This submit was initially revealed on TKer.co

Shares ended one other risky week decrease with the S&P 500 declining 1.6%. The index set a closing low of three,577.03 on Wednesday and an intraday low of three,491.58 on Thursday. From its January 3 closing excessive of 4,796.56, the S&P is now down 25.2%.

It’s extremely troublesome to foretell the place the inventory market is headed within the quick run.

And simply because latest efficiency has been poor doesn’t essentially imply we’re due for a fast, outsized rally. It doesn’t essentially imply that costs ought to tank additional both.

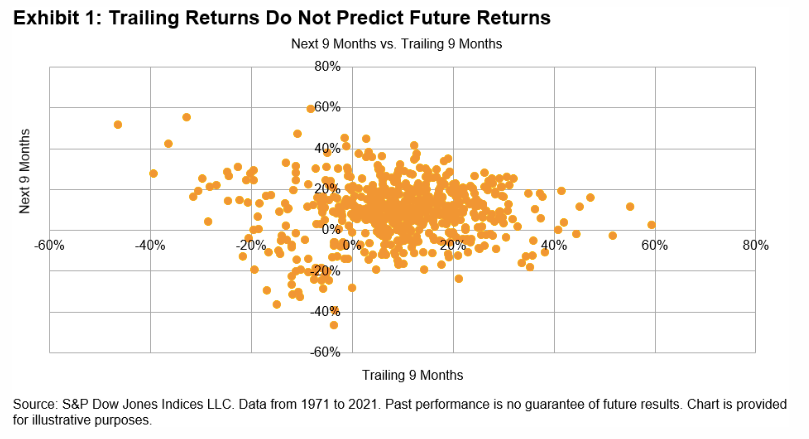

“There may be little or no relationship between trailing returns and future returns,” Craig Lazzara, managing director at S&P Dow Jones Indices, wrote on Wednesday.

Lazzara compiled and charted the historic knowledge to argue his level

“These knowledge comprise each nine-month interval since 1971, not simply the January-September intervals; the precise correlation between the final 9 months’ returns and the following 9 months’ returns is 0.006,” he wrote. “A statistician’s greatest guess of the following 9 months’ returns would merely replicate the median return of the collection, ignoring regardless of the final 9 months’ returns had truly been.”

He added that “there’s excellent news hidden” in that actuality: “The market has no reminiscence; one of the best guess of future returns doesn’t rely on the quick previous.”

It’s vital to notice that this doesn’t indicate that it’s a coin toss whether or not shares go up or down at any given cut-off date. Lest we neglect, the inventory market often goes up.

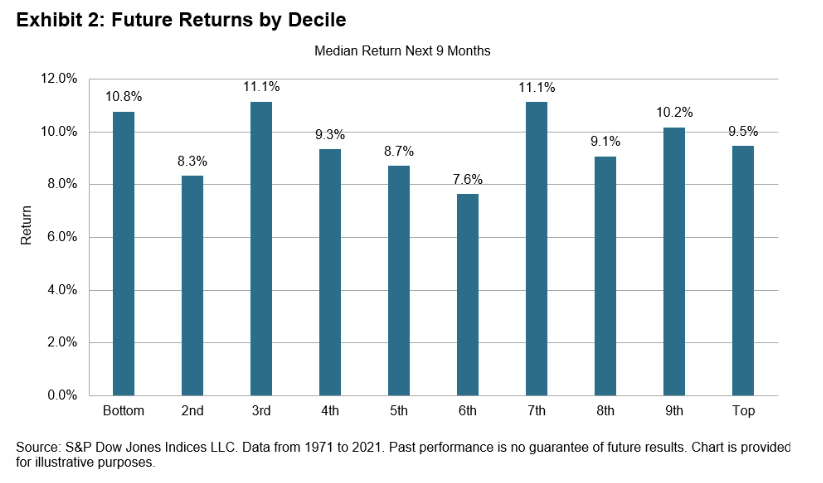

Lazzara broke up the dataset to to indicate the median returns over the following 9 months by deciles based mostly on trailing returns. As you may see, the median future returns are all considerably optimistic, starting from 7.6% to 11.1% throughout the deciles.

“Over all nine-month intervals within the final 50 years, the median return was 9.5%,” Lazzara mentioned. “When historic returns have been within the backside decile, the median return within the subsequent 9 months was 10.8%, a not-inconsiderable enchancment over the worldwide median.“

Now it’s at this level I’ve to remind you that you just shouldn’t count on common outcomes within the quick run. Additionally, simply because shares often go up doesn’t imply shares all the time go up.

Nonetheless, these averages have traditionally materialized for long-term traders with the persistence and abdomen to trip the frequent ups and fewer frequent downs of the market.

