There are few issues traders get pleasure from greater than receiving a dividend fee every quarter. Nonetheless, a well-liked ETF from JPMorgan, the JPMorgan Fairness Premium Revenue ETF (NYSEARCA:JEPI), takes this method and does it one higher by paying traders a dividend on a month-to-month foundation.

Not solely that, however JEPI’s dividend yield is a large 11.8% on a trailing foundation, which is greater than seven occasions the common yield for the S&P 500 of 1.65% and practically 3 times the yield that traders can get from 10-year treasuries. Now, let’s check out JEPI’s surging reputation, its technique, the way it achieves this double-digit payout, and the holdings that comprise this engaging ETF.

Surging Reputation

The JPMorgan Fairness Premium Revenue ETF has shortly garnered over $21 billion in property underneath administration (AUM) and has grow to be one of many most-discussed ETFs available in the market since bursting onto the scene in Might 2020. JEPI was one of the crucial in style ETFs of 2022, bringing in file inflows for an actively-managed ETF of practically $13 billion. Simply this previous week, JEPI was the highest ETF available in the market by way of attracting new capital, bringing in over $500 million in weekly inflows.

The ETF’s reputation will be attributed to its double-digit dividend yield, its month-to-month dividend, and the truth that it comes from a blue-chip sponsor, JPMorgan. The 11.8% dividend yield and payout schedule maintain vital enchantment to many traders — holders basically obtain practically 1% of their whole funding every month within the type of a dividend.

What’s JEPI ETF Precisely?

JEPI’s technique is to generate revenue whereas limiting volatility and draw back. In response to JPMorgan, JEPI “generates revenue by a mixture of promoting choices and investing in U.S. large-cap shares, looking for to ship a month-to-month revenue stream from related possibility premiums and inventory dividends.” JEPI additionally “seeks to ship a good portion of the returns related to the S&P 500 index with much less volatility.”

JEPI does this by investing as much as 20% of its property into ELNs (equity-linked notes) and promoting name choices with publicity to the S&P 500. This technique did its job effectively final yr, as JEPI fell simply 3.5% versus a a lot bigger 19.6% decline for the S&P 500.

Nonetheless, it must be famous that this technique might also restrict a few of JEPI’s upside when shares are surging. Working example, the S&P 500 and Nasdaq are up 6.2% and 13.1% year-to-date, respectively, whereas JEPI is down 0.6% to this point in 2023. That mentioned, for traders who’re extra interested by revenue than capital appreciation, it’s arduous to beat JEPI. Nonetheless, there’s a spot for each in investor portfolios, which is why I personal JEPI as a part of a balanced portfolio.

JEPI’s Holdings

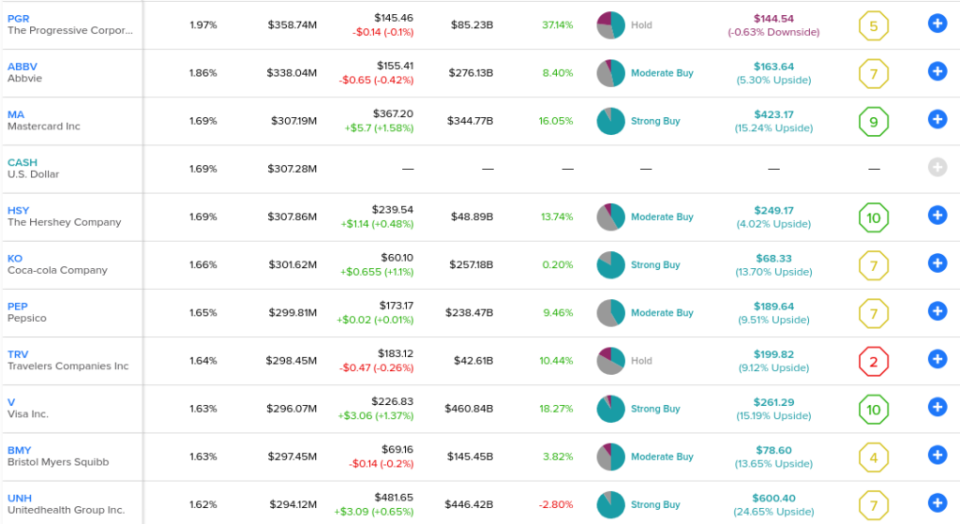

JEPI is well-diversified, with holdings unfold out throughout 115 U.S.-based shares. Its prime 10 holdings make up a mere 17.1% of property, and no particular person inventory makes up greater than 1.97% of the fund.

