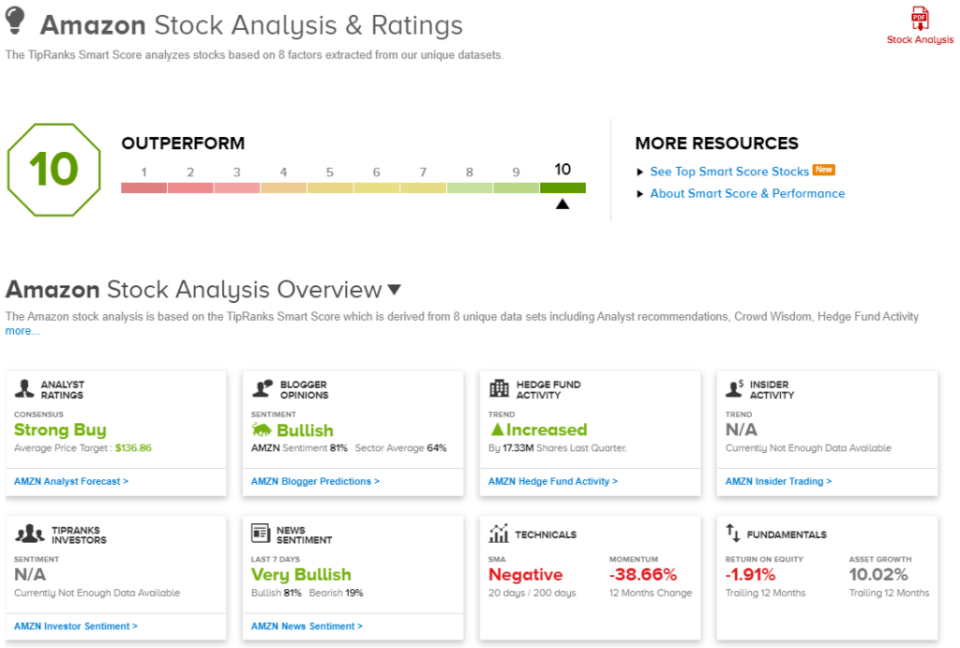

Recognizing the correct shares is a talent that each investor must study, and the sheer quantity of market knowledge, on the principle indexes, on particular person shares, on and from inventory analysts, can current an intimidating barrier. Happily, there are instruments to assist. The Good Rating is a knowledge assortment and collation software from TipRanks, utilizing an AI-powered algorithm to kind the information on each inventory in response to a sequence of things, 8 in all, which can be identified for his or her sturdy correlation with future share outperformance.

That each one seems like a mouthful, nevertheless it boils all the way down to this: a classy knowledge software that provides you a easy rating, on a 1 to 10 scale, to evaluate the prospects of any given inventory. It places the advanced world of inventory market knowledge at your fingertips.

The Good 10, after all, needs to be an excellent neon signal put up guiding buyers in for a more in-depth look – and typically, it guides buyers towards shares which have by no means lacked for headline or discover. These are a number of the market’s giants, shares which can be family names, function trillion-dollar market caps, and boast Robust Purchase consensus rankings from the Road’s greatest skilled analysts. So, let’s give two of them a more in-depth look.

Amazon (AMZN)

First up on our record is Amazon, a reputation that doesn’t want a lot introduction. Likelihood is, we’ve all purchased one thing from Amazon just lately; the corporate is a big among the many world’s retailers – the second largest on the earth – with a number one place within the e-commerce sector. As well as, Amazon’s cloud computing service (AWS) additionally holds a market-leading place.

Amazon’s gigantism in retail is complemented by its place amongst Wall Road’s publicly traded firms. It’s considered one of simply 4 trillion-dollar-plus firms, when measured by market cap. Amazon’s $1.03 trillion in market cap places it fourth place, behind #1 Apple, Microsoft, and Google-parent Alphabet.

Because the main e-commerce agency, Amazon benefited closely throughout the pandemic/lockdown interval – nevertheless it noticed drastic losses final 12 months, because the pandemic receded and enterprise and social actions returned to extra regular patterns. In 2022, Amazon’s share value fell by 51%, shedding properly over $800 million in market cap.

