As we head into the ultimate stretch of 2022, with lower than three weeks till we flip the web page to 2023, the markets and the financial system are sending a sequence of blended indicators. Shares have leveled out considerably over the previous month, with diminished volatility in comparison with the earlier six months. On the similar time, traders should take into account the financial indicators – particularly persistently excessive inflation and uncertainty over the Federal Reserve’s rate of interest determination this week. It’s a troublesome setting for making inventory selections.

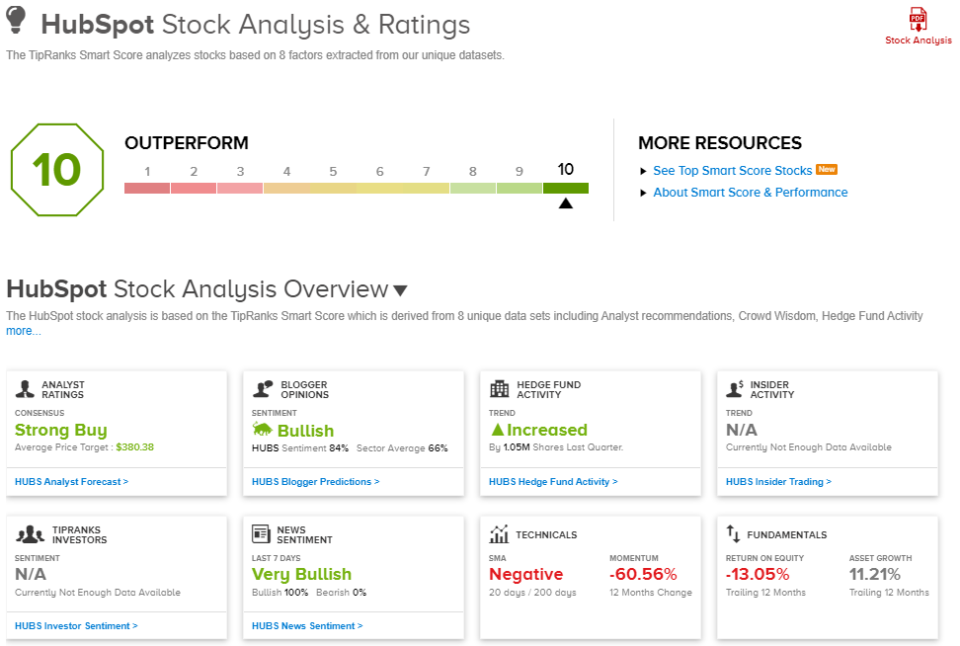

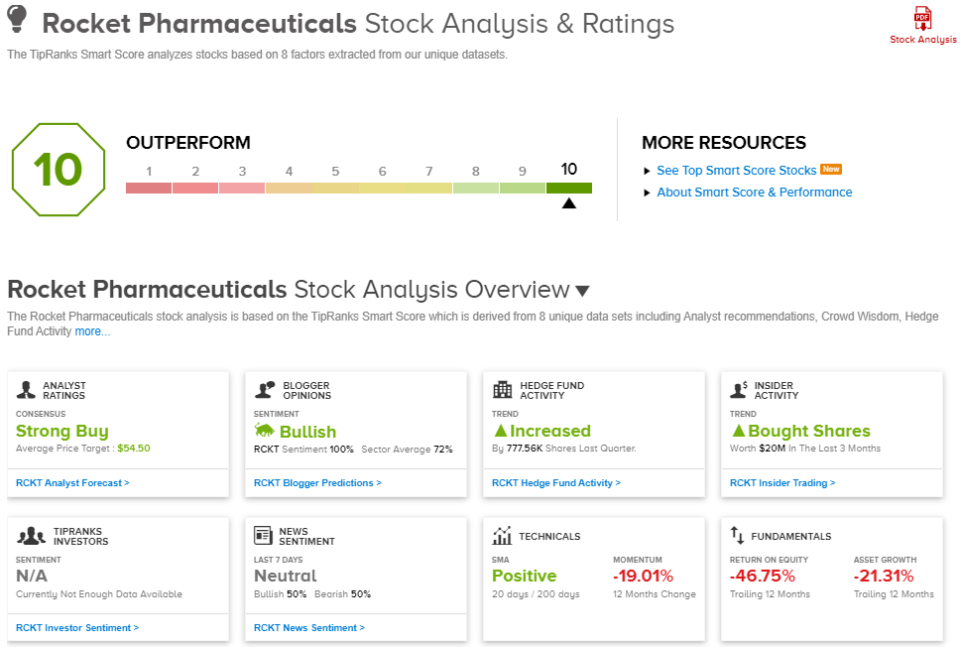

What’s wanted right here is a straightforward software that may minimize by way of the noise and provides an easy-to-read, data-driven signal on any explicit inventory. That’s the place the TipRanks Sensible Rating is available in, an analytic software that takes the flood of uncooked market knowledge and breaks it down by a sequence of 8 readily identifiable components, every of which is thought to match as much as future outperformance. Taken collectively, and distilled right into a single-digit rating, these components give a helpful pointer for every inventory. The Sensible Rating score comes on a scale of 1 by way of 10, with a Good 10 being the best, and the clearest signpost for traders.

