-

The US’s mountain of debt has develop into a explanation for concern for traders this yr.

-

The federal government is prone to spend extra on curiosity funds than on protection over the subsequent 5 years, per Capital Group.

-

The ballooning debt burden might ultimately chip away on the demand for Treasury bonds, in keeping with the funding supervisor.

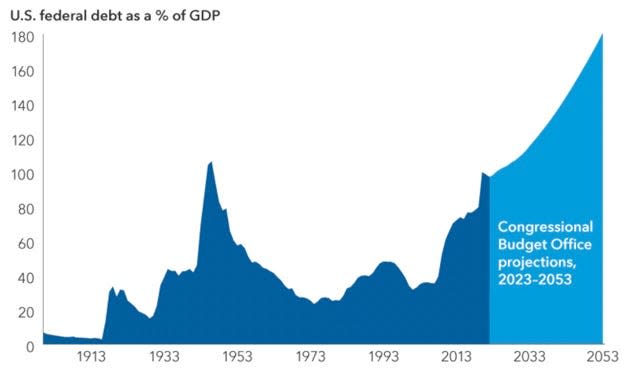

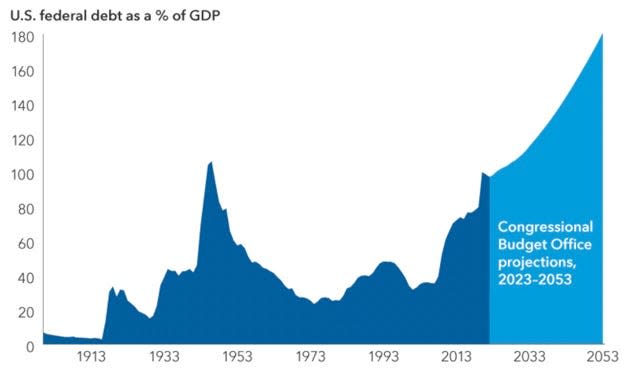

The US’s mountain of debt is rising each day – and the federal government might quickly be spending extra on curiosity funds than on protection, in keeping with Capital Group.

“US debt dynamics are evolving in a method that requires consideration,” Darrell Spence, an economist for the US asset supervisor, mentioned in a analysis be aware again in October. “Over the subsequent 5 years, web curiosity funds on the debt are anticipated to surpass protection spending.”

Spence added that if the world’s largest financial system’s debt pile rises on the charge anticipated by the Congressional Price range Workplace, the federal government’s spending on web curiosity funds might rise from beneath $500 billion to a staggering $1.4 trillion by 2033.

The concept that curiosity funds might quickly surpass protection spending may very well be a supply of concern for policymakers, with President Joe Biden pledging Monday to ask Congress for over $100 billion value of funding to assist each Israel and Ukraine.

Debt has emerged as a significant concern for Wall Road this yr, with lawmakers reaching an Eleventh-hour deal to boost the federal government borrowing restrict again in Could and Treasury bonds struggling a rout that ranks amongst the worst sell-offs in market historical past.

The US authorities’s liabilities breached an eye-watering $33 trillion on September 18 — a month later, the determine had jumped $33.64 trillion, implying a mean day by day enhance of $20 billion.

America’s borrowings be approaching ranges that might trigger financial misery, in keeping with Spence.

Usually, a rustic’s debt ranges develop into an issue if it “had rates of interest that had been greater than its financial development charge, the incremental income generated by the financial system annually grew to become smaller than the curiosity funds on the debt, and the debt started to develop all by itself,” he wrote.

“The US had been removed from reaching that threshold. Till now,” he added.

Spence warned that the ballooning debt pile might power the federal government to boost taxes, gasoline additional bond sell-offs, and power the Federal Reserve to lock in greater rates of interest.

“Slower financial development additionally may very well be anticipated, on condition that authorities spending would must be re-routed to debt service,” he added. “For traders, this might result in decrease inventory market returns over time, given the sturdy long-term correlation between GDP development and market returns.”

This text was initially revealed on October 20, 2023.

Learn the unique article on Enterprise Insider