-

UBS strategists say six out of eight indicators of a inventory market bubble are already flashing.

-

Generative AI hype has pushed inventory costs to document highs, elevating bubble fears.

-

Present circumstances mirror 1997, not 1999, suggesting a bubble may quickly type.

There’s been quite a lot of discuss concerning the inventory market being in a bubble over the previous 12 months as hype for generative synthetic intelligence drives inventory costs to document highs.

In a latest observe from UBS, strategist Andrew Garthwaite outlined the eight warning indicators of a inventory market bubble — and in response to Garthwaite, six of them are already flashing.

Meaning the inventory market is not in a bubble but, however could possibly be quickly.

“The upside danger is that we find yourself in a bubble. If we’re in such a state of affairs, then we imagine it’s much like 1997 not 1999,” Garthwaite mentioned.

That is essential as a result of inventory market bubbles usually result in a painful 80% decline as soon as it pops, however Garthwaite says we’re not there simply but.

“We solely make investments for the bubble thesis if we’re in 1997 not 1999 (which we predict we’re),” Garthwaite mentioned.

These are the eight inventory market bubble warning indicators, in response to Garthwaite.

1. The tip of a structural bull market – Flashed

“Bubbles are likely to happen when historic fairness returns have been very excessive relative to bond returns and thus traders extrapolate historic returns to be predictors of future returns – when in truth future returns, as proven by the ERP, are considerably under their norms,” Garthwaite mentioned.

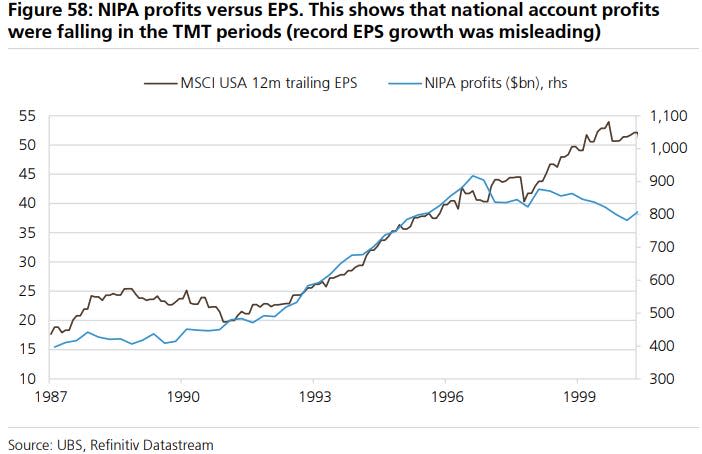

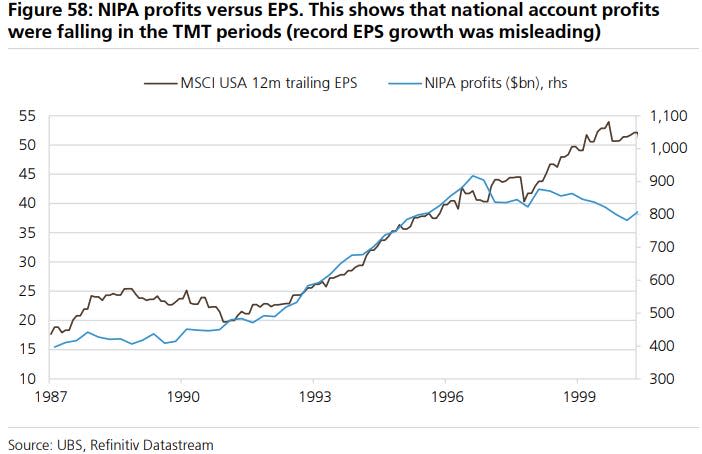

2. When income are beneath strain – Flashed

Whereas S&P 500 income have been booming over the previous 12 months, there may be one other measure of company income that ought to be monitored by traders.

NIPA income measure the profitability of all companies, together with personal corporations, and when these diverge with the income of publicly traded corporations, traders ought to take discover.

