The present market circumstances are characterised by uncertainty, requiring buyers to be aware of the varied cross-currents that may influence shares and different buying and selling devices. The current banking disaster sparked by SVB’s failure has contributed to a local weather of uncertainty, with persistently excessive inflation and rates of interest. Moreover, a cooling job market might be a sign of a slowing economic system.

What’s wanted here’s a clear signal market gamers can use to type out the sound investments from the ‘noise.’ In unsure occasions, the same old markers aren’t totally dependable – however the TipRanks Sensible Rating instrument can lower via the muddle of information and shine a light-weight on stable alternatives.

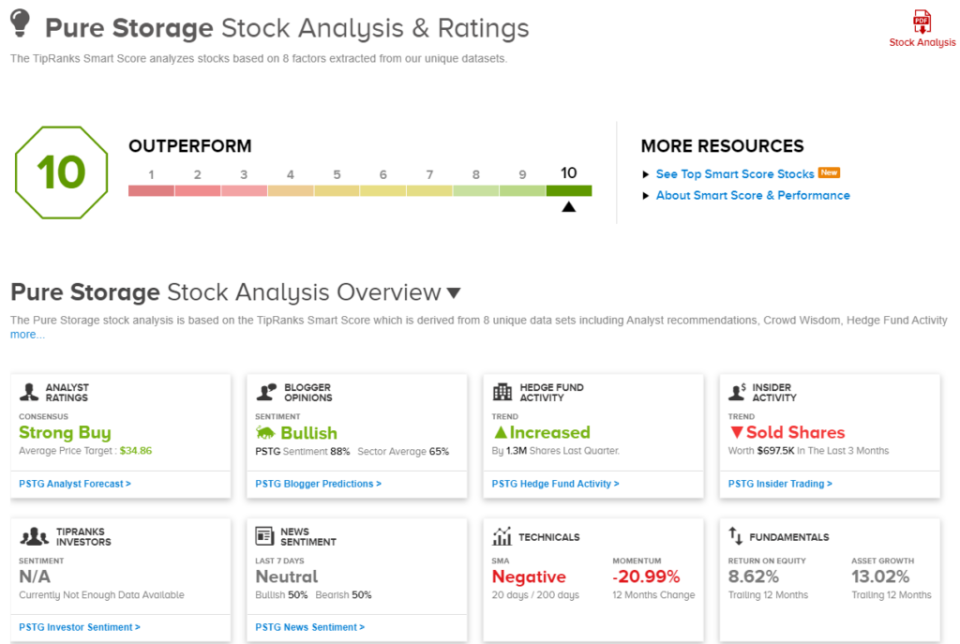

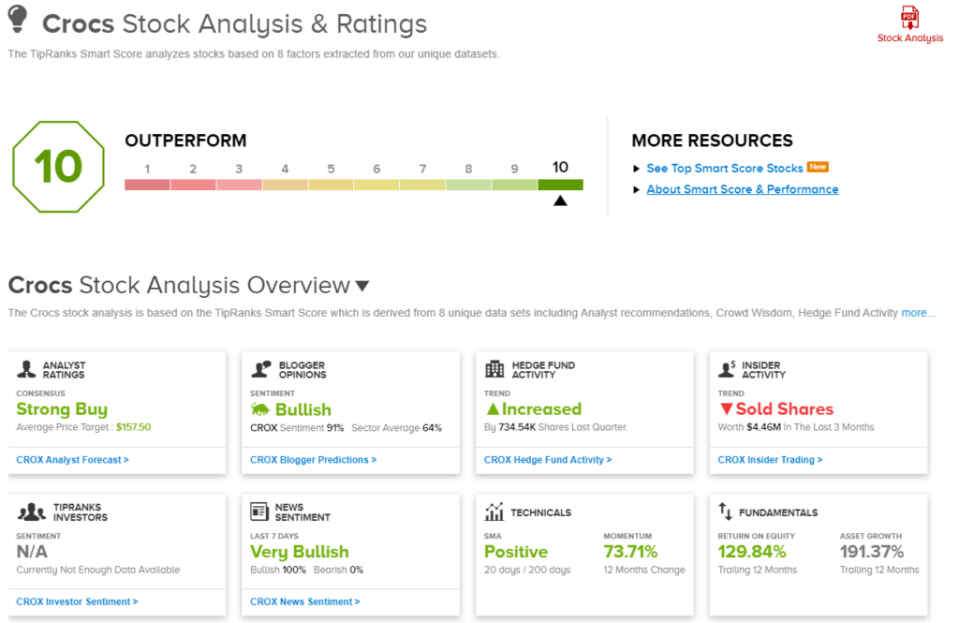

The instrument takes a set of algorithms to gather, collate, and type the amount of market knowledge, generated by hundreds of publicly traded shares – after which it makes use of that knowledge to price the shares in response to a set of 8 elements, all often called correct predictors of future efficiency. The 8 elements are then scored collectively, giving every inventory a single-digit ranking on a 1 to 10 scale. It’s a easy and intuitive marker, telling buyers at a look how the inventory is prone to transfer.

The ’Good 10’ is the best ranking from the Sensible Rating, and it doesn’t fall on simply any inventory. These are the equities that deserve a re-assessment from buyers, the shares that hit all the fitting bins. We’ve opened up the TipRanks database to tug the small print on two of those Good 10s; these are top-rated shares providing buyers stable alternatives for features within the months forward.

Pure Storage, Inc. (PSTG)

The primary ‘good 10’ inventory we’ll flip to is Pure Storage, an organization targeted on a significant area of interest within the digital world, pc reminiscence chips. Pure Storage affords a variety of flash-based, cloud-ready reminiscence chips and methods, match for entry-level via enterprise-grade functions. The corporate’s reminiscence methods can assist large-scale cloud computing, and clients can discover the whole lot from solid-state flash drives to the large-scale FlashStack servers that again up knowledge middle actions. Pure Storage boasts that its reminiscence methods are 85% extra power environment friendly than competitor merchandise.

