Do you keep in mind first listening to about this unusual factor known as “the cloud”? It was in all probability someday within the 2010s. Many stated it could be a large boon for tech firms — and so they had been proper.

Spending on public cloud utilization rose from $31 billion in 2015 to just about $200 billion in 2023. Microsoft‘s Clever Cloud and Amazon‘s (NASDAQ: AMZN) Amazon Net Providers (AWS) present terrific income streams with annual run charges of over $100 billion every. This know-how has been the linchpin driving complete returns of over 900% since 2015 for each shares.

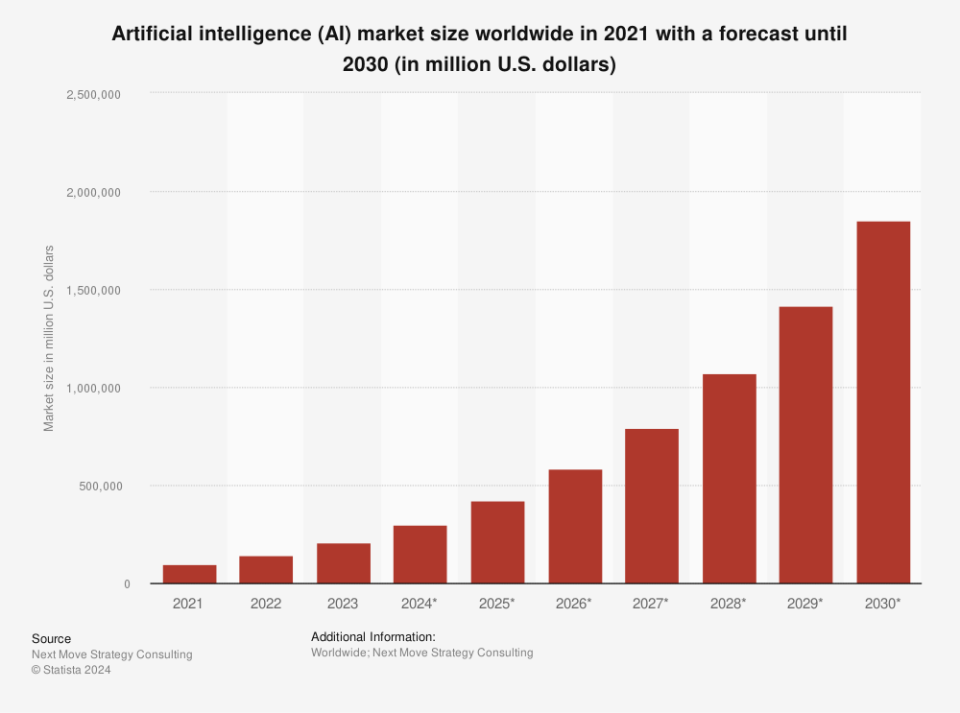

Synthetic intelligence (AI) appears to be like like the following large factor. Some say it is going to be as transformative because the web. The Worldwide Financial Fund says it can change almost 40% of jobs worldwide, and knowledge compiled by Statista exhibits the AI market will enhance sixfold from $300 billion this 12 months to over $1.8 trillion by 2030.

Listed here are 4 firms making the most of the expansion in AI with the potential to make buyers very comfortable within the subsequent six years.

Palantir

Palantir (NYSE: PLTR) is a well-liked inventory, and far of the hype is deserved. Managing, analyzing, and utilizing knowledge to optimize decision-making are on the core of its enterprise. And its platforms for the non-public sector and governments use AI to do that.

Palantir’s latest product, Synthetic Intelligence Platform (AIP), can also be constructed for the protection and the non-public sectors, the place it deploys on the shopper’s community and leverages giant language fashions (LLMs). What precisely does this imply? Here is an instance from Palantir.

Say that you are a navy operator in control of forces within the area, and knowledge is available in saying the enemy is amassing gear close by. The operator can visualize the sphere and ask questions akin to, “What enemy items are close by?” and “What are seemingly enemy formations?” Then, they will direct drones or satellites to seize pictures. Utilizing this know-how assists the operator with planning and operational choices.

Palantir has traditionally performed properly with protection income. This can be a terrific supply of earnings as a result of governments have deep pockets. Nonetheless, the non-public sector additionally affords a large market.

The corporate’s business income grew 32% year-over-year (YOY) within the fourth quarter of 2023 to $284 million (an acceleration from the 23% YOY progress in Q3), and authorities income grew 11% to $324 million. Palantir was additionally worthwhile on a usually accepted accounting ideas (GAAP) foundation for the fifth straight quarter — a powerful achievement for a high-growth tech firm.

The inventory trades for 25 instances gross sales, which is not low-cost, however this falls to twenty on a ahead foundation utilizing gross sales estimates. There’s short-term danger due to the valuation, so think about shopping for over time. In the long run, Palantir’s AI credentials are top-notch.