Reviewing the macro crosscurrents 🔀

There have been a number of notable knowledge factors from final week to contemplate:

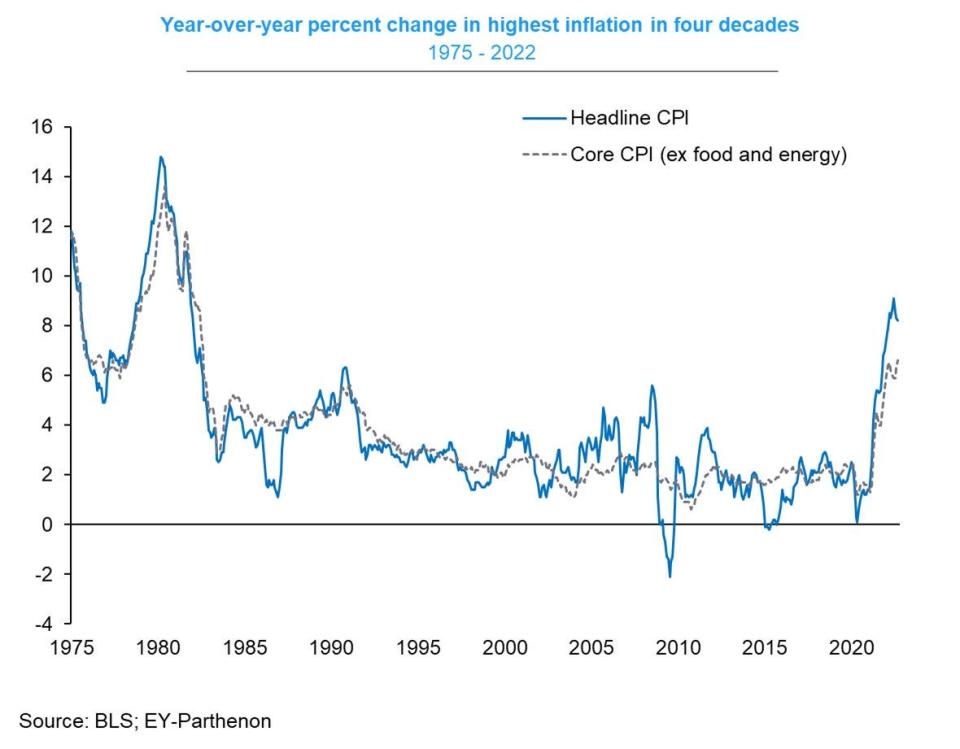

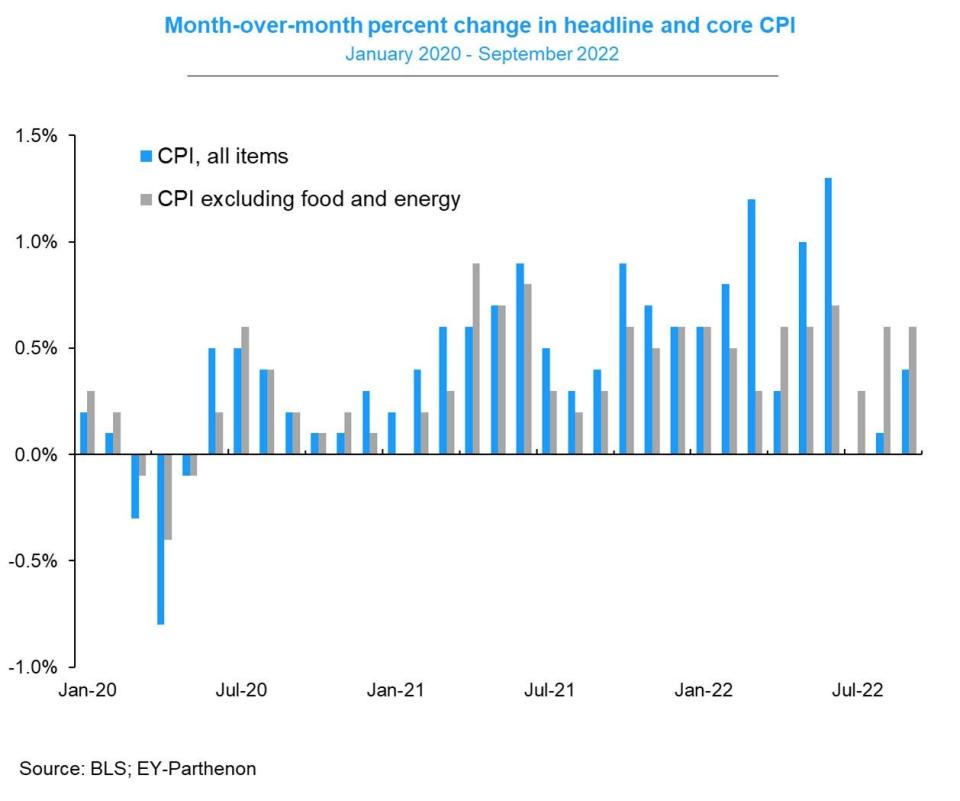

🎈 Inflation stays an issue. The patron worth index (CPI) in September was up 8.2% from a 12 months in the past. Adjusted for meals and vitality costs, core CPI was up 6.6%, the very best print since August 1982. Each measures have been hotter than economists’ expectations.

On a month-over-month foundation, CPI was up 0.4% and core CPI was up 0.6%. Once more, each measures have been hotter than anticipated.

