Amidst the noise of blue-chip giants, penny shares quietly beckon buyers with the attract of undiscovered potential. For these keen to dive deep into the market’s undercurrents, these low-priced equities promise a treasure trove of alternative.

The ‘pennies’ are shares priced beneath $5 per share, and basic math tells us that even a small achieve in absolute worth will shortly flip right into a high-percentage return.

What’s the flip aspect? Minor share value depreciation can gasoline main proportion losses. By nature of those large actions, penny shares are notoriously unstable.

The analysts at Piper Sandler are keen to shoulder this threat – and they’re recommending two pennies specifically for large achieve. Based on the analysts, these two shares may bounce at the least 300% within the coming 12 months.

Based on the TipRanks database, each have additionally been cheered by the remainder of the Road, as they boast a ‘Sturdy Purchase’ consensus ranking. Let’s take a better look.

Zura Bio (ZURA)

We’ll begin with a clinical-stage biopharmaceutical firm, Zura Bio. This firm is specializing in the creation of recent medication within the discipline of immunology, particularly within the remedy of autoimmune and inflammatory situations. Zura is following a dual-pathway strategy, to satisfy sufferers’ therapeutic wants and supply a tangible enchancment to their well-being. To this finish, the corporate has three property within the improvement pipeline, all of which have accomplished Section 1 scientific trials and are thought of able to advance to Section 2.

The corporate’s main asset is tibulizumab, an anti-IL-17 and anti-BAFF twin antagonist that’s probably first in its class for the remedy of each hidradenitis suppurativa (HS) and systemic sclerosis (SSc). The primary of those situations is an inflammatory follicular pores and skin illness and is estimated to impression between 300,000 and 400,000 sufferers within the US. The second situation is an autoimmune illness inflicting tissue irritation and fibrosis and is probably deadly. Tibulizumab confirmed promise in early testing and is at present scheduled to provoke a Section 2 research within the remedy of SSc throughout 4Q24, in addition to a Section 2 research in HS throughout 2Q25.

The corporate’s second asset is ZB-168, described as a ‘totally human-IgG1 monoclonal antibody focused in opposition to the IL-7Rα,’ a pathway that performs an vital position within the improvement, functioning, and homeostasis of immune system T cells. Zura believes that ZB-168 provides promise as a therapeutic selection for autoimmune illnesses that contain the IL-7 or TSLP signaling paths.

Lastly, Zura is working with torudokimab, its third drug candidate. This drug is one other monoclonal antibody, described as totally human and excessive affinity. Torudokimab’s motion is described by the corporate as neutralizing IL-33, stopping ST2-dependent and ST2-independent (e.g., RAGE) irritation.

Based mostly on the potential of Zura’s stable set of property, and its $3.43 share value, Piper Sandler analyst Yasmeed Rahimi thinks that now’s the time to get in on the motion.

“Zura Bio is a scientific stage biotech firm that’s thoughtfully creating a pipeline of best-in-class antibodies that act throughout twin pathways for the remedy of illnesses throughout irritation and immunology with excessive unmet want… ZURA has 3 differentiated property in Ph2 improvement throughout 4 indications, the place we level out that every one of those compounds have been in-licensed from main massive pharma corporations comparable to Eli Lily and Pfizer, considerably de-risking these property and positioning ZURA for speedy commercialization in our view,” Rahimi famous.

“Contemplating the multitude of upcoming catalysts with 9 in IL-17/BAFF, 14 in IL-7 and TSLP, and 5 in IL-33, we imagine these catalysts will drive vital share beneficial properties as they validate the potential for pipeline enlargement alternatives, opening the door for a ‘pipeline-in-a-product’ and unlocking additional sequential worth throughout every of ZURA’s property,” Rahimi added.

To this finish, Rahimi charges ZURA inventory an Chubby (i.e. Purchase), and her value goal of $26 implies a sturdy one-year upside potential of 659%. (To observe Rahimi’s observe file, click on right here)

Are different analysts in settlement? They’re. 4 Buys and no Holds or Sells have been issued within the final three months. So, the message is obvious: ZURA is a Sturdy Purchase. Given the $21.33 common value goal, shares may soar ~523% from present ranges. (See ZURA inventory forecast)

Monte Rosa Therapeutics (GLUE)

The second penny inventory on the listing of Piper Sandler picks is Monte Rosa, one other biopharmaceutical firm. Monte Rosa is working with protein degradation to develop new remedy approaches for a wide range of illness situations. The corporate got here to this strategy via the belief that many human illness situations are brought about or exacerbated by irregular intracellular protein perform, particularly, irregularities in protein degradation, the method by which outdated, nonfunctioning, or irregular proteins are damaged down and cleared from wholesome cells and tissues.

Monte Rosa makes use of molecular glue degraders (MGDs) to induce protein-protein interactions, and to allow the elimination of focused proteins. The corporate believes that this strategy could open up new remedy choices, by the elimination of therapeutically related proteins which have resisted remedy by the present panoply of small molecule medication available on the market.

