-

The US client is doing simply tremendous, and their resilient spending habits ought to assist stave off a recession.

-

That is true even amid considerations of dwindling extra financial savings and the approaching resumption of pupil mortgage funds.

-

These 5 charts assist present simply how resilient the US client is regardless of fears of a recession.

The US client is doing simply tremendous as they proceed to spend cash regardless of elevated inflation and ongoing fears {that a} recession will quickly hit the economic system.

Regardless of some commentators sounding the alarm, the US client is not in imminent monetary hassle due to dwindling extra financial savings from the COVID-19 pandemic on high of pupil mortgage funds set to kick in once more later this 12 months.

That is the large takeaway from Carson Group’s chief market strategist Ryan Detrick, who highlighted simply how robust the buyer actually relies on varied financial datasets within the agency’s 2023 mid-year outlook report.

The buyer is necessary to trace for as a result of about 70% of the US economic system is pushed by client spending, which depends closely on the every day spending habits of greater than 300 million People.

And present knowledge is pointing to stronger tendencies at the moment than pre-pandemic.

These are the 5 key charts that present simply how robust the buyer is, and why that power ought to proceed to protect the US economic system from an imminent recession.

1. Month-to-month debt funds are manageable.

“When eager about debt, the important thing query is whether or not households are in a position to service that debt,” Detrick.

Enter the family debt service ratio, which measures the share of customers’ revenue that’s getting used to repay all kinds of money owed, from mortgages to bank card payments to pupil loans.

Primarily based on estimates from JPMorgan, the family debt service ratio on the finish of the second quarter was 9.7%. That determine is effectively beneath the 13.2% studying seen within the fourth-quarter of 2007, and it is also beneath the pre-pandemic common of 11.2%. That provides the buyer loads of wiggle room to tackle extra debt if they should, which might result in extra spending and assist raise the economic system.

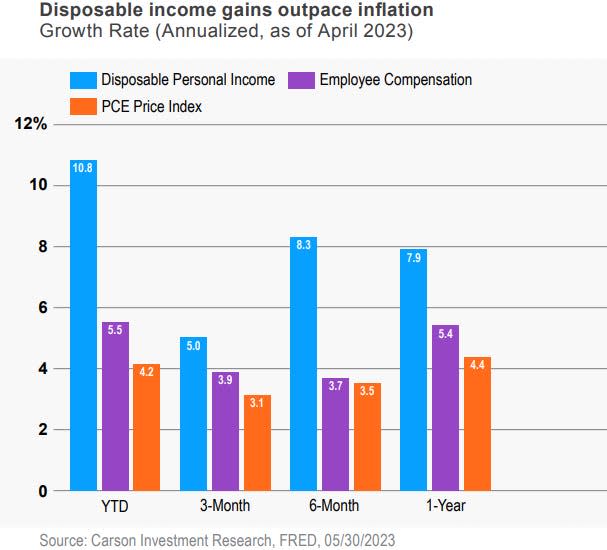

2. Actual revenue development.

For a lot of the previous two years, wage positive aspects have didn’t hold tempo with rapidly rising inflation. However with inflation lastly falling, and wage positive aspects holding regular, that is modified. It means customers finally have more cash of their pocket, one other good signal that ought to assist the economic system going ahead.

“Disposable revenue has grown at an annualized tempo of 10% over the primary 5 months of this 12 months. In the meantime, inflation is working nearly 4%, which means households are seeing actual revenue positive aspects,” Detrick mentioned.