Extra just lately, Amazon has confirmed a tick up in gross sales. Whole revenues for 4Q22 got here to $149.2 billion, up 8.6% and above the $145.4 billion that had been anticipated. The corporate’s backside line, nevertheless, missed the forecasts. On earnings, the corporate confirmed an EPS of three cents, evaluating unfavorably to the anticipated 17 cents.

The income steering for Q1 was set within the vary of $121 billion to $126 billion, which might characterize progress of 4% to eight% year-over-year; analysts had been predicted Q1 steering of $125.1 billion.

Eric Sheridan, considered one of Goldman Sachs’ 5-star analysts, sees Amazon in place for additional positive aspects, with a sequence of catalysts offering assist: “For AMZN shares, we nonetheless see the ahead catalyst path dominated by a combination of 1) bottoming of income deceleration dynamic for AWS; 2) continued proof factors of a return to pre-pandemic ranges of working margins for its North America eCommerce operations and/or 3) stability vs. volatility within the consumption habits of the Amazon Prime family client within the coming quarters…. Long run, we’re unchanged in our long-term view of the potential for cloud computing (as evidenced by Amazon’s $110bn income backlog that grew +37% YoY.”

In Sheridan’s view, Amazon is value a Purchase score – and his value goal, of $145 implies {that a} one-year achieve of 40% is arising for AMZN shares. (To observe Sheridan’s observe report, click on right here)

The large tech names sometimes collect loads of Wall Road consideration, and Amazon has 38 current analyst opinions – breaking down 37 to 1 in favor of Buys over Holds for a Robust Purchase analyst consensus score. The inventory’s common value goal, $136.86, and buying and selling value, $103.29, add as much as 32.5% potential share appreciation within the subsequent 12 months. (See Amazon inventory evaluation)

Alphabet, Inc. (GOOGL)

Subsequent up is Alphabet, the guardian firm of Google. Alphabet holds the following rung up amongst public companies; its $1.3 trillion in market cap makes it the third-largest firm on Wall Road. Alphabet is greatest identified for its Google subsidiary, which has an iron grip on the lion’s share of the web search enterprise, and virtually as massive a share in internet advertising.

Google will be the largest income driver for Alphabet, however the firm has a slew of extra subsidiaries, giving it footholds in a wide range of tech-oriented fields. The extra high-profile of those embrace its possession of DeepMind, within the AI subject; Wing, the drone-based freight supply service, and Waymo, an autonomous car growth enterprise.

Alphabet has felt some strain just lately, as its just lately launched Bard AI has been perceived as inferior to its competitors, primarily Microsoft’s Bing and the brand new ChatGPT. Lengthy-term, nevertheless, the Google providing in AI has some essential benefits. Based mostly on the dimensions and breadth of Alphabet’s subsidiary holdings, the corporate can draw on a deep properly of information to feed the machine studying points of its AI.

On the monetary aspect, Alphabet can depend on sturdy income efficiency and money holdings. The corporate noticed $76 billion on the high line in 4Q22, the final reported quarter, and completed 2022 with $21.8 billion in money and money equivalents. Whereas the whole income was in keeping with forecasts, the corporate’s This autumn EPS of $1.05 missed the expectations by 11%, or 13 cents. Even with these whiffs, Alphabet nonetheless pulled in a quarterly free money stream of $16 billion.

Trying ahead, BNP Paribas analyst Stefan Slowinski believes the corporate’s AI is the important thing to future efficiency, writing: “On the AI entrance, we anticipate Google to struggle again and launch a string of generative AI supported providers, whereas additionally turbo charging present choices… Google is greatest positioned given it has developed its personal massive language fashions because it acquired DeepMind 9 years in the past (and isn’t depending on a 3rd occasion like OpenAI), has the perfect Search software and knowledge set, its personal proprietary silicon since 2015, and consumer expertise DNA.”

To this finish, Slowinski provides GOOGL shares an Outperform (i.e. Purchase) score, whereas setting his value goal at $123 for ~19% upside potential over the approaching 12 months. (To observe Slowinski’s observe report, click on right here)

General, the Robust Purchase consensus score right here is predicated on a unanimous 32 optimistic analyst opinions. Alphabet’s inventory is priced at $103.73 and carries a $129.58 common value goal, suggesting a achieve of ~25% within the subsequent 12 months. (See Alphabet inventory evaluation)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your personal evaluation earlier than making any funding.