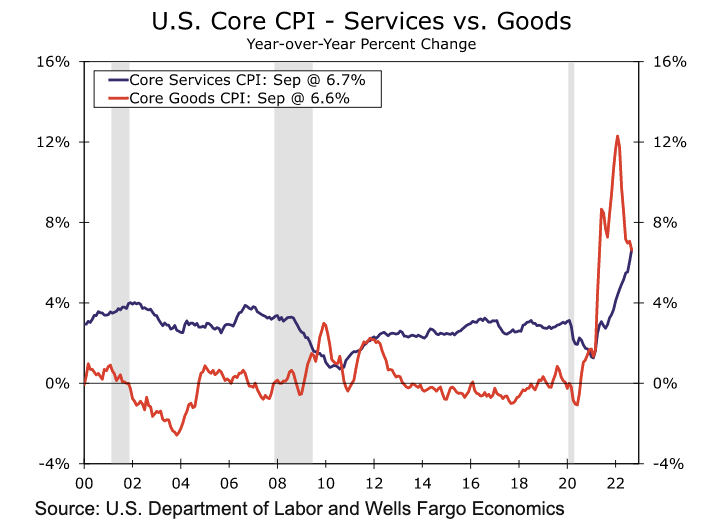

🔀 Items inflation cools, companies inflation heats up. Wells Fargo separated items inflation and companies inflation. The previous has been cooling because the latter has been heating up. Maybe a mirrored image of the continued pattern of shopper spending extra money “doing stuff” and fewer cash “shopping for stuff.”

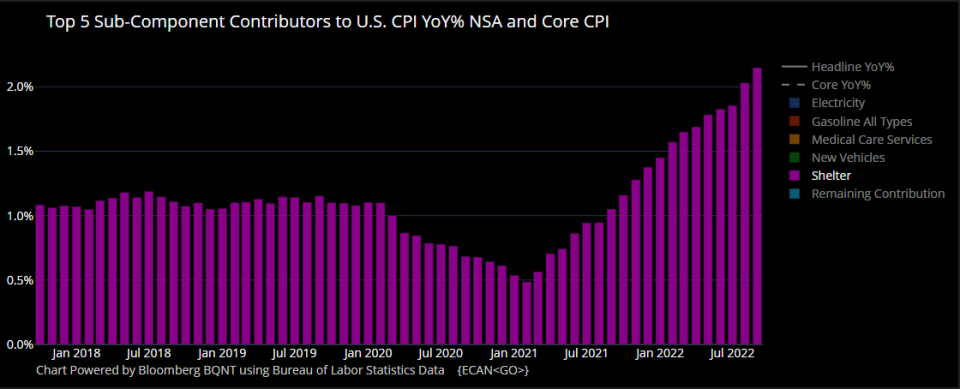

Right here’s a extra detailed have a look at what drove the month-over-month improve in costs. Vitality and automobile costs have been on the decline. However shelter costs have been scorching, in keeping with the CPI report.

🏘 Shelter costs inflate inflation. Excessive dwelling costs and rents the place mirrored in scorching shelter costs,1 which was up 6.6% year-over-year and 0.7% month-over-month. This chart from Bloomberg’s Michael McDonough reveals how shelter costs have grow to be a giant driver of the recent CPI prints.

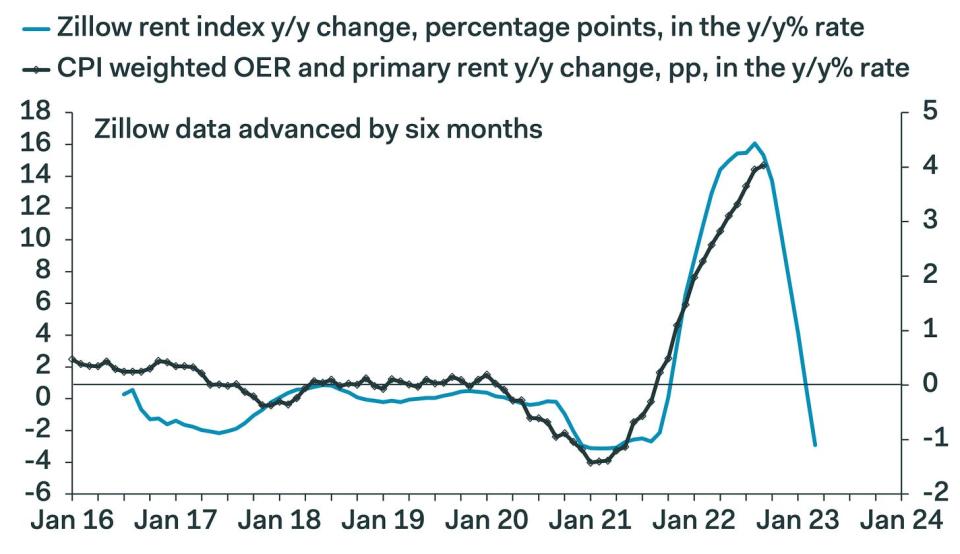

Nonetheless, numerous economists have been fast to warning that the best way shelter costs are measured within the CPI report recommend the enter might replicate lagged knowledge. From Pantheon Macroeconomics’ Ian Shepherdson: “Worrying about exploding lease inflation? It most likely does not have far more to run. The chart reveals second variations of the Zillow lease index and the CPI model, lagged six months.“