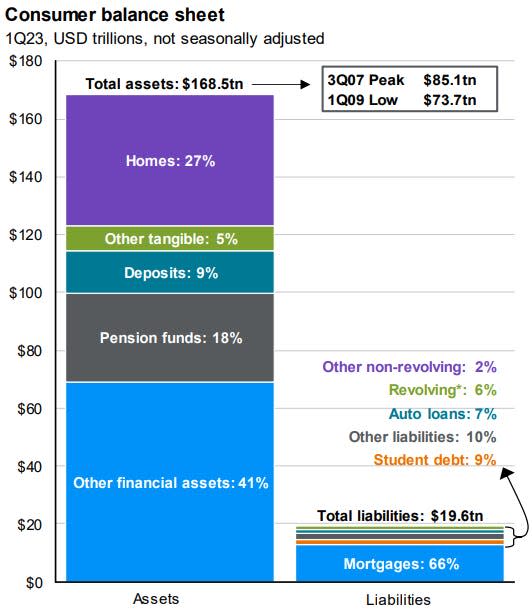

3. A wholesome stability sheet.

Shoppers have $168.5 trillion in complete belongings in comparison with simply $19.6 trillion in debt. That is a wholesome stability sheet and does not imply a interval of weak point forward.

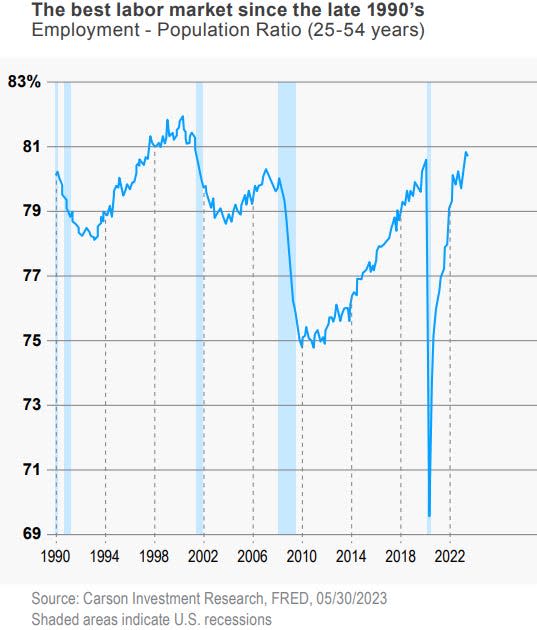

4. A robust jobs market.

On the finish of the day, all that issues is that buyers have jobs, as that is what fuels the majority of their spending habits. If they’ve a paycheck, they’re spending cash. So it is no shock simply how necessary the power of the job market is for the buyer, and proper now the job market is wanting nice, with loads of open positions for these which can be wanting round.

“The employment-population ratio for prime-age staff (25-54 years), which accounts for labor pressure participation points and an getting old inhabitants, is now at 80.7%. That’s larger than at any level between 2002 and 2022. That is really outstanding, and factors to a labor market that’s the strongest we have seen because the late Nineties,” Detrick mentioned.

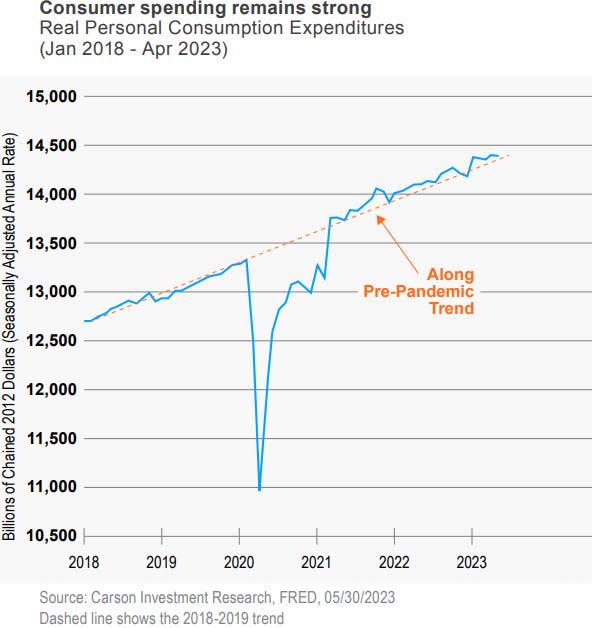

5. Robust spending tendencies.

“Consumption continues to run alongside the pre-pandemic development, even after adjusting for inflation… Spending pushed by rising actual incomes means customers do not feel the necessity to borrow to the extent they did earlier than the pandemic,” Detrick mentioned.

Learn the unique article on Enterprise Insider