International markets had an acute panic assault this week — a sudden bout of chaos in what has been in any other case a quite placid and predictable yr.

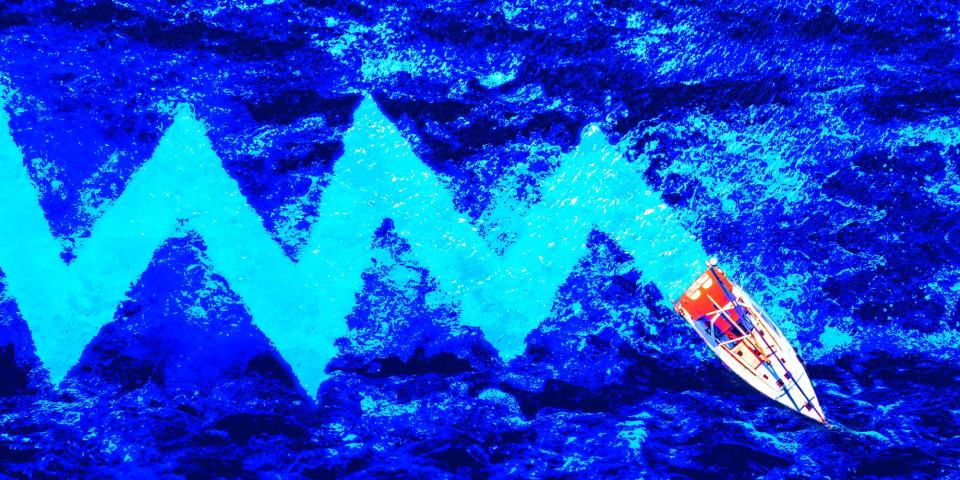

The dizziness began in Asia: Markets crashed in Japan early Monday, with the headline Nikkei index falling by as a lot as 12.4%. The trembling then unfold throughout the globe as cryptocurrencies — supposedly an uncorrelated retailer of worth — skilled a brief lack of management, plummeting together with every thing else. By the tip of the day it was clear that US inventory markets couldn’t catch their breath. Totally untethered from actuality, hearts palpitating wildly up and down Wall Road, the Dow Jones Industrial Common closed down greater than 1,000 factors, a 2.6% drop, whereas the tech stock-heavy Nasdaq tanked by 3.4% and the S&P 500 sank 3%. Within the days that adopted, the market jumped or fell with every new piece of data, resulting in a definite tightness in each investor’s chest.

As with every panic assault, the explanations for its sudden onset are myriad — a compounding of long-known anxieties each out and in of our management. After the Financial institution of Japan hiked rates of interest, the Japanese yen appreciated immediately, scrambling the carry commerce, a preferred Wall Road technique that had been paying off for years however requires placid markets to maintain itself. Added on prime have been issues about Large Tech, the spine of 2024’s roaring market. After wrapping up earnings season with little revenue to indicate for investments in AI, worries that corporations wasted $1 trillion on this nifty however unproven tech went from whispers to open debate.

Most essential, although, was the market’s painful processing of the July jobs report, which confirmed that the US added simply 114,000 new jobs final month, effectively under economists’ expectations. The principle cause for the market’s tranquility this yr was the sturdy conviction that America’s battle with inflation would finish with a gentle touchdown, an excellent state of affairs the place costs come again underneath management with out a surge of job losses. The current uptick in unemployment — which rose to 4.3% in July — compelled Wall Road to simply accept that its excellent financial state of affairs is in danger and that the Federal Reserve, which has been targeted on getting inflation underneath management, could also be behind the curve on chopping rates of interest to assist the labor market. It was sufficient to ship the market right into a full-on tantrum.

A gentle touchdown stays Wall Road’s base case. Fed Chairman Jerome Powell is prone to step in to spice up the financial system in September. And it’s possible that the current weak point within the job market is only a degree setting again to a extra sustainable existence. However even a bit doubt will be pernicious for finance, a world dominated by chances. After a quite lengthy absence, fears that the US financial system might tip into recession got here again into view, which brought on the folks of markets — from the macro merchants to the inventory jockeys — to panic.

All this bedlam is a warning {that a} new period is approaching. The inflationary post-pandemic financial system is fading, and one thing new will quickly substitute it. We have no idea if that regime will reward development or worth shares, whether or not it can ship cash flows again to Japan or to Mexico. We have no idea this new financial system’s construction — solely that it is going to be slower than what we’re experiencing now and maybe extra “regular” than something we have seen for the reason that 2008 monetary disaster. The plan is to return to a 2% inflation fee and a 2% benchmark rate of interest. Precisely how we get there — by way of a gentle touchdown or after a recession — is the query that can have markets convulsing between recent knowledge prints and central-bank bulletins till we attain our vacation spot. It could be a turbulent ending, however a minimum of it is in sight.

There are ranges to this, man

The indicators that the financial system is slowing are neither sudden nor unintended. They’re a part of our restoration from the pandemic. Within the face of an financial system so sizzling that each wages and costs shot up uncomfortably, the Fed jacked up rates of interest from 0% to five.25%. The specific intention was to faucet the brakes, sluggish client spending, and get companies to ease up on a few of their hiring. This put Wall Road in “dangerous information is nice information” mode — so-so financial knowledge was proof that larger charges have been really slowing issues down, and over the previous yr, buyers bought loads of proof. The buyer worth index continued its downward development in June, coming in at 3%, simply above the Fed’s 2% goal. Fewer and fewer Individuals give up their jobs as they grew to become much less assured that they’d instantly discover new ones. Wages stored rising, however extra slowly, which implies costs might stabilize.