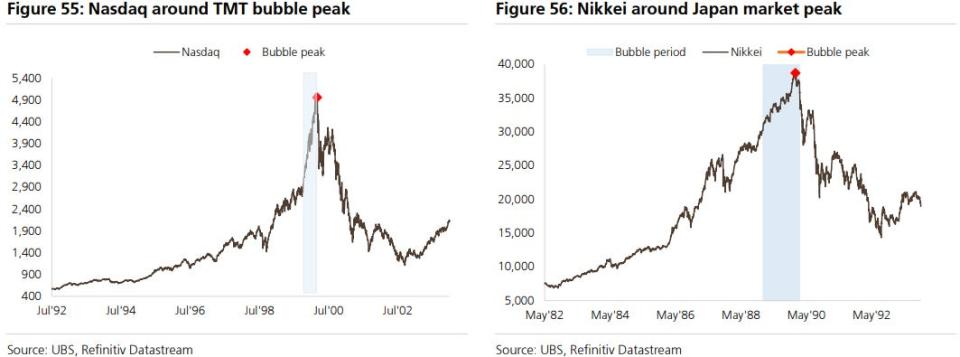

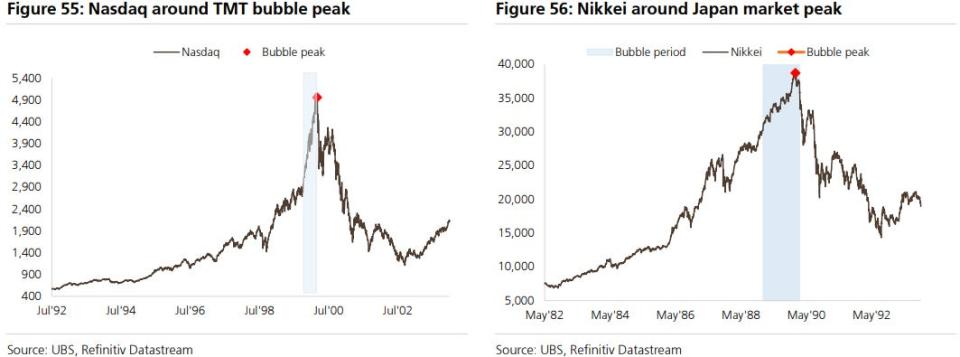

“We are able to see this if we have a look at the TMT interval when the NIPA income fell whereas inventory market income rose. The identical was true in Japan within the late Nineteen Eighties,” Garthwaite mentioned.

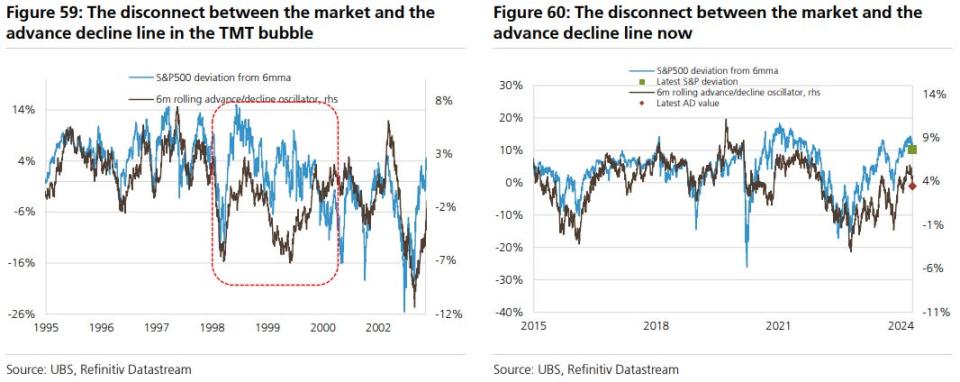

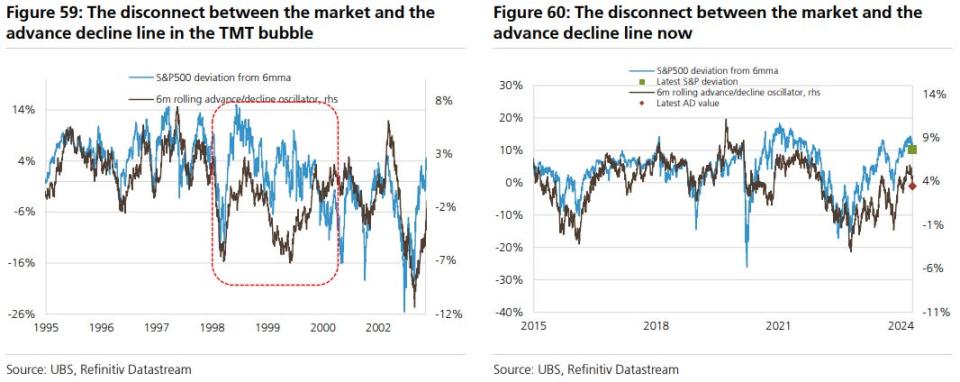

3. Giant lack of breadth – Flashed

When the inventory market is extraordinarily concentrated in a handful of corporations which might be driving the majority of the beneficial properties, that is an indication that breadth is weak.