For now, Monte Rosa is working with MGDs that promote degradation of focused proteins by facilitating interactions between these focused proteins and a ubiquitin ligase. The MGDs bind to the ubiquitin ligases, and create new surfaces on the focused proteins. These surfaces are complementary to the therapeutically related targets, and permit promotion of protein degradation. The corporate makes use of its QuEEN platform, a proprietary know-how, to rationally design, develop, and deploy the MGDs.

The main drug candidate, created on the QuEEN platform, is MRT-2359. This MGD is ‘potent, selective, and orally bioavailable,’ and is designed to advertise focused degradation of the GSPT1 protein, via induction of interactions between cereblon (CRBN), a element of the E3 ubiquitin ligase and the interpretation termination issue GSPT1. This drug candidate is advancing in an ongoing Section 1/2 scientific trial, and knowledge from the Section 1 section is anticipated for launch throughout 2H24.

This firm’s novel strategy and early success with its QuEEN platform have caught the attention of Piper Sandler analyst Edward Tenthoff.

“Whereas computational approaches are frequent in protein degradation, QuEEN is refined and complete, enabling the corporate to rationally design MGDs… Importantly, QuEEN is now quickly yielding MGDs in opposition to therapeutically related targets. We anticipate Monte Rosa to create shareholder worth by reporting scientific knowledge on MRT-2359, and by advancing and increasing its early MGD pipeline, and probably signing extra partnerships… We see the chance for Monte Rosa to shut the valuation hole with different TPD performs Arvinas and Kymera…”

In Tenthoff’s view, GLUE shares deserve an Chubby (i.e. Purchase) ranking, and his $16 value goal on the inventory suggests {that a} 12-month achieve of 315% lies forward. (To observe Tenthoff’s observe file, click on right here)

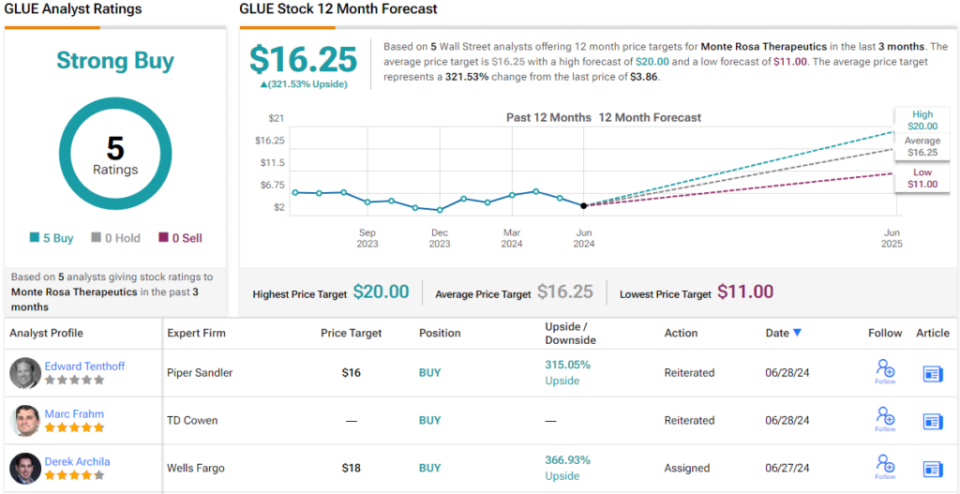

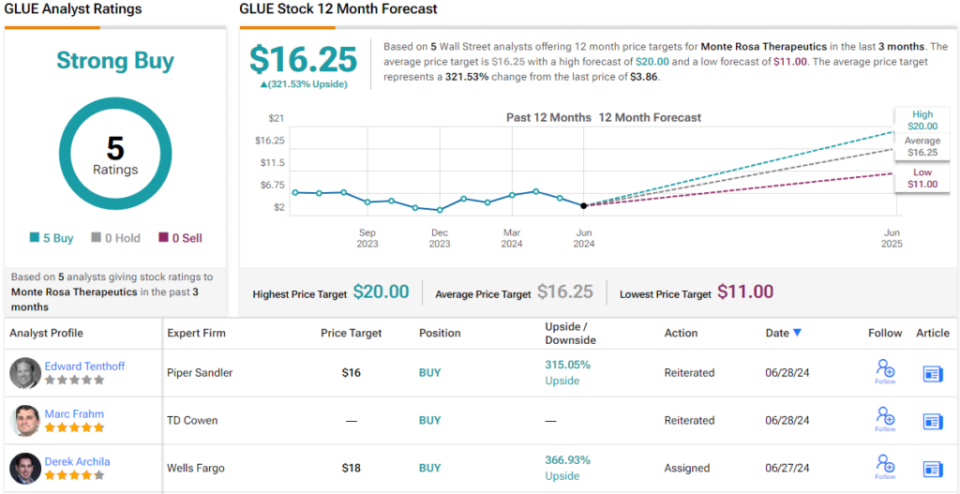

Do different analysts agree? They do. Solely Purchase rankings, 5, actually, have been issued within the final three months, so the consensus ranking is a Sturdy Purchase. The shares are buying and selling for $3.86 and their $16.25 common goal value signifies room for a 321% improve from that stage. (See GLUE inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather vital to do your personal evaluation earlier than making any funding.