With two full months of 2023 behind us, it’s arduous to say simply how this yr goes to form up. January noticed a robust rally, whereas February was unstable and market analysts and economists are nonetheless debating the place the long-term developments will head.

However what can the retail investor do, whereas the professionals are debating? A flip to the info could yield some solutions – and provides clues towards compelling shares. The Sensible Rating knowledge device from TipRanks is specifically designed to chop by way of the fog of uncertainty. The Sensible Rating algorithm gathers the aggregated knowledge on practically 9,000 publicly traded shares, after which it measures the info and the shares in opposition to a set of things, 8 in all, which have all confirmed efficient predictors of future share outperformance. Every inventory is given a rating, a easy digit on a scale of 1 to 10, with a ‘excellent 10’ indicating that every thing is in alignment – and indicating that buyers ought to pay nearer consideration to this one.

So, to get began, we’ve pulled up the TipRanks knowledge on two healthcare-related shares which have each earned the Sensible Rating’s excellent 10. At first look, these are each Robust Purchase-rated shares with double-digit upside potential for the yr to return. Some nearer consideration could tell us simply what else makes these two shares so compelling proper now.

Agios Prescription drugs, Inc. (AGIO)

First up is Agios Pharma, an organization centered on mobile metabolism and the event of latest therapies for genetically outlined extreme illnesses. The corporate’s preliminary focus has been on therapeutic brokers for hemolytic anemias, a severe situation outlined by the lack of crimson blood cells quicker than the physique can exchange them. Hemolytic anemias are often symptomatic of an underlying situation, and Agios’ first drug candidate, mitapivat, has already been accepted for the therapy of grownup PK deficiency (PKD).

That approval got here in Febuary of final yr, and the corporate has been engaged on the commercialization of mitapivat, branded as Pyrukynd, since then. Within the fourth quarter of 2022 – the final quarter reported – Agios confirmed product revenues from Pyrukynd gross sales totaling $4.3 million. The corporate had accomplished prescription enrollment varieties from 105 distinctive sufferers on the finish of 4Q22, and a complete of 78 sufferers on Pyrukynd prescriptions. These 78 sufferers characterize a 39% quarter-over-quarter enhance.

The sturdy launch of Pyrukynd is just not Agios’ solely catalyst. The corporate at present has mitapivat below investigation in a number of human scientific trials, with the 2 main ones being a Part 2 trial in opposition to sickle cell illness and a Part 3 trial in opposition to thalassemia. Necessary occasions this yr embrace completion of enrollment within the Part 3 ENERGIZE and ENERGIZE-T research of Pyrukynd/mitapivat within the therapy of thalassemia, and on the sickle cell observe, a Part 2 knowledge readout and the ‘go/no go’ resolution on development to a Part 3 trial – anticipated by mid-year.

Turning to the Sensible Rating, we discover that three explicit elements are strongly optimistic, supporting this inventory’s Good 10. On the technical aspect, the straightforward shifting common, a measure of the inventory’s value pattern, registers optimistic, whereas the monetary bloggers, who’re often most fickle about their selections, are 100% bullish right here. And of the hedge funds tracked by TipRanks, holdings in AGIO elevated by 515,000 shares final quarter.

The important thing factors for Piper Sandler analyst Christopher Raymond revolve across the firm’s capacity to take a number of pictures on aim with one drug product. As Raymond writes, “[We] consider the corporate’s lead asset – Pyrukynd (mitapivat) – has novel MoA (mechanism of motion) to deal with hemolytic anemia in a number of uncommon illnesses. Whereas already accepted in an ultra-rare illness, PK deficiency (PKD) in adults, we consider that actual worth drivers for AGIO shall be approval in bigger indications together with your entire thalassemia spectrum (not simply beta-thalassemia) and sickle cell illness (SCD), for which growth is at present underway. Given the promising PoC (proof of idea) and efficacy knowledge to date in each these indications, we consider that Pyrukynd has the potential to change into a real pipeline-in-a-product driving significant upside for the inventory.”