A choose few shares will decide up the ‘Good 10’ rating, the best score from the Sensible Rating. Are these the appropriate ones on your portfolio? In keeping with the algorithms, they verify all of the bins for features within the 12 months forward; we’ve pulled up particulars on three of them to search out out what makes them tick. Right here they’re, together with commentary from the Avenue’s analysts.

HubSpot, Inc. (HUBS)

We’ll begin within the tech world the place HubSpot is a well known identify in on-line inbound advertising and marketing, and has a repute as an innovator within the area. HubSpot affords its clients – social media specialists, CRM specialists, content material managers, and search engine optimisation optimizers – a robust line-up of net analytic merchandise, utilizing the freemium mannequin. Beneath this mannequin, fundamental companies can be found to customers freed from cost, with higher-level choices and upgrades out there as paid subscriptions.

HubSpot’s software program is in 6 languages, and is in use in additional than 120 international locations by greater than 158,000 paying clients. That metric comes from the 3Q22 monetary outcomes, and represents a 24% enhance year-over-year. The corporate’s subscription mannequin is worthwhile, and HubSpot introduced in over $11,000 on common, in subscription income per buyer in Q3, up 7% for the year-ago interval. Complete income in 3Q22 was reported at $444 million, for a 31% y/y achieve. Subscription income made up $435 million of that complete, and was up 32% from 3Q21.

On earnings, the corporate reported each positives and negatives. In GAAP phrases, HubSpot posted a quarterly internet lack of $31.4 million, or 65 per share. This was considerably deeper that the GAAP internet loss posted in 3Q21. Then again, in non-GAAP figures, internet earnings was optimistic, at $35.1 million, or 69 cents per diluted share, representing a 37% enhance within the internet and a 38% enhance within the diluted EPS.

Nevertheless, the inventory, like so many others, has taken a sound beating this 12 months, and shares now commerce at a 56% low cost to the worth originally of 2022.

That might be a possibility, in keeping with the thesis laid out by Credit score Suisse analyst Wealthy Hilliker.

“We consider HubSpot is positioning itself as the subsequent entrance and center workplace software program chief and that its value-led development technique is strongly resonating with clients in any respect phases of their lifecycles, resulting in higher standardization and eventual enlargement… We consider the mix of considerate, diligent, and continued product improvement, coupled with a well-trodden, pure freemium to paid conversion movement, has resulted in a deeply compelling product and value-led development algorithm that’s getting clients ‘Hooked on Hubs,'” Hilliker opined.

To this finish, Hilliker charges HUBS an Outperform (i.e. Purchase), with a $400 value goal that means a one-year achieve of 37%. (To look at Hilliker’s monitor file, click on right here)

General, tech corporations like HubSpot by no means lack for analyst consideration, and HUBS shares have 21 current analyst evaluations on file. These break down 19 to 2 in favor of Buys over Holds, for a Sturdy Purchase consensus score. With a buying and selling value of $291.38 and a median value goal of $380.38, the inventory boasts a possible upside of ~31%. (See HUBS inventory evaluation on TipRanks)

Vaxcyte, Inc. (PCVX)

The following ‘excellent 10’ inventory we’re taking a look at is Vaxcyte, a biotech agency concerned in vaccine analysis, engaged on prophylactic vaccines towards a spread of great bacterial infections, together with pneumococcal illness, Group A strep, and periodontitis. The corporate’s analysis tracks are primarily based on Vaxcyte’s proprietary cell-free protein synthesis platform, XpressCF, and the goal is to create vaccines that function distinct antigens and protein carriers – essential constructing blocks important to vax efficacy.

The corporate’s analysis pipeline at the moment options 4 tracks, with three of them at the moment at pre-clinical phases. The fourth, VAX-24, is underneath improvement as a preventative for invasive pneumococcal illness and pneumonia. VAX-24 is a 24-valent pneumococcal conjugate vaccine (PCV) candidate, and knowledge launched on the finish of October was extremely optimistic, assembly a number of milestones. The topline knowledge from the Section 1/2 proof-of-concept examine confirmed optimistic outcomes on security, tolerability and immunogenicity in any respect doses, and supplied assist for the corporate to maneuver ahead with a Section 3 trial primarily based on the two.2mcg dose. The examine was carried out with wholesome adults aged 18 to 64. Trying forward, Vaxcyte is planning to conduct regulatory discussions re: Section 3 trial throughout 2H23, and expects to have Section 3 knowledge out there in 2025.

The market response to the info launch exhibits why biotech shares may be standard with traders – the shares jumped 60% in at some point, and at the moment are buying and selling at roughly double their October 20 valuation.

Vaxcyte took benefit of the bounce in share value to make a public providing of inventory. The corporate put 17,812,500 shares of frequent inventory in the marketplace, at $32 every, and with the underwriters choices totally subscribed, realized $690 million in gross proceeds from the sale.

