The U.S. formally hit its $31.4 trillion debt ceiling on Jan. 19 — launching a ticking time bomb towards a probably “calamitous” debt default.

Unable to interrupt the political impasse in Congress, the Treasury will now take “extraordinary measures” to make sure the federal government will pay its payments.

Do not miss

-

This is how a lot cash the typical middle-class American family makes — how do you stack up?

-

‘Maintain onto your cash’: Jeff Bezos issued a monetary warning, says you may wish to rethink shopping for a ‘new vehicle, fridge, or no matter’ — listed below are 3 higher recession-proof buys

-

Wealthy younger Individuals have misplaced confidence within the inventory market — and are betting on these 3 property as a substitute. Get in now for robust long-term tailwinds

The emergency measures are as a result of expire on June 5, in keeping with Treasury Secretary Janet Yellen – triggering fears of a nasty fallout for Individuals.

Listed below are 3 ways it may harm you.

Freezing social assist

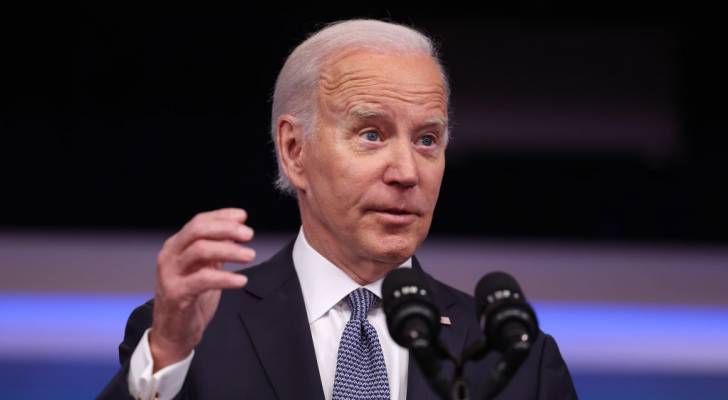

The Council of Financial Advisers (CEA) – an company that advises the President on financial coverage – has painted a grim image of life after debt default.

Each single American may really feel the affect.

“Funds from the federal authorities that households depend on to make ends meet could be endangered,” the CEA explains. “The fundamental features of the Federal authorities—together with sustaining nationwide protection, nationwide parks, and numerous others—could be in danger.

“The general public well being system, which has enabled this nation to react to a worldwide pandemic, could be unable to adequately perform.”

What does that imply for particular person households?

It signifies that the federal government may delay numerous paychecks that assist hundreds of thousands of Individuals, resembling Social Safety funds, Medicare and Medicaid, and advantages to veterans.

Learn extra: You possibly can be the owner of Walmart, Complete Meals and CVS (and acquire fats grocery store-anchored earnings on a quarterly foundation)

Market turmoil

Historical past tends of repeating itself and this doesn’t bode properly for America’s eleventh-hour debt ceiling choice … or your investments.

In 2011, Congress authorised a debt ceiling extension with simply hours to spare earlier than the Treasury would default.

This shut name prompted credit standing company Commonplace & Poor’s to strip the U.S. of its prized AAA (excellent) ranking, eradicating it from its record of lowest-risk nations. The company cited dysfunctional policymaking in Washington as an element within the downgrade.

Skittish traders reacted shortly and the inventory market tanked. It took the S&P 500 index virtually six months to recuperate.

What’s occurring at present is analogous.

The approaching months of “extraordinary measures” look set for an extended, drawn-out political wrestling match, with opposing Republicans utilizing their votes on an extension as leverage to hunt spending cuts.

As issues stand, one other down-to-the-wire debt ceiling extension appears doubtless.

This might trigger a storm for the S&P 500 index, which sufferd a 19% decline in 2022.

Bank card and mortgage charges

Bank card rates of interest, in addition to different interest-bearing loans like mortgages and auto loans, are tied to the well being of the U.S. economic system – which is dealing with dire straits on this debt default debacle.

The Federal Reserve raised its key short-term rate of interest by one other 0.25 share level earlier this month, pushing borrowing prices to the best degree since 2007.

When the fed funds fee goes up, the prime fee – the rate of interest banks lend to clients with good credit score – additionally will increase.

This implies debtors should pay increased rates of interest on their bank card balances. Mortgages may additionally change into dearer for American households.

In keeping with the CEA: “These and different penalties may set off a recession and credit score market freeze.”

A treasured approach to shield your self

With the U.S. stability sheet in such a precarious place, your 401(okay) or IRA — and your retirement itself — may very well be in danger.

You possibly can attempt to modify your retirement accounts for higher safety, however there’s a lesser-known different that would repay large.

A Gold IRA is a sort of particular person retirement account that lets you put money into gold and different treasured metals in bodily kinds, resembling cash, as a substitute of shares, mutual funds and different conventional investments.

It’s an awesome different as a result of not like the U.S. greenback, which has misplaced 98% of its buying energy since 1971, gold’s buying energy stays extra secure over time.

Choosing a Gold IRA offers you the chance to each diversify your portfolio and stabilize your funds.

If you wish to open a Gold IRA, there are respected providers that’ll allow you to roll over your present 401(okay) or IRA into this new account — and shortly.

This text supplies data solely and shouldn’t be construed as recommendation. It’s offered with out guarantee of any sort.