Primarily based on the above, Raymond provides AGIO an Chubby (Purchase) score, and his $41 value goal implies a 68% upside potential for the approaching yr. (To look at Raymond’s observe report, click on right here.)

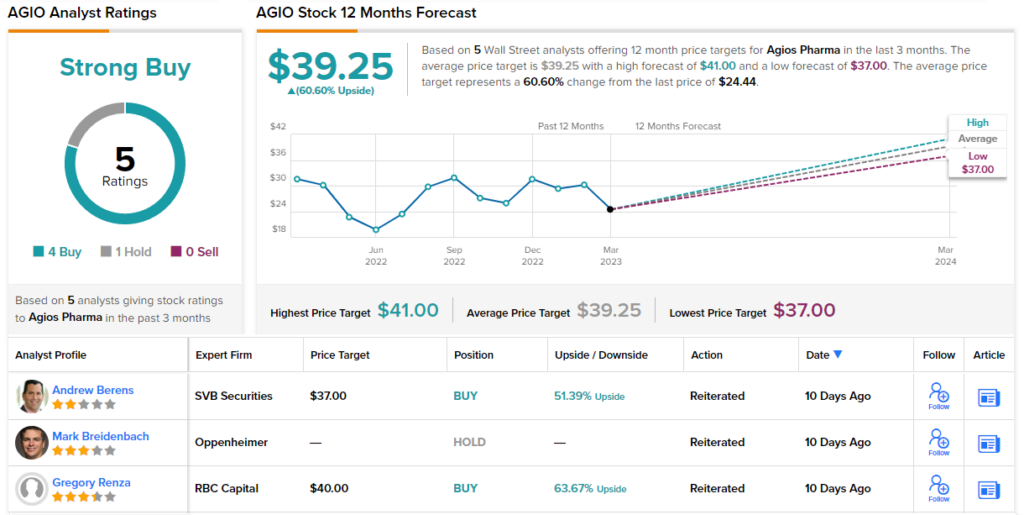

Whereas the Piper Sandler view is especially bullish, the Avenue can be typically optimistic about Agios. The corporate has 5 current analyst rankings on file, together with 4 to Purchase and 1 to Maintain, for a Robust Purchase consensus score. With a median value goal of $39.25 and a present buying and selling value of $24.44, the inventory has an upside of 61% out to the one-year time horizon. (See Agios’ inventory forecast at TipRanks.)

Prometheus Biosciences (RXDX)

The second inventory on our Good 10 listing is Prometheus Bioscience, a biopharma agency creating new therapies for autoimmune gastrointestinal circumstances, significantly inflammatory bowel illnesses (IBD). Prometheus is following a biomarker-targeted strategy to create therapeutic brokers, utilizing a novel profile for every affected person. This mode of therapy, patient-centric, provides an opportunity to remodel the therapy of immune-related intestinal circumstances.

Whereas most of this firm’s pipeline remains to be in pre-clinical discovery phases, the lead drug candidate, PRA023, has proven promise within the therapy of each Crohn’s illness and ulcerative colitis (UC). This previous December, Prometheus underlined that promise when it introduced strongly optimistic leads to two Part 2 scientific trials of PRA023, within the therapy of each Crohn’s and UC. On the Crohn’s observe, the APOLLO Part 2 trial demonstrated the drug’s effectiveness in decreasing irritation and lowering fibrosis; in all, the trial produced a 49.1% remission price. Alongside that, the ARTEMIS trial within the therapy of UC achieved its major endpoint, with 26.5% of sufferers getting into a scientific remission. Drug security ranges and tolerance had been acceptable in each trials.