Trying forward, BTIG analyst Thomas Shrader sees loads of energy within the firm’s pipeline and its potential addressable market. He writes, “The corporate’s vaccines look poised to turn into best-in-class within the practically $40 billion infectious illness vaccine market… Many of the present worth of the inventory is predicated on the lead program VAX-24 and the current P1/2 readout leaves the vaccine poised to be BIC on this $7 billion market that would double within the subsequent decade…”

“It’s arduous to think about a stronger readout than the current P1/2 knowledge for VAX-24 with all three doses demonstrating a profile more likely to assist approval and all three doses exhibiting an AE profile basically an identical to much less efficient however already authorized vaccines,” Shrader added.

Shrader provides a Purchase score to his commentary on Vaxcyte, and completes his bullish stance with a $69 value goal, indicating his confidence in an upside of ~63% for the subsequent 12 months. (To look at Shrader’s monitor file, click on right here)

General, Vaxcyte has picked up 4 current analyst evaluations, and they’re all optimistic – making the Sturdy Purchase consensus score unanimous. The shares final closed at $42.39 and have a median value goal of 61.75, implying a ~46% upside by the tip of subsequent 12 months. (See PCVX inventory evaluation on TipRanks)

Rocket Prescribed drugs (RCKT)

Many people are born with issues for which there isn’t any remedy, or for which solely meager remedies exist to enhance their high quality of life. Nevertheless, with gene remedy, it’s stated that whole illnesses may be eradicated after only one remedy that targets their supply.

The following inventory, Rocket Pharma, is a gene remedy firm concerned within the improvement of latest remedies for extreme ailments with ‘excessive unmet medical wants.’ The corporate makes use of gene remedy strategies to adapt viruses as supply methods, able to inserting new genetic info straight into the disease-affected cells, changing the inaccurate or broken genes and altering the cell on the genetic and molecular ranges to cut back the illness presentation. Probably, these therapies provide potential for cures of the focused ailments, reasonably than palliative care.

The corporate’s pipeline options lively applications engaged on gene therapies for a number of terminal cancers and extreme pediatric circumstances. Focused ailments embrace Danon Illness, Fanconi Anemia (FA), Leukocyte Adhesion Deficiency (LAD-I), and Pyruvate Kinase Deficiency (PKD), and the corporate is working by way of related viral vector (AAV) and lentiviral vector (LVV) tracks to create supply methods for the genetic therapeutic brokers.

Based mostly on current sturdy scientific outcomes, Rocket expects to make regulatory filings on each the LAD-I and FA tracks throughout 2023. The LAD-I submitting is deliberate for 1H23, and the FA submitting for 2H23. Scientific knowledge on each tracks needs to be offered earlier than the tip of this 12 months.

In different scientific updates, Rocket has reported optimistic outcomes from its Section 1 scientific trial of RP-A501 towards Danon Illness. The examine confirmed that the drug candidate gave a sturdy remedy impact and pediatric and grownup sufferers confirmed 9 to 36 months of illness enchancment. The drug candidate was additionally well-tolerated. The corporate has designed a Section 2 pivotal examine, and is working with the FDA to get regulatory suggestions.

Whereas all of that has been occurring, Rocket has additionally moved to develop its AAV-based gene remedy program in heart problems by way of the acquisition of Renovacor. The transfer provides Rocket possession of Renovacor’s pipeline of AAV-based gene remedy merchandise. The merger phrases have been carried out in all inventory, and Renovacor shares stopped buying and selling on December 1.

Rocket’s shares troughed in Might of this 12 months, however since then are up 139%. But, Canaccord analyst Whitney Ijem sees the corporate in a robust place to proceed its features.

“We proceed to assume RCKT shares signify a singular alternative throughout the gene remedy house. We like the corporate’s differentiated gene remedy pipeline… The late-stage pipeline supplies line of sight to commercialization for each RP-L201 and RP-L102, with BLA+MAA filings anticipated in 1H23 and 2H23, respectively. Within the meantime, RCKT’s earlier-stage pipeline ought to proceed to offer scientific catalysts within the close to to medium time period. Plus, we anticipate provides to the pipeline – so known as ‘Wave 2’ in 2023 – will additional add to valuation and the catalyst-driven facet of the story,” Ijem opined.

These feedback again up Ijem’s Purchase score, and her value goal, of $49, implies a 157% upside potential for the 12 months forward. (To look at Ijem’s monitor file, click on right here)

The bulls are undoubtedly working for RCKT; the inventory has 11 current analyst evaluations, and they’re all optimistic – for a unanimous Sturdy Purchase consensus score. The inventory is priced at $19, and its $54.90 common value goal is much more bullish than the Canaccord view, suggesting ~187% achieve within the subsequent 12 months. (See RCKT inventory evaluation on TipRanks)

Keep abreast of the finest that TipRanks’ Sensible Rating has to supply.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your individual evaluation earlier than making any funding.