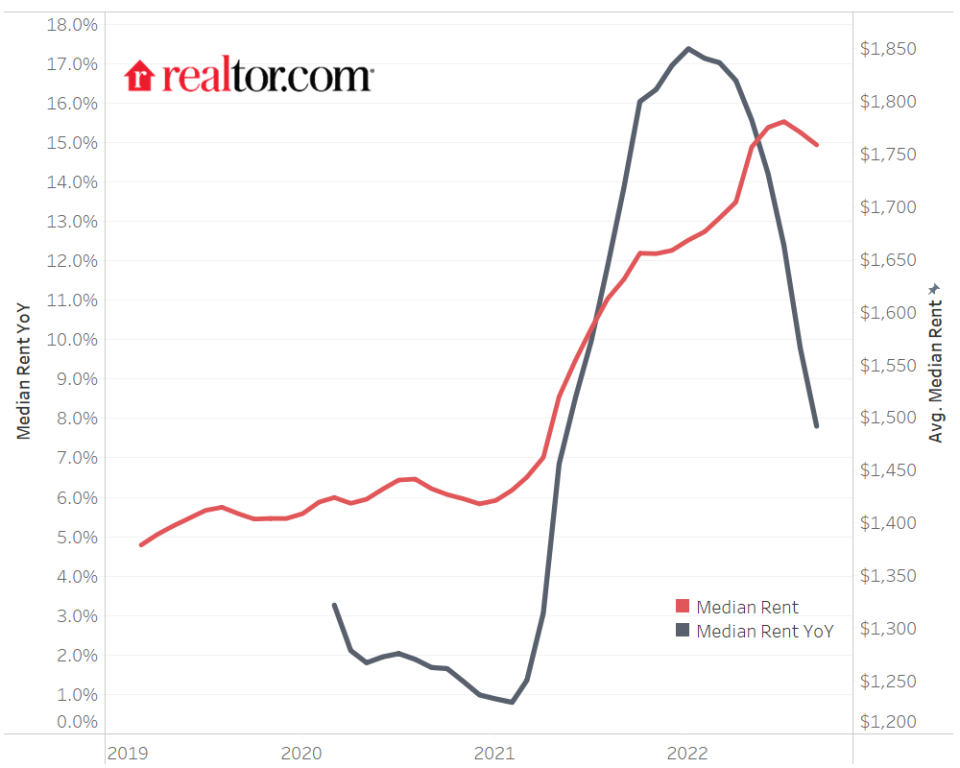

Realtor.com knowledge reveals rents are nonetheless up from 12 months in the past, however have turned decrease on a month-to-month foundation.

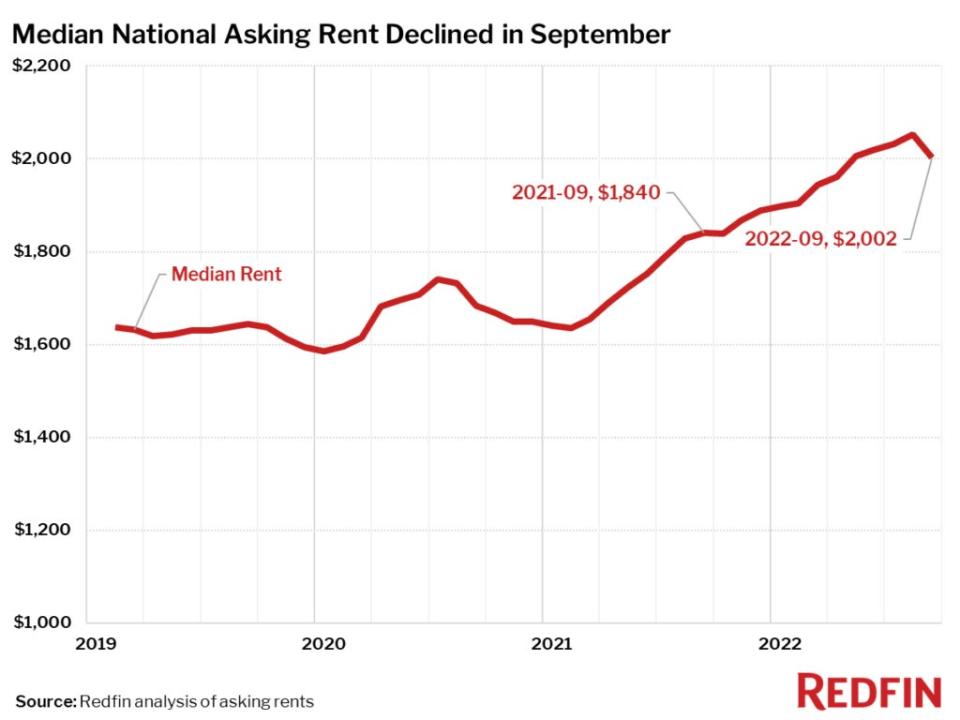

Redfin knowledge additionally confirmed rents have been falling on a month-to-month foundation.

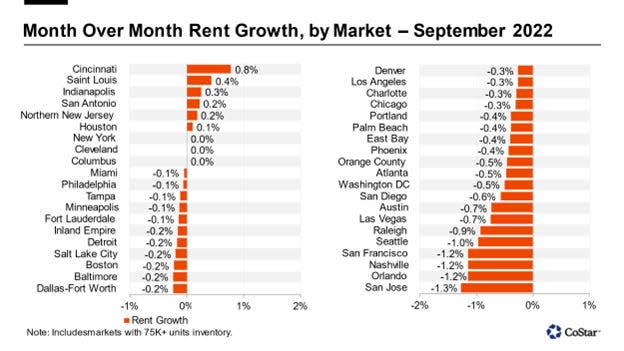

In response to CoStar knowledge, rents in September fell in 75% of markets tracked by Flats.com.