Pure Storage has a buyer base greater than 15,000 sturdy, and in current months has scored some necessary enterprise wins. Simply this previous March, Pure Storage introduced that its FlashBlade unified quick file and object storage answer, had been chosen by the Australian Genome Analysis Facility as the important thing to rushing up knowledge efficiency on the genomic pipeline. Earlier this 12 months, in January, Pure Storage made an excellent larger splash, with the publication of reports that it’s partnering with Meta on the AI Analysis SuperCluster (RSC). Meta selected Pure Storage to leverage the FlashArray and FlashBlade reminiscence methods.

These bulletins bookended a stable fiscal 12 months. Pure Storage final month reported its monetary outcomes for This autumn and monetary 12 months 2023, which led to February. The corporate reported $810.2 million on the prime line for the quarter, up 14% year-over-year and in-line with expectations. On the backside line, the GAAP EPS of twenty-two cents was 15 cents above the forecast, whereas the non-GAAP determine of 53 cents got here in effectively forward of the 39-cent expectation. In an necessary metric wanting ahead, the corporate had $1.1 billion in quarterly subscription companies ARR, for a 30% year-over-year acquire.

Whereas these outcomes had been thought-about constructive, buyers had been spooked by the corporate’s ahead steerage, which predicted fiscal 2024 income to develop by ‘mid to excessive’ single digits – towards a Avenue expectation of 13%.

The steerage miss didn’t stop Wedbush’s 5-star analyst Matt Bryson from coming down with a bullish outlook on the shares.

“PSTG proved us mistaken as revenues reasonably constantly exceeded expectations helped in small half by PSTG’s inclusion in FB/Meta’s construct -out of its AI supercomputer. Furthermore, extra average expense development (with comparatively excessive working bills having been a key criticism of PSTG since its inception having been an oft criticized portion of the story) has led to a considerably improved earnings outlook,” Bryson opined.