UiPath

Here is a phrase so as to add to your vocabulary: robotic course of automation (RPA). This takes tedious and non-value-adding duties and automates them.

For instance, a mortgage dealer could spend hours reviewing emails, downloading attachments, and manually getting into knowledge into functions. With RPA, this may be automated, liberating the dealer to concentrate on higher-level duties like speaking with underwriters and reaching out to clients. That is an instance of what UiPath (NYSE: PATH) can do for its clients.

Talking of shoppers, UiPath boasts over 10,800 of them, and so they present $1.4 billion in annual recurring income (ARR). Gross sales got here in at $326 million within the third quarter of UiPath’s fiscal 2024 (the three months ended Oct. 31, 2023) on 24% progress, which is spectacular, contemplating the difficult financial atmosphere in 2023. UiPath additionally has a fortress-like stability sheet with $1.8 billion in money and investments and no long-term debt.

UiPath has stiff competitors in a fragmented trade, which often is the most vital danger for buyers. The corporate can also be not GAAP worthwhile, though it’s cash-flow constructive. The inventory trades for 11 instances gross sales, which is affordable for the trade.

RPA has the potential to avoid wasting firms huge quantities of cash by automating low-level duties, and UiPath could possibly be a big long-term beneficiary of this development.

Evolv Applied sciences

Earlier than I delve into this firm, please be aware that this inventory has a market cap of lower than $1 billion, making it extra speculative than others. Managing danger is essential, so speculative shares ought to solely occupy a set portion of your portfolio, based mostly in your age, i.e., how a lot time it’s important to make up losses, and danger tolerance. With that understanding, Evolv Applied sciences (NASDAQ: EVLV) sells fascinating know-how that might save your life (and perhaps make buyers a great deal of cash).

At the moment, when getting into a stadium or different venue, folks stand in line to undergo a metallic detector one by one, empty their pockets, and infrequently get a second screening with a wand. It is inefficient, and gadgets are sometimes missed.

Evolv’s know-how is totally different. A number of folks can stroll by the AI-powered machines, and the detectors take a look at numerous traits, akin to shapes, to determine weapons or knives, relatively than alerting for all the things metallic, like automobile keys. Alerts present safety personnel the place the thing is detected, and so they take it from there.

Faculties, hospitals, and stadiums are the goal clients for Evolv. A number of main sports activities groups, college districts, and medical campuses already use it. Ending ARR in Q3 2023 was $66 million on 129% year-over-year progress, and subscriptions jumped 137% to simply over 4,000. With a market cap of $676 million, Evolv trades at an inexpensive 10 instances ARR and has a great deal of potential.

Amazon

I stated there was a minimum of one firm on this article that you’ll have by no means heard of, however it’s in all probability not this one. Amazon is thought for its on-line market, however can even profit tremendously from AI since AWS is the world’s main cloud service supplier.

AI software program requires tons of knowledge, and far of this will likely be processed within the cloud. Amazon additionally affords different AI options, like foundational fashions — which permit customers to tailor AI software program to their wants.

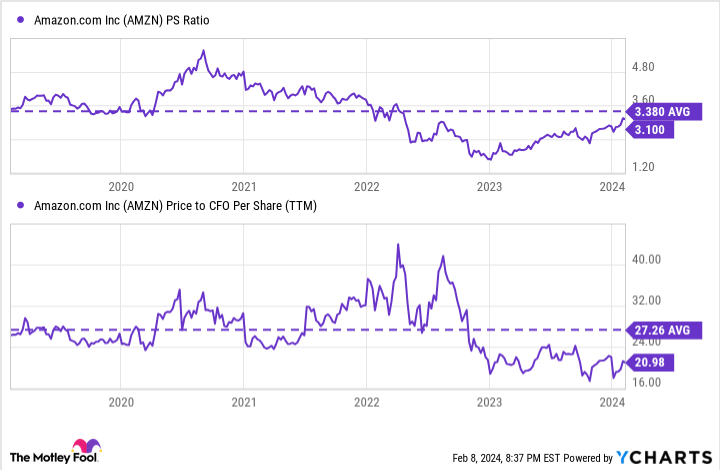

Amazon simply launched its This autumn 2023 earnings, and so they had been spectacular. Whole income was up 14% to $170 billion, together with vital will increase in money movement and working earnings. As depicted under, the inventory rose however nonetheless trades under its five-year common, based mostly on gross sales and money movement.

AI will give Amazon a lift that ought to please buyers for years to return.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Palantir Applied sciences wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 5, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Bradley Guichard has positions in Amazon and UiPath. The Motley Idiot has positions in and recommends Amazon, Microsoft, Palantir Applied sciences, and UiPath. The Motley Idiot has a disclosure coverage.

Prediction: These Might Be the Finest-Performing Synthetic Intelligence (AI) Shares Via 2030 was initially printed by The Motley Idiot