Right here’s SGH Macro’s Tim Duy on CPI: “This knowledge is lagging asking rents indices by about 4 quarters, which signifies that the latest decline in asking rents won’t be mirrored in decrease shelter inflation till the second half of subsequent 12 months. The Fed is conscious of this lag, and the query posed within the markets is when will they reasonable the tempo of charge hikes to account for it? … The issue for the Fed isn’t shelter, or used automobiles, or new automobiles, or some other one-off element that’s used to elucidate anyone report. The issue is that underlying, persistent inflation has risen – and relying on the measure is perhaps anyplace from 6-8%.“

📉 Costs for imported items fall. Import costs fell 1.2% month-over-month in September. That is the third straight month of declines (-1.1% in August and -1.4% in July). A lot of this may be defined by decrease commodity costs and the ascent of the U.S. greenback.

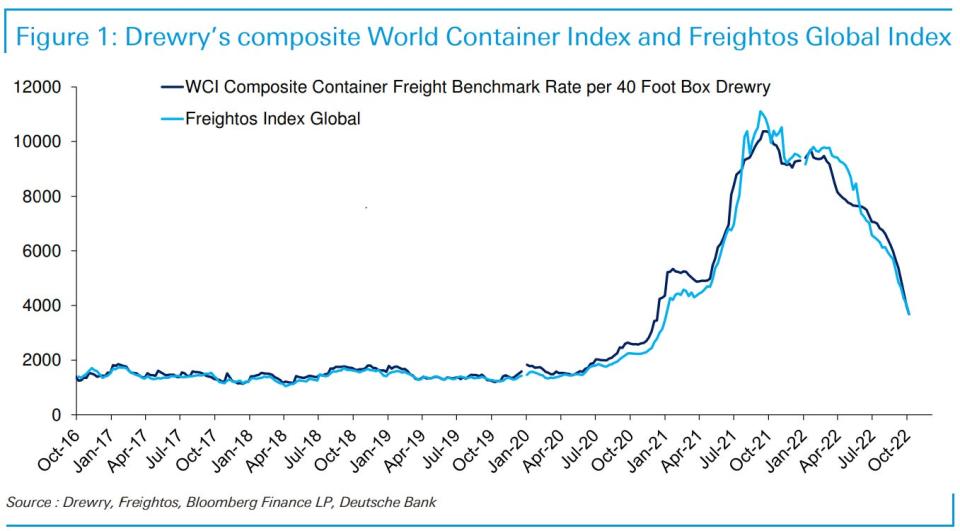

🚢 Freight prices are down. International freight costs are “down round 70% since their lofty peaks this time final 12 months,” Deutsche Financial institution analysts noticed.

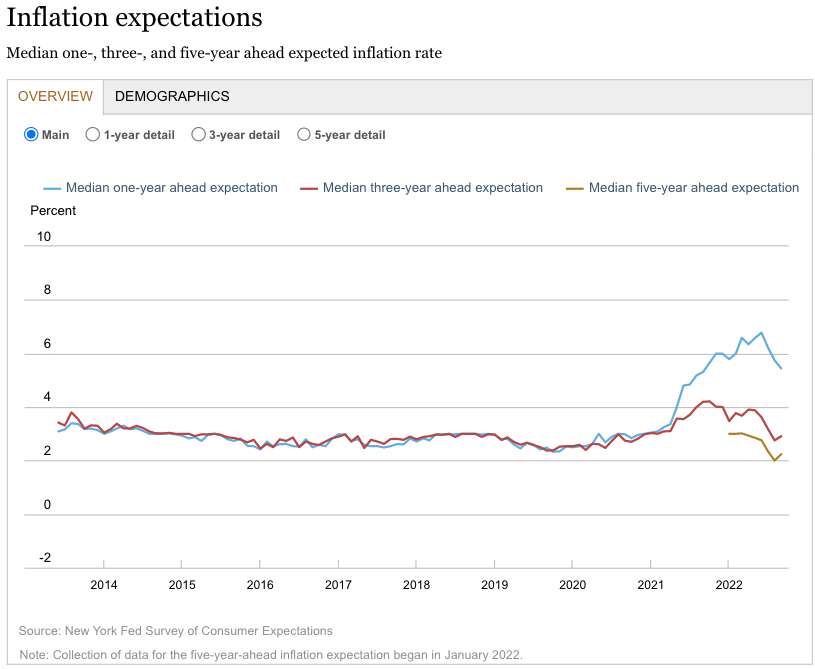

🔥 Inflation expectations warmth up somewhat. From the College of Michigan’s Survey of Customers: “The median anticipated year-ahead inflation charge rose to five.1%, with will increase reported throughout age, earnings, and training. Final month, long term inflation expectations fell under the slender 2.9-3.1% vary for the primary time since July 2021, however since then expectations have returned to that vary at 2.9%. After 3 months of anticipating minimal will increase in fuel costs within the 12 months forward, each quick and longer run expectations rebounded in October.“

The New York Fed’s Survey of Shopper Expectations was a bit blended: “Median one-year-ahead inflation expectations continued to say no in September, falling by 0.3 share level to five.4%, its lowest studying since September 2021. In distinction, three-year-ahead inflation expectations rose barely to 2.9% from 2.8% in August…“

