The inventory market has been scorching scorching in 2023. The S&P 500 has gained almost 25% on the 12 months, whereas the tech-heavy Nasdaq has zoomed greater than 40%. Which means bargains are few and much between lately.

Nevertheless, the market did mark down a number of high-quality shares this 12 months. Brookfield Infrastructure (NYSE: BIPC)(NYSE: BIP), Kinder Morgan (NYSE: KMI), and Stag Industrial (NYSE: STAG) have underperformed and now commerce at discount costs and better dividend yields. These enticing payouts will present their buyers with the present of recurring revenue in 2024 and past.

Progress on sale

Shares of Brookfield Infrastructure are roughly flat this 12 months. It has gotten considerably cheaper, contemplating its funds from operations (FFO) are on observe to rise by greater than 10% per share to round $3.00. With shares just lately buying and selling arms at about $36 apiece, Brookfield sells for roughly 12 instances FFO. That is a discount in comparison with the broader market. The S&P 500 trades at over 21 instances earnings whereas the Nasdaq fetches greater than 28 instances earnings.

Brookfield’s discount value is a giant motive why it presents a high-yielding dividend (at present 4.3% in comparison with the 1.5% dividend yield of the S&P 500). That already high-yielding payout ought to head even increased in 2024 and past. Brookfield goals to extend it by 5% to 9% per 12 months. It has delivered 8% compound annual dividend progress since 2013.

The corporate has loads of gas to extend its dividend. Its natural drivers (inflation-linked price will increase, quantity progress as the worldwide financial system expands, and growth initiatives) ought to enhance its FFO per share by 6% to 9% yearly. With inflation nonetheless elevated and a report capital venture backlog, Brookfield is in a wonderful place to ship high-end natural progress over the following few years. In the meantime, the corporate has closed a number of acquisitions this 12 months (a number one international container leasing firm and three information heart platforms), placing it in a powerful place to ship double-digit progress once more in 2024.

A bottom-of-the-barrel valuation

Kinder Morgan’s inventory value is down barely this 12 months, although it is having one other stable 12 months. The pure gasoline pipeline large produces very secure money move, giving it the funds to pay a high-yielding dividend whereas investing in increasing its midstream operations.

Kinder Morgan’s dividend at present yields 6.4%, placing its yield within the high 5% of these within the S&P 500. The corporate has already revealed plans to lift its cost by one other 1.8% subsequent 12 months, which might be its seventh consecutive 12 months of dividend progress.

The corporate’s dust low cost valuation is the primary driver of its big-time dividend yield. Kinder Morgan at present expects to supply $5 billion, or $2.21 per share, of distributable money move subsequent 12 months (up 5% from 2023). With its inventory just lately buying and selling at lower than $18 per share, Kinder Morgan sells for round eight instances its money move. That is scraping the underside of the valuation barrel.

In the meantime, there’s upside to its 2024 progress plan. The corporate agreed to amass STX Midstream in a $1.8 billion deal, which ought to shut early subsequent 12 months. Even with that acquisition, the corporate has large monetary flexibility to make extra investments and opportunistically repurchase shares, which might additional enhance its money move per share.