With document focus within the mega-cap tech shares, that’s precisely what has been occurring because the median inventory fails to ship sturdy returns.

“We are able to see this particularly if we have a look at the advance to say no line versus the S&P 500 throughout the TMT interval,” Garthwaite mentioned.

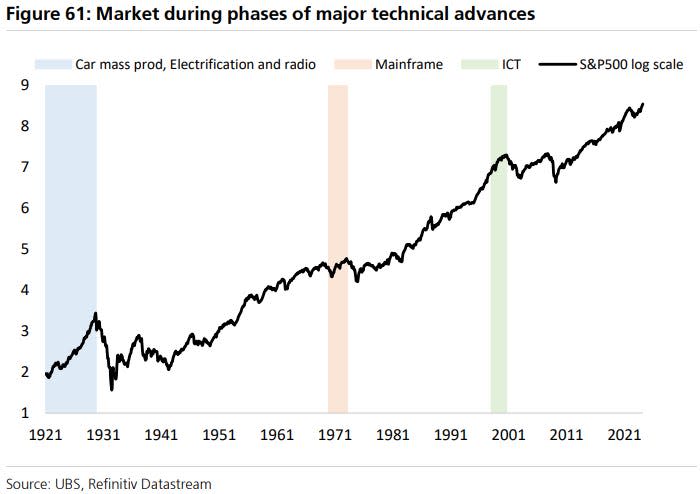

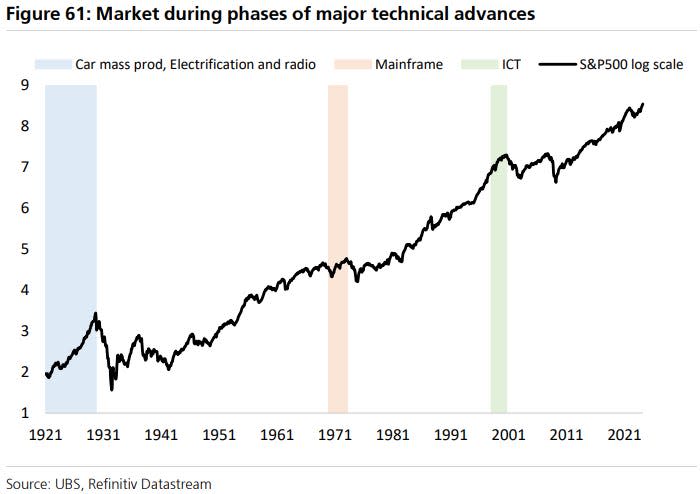

4. Wants a 25-year hole from the prior bubble – Flashed

“This permits an entire set of traders to imagine ‘it’s completely different this time round’ and develop theories that equities ought to be on a structurally decrease ERP,” Garthwaite mentioned.

5. Has a 25-year hole from prior bubble – Flashed

“This narrative both revolves round dominance or extra usually expertise. Within the nineteenth century there was a bubble related to railways and within the twentieth century there was a bubble within the run-up to 1929 which was related to the mass manufacturing of automobiles, electrification of cities and the radio,” Garthwaite mentioned.

6. Retail begins to take part aggressively – Flashed

When retail traders aggressively purchase into the inventory market, it permits the fairness danger premium to fall to very low ranges, resulting in sky-high valuations.

“There may be some proof of this such because the bull/bear ratio of particular person traders being very excessive relative to its norm,” Garthwaite mentioned.

7. Financial coverage being too free – Hasn’t flashed

Earlier bubbles occurred when actual rates of interest had been allowed to fall in an enormous approach. That hasn’t occurred but, because the Federal Reserve has but to chop rates of interest.

“Present financial circumstances look abnormally tight versus the output hole,” Garthwaite mentioned.

8. Prolonged interval of restricted declines – Hasn’t flashed

Earlier inventory market bubbles noticed a multi-year interval of restricted sell-offs of lower than 20%.

With the S&P 500 experiencing a painful bear market in 2022 and promoting off greater than 25% at its low, there could possibly be an extended option to go earlier than this situation is met.

Learn the unique article on Enterprise Insider