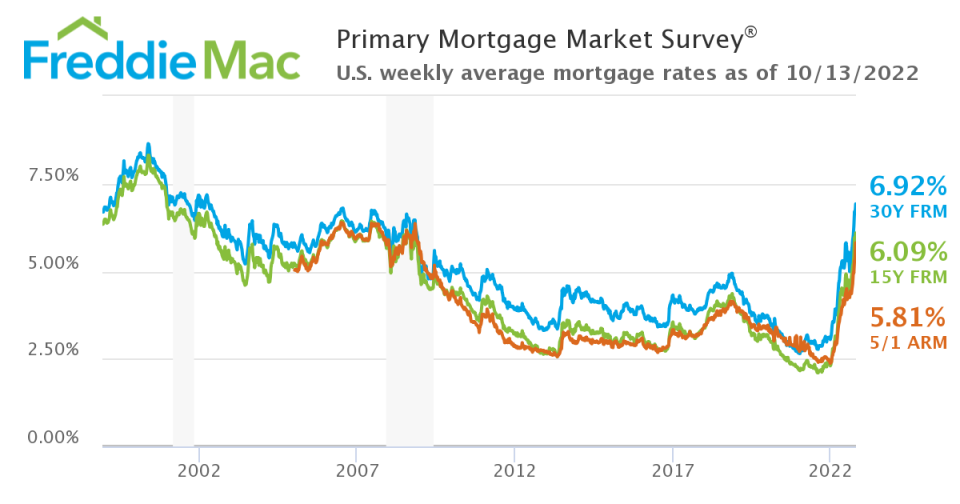

🏠 Mortgage charges leap. From Freddie Mac: “Charges resumed their record-setting climb this week, with the 30-year fixed-rate mortgage reaching its highest degree since April of 2002. We proceed to see a story of two economies within the knowledge: sturdy job and wage progress are holding shoppers’ steadiness sheets optimistic, whereas lingering inflation, recession fears and housing affordability are driving housing demand down precipitously. The subsequent a number of months will undoubtedly be vital for the financial system and the housing market.“

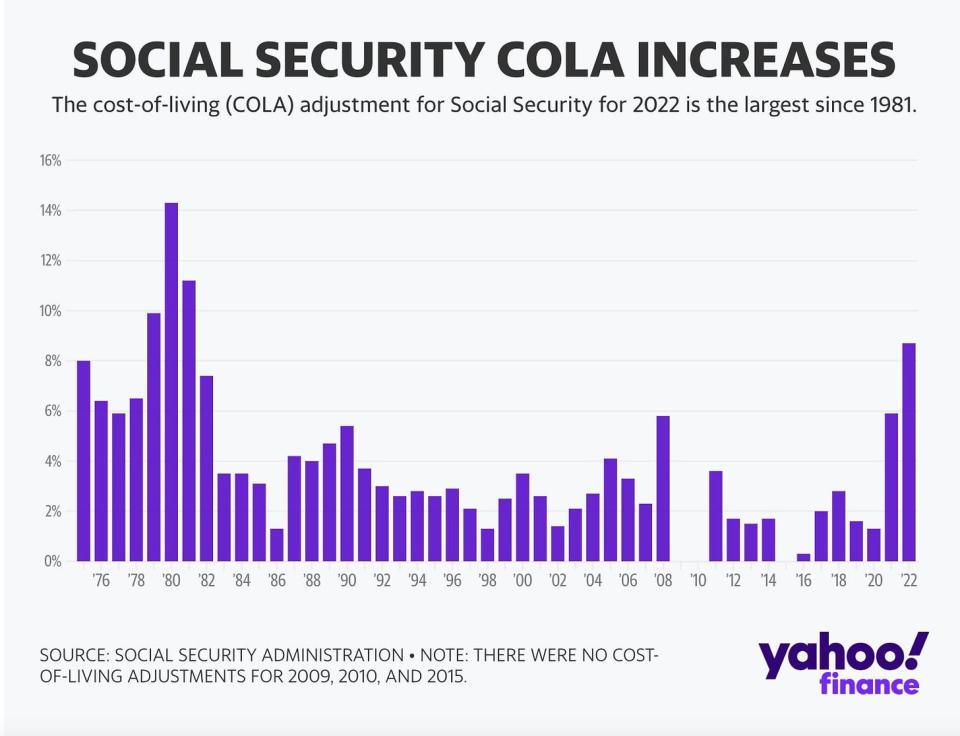

💸 Social Safety advantages to leap in 2023. From the Social Safety Administration: “Social Safety and Supplemental Safety Earnings (SSI) advantages for about 70 million People will improve 8.7% in 2023, the Social Safety Administration introduced as we speak. On common, Social Safety advantages will improve by greater than $140 monthly beginning in January.“

