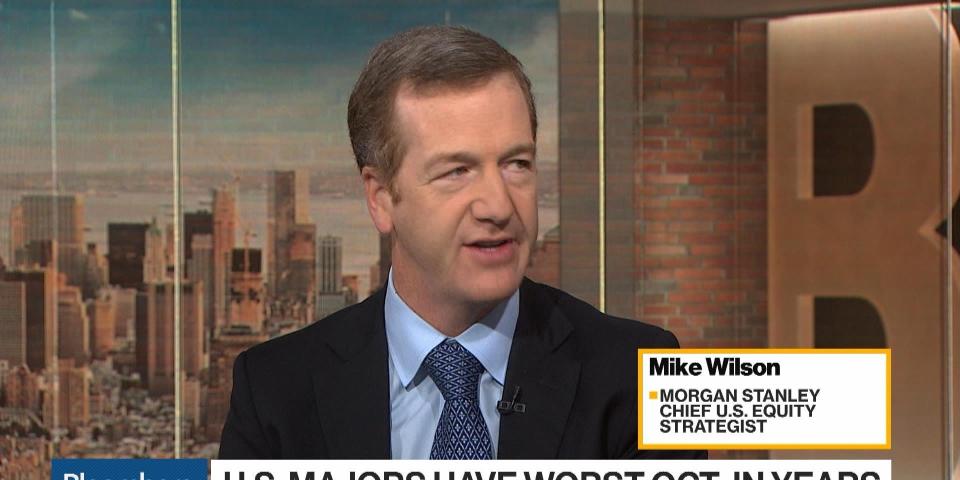

Mike Wilson, Morgan Stanley CIO and chief equities strategist

The present rally in shares is a fluke, and the bear market continues to be alive. Importantly, company earnings are set to drop by the remainder of this yr, which is able to spark a sell-0ff, in accordance with Morgan Stanley’s high inventory strategist Mike Wilson.

Wilson has warned of a steep earnings recession for months. Firms are nonetheless battling inflation pressures and tighter monetary circumstances, which may take earnings down as a lot as 16%, he predicted.

“Whereas we consider that AI is for actual and can seemingly result in some substantial efficiencies that assist to struggle inflation, it is unlikely to forestall the earnings recession we forecast for this yr,” Wilson mentioned in a latest word.

Tom Lee, Fundstrat head of analysis

Fundstrat’s Tom Lee, among the many first to name the bull market in shares, thinks the rally has room to develop past the tech sector.

In Lee’s view, the economic system is definitely on the verge of an growth, not a recession. Inflation is displaying indicators of softening, and companies are literally headed for a growth in profitability.

“As a substitute of a recession unfolding, it seems to be just like the economic system is slipping into an growth, he mentioned in a latest interview with CNBC. “I do not assume shares are prolonged. I believe the FAANGS did the heavy lifting and I believe if we’re slipping into an growth, lots of different teams are going to take part,” he later added.

Goldman Sachs

The hype for AI is actual and could lead on the S&P 500 to climb larger this yr, Goldman Sachs mentioned.

The funding financial institution touted the potential advantages of AI, as corporations adopting the expertise may see a lift in productiveness and due to this fact, a lift to earnings. That might take the S&P 500 as a lot as 14% larger within the coming years, strategists mentioned.

And although the AI pleasure has primarily boosted tech shares, the rally may spill over into different sectors, as earlier episodes of slim market breadth have translated into a bigger proportion of successful shares within the S&P 500 general.

The financial institution has additionally lowered its estimate of recession hitting the economic system this yr to 25%, down from a 35% probability predicted earlier this yr.

The S&P 500 may finish the yr at 4,500, strategists predicted, implying round a 5% upside from present ranges and a achieve of about 17% for the complete yr.

Learn the unique article on Enterprise Insider