The subsequent bull market is coming, but it surely’s unattainable to inform precisely when shares are going to maneuver increased. Financial uncertainty would possibly delay the subsequent large surge out there.

Nonetheless, traders can attempt to allocate belongings correctly to make sure that they will profit when the subsequent bull market does come. These two development shares beneath are prone to play an enormous position every time that happens.

Palo Alto Networks

Palo Alto Networks (NASDAQ: PANW) is among the leaders within the cybersecurity business, which is experiencing robust demand catalysts. Digital threats are an rising drawback — malicious actors are executing ransomware and different assaults at an rising price, and people assaults have gotten extra environment friendly.

Palo Alto Networks’ choices embrace firewalls and different edge safety merchandise, that are necessary for shielding any group’s community. Its product portfolio receives excessive marks from prospects and business analysts, so the demand for Palo Alto’s merchandise must be robust for years.

In the latest quarter, Palo Alto reported 20% income development together with even sooner development in remaining efficiency obligations, which is a robust indicator of future income. It additionally posted spectacular development in each working income and money flows. These are robust alerts that its gross sales development price is sustainable, and that the corporate can effectively translate these gross sales into earnings.

It is on tempo to supply greater than $2 billion in free money move over the subsequent yr, which is strictly what long-term traders wish to see.

Palo Alto Networks additionally sports activities a large financial moat, due to its scale, its mental property, and excessive prospects’ switching prices. That ought to give traders confidence in its skill to keep up its aggressive place transferring ahead. Synthetic intelligence (AI) is including further uncertainty to an already dynamic cybersecurity business, and it is arduous to foretell the long-term outcomes from a market that is in flux.

Nonetheless, Palo Alto’s important market share is unlikely to dissipate by the subsequent bull market, and the corporate is investing closely to reinforce its product portfolio with new know-how. It is prone to be some of the widespread shares in an business that ought to entice a lot of investor consideration down the highway.

Palo Alto Networks’ price-to-cash move ratio is beneath 35, which is low sufficient to create upside potential if the corporate maintains its excessive development price and profitability. With a market capitalization closing in on $100 billion, the inventory could possibly be one of many greater drivers of the subsequent bull market.

Alphabet

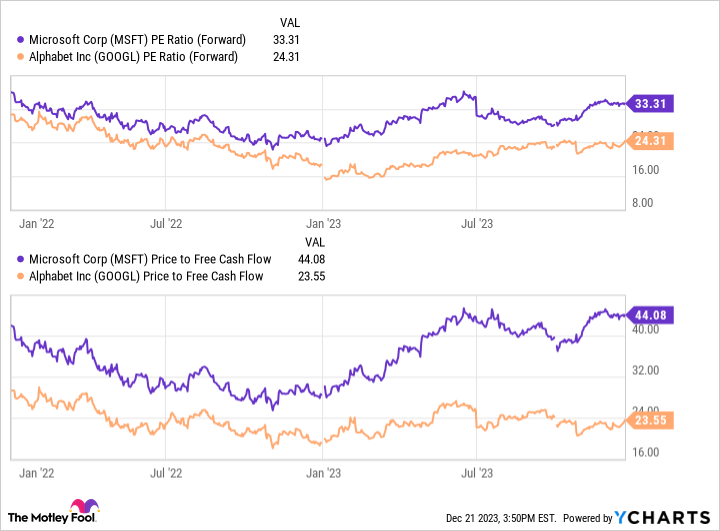

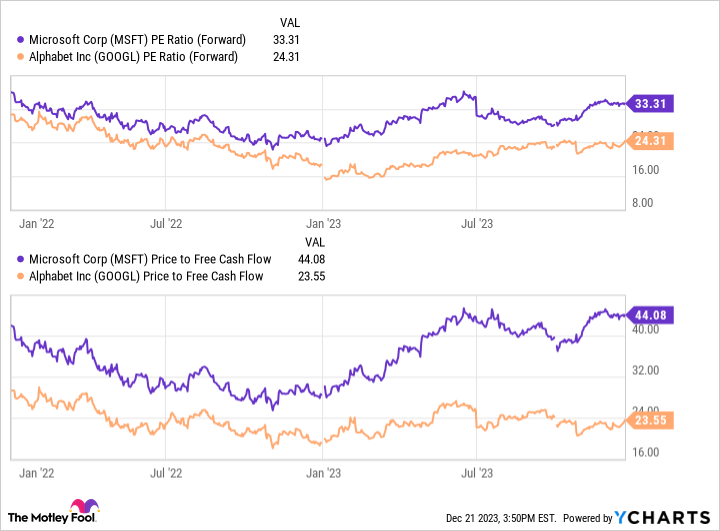

Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) is not precisely flying beneath the radar, but it surely’s change into a transparent second fiddle to its rival Microsoft in latest months. Microsoft has outperformed the Google guardian firm from the beginning of 2022 to the current, and the valuation hole between the 2 firms has widened considerably.

Alphabet is less expensive to purchase relative to free money move and forecast earnings, that are core measurements of efficiency for established companies.

