Discovering the subsequent nice inventory, like an Amazon or, extra lately, Nvidia (NASDAQ: NVDA), is the dream — one inventory that may generate portfolio- and life-changing returns, typically in a short time. Tremendous Micro Pc (NASDAQ: SMCI) has given buyers its finest Nvidia impression. The inventory is up a whopping 750% over the previous 12 months.

Now, a inventory not often goes up that a lot, that rapidly. That is why it may appear wild that I am predicting it should proceed. In fact, success is probably not a straight line. Nonetheless, I imagine Supermicro, as it’s higher recognized lately, might simply mimic Nvidia’s epic multiyear run and soar upward over the approaching years.

Supermicro is changing into the market chief in its discipline

The recipe for Supermicro’s success is straightforward. Dominant management in a quickly rising business equals outperformance. Traders are already seeing the equation play out, which helps clarify the inventory’s exceptional success. My prediction is predicated on the straightforward concept that synthetic intelligence (AI) spending will proceed properly into the longer term.

First, the fundamentals. Supermicro is a computing {hardware} innovator. It started with motherboards within the early Nineteen Nineties however right now sells turn-key modular server methods to companies. Are you aware the best way to construct a pc from scratch? Neither do many firms. So, like most would do, they flip to an knowledgeable like Supermicro.

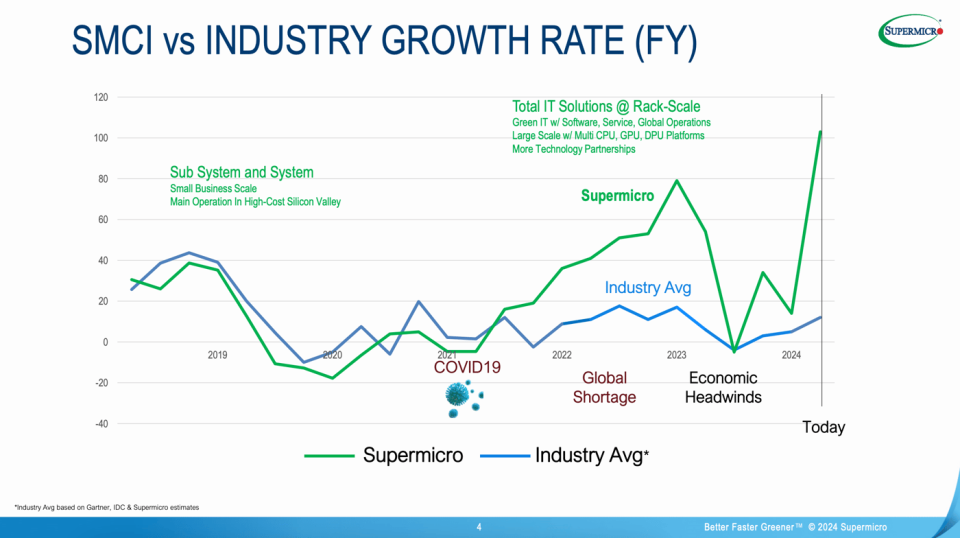

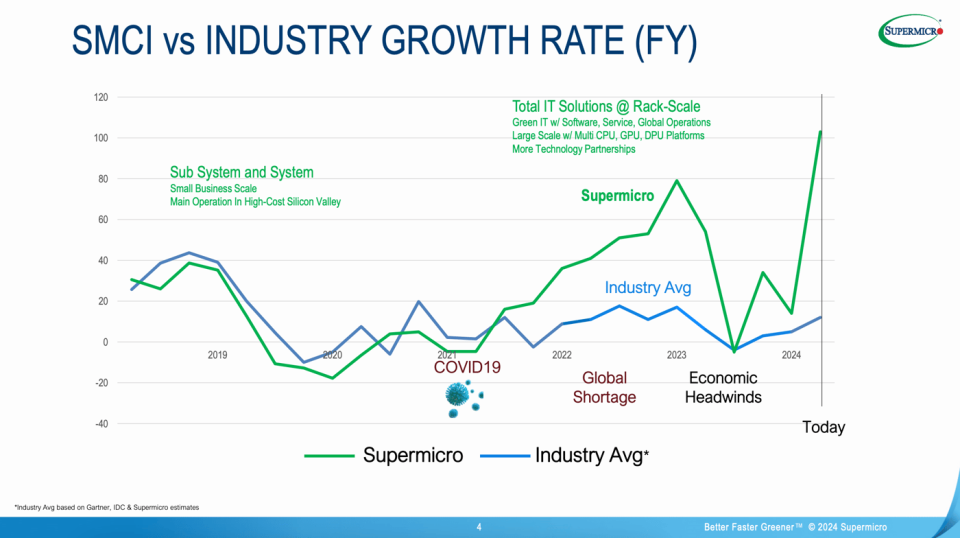

Supermicro’s modular system may be simply scaled to the dimensions an organization wants and may be constructed upon sooner or later if wants develop. Like Nvidia’s AI chips, clients are flocking to Supermicro for his or her AI wants:

Administration is basing this on its inner information and business information from Gartner. Supermicro’s income grew 103% 12 months over 12 months within the second quarter of fiscal 12 months 2024 (ended Dec. 31, 2023), and steering is for as much as 218% year-over-year progress within the present quarter.