JEPI ETF’s prime holdings are made up of a mixture of shares from historically steady and defensive industries identified for his or her dividends. The patron staples phase is well-represented within the prime 10 by mushy drink giants Coca-Cola and Pepsi, in addition to sweet firm Hershey. Pepsi and Coca-Cola are Dividend Kings which have been paying and rising their dividend payouts for 50 and 60 years, respectively, so these are the kinds of shares that you simply need to personal in a dividend ETF.

Financials are additionally well-represented — Progressive, an insurer, is the most important holding, and it’s joined by one other insurance coverage firm, Vacationers, within the prime 10. In the meantime, fee networks like Visa and Mastercard make an look as effectively.

Additional, the healthcare trade has a heavy presence within the prime holdings by shares like AbbVie and Bristol Myers. The healthcare trade is historically regarded as a defensive enterprise, and healthcare spending is much less correlated to the general financial system, so that is an advantageous sector for a dividend fund to focus on.

Be aware that JEPI additionally owns some non-dividend shares, corresponding to Amazon and Alphabet. It possible owns these kind of names to generate revenue utilizing their derivatives (choices) and to realize extra publicity to the upside potential of progress shares and the S&P 500 as a complete.

Beneath is a take a look at the JEPI ETF’s prime holdings, taken from the ETF’s holdings web page:

What’s the Value Goal for JEPI Inventory?

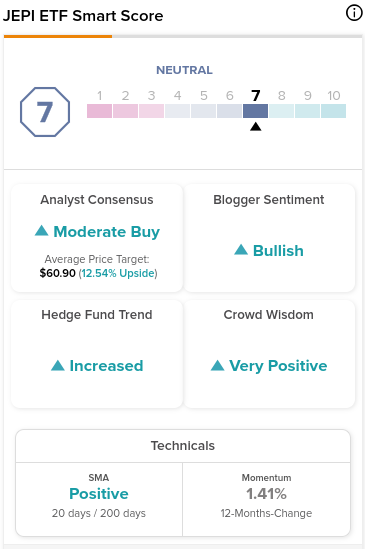

Along with this double-digit dividend yield, the JPMorgan Fairness Premium Revenue ETF additionally has some room for upside, in accordance with analysts. The common JEPI inventory worth goal of $60.90 is 12.5% larger than JEPI’s present worth. Mix this upside potential with JEPI’s 11.8% yield, and also you theoretically arrive at a compelling one-year return for the ETF.

TipRanks makes use of proprietary know-how to compile analyst forecasts and worth targets for ETFs primarily based on a mixture of the person performances of the underlying property. By utilizing the Analyst Forecast device, traders can see the consensus worth goal and ranking for an ETF, in addition to the very best and lowest worth targets.

TipRanks calculates a weighted common primarily based on the mix of all the ETFs’ holdings. The common worth forecast for an ETF is calculated by multiplying every particular person holding’s worth goal by its weighting throughout the ETF.

ETFs additionally get Sensible Rating scores, and JEPI has an ETF Sensible Rating of seven out of 10. Moreover, JEPI seems to be engaging primarily based on numerous different TipRanks indicators, together with bullish blogger sentiment, rising hedge fund involvement, and optimistic crowd knowledge.

Along with these engaging options, JEPI additionally has an affordable expense ratio of 0.35%.

JEPI’s Dangers

The primary threat of an ETF like that is that, as mentioned above, JEPI’s method implies that it might lag the broader market throughout a bull market, as evidenced by this yr’s underperformance versus the S&P 500 and the Nasdaq.

Nonetheless, it by no means hurts so as to add some ballast to your portfolio. The market has been unstable lately, and if the market takes a flip for the more severe as 2023 unfolds, JEPI ought to maintain up effectively, because it did final yr.

The opposite threat right here is that as a reasonably new ETF, JEPI doesn’t have a protracted observe file of returns, however the portfolio managers in control of the fund, Hamilton Reiner and Raffaele Zingone, have 36 and 32 years of expertise, respectively, and JPMorgan is a blue-chip asset supervisor, so this isn’t a priority that retains me up at night time.

For traders looking for dependable month-to-month revenue, it’s arduous to beat JEPI, and its double-digit yield stands out within the present market setting. I personal JEPI and look at it as a key cornerstone of my portfolio that offers me some draw back safety, publicity to a big swath of the U.S. financial system, and, better of all, a gradual stream of month-to-month funds that add as much as a well-above-average 11.8% yield over the course of the yr.

Disclosure