The extra leisurely tempo of development stored the inventory market rolling alongside merrily. Customers nonetheless had cash to spend, and after mountaineering costs through the pandemic, corporates loved document income. On August 1, the day earlier than the roles report dropped, the S&P 500 was up 11.8% for the yr, whereas the Nasdaq and the Dow had gained 9.1% and seven%. Whereas there was some demand for defense towards the prospect of volatility reemerging, general sentiment throughout Wall Road had gotten extra bullish.

“We’re not seeing a ton of demand for draw back safety,” Mandy Xu, Cboe’s head of derivatives-market intelligence, informed me on the finish of final month. She added that, for probably the most half, Wall Streeters have been making a number of bets that the market would go up. When everybody begins betting in the identical route, it will get lopsided.

The sudden reassessment after the roles report not solely caught many buyers on Wall Road offside however modified all the market’s tenor — dangerous information is now dangerous information. A slowing financial system is what policymakers and buyers needed to see, however not one so sluggish that it might harm the roles market or, within the worst case, tip the financial system right into a full-on recession. The query is whether or not we’re within the former sort of slowdown and never the latter.

If you happen to dig deeper into current financial knowledge, there is a sturdy case for the US being in a kinder, extra forgiving slowdown. The July jobs report confirmed wage development at 3.6% yr over yr, which means persons are nonetheless getting raises even when adjusting for inflation. Over at Apollo International Administration, Torsten Slok, the chief economist, argued to purchasers that the “supply of the rise within the unemployment fee will not be job cuts however an increase in labor provide due to rising immigration.” In different phrases, there isn’t a sudden surge in layoffs, simply extra demand for jobs. In one other observe to purchasers on Tuesday, Slok famous that the speed of debtors defaulting on dangerous loans has declined over the previous yr — not what you’d count on to see forward of a recession.

Till Individuals lose their jobs, shoppers will preserve spending. So long as shoppers preserve spending, the US financial system can keep on observe. The issue is uncertainty. Till Wall Road can make sure that the buyer will maintain on (or not), conviction is definitely shaken. And when conviction is definitely shaken, there’s a heightened danger of stampedes. It takes a number of knowledge factors to get to readability, and the method of sifting by way of them to see the brand new form of the market is in its early innings.

Not all corporations will come out on prime on this new setting. Firms have been capable of jack up costs over the previous three years to pad document income, however shoppers are getting choosier about what they spend their cash on, typically shifting to cheaper merchandise. That is inflicting hassle for some manufacturers that pushed their costs too far. Starbucks, which raised costs over the pandemic, missed earnings within the second quarter. McDonald’s, which has raised costs by a whopping 40% since 2019, additionally whiffed. In the meantime, Shake Shack, which raised costs by solely about 8% by way of the pandemic, beat earnings estimates over the identical interval. This dispersion in winners and losers implies that (gasp!) buyers will have to be choosier in regards to the shares they choose, Kevin Gordon, a director and senior funding strategist at Charles Schwab, informed me. Using an index will not be going to chop it anymore.

“Those which might be doing effectively on pricing energy are doing effectively. Those who usually are not are getting crushed for lacking estimates,” he informed me. “Firms that benefited from the inflation wave are now not benefiting.”

Over the previous few years, a few of Wall Road’s most distinguished buyers have complained that the artwork of basic monetary evaluation has been misplaced. Digging for affordable shares, studying stability sheets, listening to investor calls — a few of that has been changed with quant buying and selling and index hugging. Maybe it can discover its place available in the market to return, or possibly it is only a cease on the way in which to the following development. A part of the chaos of this second is that nobody is aware of.

Identified knowns and unknown knowns

Traders have spent many of the previous 4 years attempting to get their heads round one unknown after one other. Since 2020 they’ve gone from pandemic-driven emergency interest-rate cuts to traditionally quick, inflation-fighting interest-rate hikes. The financial system was primarily put into sleep mode, shortage pushed costs up, and companies laid off employees solely to carry them again. If this felt like a wild experience, that is as a result of it was. In spite of everything that weirdness and uncertainty, returning to a standard state of affairs can really feel like its personal sort of shock. If all goes to plan, that’s the sort of market we’ll be coming into: normality. A “regular” financial system with inflation close to 2%, regular job beneficial properties dispersed throughout industries, and a Fed that may possibly fade into the background for some time. Be boring.

The Fed is prone to lower charges in September, but when the financial system’s deterioration accelerates, the likelihood of a recession will increase, and people cuts is probably not sufficient to cease it. A recession is a “regular” occasion, too, simply not a very enjoyable one. After years of bizarre occasions and outsize beneficial properties, Wall Road is dancing on a knife’s edge. Trades that labored in our unusual post-pandemic market won’t work underneath a extra customary financial regime of low inflation and decrease rates of interest. As we noticed with the carry-trade blowup, altering these positions usually means violence. What occurred on Monday was a sudden realization that the brand new construction might assert itself earlier than Wall Road imagined it might. Count on extra mayhem because the market parses each new piece of data, greedy for one thing strong, shifting with no matter knowledge eases or engenders recession fears. That is the tune the market is dancing to now. It is a sort of chaos, however think about it optimistic chaos.

Linette Lopez is a senior correspondent at Enterprise Insider.

Learn the unique article on Enterprise Insider