“With current outcomes suggesting the great components of the PSTG story are nonetheless intact (with no obvious firm particular points); administration having, in our view, largely derisked steerage for FQ1’24/FY2024, with a number of intermediate time period catalysts in place (PSTG’s new FlashBlade//E , decrease NAND costs, and so on.); and with PSTG buying and selling effectively under historic valuations, we see a horny alternative to spend money on PSTG at present ranges,” the analyst added.

Quantifying this stance, Bryson provides PSTG shares an Outperform (i.e. Purchase) ranking, whereas setting a value goal of $34 that means ~33% upside for the approaching 12 months. (To observe Bryson’s observe file, click on right here)

General, PSTG shares get a Robust Purchase ranking from the analyst consensus, based mostly on 15 current analyst evaluations breaking down 14 to 1 in favor of Buys over Holds. The inventory’s $34.86 common value goal implies a 36% one-year upside from the present buying and selling value of $25.62. (See PSTG inventory evaluation)

Crocs, Inc. (CROX)

Subsequent up, we’ve a widely known footwear model that wants no introduction: Crocs. Everyone knows the froth clogs that introduced the corporate to prominence, however Crocs now affords a a lot wider array of footwear and types to reinforce the enduring (an eponymous) clogs – the whole lot from sandals to sneakers, and even formal footwear.

A take a look at just a few numbers will present how Crocs has grown, from its begin at a Florida boat present in 2001, the place it offered 200 pairs, to its present incarnation that sees over $3 billion in annual gross sales. Crocs might be present in 85 international locations, and the corporate sells greater than 100 million pairs of footwear – of all sorts – yearly. All of this makes Crocs one of many world’s top-ten non-athletic footwear manufacturers.

Crocs’ sturdy market place has led to stable quarterly and annual outcomes. The corporate beat expectations in its This autumn and monetary 12 months 2022 monetary report, with the quarterly outcomes coming in sturdy. The highest line of $945.2 million edged over the forecast by $6 million, whereas the underside line non-GAAP EPS of $2.65 got here in 42 cents, or 18% forward of the forecast. The complete-year income, at $3.6 billion, was up 53% year-over-year and was an organization file.

Wanting forward, Crocs’ Q1 and full-year 2023 steerage additionally beat the consensus estimates. The Q1 steerage for adjusted diluted EPS was set at $2.06 to $2.19 per share – the place the Avenue had been anticipating $2.04. For the complete 12 months, the EPS steerage, at $11 to $11.31, was effectively forward of the consensus determine of $10.90. The corporate expects sturdy gross sales in 1Q23, with year-over-year income development hitting 27% to 30%.

Masking this inventory for B. Riley, analyst Jeff Lick lays out a transparent case for investor to go lengthy on CROX.

“We view Crocs as a multiyear core holding that ought to ship absolute and relative returns in 2023 and past. Crocs’ 1Q23 and FY23 steerage seem achievable and beatable. We see quite a few potential inflection factors and catalysts in 2023 and 2024 that might drive relative a number of enlargement and elevate investor notion. Crocs can be changing into a significant medium within the space of brand name, media property, and movie star growth,” Lick opined.

“Lastly,” the analyst summed up, “we see the present challenged retail and shopper surroundings as a possible supply of alternative as customers search worth and reasonably priced luxuries whereas retailers consolidate their merchandising methods and depend on confirmed companions to an excellent larger extent than regular.”

These bullish feedback again up the analyst’s Purchase ranking on the shares, and his value goal, set at $157, means that Crocs will see ~29% share appreciation this 12 months.

Zooming out, we discover that Crocs will get a Robust Purchase consensus ranking from the Wall Avenue analysts, based mostly on 6 current Buys towards 2 Holds. The shares are at the moment priced at $121.86 and their $157.50 common value goal implies an upside of 29% on the one-year time horizon. (See CROX inventory evaluation)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your personal evaluation earlier than making any funding.