There’s cheap justification for the low cost connected to Alphabet. The corporate has appeared considerably susceptible in key battles with its competitors. Microsoft has spent the previous yr impressing traders by investing in OpenAI and partnering with that firm to deliver spectacular merchandise to market, similar to ChatGPT and DALL-E, whereas Google Bard was initially acquired as a flop.

Microsoft has additionally expanded its lead over Alphabet in cloud computing by taking market share away from chief Amazon. Alphabet additionally offers with critical competitors for its Google Search and YouTube merchandise from quite a lot of various serps and social media platforms. AI is disrupting the tech world at an accelerating price, and it could possibly be bother for incumbent market leaders whose financial moats won’t be as ironclad as we used to assume.

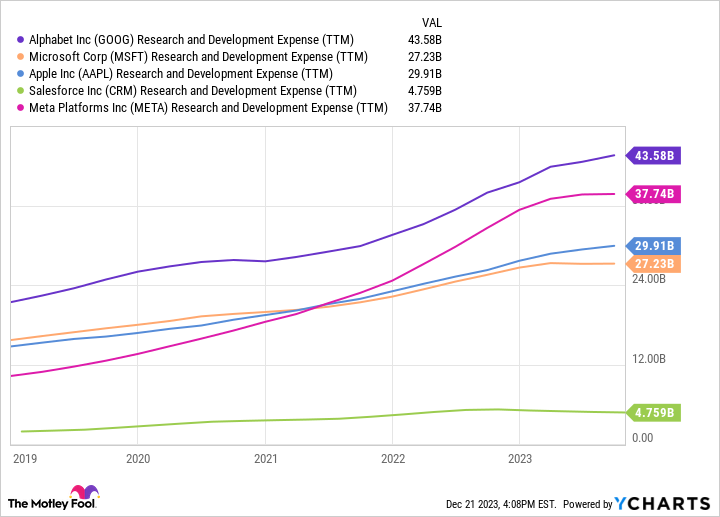

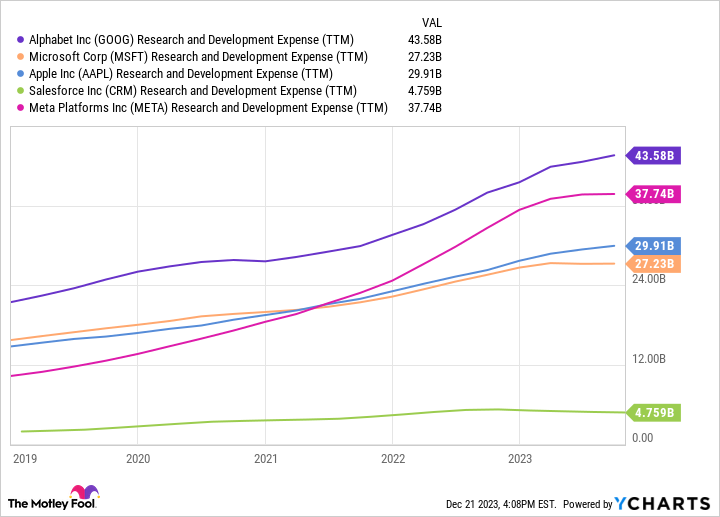

Nevertheless, the relative low cost on Alphabet shares creates a possibility for traders. Alphabet might need modestly lagged its key rivals in some methods in 2023, but it surely’s nonetheless a powerhouse. The corporate has entry to large quantities of distinctive knowledge, a shocking assortment of expertise in its group, and a $45 billion annual analysis and growth price range that ought to help its aggressive place.

The issues about aggressive pressures are truthful, however they’re considerably nitpicking relating to the subsequent bull market. Alphabet is a diversified tech large that is among the many leaders in a number of key industries, together with cloud computing, internet search, AI software program, video streaming, navigation, and cellular working programs. It additionally has significant investments in potential high-growth industries, together with well being know-how, autonomous autos, robotics, and telecommunications.

The corporate’s financial moat stays intact for now due to its large scale, community results, and deep base of mental property. Its return on invested capital (ROIC) has been over 20% for a number of years in a row, providing quantitative proof of that moat.

Alphabet is not going anyplace between now and the subsequent bull market. It is rising sooner than 10%, and that is prone to proceed for the foreseeable future. With a ahead price-to-earnings (P/E) ratio beneath 23, the inventory is priced to cost increased in a surging bull market — and with a $1.7 trillion market capitalization, Alphabet is large enough to assist energy the market itself.

Do you have to make investments $1,000 in Palo Alto Networks proper now?

Before you purchase inventory in Palo Alto Networks, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Palo Alto Networks wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of the S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Ryan Downie has positions in Alphabet, Amazon, and Microsoft. The Motley Idiot has positions in and recommends Alphabet, Amazon, Microsoft, and Palo Alto Networks. The Motley Idiot has a disclosure coverage.

These 2 Excessive-Progress Shares May Energy the Bull Market’s Subsequent Document Run was initially revealed by The Motley Idiot