This was large information for Prometheus, and the inventory spiked on the announcement. RXDX was buying and selling at $36 on December 6, 2022; by December 8, the inventory was as much as $117 – and it stays at these elevated ranges. The corporate moved rapidly to money in on this scientific success by way of an upsized public inventory providing, placing greater than 4.5 million shares available on the market. This sale, an occasion that may often lead to dilution and value discount, raised $470.5 million in internet proceeds – and didn’t dent the share value. Prometheus has already acknowledged that it’s going to use the brand new funds to assist its ongoing scientific applications.

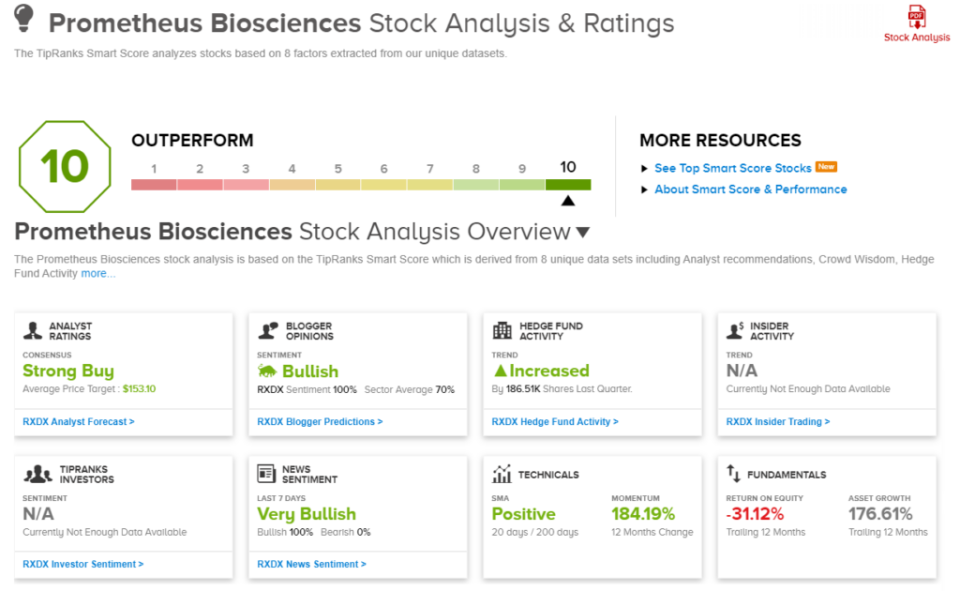

Once we have a look at Prometheus’ Sensible Rating, we discover that many of the elements are swinging strongly optimistic. These embrace 100% optimistic blogger sentiment, and ‘very optimistic’ crowd sentiment – with 8.7% will increase in holdings for the previous 30 days. The hedges additionally elevated their holdings right here, by 186,500 shares final quarter, and the technical elements present a optimistic easy shifting common and a 12-month upward momentum of 184%.

Michael Yee has written Jefferies’ protection on this inventory, and sees the energetic pipeline as the important thing level for buyers right here. Noting the corporate’s current successes, he goes on to stipulate its potential as an acquisition goal. Yee says of Prometheus, “[The] story is more and more enticing given two late-stage research for giant indications and a pleasant cadence of catalysts for early-stage applications which all ought to preserve buyers excited and make the inventory very fascinating in 2023 and 2024. Finally we expect RXDX is a horny strategic asset for large pharma given the perfect IBD knowledge to this point of any drug. ARNA was acquired for $7B and RCPT acquired for $7B for his or her S1P1 oral UC medication and RXDX to date has a lot better efficacy.”

What this provides as much as, in Yee’s view, is a Purchase score for RXDX and a value goal of $160 indicating potential for the inventory to develop 27% this yr. (To look at Yee’s observe report, click on right here.)

Yee is bullish – however he’s removed from the one bull on the Avenue. All 10 of the current analyst opinions listed here are optimistic, all naturally culminating in a Robust Purchase consensus score. The present buying and selling value is $125.73, and the common value goal of $153.10 suggests a one-year upside potential of twenty-two%. (See Prometheus’ inventory forecast at TipRanks.)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely necessary to do your personal evaluation earlier than making any funding.