Our trendy world has a voracious urge for food for metals, and good buyers can leverage that for income. The record of metals is in depth, and ranges from lesser-known uncommon components equivalent to scandium, yttrium, and gadolinium to the very important element of each battery in each digital gadget, lithium. Lithium has been rising in worth as laptops, ipads, and smartphones, with lithium-ion batteries, have proliferated, however lately the enlargement of electrical autos – and their far bigger battery packs – has pushed the value of lithium sky-high.

From an buyers perspective, this opens up a number of avenues for alternative, significantly in lithium mining and lithium processing.

In a report from B. Riley Securities, analyst Matthew Key lays out the present standing and path ahead for the lithium trade: “Lithium has arguably been the best-performing commodity because the begin of 2021, with present pricing for carbonate and hydroxide at $74,000/Mt and $80,500/Mt, respectively, primarily from battery demand for electrical autos. General, we imagine the robust outlook for EV gross sales will help strong pricing over the close to time period…”

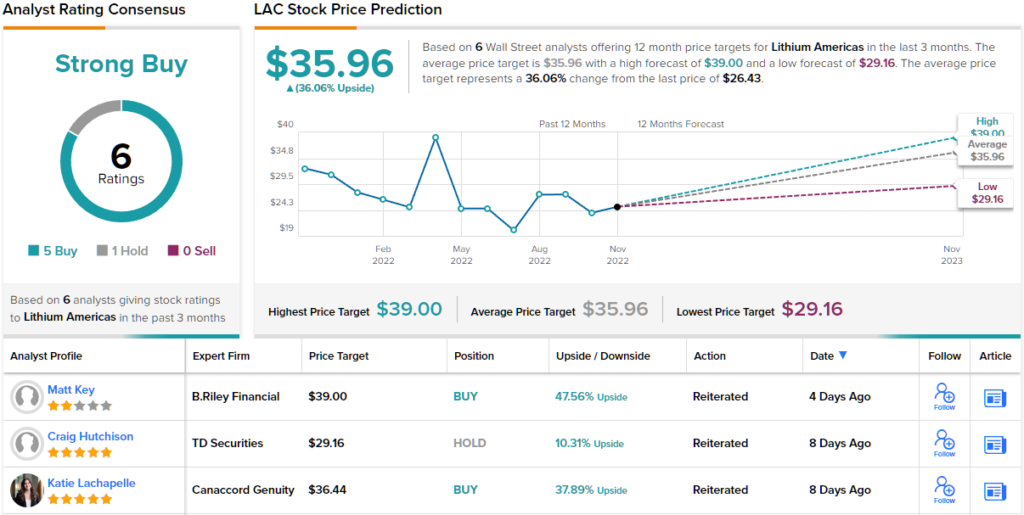

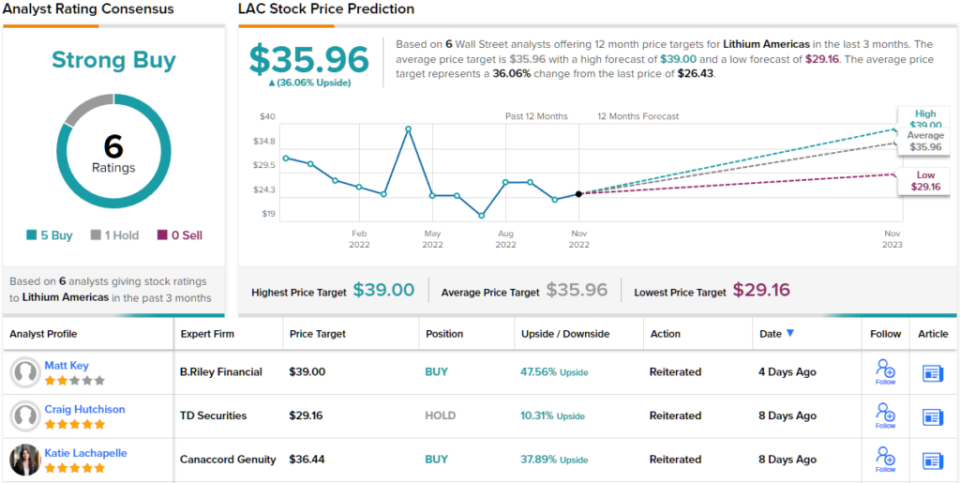

Key’s description exhibits why now could be the appropriate time for buyers to contemplate lithium, as a portfolio choice. So let’s check out two lithium shares that the analyst has given Purchase scores together with double-digit upside potential – on the order of 40% or extra. Actually, Key’s view isn’t any outlier. Working the tickers by way of TipRanks’ database, we discovered that every boasts a “Sturdy Purchase” consensus ranking from the broader analyst neighborhood.