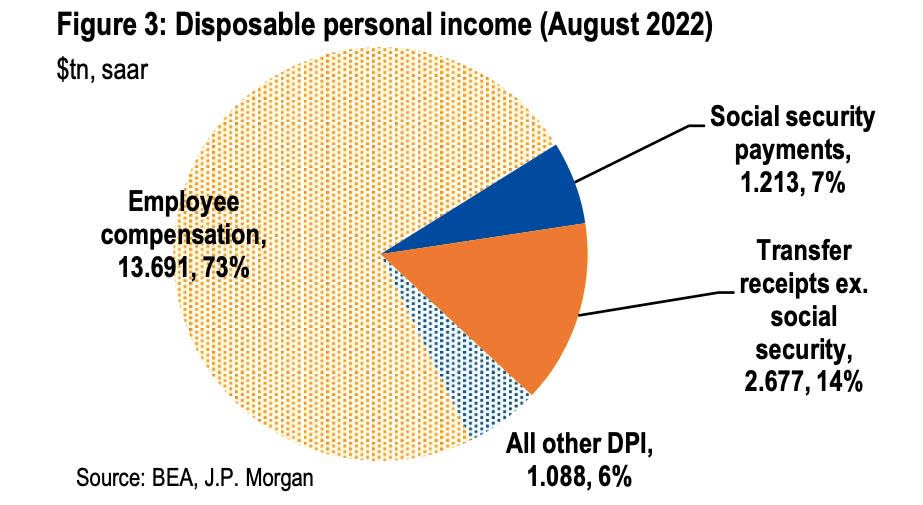

JPMorgan economists famous: “Social safety advantages at present account for less than about 7% of disposable earnings), so the COLA will likely be solely one among many elements that affect the outlook for earnings. However given the magnitude of this 12 months’s COLA, we predict the results of the rise in social safety advantages could possibly be fairly noticeable in the beginning of 2023. We predict the COLA will increase the month-to-month change in disposable earnings by about 0.6% in January and we estimate that the annualized change in actual disposable earnings in 1Q could possibly be lifted by virtually 2.5%-pts. The added earnings early subsequent 12 months must also present some assist for shopper spending and/or saving.“

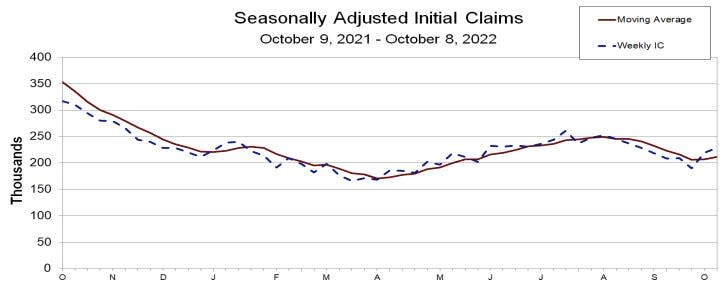

💼 Unemployment claims stay low. Preliminary claims for unemployment advantages rose to 228,000 in the course of the week ending Oct. 8, up from 219,000 the week prior. Whereas the quantity is up from its six-decade low of 166,000 in March, it stays close to ranges seen in periods of financial growth.

A few of the latest leap in claims seem like associated to the latest hurricanes. As JPMorgan economists noticed, “…preliminary claims filings jumped by 38,000 over the most recent two reported weeks, however about 40% of this improve got here from filings in Puerto Rico and Florida.”

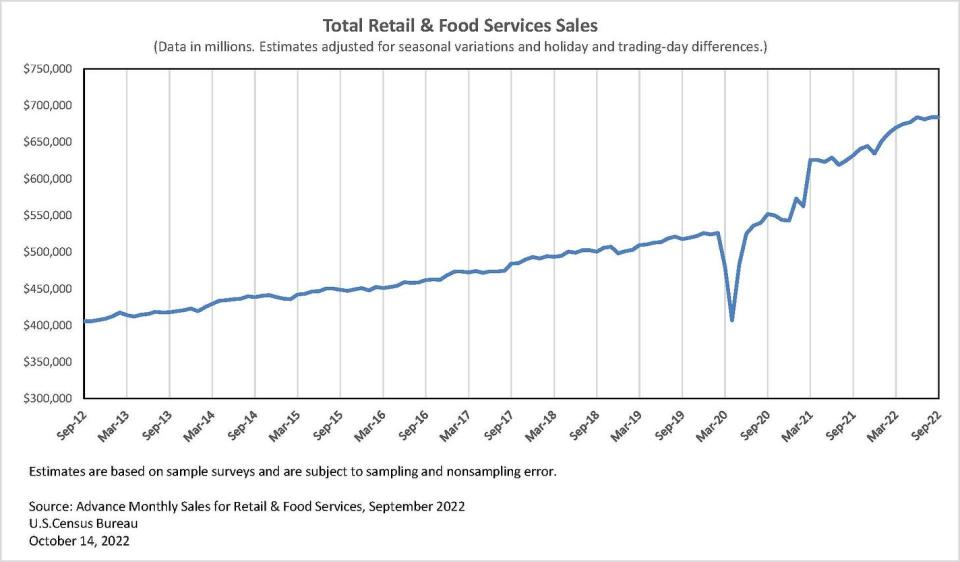

🛍 Retail gross sales are holding up. Retail gross sales in September have been flat from the earlier month however proceed to hover close to report ranges. Excluding autos and fuel, gross sales climbed by 0.3% in the course of the interval.

Eating places and bars, grocery shops, well being and private care shops, outfitters, and department shops noticed progress. In the meantime, furnishings shops, electronics shops, sporting items shops, and fuel stations noticed declines.