A quickly rising business

The million-dollar query, after all, is whether or not this will final. In accordance with the individuals most linked to AI, it will possibly and can. OpenAI CEO Sam Altman lately made headlines for his name to increase international chip capability, claiming a necessity to take a position trillions of {dollars} for the trigger. Nvidia CEO Jensen Huang predicted an extra $1 trillion in information heart spending over the subsequent a number of years.

If these predictions are remotely correct, Supermicro, which simply did $3.7 billion in income in Q2, is poised to have extra alternatives than it will possibly shake a stick at. Finally, this has to play out, and an lack of ability to assist demand might ship enterprise to Supermicro’s opponents. Nonetheless, it is exhausting to see how Tremendous Micro Pc would not have each alternative to satisfy these skyrocketing expectations for long-term progress.

A surprisingly affordable valuation

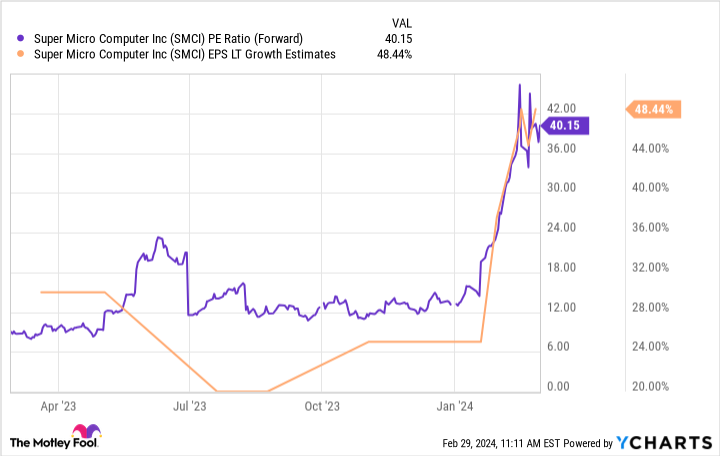

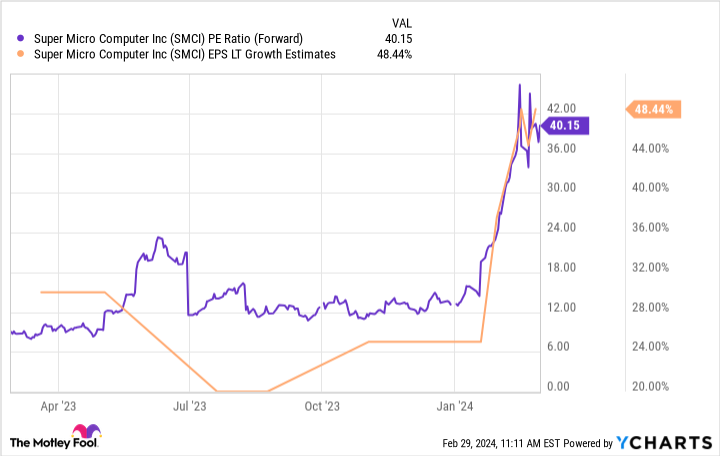

Given the abovementioned state of affairs, it is affordable to count on progress estimates to rise. That is occurred already. Analysts are searching for earnings progress averaging 48% yearly over the long run. This appears life like for a corporation now rising at a triple-digit price.

At a ahead P/E ratio of simply 40, Supermicro’s worth/earnings-to-growth (PEG) ratio is lower than 1, signaling that the inventory continues to be a discount for its anticipated future progress potential.

There’s an interesting psychological phenomenon referred to as anchoring bias, during which the thoughts sticks to the primary quantity it sees. In different phrases, buyers see how a lot Supermicro has climbed over the previous 12 months and assume that the inventory should be costly. To be honest, most shares are overpriced in the event that they rise that a lot in a 12 months.

Nonetheless, information exhibits that Supermicro might be the exception. Now, there are funding dangers since you are projecting issues sooner or later. Nothing is assured in life. Nonetheless, the information and up to date monetary efficiency point out a shiny future for Tremendous Micro Pc and its shareholders.

Must you make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Tremendous Micro Pc wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 26, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Nvidia. The Motley Idiot recommends Gartner and Tremendous Micro Pc. The Motley Idiot has a disclosure coverage.

Prediction: This Synthetic Intelligence (AI) Inventory May Be the Subsequent Nvidia was initially printed by The Motley Idiot