Nonetheless comparatively low cost regardless of the rally

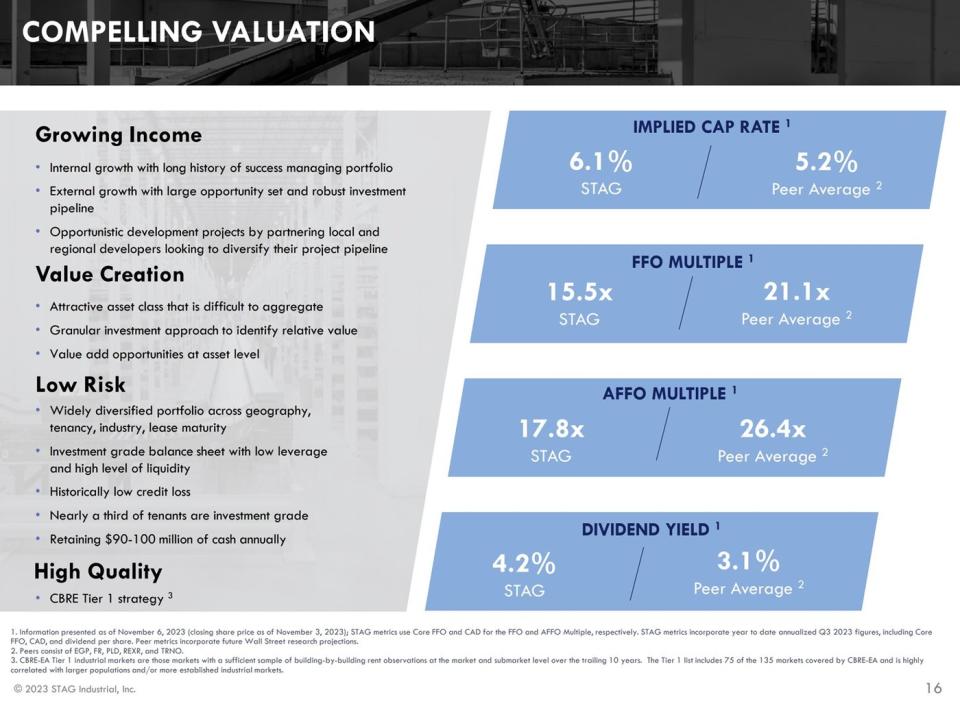

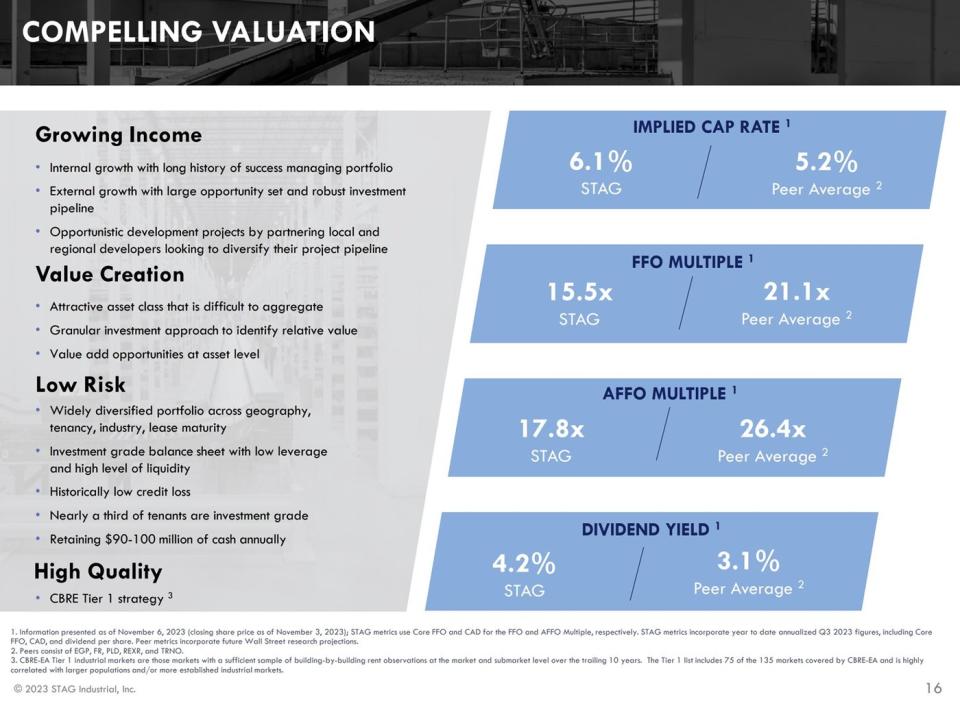

Whereas Stag Industrial has rallied about 20% this 12 months, it is nonetheless a relative discount. The industrial REIT trades at a way more compelling valuation in comparison with its friends:

As that slide exhibits, it is a greater worth than its friends throughout each metric. That is regardless of the corporate benefiting from the identical catalysts which might be driving progress throughout the economic actual property sector. For instance, the REIT just lately unveiled that it signed two 63-month early renewal leases for warehouse and distribution house with a tenant. The rental price on the renewal leases was a staggering 49.8% above the prior time period’s expiring rental price. In the meantime, the rental price will escalate by 3% yearly for the lease time period.

The corporate has quite a lot of long-term leases set to run out within the coming years, positioning it for outsized rental progress. On high of that, it has the monetary flexibility to proceed making accretive acquisitions. The corporate spent $204 million to amass a dozen buildings within the third quarter at a median cap price of 6.7%, which is even cheaper than its valuation. These progress drivers will improve Stag Industrial’s revenue, enabling the REIT to proceed rising its dividend (which it has achieved yearly because it got here public in 2011).

Give your self the present that retains on giving this vacation season

Brookfield Infrastructure, Kinder Morgan, and Stag Industrial have underperformed the market this 12 months. Due to that and their earnings progress, they commerce at discount costs and enticing dividend yields. That makes them nice shares to purchase this vacation season. They may produce enticing whole returns in 2024 as they develop their earnings and dividends.

Do you have to make investments $1,000 in Kinder Morgan proper now?

Before you purchase inventory in Kinder Morgan, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Kinder Morgan wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Matthew DiLallo has positions in Brookfield Infrastructure, Brookfield Infrastructure Companions, Kinder Morgan, and Stag Industrial. The Motley Idiot has positions in and recommends Kinder Morgan and Stag Industrial. The Motley Idiot recommends Brookfield Infrastructure Companions. The Motley Idiot has a disclosure coverage.

Vacation Sale: These 3 Dividend Shares Are Discount Buys This Vacation Season was initially revealed by The Motley Idiot