Lithium Americas (LAC)

First up, Lithium Americas, is creating two main lithium mining and processing tasks, the Cauchari-Olaroz mine in northern Argentina and the Thacker Move mine in Nevada. Thacker Move is doubtlessly North America’s finest lithium mine, with the biggest identified lithium reserves within the US. Between the 2 tasks, Lithium Americas expects to generate roughly 100,000 tons of usable lithium yearly.

For now, the corporate continues to be in growth phases, shifting each tasks towards completion and the graduation of manufacturing. In its 3Q22 report, launched on October 27, the corporate reported continued progress on the Cauchari-Olaroz, with an replace on the manufacturing ramp-up schedule anticipated earlier than the tip of this 12 months.

Turning to Thacker Move, Lithium Americas reported that, by September of this 12 months, it had despatched 100 tons of ore from the mine for the manufacturing of product samples that may be proven to potential clients and companions. The feasibility examine, required earlier than the mine can open, is scheduled for completion in 1Q23.

Whereas Lithium Americas continues to be pre-revenue, it’s in a sound monetary place. As of September 30, the corporate had available $392 million in money and different liquid belongings, together with $75 million in obtainable credit score.

Checking in with B. Riley’s Key, we discover that he’s bullish on Lithium Americas, saying of the inventory: “LAC continues to be considered one of our favourite names in our protection group, and we imagine the completion of Cauchari in early 2023 will function a significant catalyst for the inventory. Importantly, the rise in near-term carbonate pricing benefited the earnings potential of Cauchari significantly, and we at the moment are estimating $332M in EBITDA for 2023E and $385M for 2024E.”

It ought to be unsurprising, then, that Key charges LAC a Purchase. To not point out his $41 value goal places the upside potential at ~48%. (To look at Key’s observe file, click on right here)

It’s clear from the consensus ranking, a Sturdy Purchase supported by 5 Purchase scores out of 6 analyst evaluations, that Wall Avenue is bullish on this lithium firm. As for upside, the shares are buying and selling at $26.43 and their $35.96 common value goal suggests a acquire of 36% within the coming 12 months. (See LAC inventory forecast at TipRanks)

Piedmont Lithium (PLL)

The subsequent inventory we’ll have a look at is Piedmont Lithium, a lithium mining and processing agency which, like LAC above, continues to be within the growth course of. The corporate’s purpose is to show the US into a significant participant within the international lithium provide chain. It’s a practical purpose; the US has roughly 17% of the world’s confirmed lithium reserves, and with present US manufacturing averaging solely 2% of present provide, there’s loads of room for enlargement right here.

Piedmont is working to deliver mining belongings in North Carolina on-line, and its fundamental actions are on the Carolina Tin Spodumene belt, not removed from Charlotte. The corporate holds 1,100 acres in that area, and is on observe to start development actions in 2024. Spodumene focus manufacturing is scheduled to start in 2026, with a purpose of 30,000 tons yearly at full manufacturing capability.

The corporate’s different main undertaking is situated in Tennessee, the place the corporate has chosen a web site for a 30,000 ton capability lithium hydroxide plant, with manufacturing focused for 2025. The corporate’s Tennessee lithium undertaking has lately been chosen by the US authorities to obtain a $141.7 million grant from the US Division of Power, as a part of the Biden Administration’s latest infrastructure regulation.

Outdoors of the US, Piedmont has partnerships with lithium mining tasks in Quebec, on the North American Lithium (NAL) undertaking in Val d’Or, and in Ghana, within the Ewoyaa undertaking. Piedmont invested in these tasks in 2021, and expects to learn from 168,000 tons annual manufacturing of spodumene focus in Quebec, beginning in 2023, and from 30.1 million tons of identified Li2O reserves on the Ewoyaa mine. Whereas the Quebec and Ghana tasks are primarily based on smaller reserves than Piedmont has within the Carolina, they’re anticipated to go surfing at an earlier date.

Analyst Matthew Key lately bumped up his value goal on Piedmont Lithium’s inventory, and wrote of his determination: “Our PT for Piedmont elevated for 2 major causes. First, the rise in long-term hydroxide costs from $16,000/Mt to $18,000/Mt was extremely accretive to Piedmont’s hydroxide tasks in Carolina and Tennessee. In whole, the adjustment added roughly $338M in NAV worth for each belongings. As well as, the rise in long-term spodumene costs from $900/Mt to $1,200/Mt additionally benefited the NAV of the corporate’s two spodumene belongings.”

To this finish, Key charges the shares a Purchase, and his new value goal, set at $108, signifies room for ~75% upside potential within the shares.

General, there are 4 analyst evaluations on this pre-production lithium firm, and all are optimistic, making the Sturdy Purchase consensus ranking unanimous. The shares are priced at $61.56 and their $108.75 common value goal suggests a acquire of ~77% within the subsequent 12 months. (See PLL inventory forecast at TipRanks)

To seek out good concepts for lithium shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally essential to do your individual evaluation earlier than making any funding.