Maybe the most important enterprise powering the markets proper now’s synthetic intelligence (AI). Plainly each software program developer is keen to money in on AI euphoria, and expertise shares are reaping the advantages.

Because the S&P 500 and Nasdaq Composite commerce at file ranges, my eyes have been on one inventory particularly. The very best half? It is not within the “Magnificent Seven.”

Shares of Tremendous Micro Computing (NASDAQ: SMCI) have soared 5,830% in simply 5 years. Up to now in 2024, they’ve risen over 300% as of market shut on March 8. Loads of the momentum pushing the inventory proper now revolves across the firm’s newest milestone: inclusion within the S&P 500.

This firm is enjoying an essential function within the AI realm. Let’s dig into Tremendous Micro’s enterprise and get an understanding of why the inventory goes parabolic.

An excellent run to the highest, however…

Tremendous Micro performs an important function on the intersection of semiconductors and synthetic intelligence (AI). The corporate designs built-in methods for IT structure, which might embody storage clusters or server racks.

Given rising curiosity in graphics processing models (GPUs) from the likes of Nvidia and Superior Micro Units over the past 12 months, Supermicro’s providers have been in excessive demand within the background.

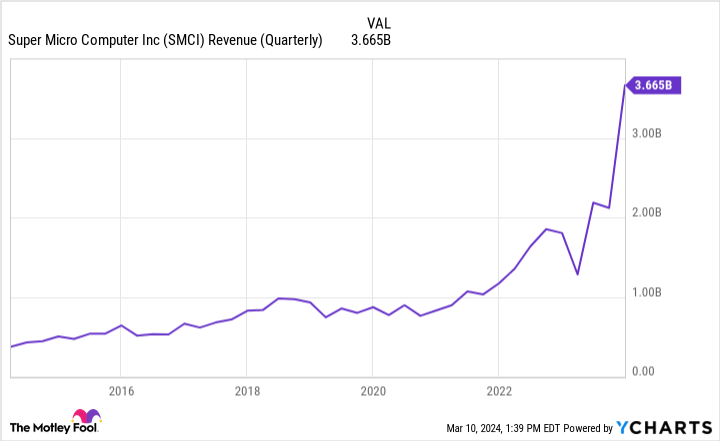

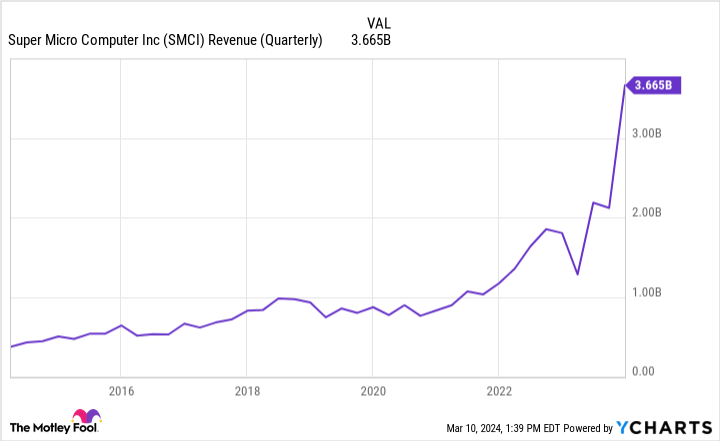

Income is rising over 100% yearly, and AI tailwinds make for an encouraging long-term outlook. It is no surprise one Wall Road analyst has referred to Supermicro as a “stealth Nvidia.”

As with all companies, there’s extra to the image than gross sales acceleration — as nice as it’s for the time being. Let’s take a look at another components to hone the complete funding thesis right here.

…there are some lingering considerations

Probably the most essential issues for traders to know is that Supermicro may be very a lot a {hardware} operation, and its margin profile is way decrease than you would possibly assume.

For the quarter ended Dec. 31, gross margin was 15.4%. This represented a lower from the prior quarter and the identical interval within the earlier 12 months. Administration addressed the margin deterioration through the earnings name, explaining that aggressive investments in new designs and market share acquisition had been the culprits.

Spending to develop is an argument that solely goes thus far. In the long term, Supermicro should show that margin enlargement and constant money move are achievable.

Valuation is changing into disconnected from fundamentals

Given the function of semiconductors within the AI revolution, it makes some sense that shares similar to Nvidia and AMD are garnering consideration. Nevertheless, Supermicro’s shut affiliation with these chipmakers has introduced some momentum into the image. This dynamic can carry plenty of threat, as traders would possibly assume they’re shopping for into the following Nvidia.

However as famous above, Supermicro and Nvidia are very completely different companies. At finest, they’re tangentially associated. Extra acceptable comparisons embody Hewlett Packard Enterprise, Lenovo, Dell, and IBM. Its inventory present trades at a price-to-sales (P/S) ratio of seven, greater than double that of IBM.

Not solely is Tremendous Micro by far the most costly inventory amongst this cohort, however the different firms talked about above have extra prolific companies throughout. It’s an especially specialised operation and isn’t as numerous as IBM or Dell, as an example.

I see it as an attention-grabbing solution to spend money on AI. The corporate operates in an essential pocket within the AI panorama, albeit one that’s beneath the radar.

However with low margins and an increasing valuation, the inventory’s premium seems to be more and more much less related from fundamentals. Whereas inclusion within the S&P 500 is a decent milestone, it isn’t motive sufficient to chase the inventory although it might soar within the close to time period as ETFs and passive funds that mimic the index rebalance their portfolios to incorporate the brand new inventory within the index.

For now, I’d sit on the sidelines and monitor the corporate’s efficiency. If Tremendous Micro Pc goes to be an influential part of the AI narrative in the long term, traders could have ample alternatives to purchase at extra acceptable valuations.

Do you have to make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for traders to purchase now… and Tremendous Micro Pc wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 11, 2024

Adam Spatacco has positions in Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units and Nvidia. The Motley Idiot recommends Worldwide Enterprise Machines. The Motley Idiot has a disclosure coverage.

This Synthetic Intelligence (AI) Firm Has Returned Practically 5,830% in Simply 5 Years and Is Headed for the S&P 500. Is It Too Late to Purchase? was initially revealed by The Motley Idiot