Shares of Palantir Applied sciences took off this yr and delivered spectacular beneficial properties of 38% as of this writing, and synthetic intelligence (AI) has performed a central position within the inventory’s surge.

The corporate, which supplies software program options to each authorities and business clients, delivered better-than-expected fourth-quarter 2023 outcomes final month, which led to an enormous bounce in its inventory value. Palantir, nonetheless, just isn’t the one firm that is benefiting from the rising demand for AI software program, as C3.ai (NYSE: AI) confirmed with its newest quarterly outcomes that it’s set to capitalize on this market as properly.

Let’s take a more in-depth have a look at C3.ai’s newest outcomes and see why it may transform a strong alternative for buyers in search of a substitute for the richly valued Palantir.

C3.ai is stepping on the gasoline

C3.ai inventory jumped 24% following the discharge of its fiscal 2024 third-quarter outcomes (for the three months ended Jan. 31, 2028) on Feb. 28. The pure-play AI enterprise software program supplier witnessed an 18% year-over-year enhance in income to $78.4 million, exceeding consensus estimates of $76.1 million. C3.ai’s web lack of $0.13 per share was additionally a lot decrease than Wall Road’s expectation of a $0.28 per-share loss.

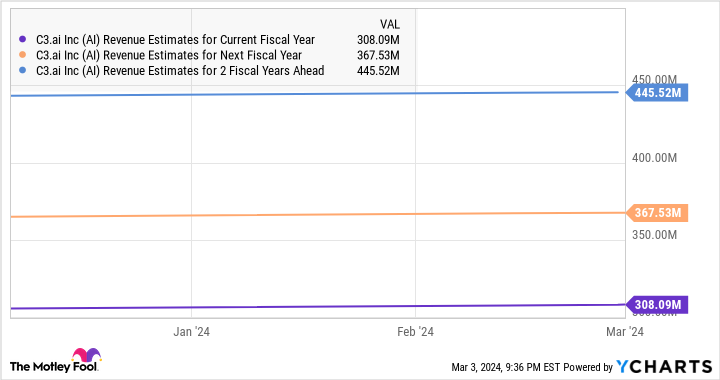

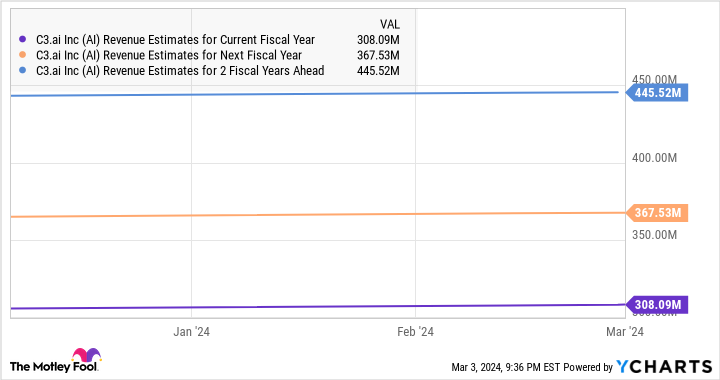

The steerage was the topping on the cake. C3.ai is anticipating fiscal Q4 income to land between $82 million and $86 million. That is barely larger than the $83.9 million consensus estimate on the midpoint. Additionally, C3.ai’s up to date full-year income steerage of $308 million exceeds Wall Road’s expectations of $306.1 million.

The up to date steerage means that C3.ai is on observe to complete fiscal 2024 with a 15.5% enhance in income. Even higher, analysts are predicting that its tempo of development may decide up over the subsequent couple of fiscal years.

That will not be stunning as C3.ai’s change to a consumption-based enterprise mannequin from a subscription-based mannequin — which earlier prompted a slowdown in its development — appears to be working as administration supposed. C3.ai did away with the subscription mannequin to cut back entry obstacles for brand spanking new clients. A consumption-based mannequin meant that anybody who desires to make use of C3.ai’s AI software program providers can merely deploy its options with out having to enter into contract negotiations.

The excellent news is that C3.ai is certainly witnessing stronger deal momentum due to the change. The corporate struck greater than 36 offers price $1 million or extra within the earlier quarter, up from 20 within the year-ago interval. The variety of offers within the $1 million to $5 million vary additionally elevated to 10 from six final yr. C3.ai additionally reported 4 offers within the $5 million to $10 million vary, up from zero within the year-ago interval.

All this means that C3.ai is certainly shifting in the suitable route and will transform a strong AI software program play in the long term. It appears on observe to profit from the AI software program market that is anticipated to clock annual development of 23% by 2032 and generate over $1 trillion in annual income, which is why buyers would do properly to purchase it earlier than it turns into costly.

The inventory is considerably cheaper than Palantir

Palantir’s red-hot rally signifies that it’s now buying and selling at an costly 26 instances gross sales. With analysts forecasting a 22% enhance within the firm’s income in 2024 to $2.7 billion, some would possibly argue that the inventory is dear when in comparison with the potential development that it’s predicted to ship. In fact, Palantir’s main place within the fast-growing marketplace for AI software program platforms signifies that it may justify its wealthy valuation in the long term.

Shares of C3.ai are buying and selling at 14 instances gross sales, which makes it considerably cheaper than Palantir. Additionally it is price noting that analysts are anticipating C3.ai’s earnings to extend at an annual tempo of 51% for the subsequent 5 years, which is sort of strong. In fact, Palantir’s earnings are anticipated to extend at a sooner tempo of 85%, however buyers must pay a way more costly valuation for the latter.

On condition that C3.ai’s development is anticipated to realize steam within the subsequent few years, shopping for this AI inventory proper now appears like a sensible factor to do because it appears set to go on a bull run, and savvy buyers have an opportunity to purchase it earlier than it will get dearer.

Do you have to make investments $1,000 in C3.ai proper now?

Before you purchase inventory in C3.ai, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and C3.ai wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 26, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot recommends C3.ai. The Motley Idiot has a disclosure coverage.

Suppose Palantir Applied sciences Inventory Is Costly? This is a Cheaper Synthetic Intelligence (AI) Inventory to Purchase Earlier than It Skyrockets was initially printed by The Motley Idiot