🛍 Spending amongst teenagers is cooling. From Piper Sandler’s semi-annual “Taking Inventory With Teenagers” survey: “Teen ‘self-reported’ spending was up 3% Y/Y to $2,331, and down 2% vs. final Spring.“

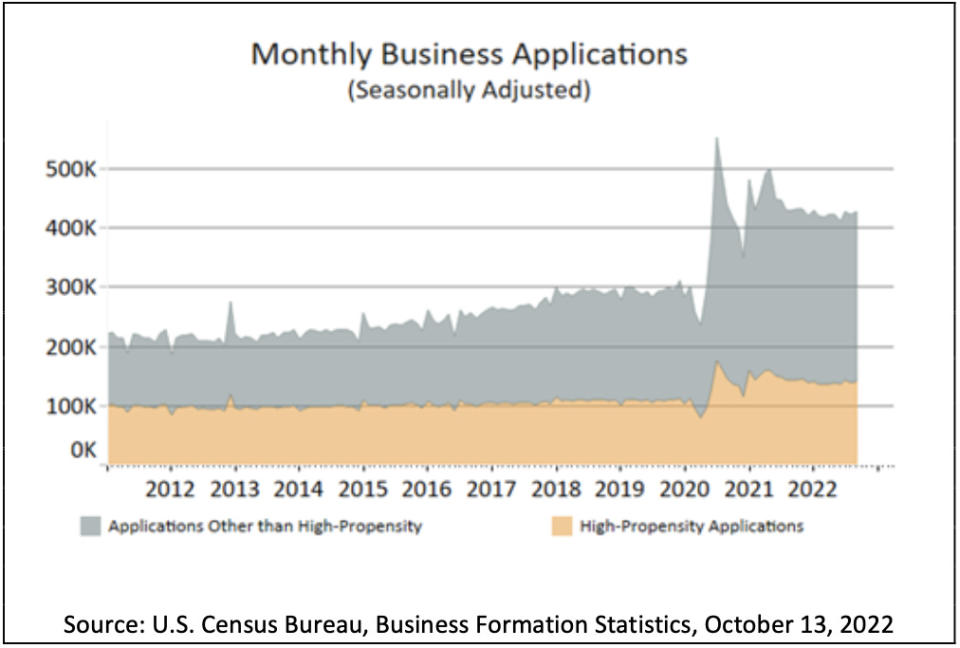

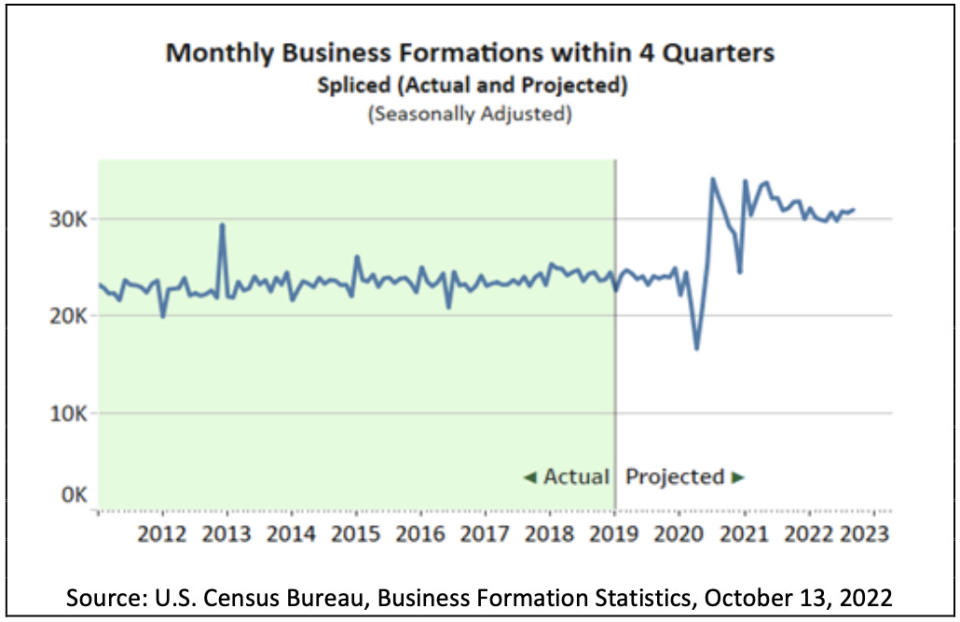

🍾 The entrepreneurial spirit is alive. From the Census Bureau: “Enterprise Purposes for September 2022, adjusted for seasonal variation, have been 425,741, a rise of 1.0% in comparison with August 2022.“

“Projected Enterprise Formations (inside 4 quarters) for September 2022, adjusted for seasonal variation, have been 30,935, a rise of 1.0 p.c in comparison with August 2022.“

Placing all of it collectively 🤔

Whereas there are a lot of indicators that costs within the financial system are easing, mixture measures of inflation stay very excessive.

So put together for issues to chill additional on condition that the Fed is clearly resolute in its struggle to get inflation underneath management. Recession dangers will proceed to accentuate and analysts will proceed trimming their forecasts for earnings. For now, all of this makes for a conundrum for the inventory market and the financial system till we get “compelling proof” that inflation is certainly underneath management.

The excellent news is there’s nonetheless a powerful case to be made that any downturn gained’t flip into financial calamity. That is corroborated by the truth that there’s been no collapse in shopper spending, which has been supported by the resilient labor market and rising incomes.

And whereas markets have had a horrible 12 months to this point, the long-run outlook for shares continues to be optimistic.

This submit was initially revealed on TKer.co

Sam Ro is the founding father of TKer.co. Comply with him on Twitter at @SamRo

Click on right here for the most recent inventory market information and in-depth evaluation, together with occasions that transfer shares

Learn the most recent monetary and enterprise information from Yahoo Finance

Obtain the Yahoo Finance app for Apple or Android

Comply with Yahoo Finance on Twitter, Fb, Instagram, Flipboard, LinkedIn, and YouTube