-

There’s extra upside left in shares after a brand new bull market began on Thursday, in keeping with Financial institution of America.

-

“After crossing the +20% mark from the underside, the S&P 500 continued to rise over the following 12 months 92% of the time,” BofA mentioned.

-

These are 5 questions buyers ought to ask now that the bear market is formally over, in keeping with BofA.

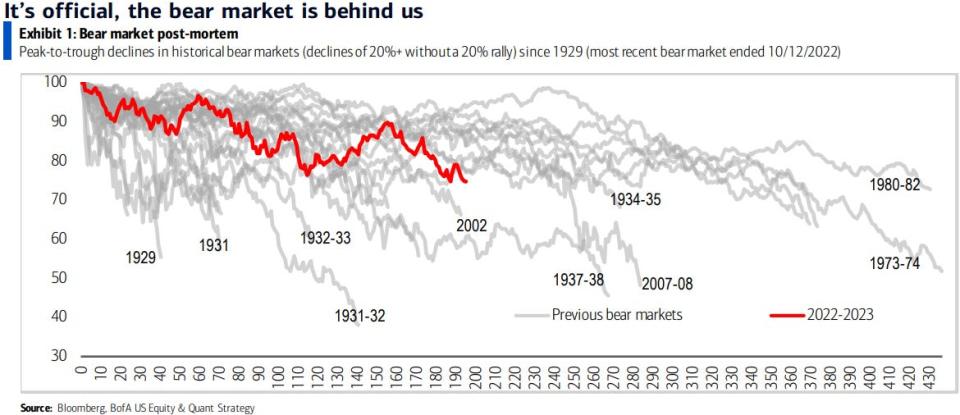

The bear market in shares is formally over and a brand new bull regime has begun after theS&P 500 closed 20% above its October 12 closing low on Thursday.

And in keeping with a Friday be aware from Financial institution of America’s fairness strategist Savita Subramanian, the inventory market features might proceed as buyers slowly purchase into the bullish surroundings and macro headwinds like rising rates of interest close to their finish.

Moreover, shares do effectively after the 20% bull market threshold is reached, primarily based on historic information.

“We do not put quite a lot of inventory (pun meant) in arbitrary definitions, however be aware that after crossing the +20% mark from the underside, the S&P 500 continued to rise over the following 12 months 92% of the time, returning 19% on common,” Subramanian mentioned.

That is primarily based on information for the reason that Nineteen Fifties and is in comparison with a 12-month profitable ratio of simply 75% and a median general 12-month return of 9%.

Whereas there are nonetheless dangers to the rally, the inventory market has a approach of continuous to climb a wall of fear whereas buyers sit on the sidelines resulting from damaging sentiment and lingering worries. However now’s the time for buyers to prepare for a brand new bull run and begin asking questions to arrange.

These are the 5 issues buyers ought to ask now that the bear market is formally over and a brand new bull regime has begun, in keeping with BofA.

1. “What is going to it take to get buyers bullish once more?”

“The wall of fear might proceed till buyers really feel ache in lengthy bonds or FOMO in equities. Buyers have purchased right into a singular fairness theme (AI, extra beneath) however a broader bull case for shares could be made: we’re off of ZIRP and actual yields are optimistic once more, volatility round charges and inflation has subsided, earnings uncertainty has declined and corporations have preserved margins by reducing prices and specializing in effectivity. After a quick mountaineering cycle, the Fed has latitude to ease. The fairness threat premium might fall from right here,” Subramanian mentioned.

2. “Ought to I spend money on actively managed funds?”

“After many years of passive fairness funds taking share from energetic, the energetic strategy in public fairness now is smart. Much less eyeballs means inefficient markets (extra alpha), greater dispersion and a reversal in passive inflows argue for inventory selecting over indexing. The index primacy this 12 months from document narrowness is unsustainable,” Subramanian mentioned.

3. “Which fairness index, equal-weighted or cap weighted?”

The equal-weighted S&P 500 might yield double the returns of the S&P 500 index primarily based on varied alerts. These embrace breadth reversion, relative worth (the equal-weighted index trades at 15x), decrease length threat vs. the cap weighted index and extra upside vs. the cap weighted index primarily based on our analysts’ value targets,” Subramanian mentioned.

4. “If shares are reviled, why is the S&P 500 buying and selling at 20x?”

“Wall Avenue is rife with conviction-less bears, and particular person investor outflows are at capitulation ranges considerably at odds with excessive snapshot multiples. 20x isn’t the rationale to be bearish – when earnings fall as they’re at present, P/E ratios broaden. It is simply math,” Subramanian mentioned.

5. “How can I earn a living off of AI?”

“The apparent beneficiaries, capex takers, are semis and choose software program corporations that may present AI companies. However not all Tech wins, many have to spend simply to stay aggressive. The bigger profit could also be had by outdated financial system, inefficient corporations that may improve earnings energy extra completely from effectivity and productiveness features,” Subramanian mentioned.

Learn the unique article on Enterprise Insider